Most states have adopted charitable solicitation laws designed to protect donors, the general public, and charities themselves from fraud. Generally, these laws require charities and their fundraisers to register with the state, describe their fundraising activities, file financial documents, and pay a fee that covers the administrative expenses of monitoring charities. The Federal Trade Commission authorizes the filing of complaints when it has reason to believe that the law has been or is being violated, and it appears to the Commission that a proceeding is in the public interest.

Connecticut Fundraising Agreement

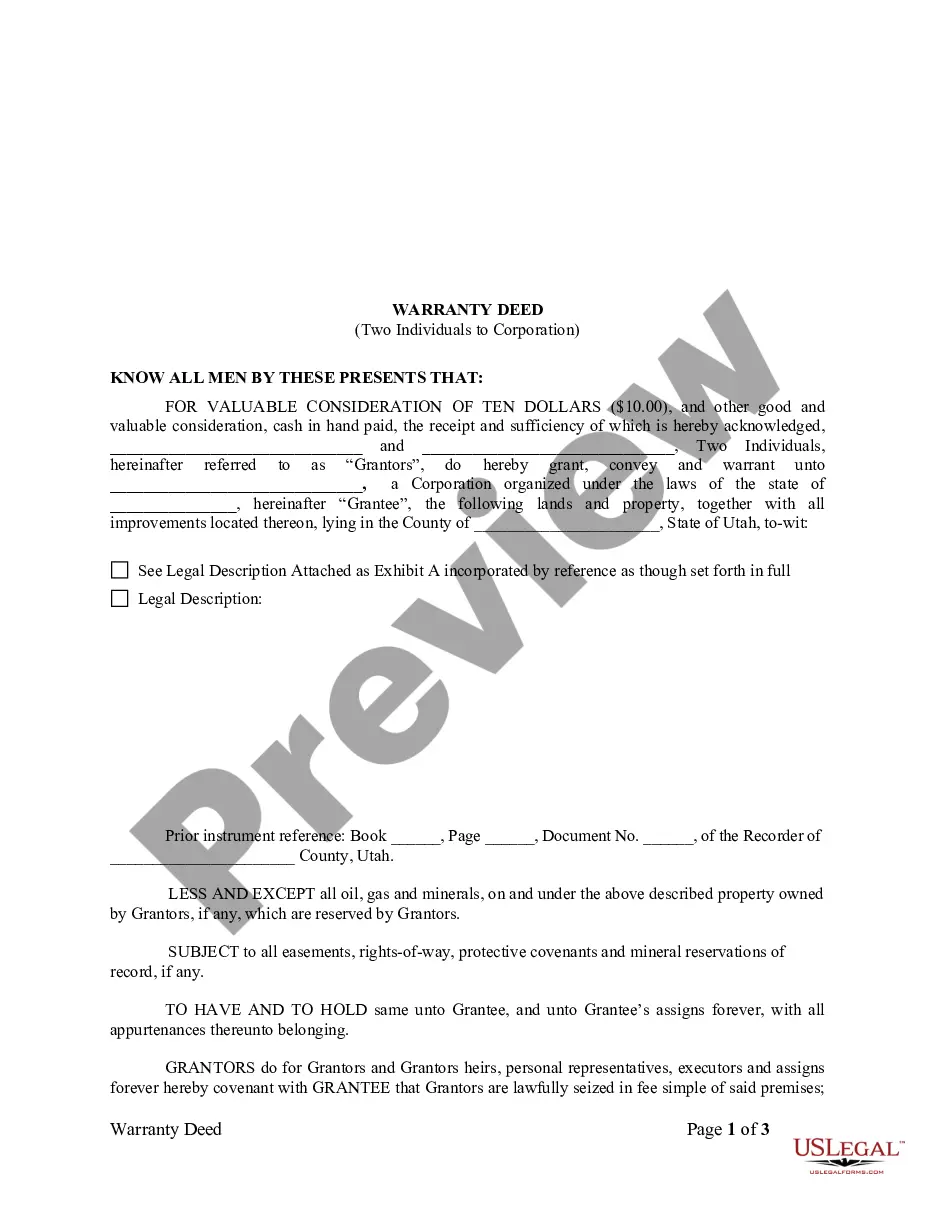

Description

How to fill out Fundraising Agreement?

If you require to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's simple and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the payment plan you prefer and provide your information to register for an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Connecticut Fundraising Agreement in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the Connecticut Fundraising Agreement.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find other forms in the legal format.

Form popularity

FAQ

To register a charity in Florida, you need to file with the Florida Department of Agriculture and Consumer Services. The process requires providing details about your organization, its purpose, and financial information. While this process is for Florida, if you intend to operate or fundraise in Connecticut, having a Connecticut Fundraising Agreement is equally essential to ensure compliance with state laws related to charitable activities.

To open a nonprofit in Connecticut, you must first choose a distinct name that complies with state rules. Next, file your Articles of Incorporation with the Connecticut Secretary of State. After that, consider creating a Connecticut Fundraising Agreement to ensure you meet all legal requirements when raising funds. Finally, obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

To report fundraising income, you should track all funds raised and maintain accurate records of expenses related to the fundraising activities. Depending on your organization's structure, you may need to file specific tax forms with the IRS and the state of Connecticut. Don’t forget that a Connecticut fundraising agreement can help clarify how income is reported and distributed among stakeholders.

A fundraising contract is a legal document that outlines the terms of a fundraising campaign or event. It details the roles of the parties involved, the use of funds, and the duration of the campaign. Having a clear fundraising contract, similar to a Connecticut fundraising agreement, can help prevent misunderstandings and ensure accountability in your fundraising activities.

Fundraising is the process of actively seeking financial support for a cause, while donations are the contributions received as a result. Fundraising involves planning and organizing events or campaigns, whereas donations can come in any form without a formal solicitation process. Understanding this distinction is essential when drafting a Connecticut fundraising agreement, as it helps clarify the expectations of the parties involved.

The 3 C's of fundraising refer to 'Capacity,' 'Character,' and 'Commitment.' Capacity involves the ability of your organization to generate funds; character denotes trustworthiness and integrity in handling donations; and commitment reflects the dedication of your team and supporters to the cause. Focusing on these elements can significantly enhance your fundraising efforts and strengthen your Connecticut fundraising agreement.

A fundraising agreement is a formal contract between a non-profit organization and an individual or business to outline the terms of fundraising activities. This document specifies the roles, responsibilities, and distribution of funds raised. A well-crafted Connecticut fundraising agreement ensures that all parties are clear on their obligations and protects the integrity of the fundraising process.

The Connecticut Solicitation of Charitable Funds Act regulates fundraising activities in the state. This law requires certain organizations to register before soliciting donations. Essentially, it protects the public from fraudulent practices while providing transparency regarding charitable fundraising. Understanding this act is vital, especially when establishing a Connecticut fundraising agreement to adhere to local laws.

To set up a non-profit in Connecticut, you must first choose a unique name and file a Certificate of Incorporation with the Secretary of State. This document should include your non-profit’s purpose and organizational structure. After that, you’ll need to apply for tax-exempt status with the IRS. Utilizing a Connecticut fundraising agreement can help define your fundraising activities and ensure compliance with state regulations.

Renewing your charity registration in Connecticut is a straightforward process. You should gather your current documentation and complete the necessary renewal application provided by the state. It is vital to ensure that your fundraising operations comply with the Connecticut Fundraising Agreement to maintain good standing. Consider using USLegalForms to access templates and resources that simplify this renewal process.