Connecticut Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Are you currently in a position where you require documentation for either business or personal purposes almost constantly.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Connecticut Revocable Trust for Asset Protection, tailored to comply with federal and state regulations.

Once you find the correct form, click Acquire now.

Choose the pricing plan that suits you, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit/debit card. Select a convenient format and download your copy. Access all the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the Connecticut Revocable Trust for Asset Protection whenever needed. Click the required form to download or print the document template. Utilize US Legal Forms, the most comprehensive range of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Revocable Trust for Asset Protection template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- 1. Locate the form you require and ensure it corresponds to the correct city/state.

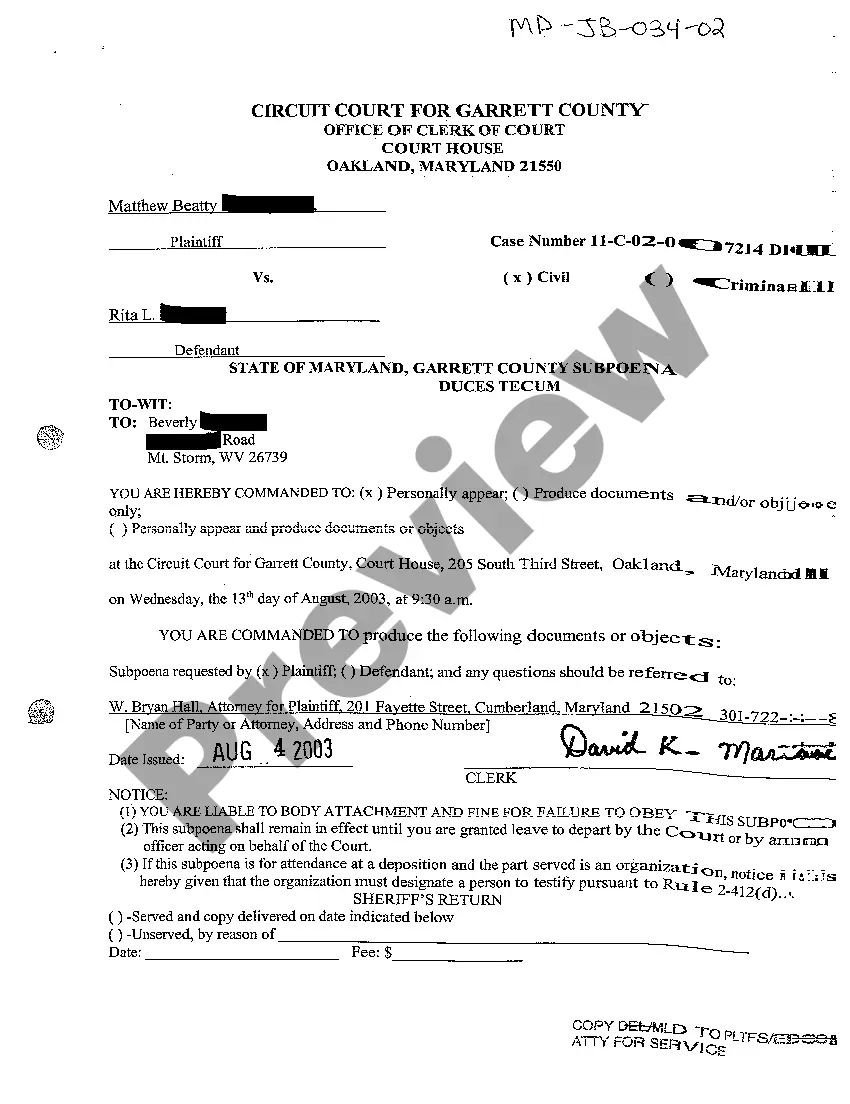

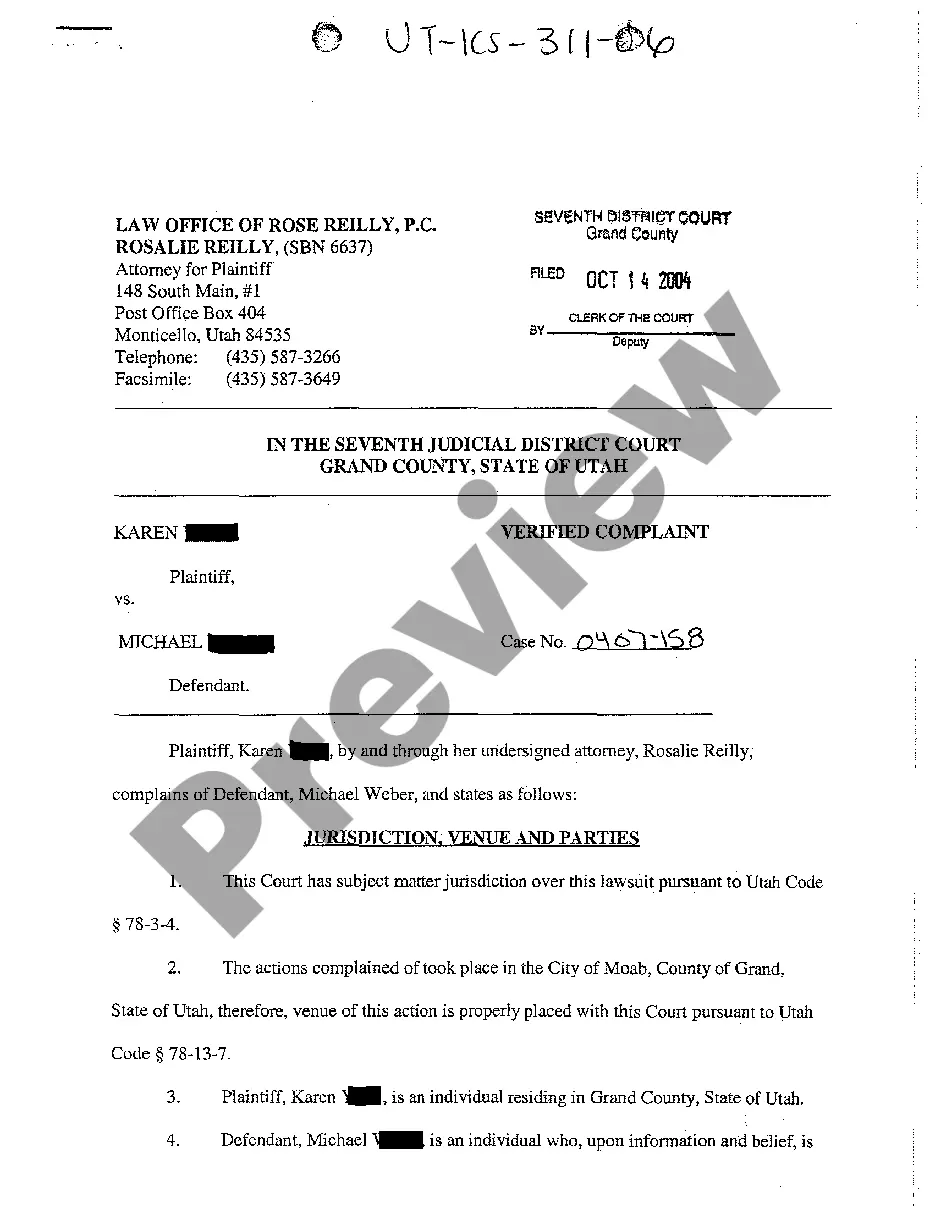

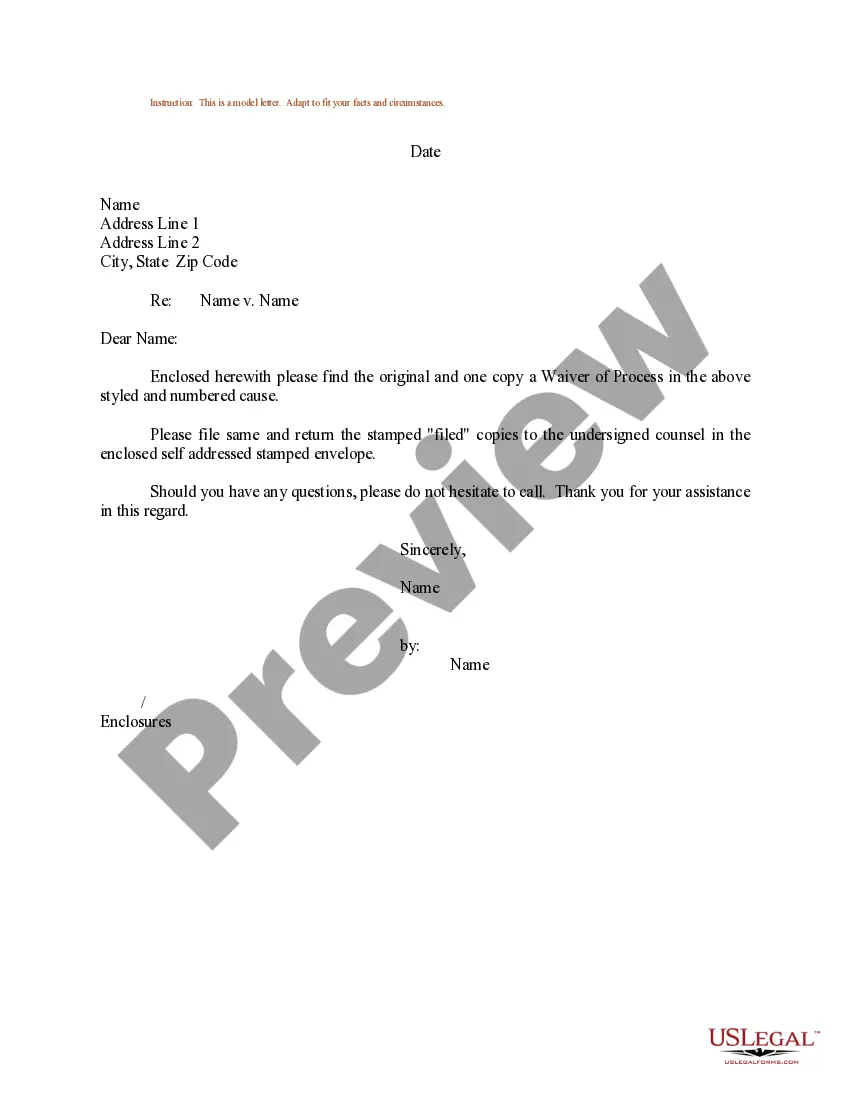

- 2. Use the Preview button to review the form.

- 3. Read the description to confirm you have selected the right form.

- 4. If the form does not match what you are looking for, utilize the Search field to find the form that fits your needs.

Form popularity

FAQ

To set up a Connecticut Revocable Trust for Asset Protection, you must first decide on the assets you want to include. Then, create the trust document, which outlines the terms and provisions of the trust. You can use online platforms like uslegalforms to streamline the process and ensure all legal requirements are met. Finally, transfer your assets into the trust, completing your setup.

