Connecticut Option of Remaining Partners to Purchase

Description

How to fill out Option Of Remaining Partners To Purchase?

Are you currently in a circumstance that requires documentation for either business or personal uses almost daily.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms provides thousands of template forms, including the Connecticut Option of Remaining Partners to Purchase, which are designed to meet federal and state regulations.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Connecticut Option of Remaining Partners to Purchase template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the correct area/state.

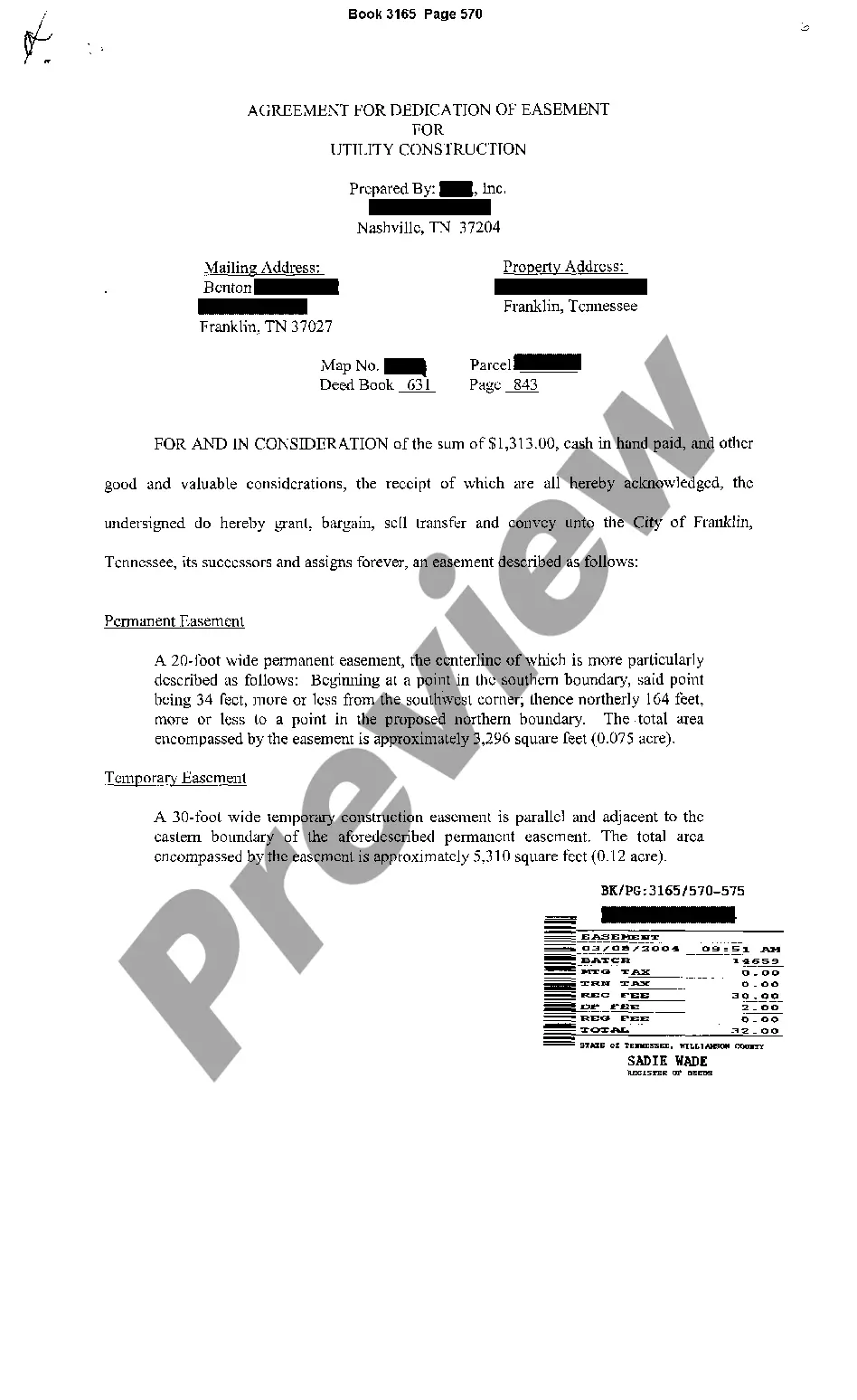

- Utilize the Preview feature to review the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to locate the form that meets your needs and criteria.

Form popularity

FAQ

In Connecticut, the treatment of alimony for tax purposes depends on when the divorce judgment was issued. If the judgment was finalized before December 31, 2018, alimony payments are taxable to the recipient and deductible for the payer. However, for judgments finalized after this date, the payments are no longer taxable, aligning with recent federal tax law changes, emphasizing the importance of understanding your specific situation.

To dissolve your Connecticut LLC, you submit Articles of Dissolution to the Connecticut Secretary of the State, Commercial Recording Division (SOTS). You are not required to use the SOTS form, you may draft your own articles of dissolution.

You must file a Connecticut income tax return if your gross income for the taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or.

CT can tax ALL your income. MA can tax the income you earned by working in MA. You'll be able to take a credit on your CT return for the taxes paid to MA, so you won't be double-taxed.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

Yes. Connecticut has reciprocity agreements with Alabama, Colorado, Florida, Georgia, Illinois, Indiana, Massachusetts, Mississippi, Nebraska, New York, Ohio, Oklahoma, and Rhode Island. Learn more about reciprocity with Connecticut.

Every PE that does business in Connecticut or has income derived from or connected with sources within Connecticut must file Form CT20111065/CT20111120SI regardless of the amount of its income or loss.

Form CT-941 is used to reconcile quarterly Connecticut income tax withholding from wages only. Form CT-941 must be filed and paid electronically unless certain conditions are met. File this return and make payment electronically using myconneCT at portal.ct.gov/DRS-myconneCT.

The Connecticut resident will receive credit from Connecticut for income tax paid to the other state on income earned for services performed in the other state. The credit allowed will be the lesser of the tax paid to the other state or the tax which Connecticut imposes on the resident's out-of-state wages.

You must file a Connecticut income tax return if your gross income for the taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or.