Connecticut Sample Letter for Final Settlement Agreement

Description

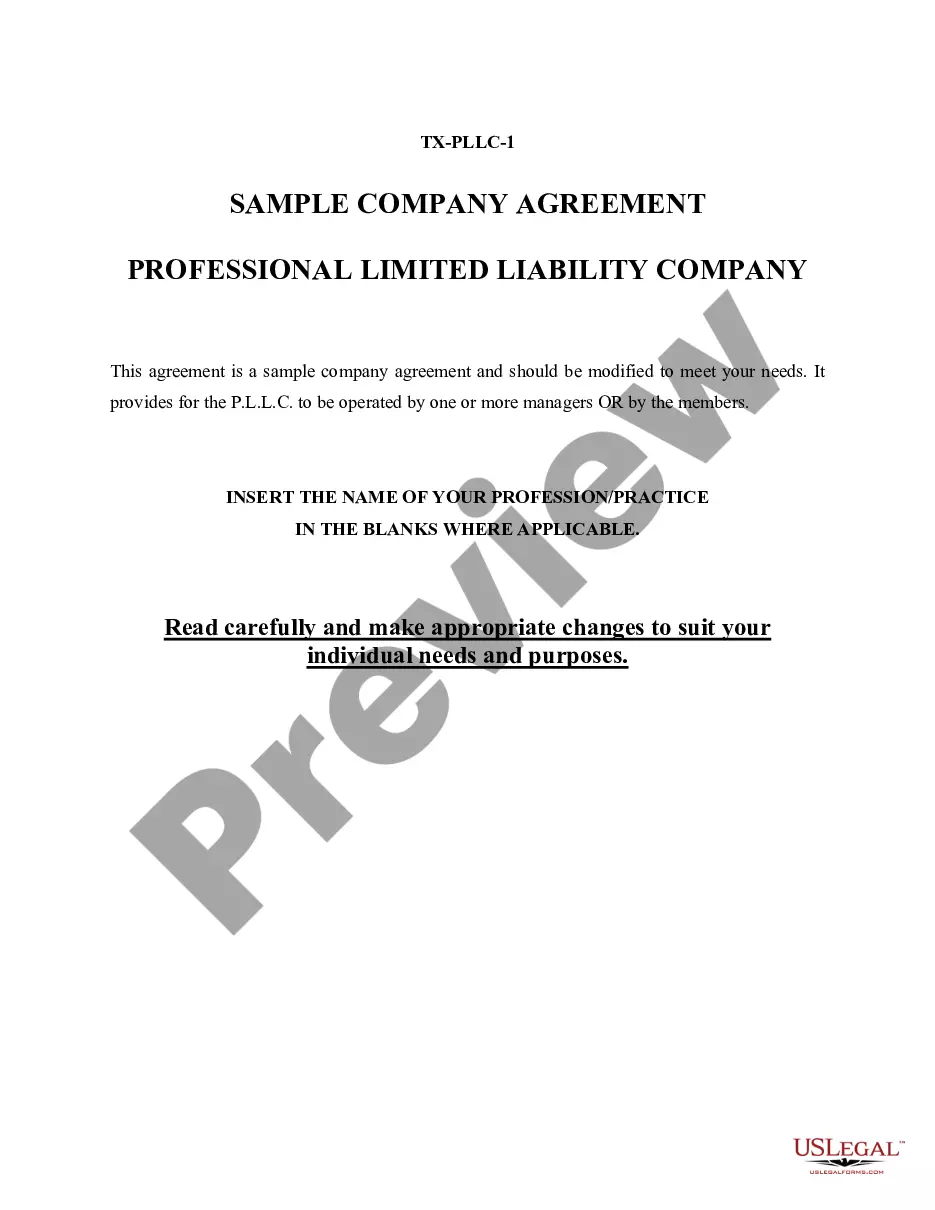

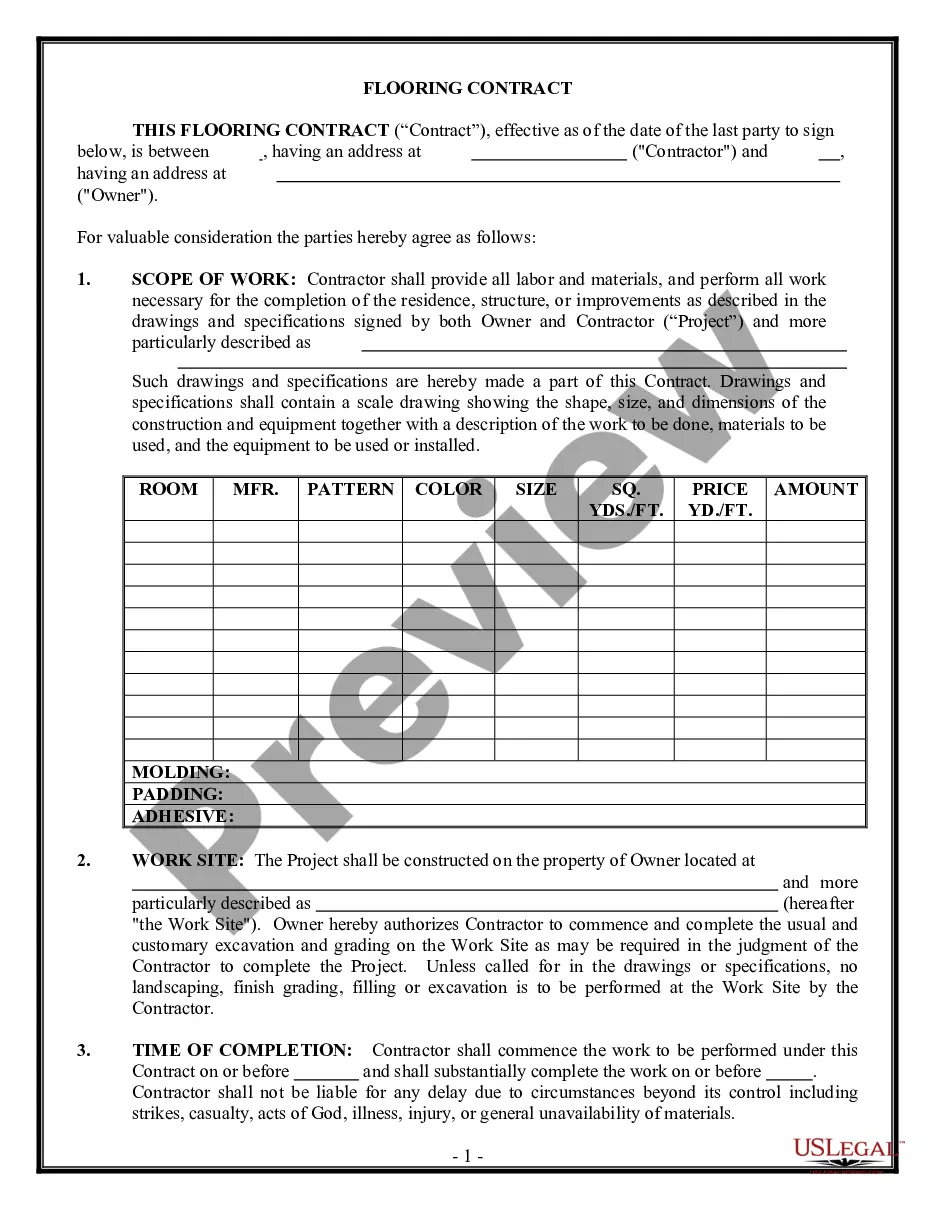

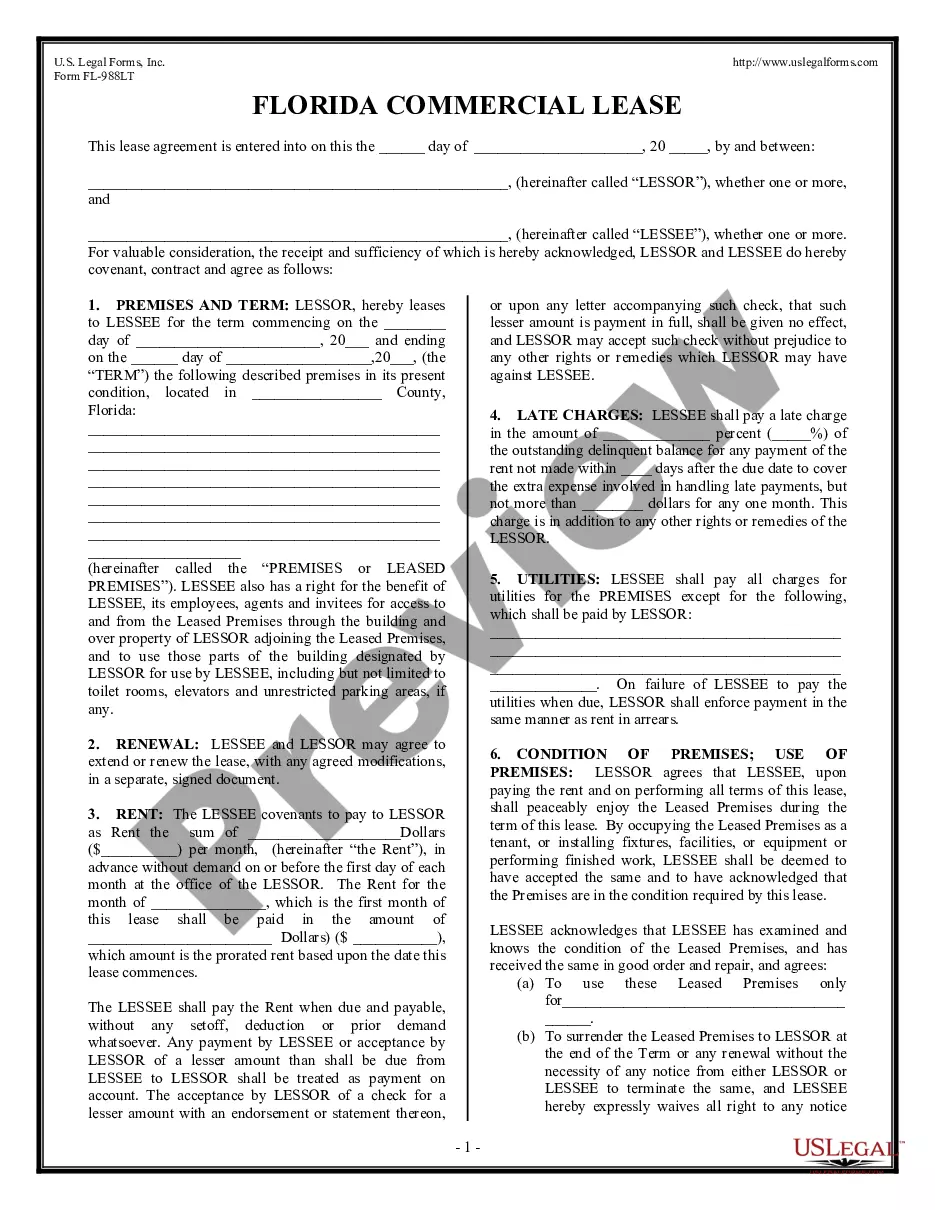

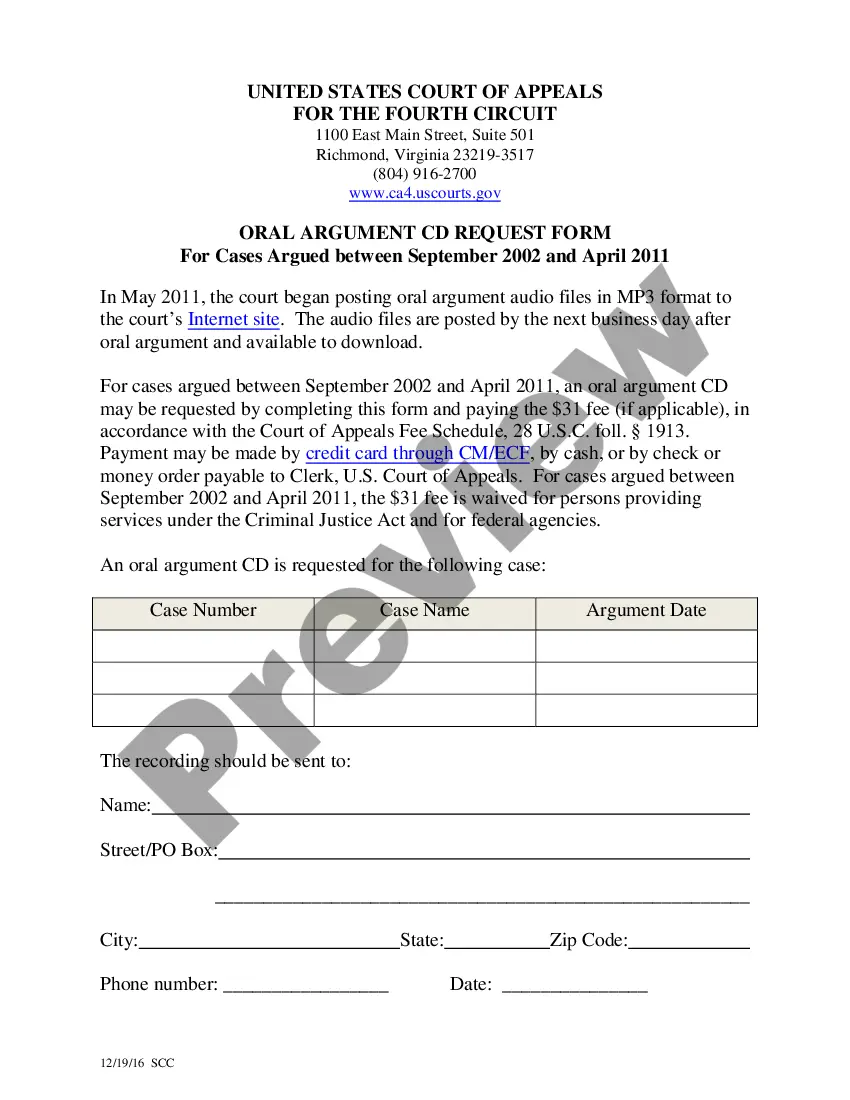

How to fill out Sample Letter For Final Settlement Agreement?

If you wish to obtain, acquire, or print legal document templates, utilize US Legal Forms, the leading selection of legal forms available online.

Take advantage of the site's simple and convenient search to find the documents you need.

A range of templates for commercial and personal purposes are categorized by type and state, or keywords. Use US Legal Forms to access the Connecticut Sample Letter for Final Settlement Agreement in just a few clicks.

Step 5. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Connecticut Sample Letter for Final Settlement Agreement. Each legal document template you download is yours