One downside of a Connecticut Revocable Trust for Asset Protection is that it may not provide complete protection from creditors. While it does offer advantages for avoiding probate, you still retain control of the assets, which can expose them to claims. Additionally, setting up and maintaining a trust can involve legal fees and administrative tasks. It's essential to weigh these considerations against the benefits to determine if this solution is right for you.

For asset protection in Connecticut, a revocable trust is a common choice, but consider an irrevocable trust for stronger safeguards. An irrevocable trust removes assets from your estate, making them less accessible to creditors. Choosing the best type of trust depends on your specific financial situation and goals. Consulting with a professional can help you determine the right type of trust tailored to your needs.

A Connecticut Revocable Trust for Asset Protection can provide some level of protection, but it is crucial to understand its limits. While it allows for the management of assets during your lifetime, creditors may still have access to these assets. However, it does help avoid probate and can provide a clear plan for asset distribution. To strengthen protection, consider combining it with other legal strategies.

To start a Connecticut Revocable Trust for Asset Protection, begin by identifying the assets you wish to protect. Next, consult a legal professional to help you draft the trust document according to Connecticut laws. Once the document is complete, transfer your chosen assets into the trust. This process ensures that your assets are managed and distributed according to your wishes while providing a layer of protection.

Setting up a protective trust starts with choosing the right type of trust for your needs, such as a Connecticut Revocable Trust for Asset Protection. Next, you will need to draft the trust document and appoint a reliable trustee. Once the trust is established, funding it with your assets is crucial, and it's often beneficial to consult with legal professionals for accurate execution.

Writing an asset protection trust involves more than filling out a template; it requires careful thought about your wishes and asset distribution. A Connecticut Revocable Trust for Asset Protection must outline the management of your assets during your lifetime and after. Using platforms like uslegalforms can simplify this process by providing templates and guidance that adhere to state requirements.

The best trust structure for asset protection often combines a revocable trust with certain irrevocable components. A Connecticut Revocable Trust for Asset Protection allows flexibility initially, while strategic irrevocable trusts can protect assets from creditors. Consider consulting with an estate planning expert to tailor a structure that meets your specific needs and goals.

One of the most significant errors parents make is failing to communicate their intentions clearly when creating a trust fund. Without proper guidance or documentation, beneficiaries may not understand the terms of a Connecticut Revocable Trust for Asset Protection. Additionally, neglecting to update the trust as family circumstances change can lead to confusion and potential conflicts.

To establish a Connecticut Revocable Trust for Asset Protection, you need to ensure that the trust is properly drafted and funded. This involves appointing a trustee, choosing beneficiaries, and clearly detailing how assets will be managed. Additionally, you should consider state regulations that dictate what can be included in the trust, ensuring compliance with legal standards.