No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Connecticut Collection Agency's Return of Claim as Uncollectible

Description

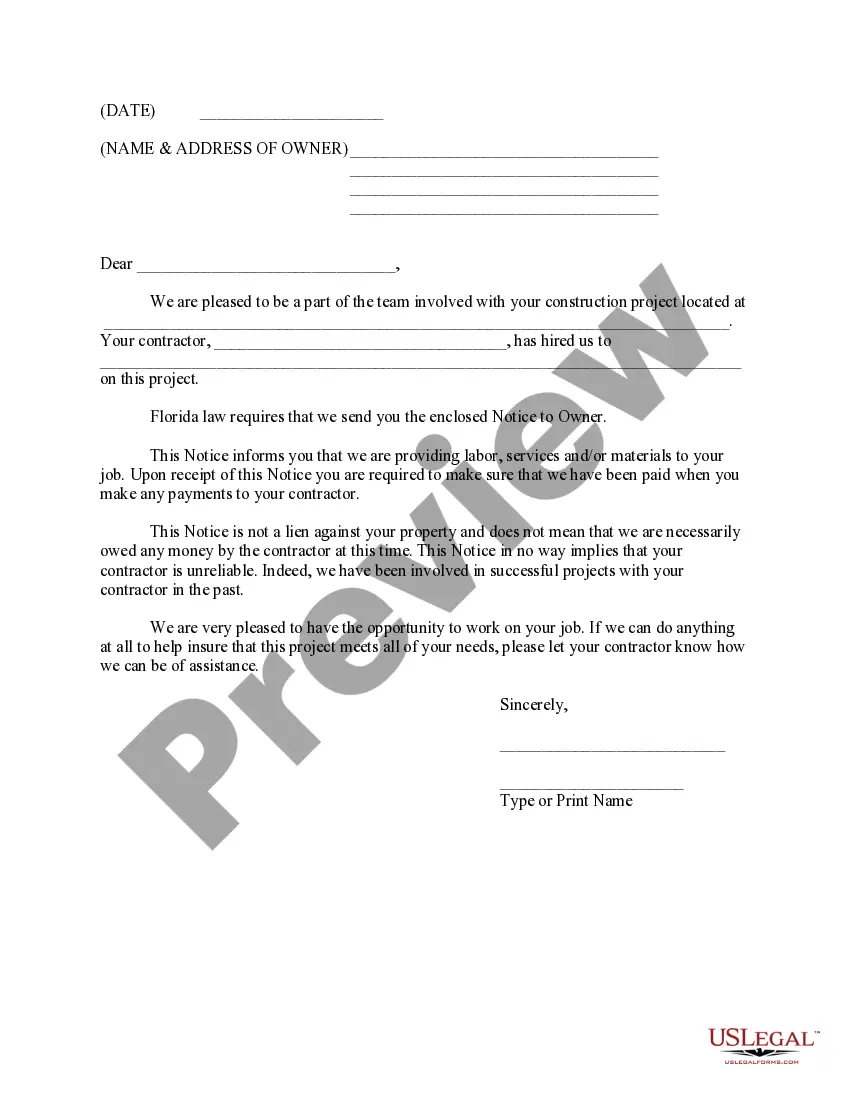

How to fill out Collection Agency's Return Of Claim As Uncollectible?

It is feasible to spend hours online searching for the appropriate legal document template that meets your state and federal requirements.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can easily download or print the Connecticut Collection Agency's Return of Claim as Uncollectible from my service.

If available, utilize the Preview button to review the document template as well.

- If you have a US Legal Forms account, you may sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Connecticut Collection Agency's Return of Claim as Uncollectible.

- Each legal document template you purchase is yours forever.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the basic instructions below.

- First, ensure that you have selected the correct document template for the area/region of your choice.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

If you haven't yet paid your debt, you can try to get the collections agency to agree to remove the item once it is paid off. If you've already paid the debt, you don't have much bargaining power but you can ask your creditor to take this action on your behalf as a gesture of goodwill.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

STATUTE OF LIMITATIONS FOR DEBT COLLECTION Creditors attempting to collect past-due debt, must bring an action in court (known as an action for account) within six years of the time the right of action accrues or the claim is barred by operation of the statute.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.