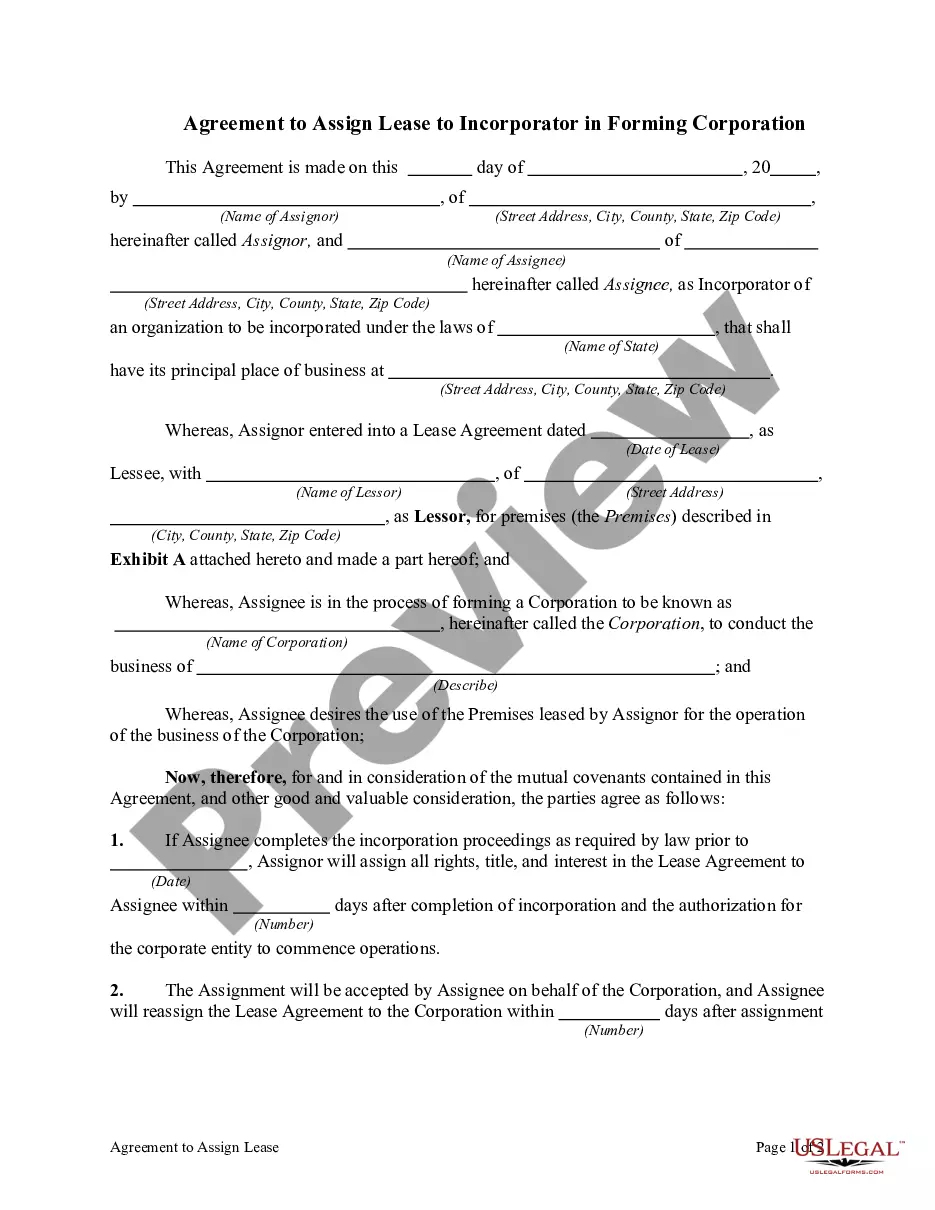

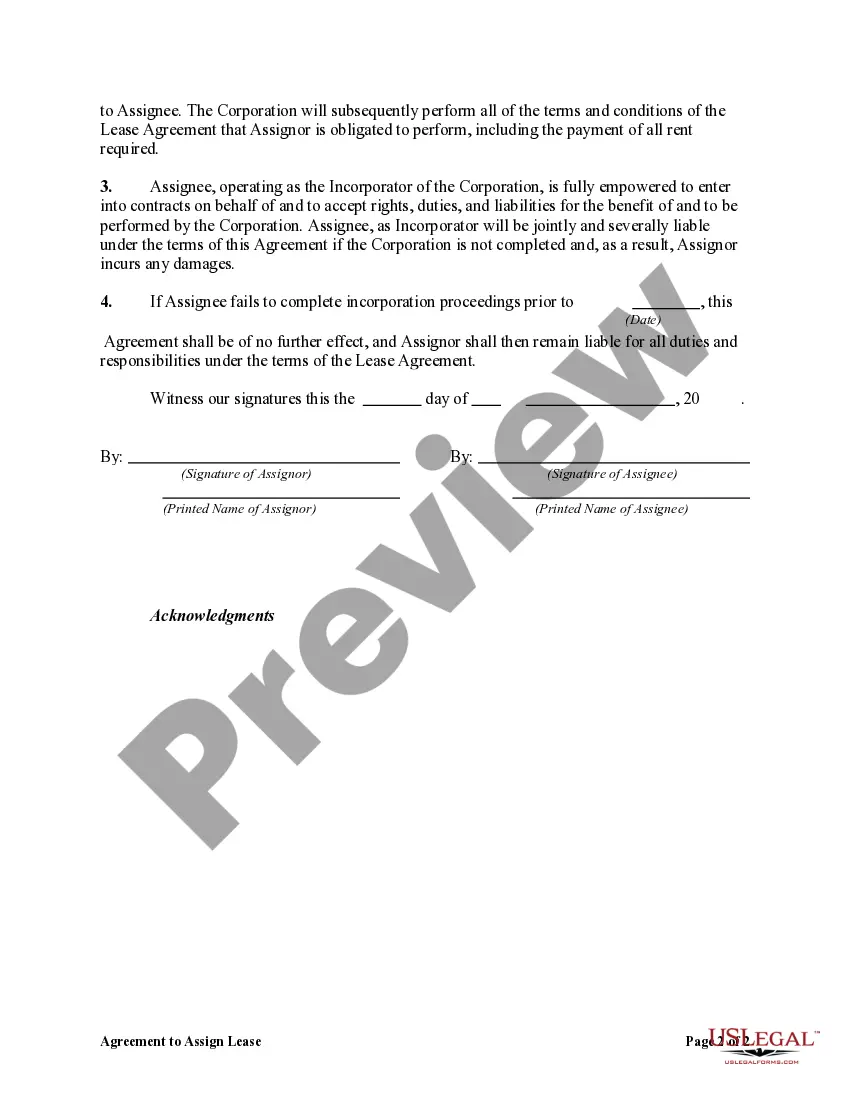

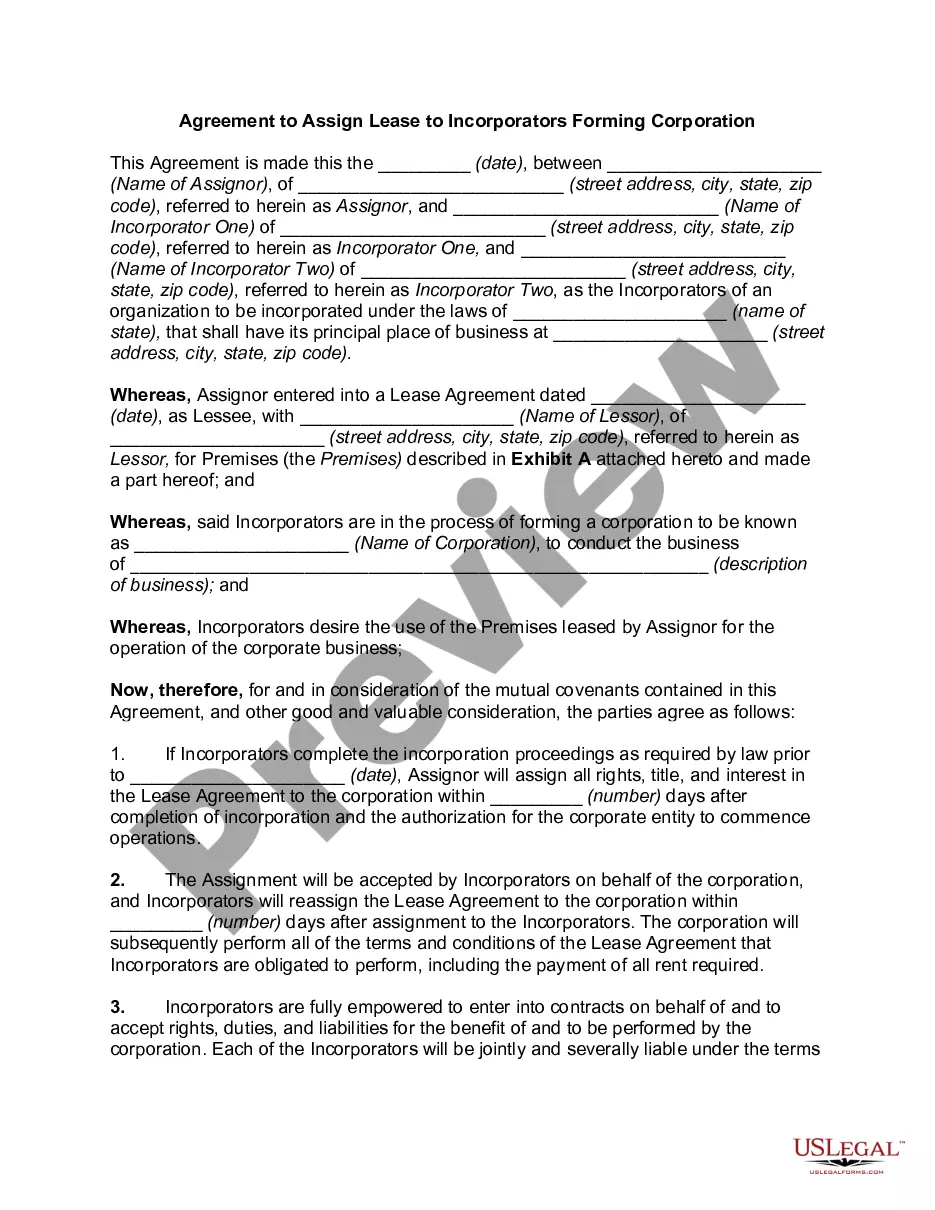

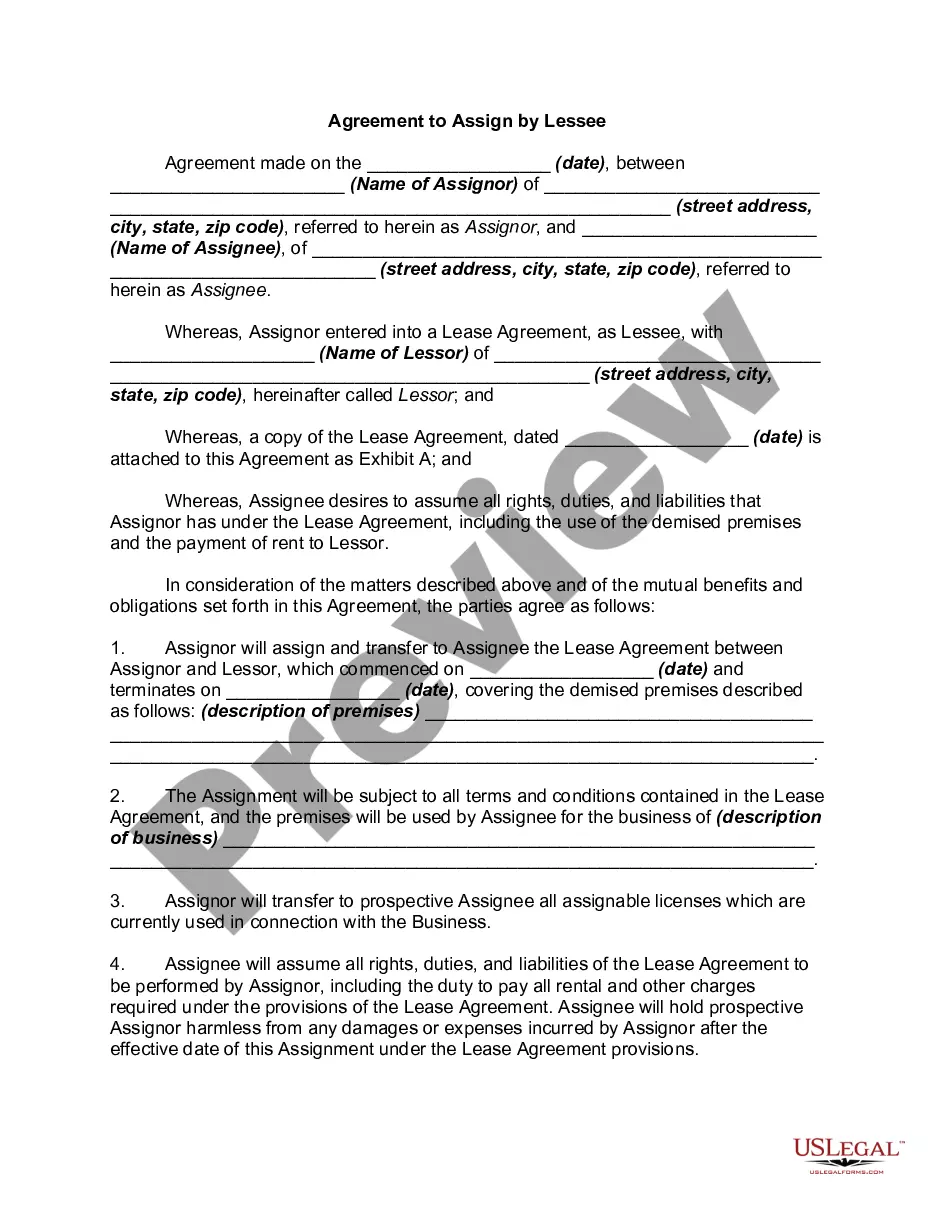

Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation

Description

How to fill out Agreement To Assign Lease To Incorporator In Forming Corporation?

You can spend time online attempting to locate the legal document template that satisfies the federal and state regulations you require.

US Legal Forms offers a vast collection of legal forms that have been reviewed by professionals.

You can easily download or print the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation from the service.

First, make sure that you have chosen the correct document template for the state/city that you select. Review the form details to confirm that you have chosen the right form. If available, utilize the Review button to look over the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download button.

- Next, you can complete, modify, print, or sign the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation.

- Every legal document template you obtain is yours indefinitely.

- To receive an additional copy of any purchased form, navigate to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

