Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal purposes, organized by type, state, or keywords.

You can find the latest versions of forms such as the Connecticut Bartering Contract or Exchange Agreement within moments.

Review the form summary to ensure you have chosen the right form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have an account, Log In to obtain the Connecticut Bartering Contract or Exchange Agreement from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to check the content of the form.

Form popularity

FAQ

Yes, bartering income is taxable in the US. When you trade goods or services, the value of what you receive must be reported as income on your tax return. Therefore, utilizing a Connecticut Bartering Contract or Exchange Agreement can help you document these transactions accurately, ensuring you meet your tax obligations while benefiting from bartering.

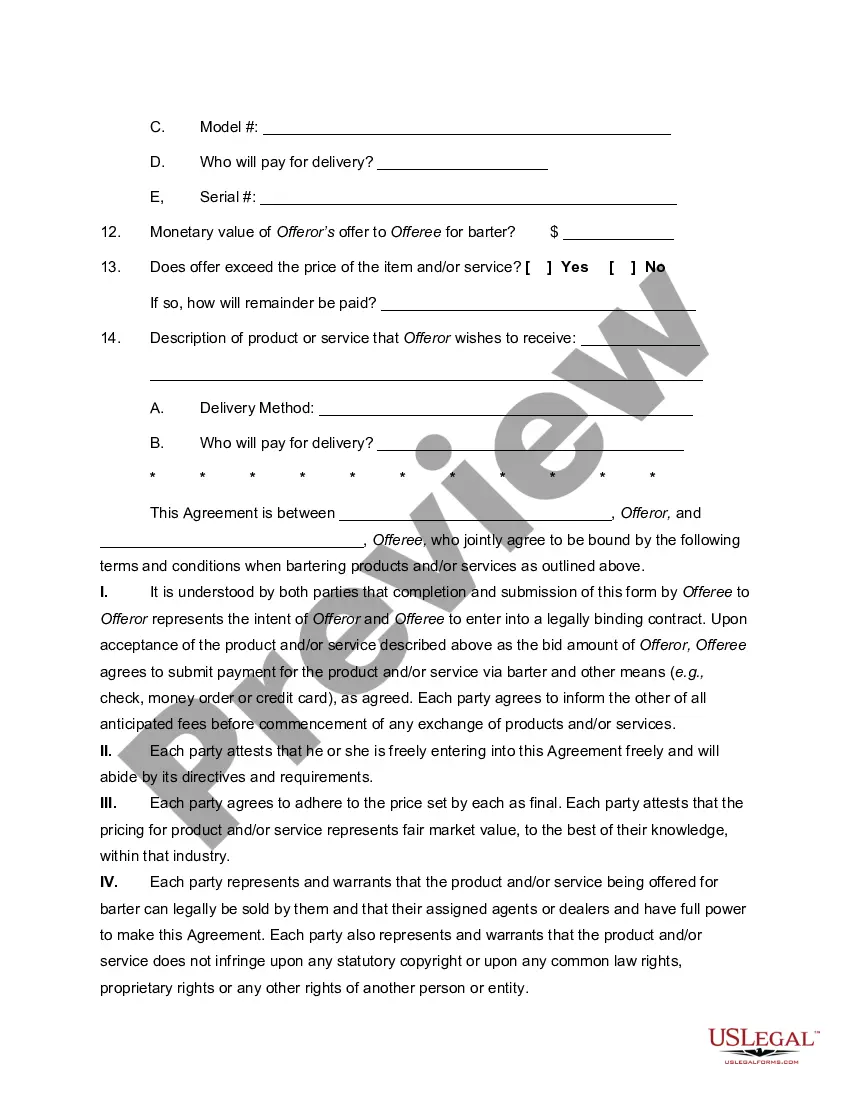

An example of a barter contract could involve a web designer agreeing to create a website in exchange for legal services from a lawyer. The Connecticut Bartering Contract or Exchange Agreement would detail the specifics, such as the deliverables and timelines for both parties. This clarity helps maintain a positive working relationship and ensures both sides hold up their end of the bargain.

