Connecticut Sample Letter for Judgment Confirming Tax Title

Description

How to fill out Sample Letter For Judgment Confirming Tax Title?

If you need to gather, acquire, or create legal document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Take advantage of the site’s user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now option. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal document and download it to your device. Step 7. Finalize, edit, and print or sign the Connecticut Sample Letter for Judgment Confirming Tax Title.

Each legal document template you obtain is yours permanently. You have access to every document you downloaded in your account. Select the My documents section and choose a document to print or download again.

Complete and download, and print the Connecticut Sample Letter for Judgment Confirming Tax Title with US Legal Forms. There are countless professional and state-specific documents available for your business or personal needs.

- Utilize US Legal Forms to find the Connecticut Sample Letter for Judgment Confirming Tax Title with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to access the Connecticut Sample Letter for Judgment Confirming Tax Title.

- You can also retrieve documents you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

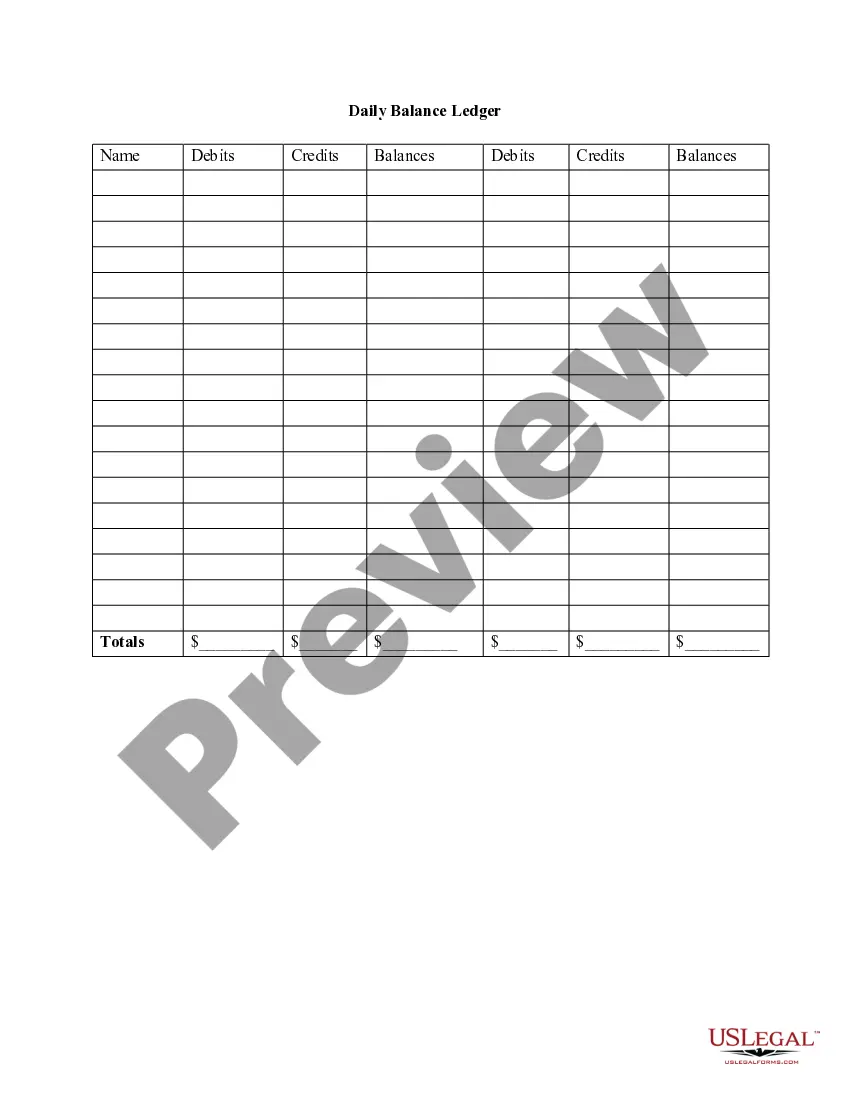

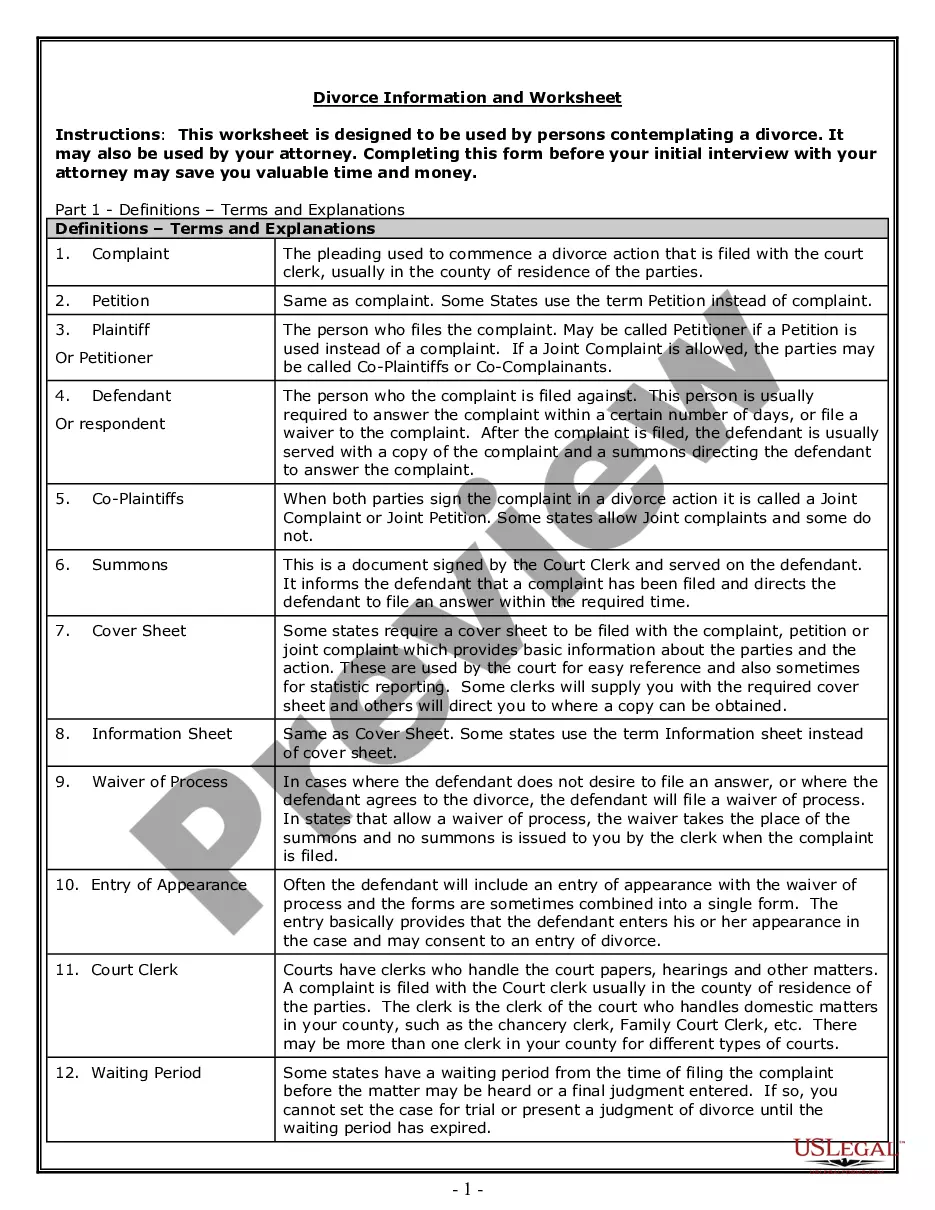

- Step 2. Utilize the Preview option to review the form’s content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal document collection.

Form popularity

FAQ

Motions for orders of compliance (or motions to compel, as they are frequently called) are governed by Section 13-14 of the Connecticut Practice Book. As in many jurisdictions, judges in Connecticut generally prefer that parties and their counsel resolve discovery disputes without the need for judicial intervention.