Form popularity

FAQ

To set up a corporation in Connecticut, begin by filing your articles of incorporation with the Secretary of State. Following this, draft corporate bylaws, hold an initial meeting of directors, and issue stock to shareholders. Utilizing the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation can streamline your process and clarify your responsibilities as you establish your corporation.

In Connecticut, the minimum tax for a corporation is typically $250, but this can vary based on certain factors, including revenue. It's crucial to consult with a tax advisor for the most accurate information pertinent to your situation. Additionally, understanding the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation may also impact your tax obligations.

You can find articles of incorporation in Connecticut through the Secretary of the State's online search tool. This platform allows you to view and download documents related to your corporation. Familiarizing yourself with the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation can enhance your comprehension of your corporate documents.

To obtain a copy of your business license in Connecticut, contact the local city or town clerk's office where your business is registered. They usually keep records of all business licenses issued in their jurisdiction. Make sure to check the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation to understand any licensing requirements related to your corporation.

Yes, you can start a corporation by yourself in Connecticut. You need to complete the necessary paperwork, including the articles of incorporation, and submit it to the state. Understanding the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation will be beneficial, as it may play a significant role in your corporate structure.

You can obtain articles of incorporation for Connecticut from the Connecticut Secretary of the State's website. Typically, these documents are available for download or can be requested directly from their office. If you are forming a corporation, it's essential to have a solid understanding of the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation as it relates to your articles.

Forming a corporation begins with selecting a name and preparing the Articles of Incorporation for filing. You'll then need to establish corporate bylaws, appoint directors, and issue shares. Finally, using the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation will enhance your business establishment process by facilitating the assignment of leases and ensuring that your rights as a corporation are protected.

The formation of a corporation involves several key steps, starting with filing Articles of Incorporation with the state. Next, you’ll need to create corporate bylaws, hold an initial meeting, and issue stock to shareholders. Additionally, implementing the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation will help in securing necessary leases and ensuring legal compliance from the very beginning.

Yes, one person can own 100% of a corporation. This structure allows for complete control over business decisions and profit distribution. It's important to keep in mind that the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation can facilitate the transition of lease agreements to your corporation, ensuring you maintain ownership and manage your assets seamlessly.

Creating a corporation involves several critical steps. First, you need to choose a unique name and file your Articles of Incorporation with the state. Following that, you will need to create corporate bylaws and consider formalizing the Connecticut Agreement to Assign Lease to Incorporator in Forming Corporation to secure property rights necessary for your business operations.