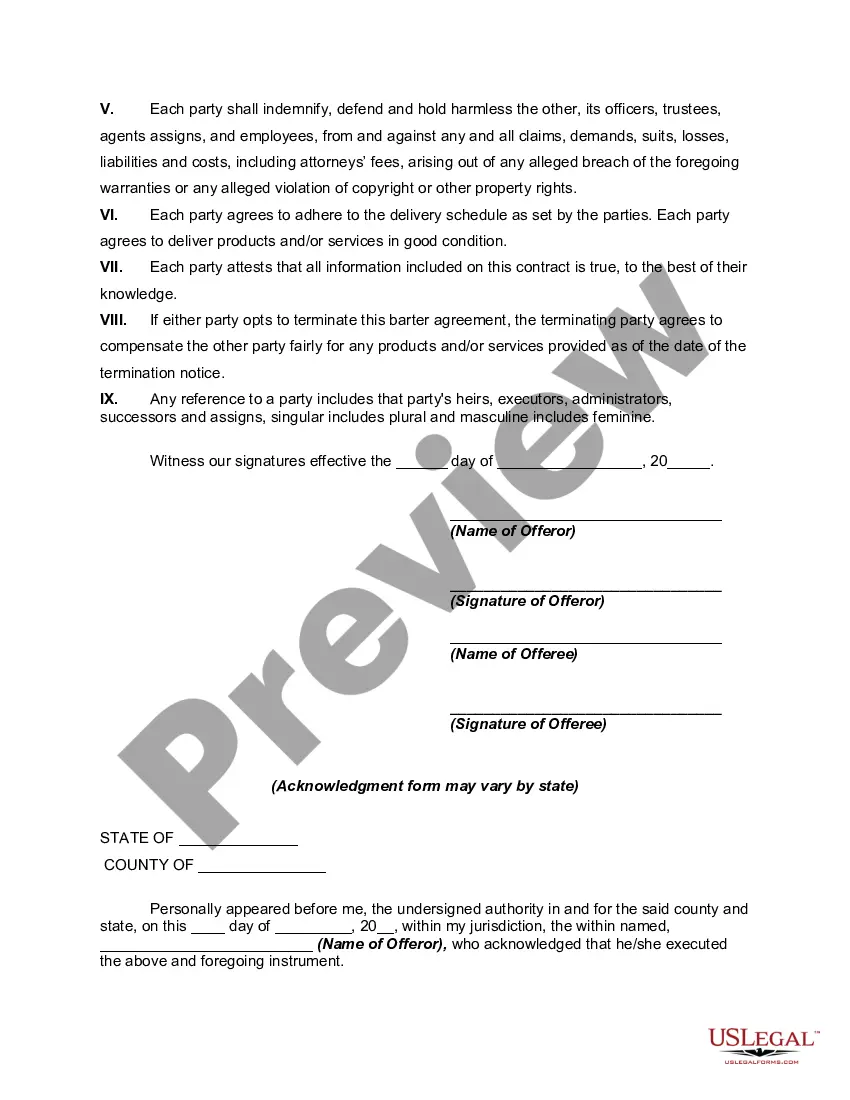

Bartering is governed by the same laws as other contracts, which means both parties should fulfill their obligations as outlined in their agreement. In the context of a Connecticut Bartering Contract or Exchange Agreement, it is essential to ensure that the terms are clear and legally binding. Familiarizing yourself with local laws can prevent potential disputes and protect your interests.

Bartering is not illegal in the US; in fact, it is a common practice. However, participants must comply with various laws and regulations that govern transactions, including tax obligations. Understanding the correct formation of a Connecticut Bartering Contract or Exchange Agreement can help you engage in legal and ethical bartering without violating any laws.

Starting a bartering business involves identifying the services or products you can offer and determining your target market. You should create a clear Connecticut Bartering Contract or Exchange Agreement that outlines terms and conditions for every transaction. Utilizing platforms like uslegalforms can simplify the process by providing the necessary templates and guidance to ensure smooth trades.

Yes, bartering remains legal in the United States, including Connecticut. Individuals and businesses can engage in these exchanges using a Connecticut Bartering Contract or Exchange Agreement, as long as both parties agree on the terms. Such agreements provide a framework that ensures clarity and legality in the transaction.

The IRS recognizes bartering as a legitimate form of trade and requires any income received through bartering to be reported. You must report the fair market value of the goods or services exchanged in your Connecticut Bartering Contract or Exchange Agreement. Understanding the tax implications allows you to navigate bartering with confidence.

To write a barter agreement, start by clearly identifying the parties involved and the items or services being exchanged. It is essential to detail the terms of the exchange, including any deadlines and conditions. Once you've drafted the Connecticut Bartering Contract or Exchange Agreement, ensure both parties review and sign the document to protect their interests.

The limits of bartering often revolve around the legality of the items or services exchanged and the agreed-upon values. Some regulations may apply based on local laws, and it can be challenging to find a bartering partner who has what you need. A Connecticut bartering contract can help clarify expectations and ensure compliance with any applicable rules.

An example of a barter agreement might involve a graphic designer offering design services in exchange for legal advice from a lawyer. This agreement would detail the services provided and their respective values, creating a transparent understanding. Using a Connecticut bartering contract can help formalize such exchanges and protect both parties involved.