indefinitely. You will have access to every form you acquired in your account. Click on the My documents section and select a form to print or download again. Be proactive and download and print the Connecticut Sample Letter for Final Settlement Agreement with US Legal Forms. There are many professional and state-specific forms you can use for your business or personal needs.

- When you are already a US Legal Forms user, Log In to your account and click the Download button to locate the Connecticut Sample Letter for Final Settlement Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the page to find other versions of the legal form template.

- Step 4. Once you have located the form you require, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

What Should Be Included in a Settlement Agreement? Identifying information for all involved parties. A description of the issue you're seeking to settle. An offer of resolutions that both parties agree to. Proof of valid consideration from both parties without coercion or duress. Legal purpose.

This is a formal letter that should include: A summary of the original incident with any factual disputes highlighted. Evidence to support the version of events provided in the Settlement Demand Letter. An outline of any relevant legal standards that apply to the matter. A settlement offer and terms/timeline for acceptance.

I/We understand that the Bank has introduced ?OTS SCHEME? for recovery of outstanding dues, waiving some part of the interest and other charges in the account. I/We request you to consider my case for One Time Settlement and advise me the rebate I shall get if I arrange to pay the balance outstanding in full.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

A settlement letter is a written offer from a creditor to settle a debt, and serves as legal documentation of this arrangement. A settlement letter is a legally binding agreement on both you and the creditor, and technically replaces your original contract with them.

In its simplest form, the settlement agreement states that for a specific amount of money paid, the lawsuit is dismissed. In a more complex form, this type of document can stipulate: Payment limits and plans. Confidentiality clauses.

A debt settlement letter is a written proposal for you to offer a specific amount of money in exchange for the forgiveness of your debt. These letters address why you're unable to pay the debt, how much you're willing to pay now, and what you would like from the creditors in return.

If you're thinking about negotiating a settlement or repayment agreement with a debt collector, consider the following three steps: Confirm that you owe the debt. ... Calculate a realistic repayment plan. ... 3. Make a repayment proposal to the debt collector.