Rule 4.2 of the Rules of Professional Conduct provides that ?[i]n representing a client, a lawyer shall not communicate about the subject of the representation with a party the lawyer knows to be represented by another lawyer in the matter, unless the lawyer has the consent of the other lawyer or is authorized by law ...

Rule 8.4(7) defines ?professional misconduct? by a Connecticut attorney as including speech that the lawyer knows or reasonably should know ?is harassment or discrimination on the basis of? any of 15 listed characteristics?among them race, sex, religion, disability, sexual orientation, and gender identity.

Rule 7.1. A lawyer shall not make a false or misleading communication about the lawyer or the lawyer's services. A communication is false or misleading if it contains a material misrepresentation of fact or law, or omits a fact necessary to make the statement considered as a whole not materially misleading.

Although it is prohibited to mix lawyer funds with client funds, Rule 1.15 of the Connecticut Rules of Professional Conduct permits a lawyer's own funds to be placed in a trust account for the sole purposes of paying financial institution service charges on the account or to obtain a waiver of fees and service charges ...

Rule 1.10 - Imputation of Conflicts of Interest: General Rule (a) While lawyers are associated in a firm, none of them shall knowingly represent a client when any one of them practicing alone would be prohibited from doing so by Rules 1.7, 1.8(c), or 1.9, unless the prohibition is based on a personal interest of the ...

Rule 7.1. A communication is false or misleading if it contains a material misrepresentation of fact or law, or omits a fact necessary to make the statement considered as a whole not materially misleading.