The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

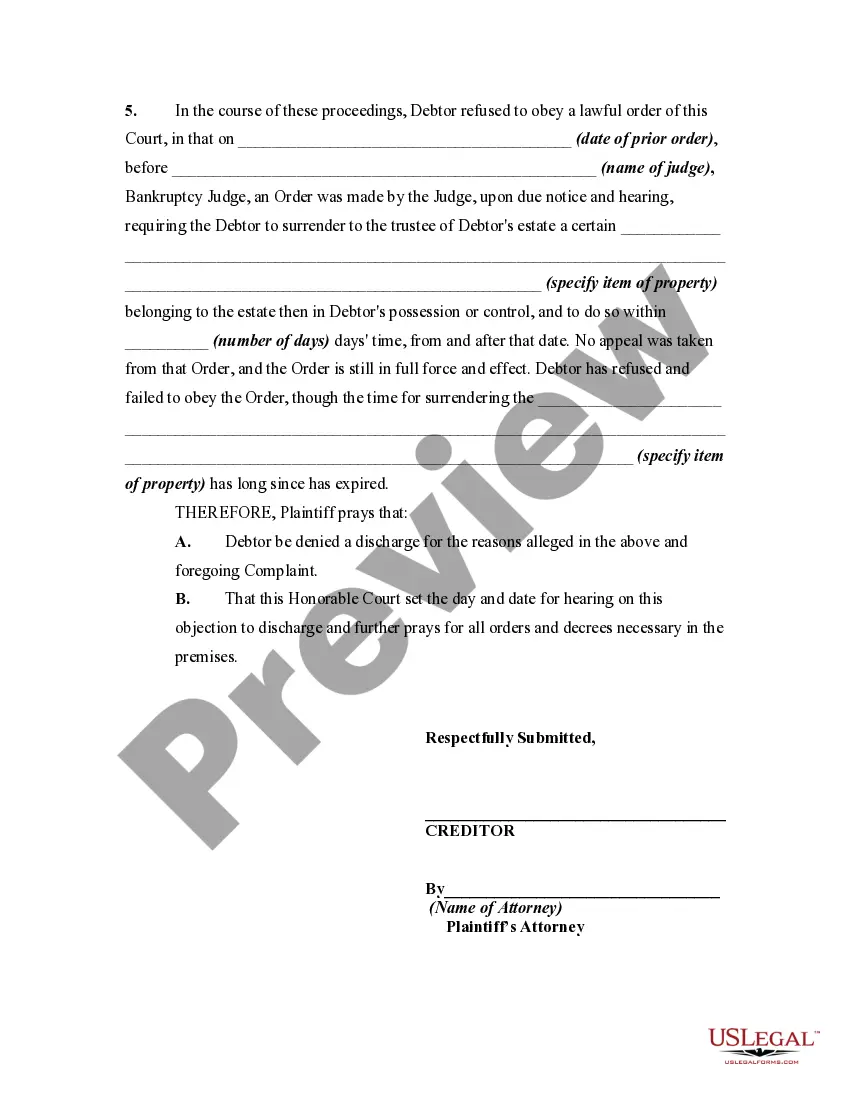

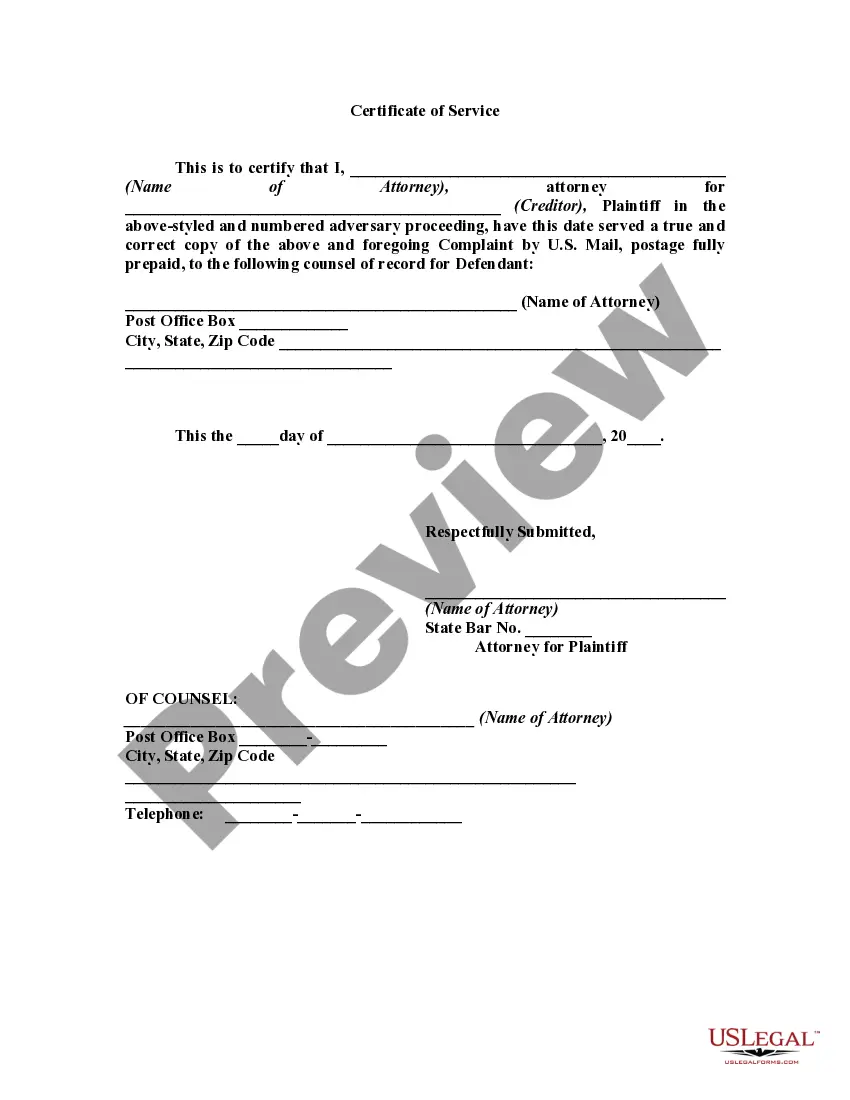

Connecticut Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court

Description

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Proceedings For Refusal By Debtor To Obey A Lawful Order Of The Court?

It is possible to spend time on the web trying to find the lawful record template that fits the federal and state requirements you will need. US Legal Forms supplies a large number of lawful types that are analyzed by specialists. You can easily download or print the Connecticut Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the from our services.

If you currently have a US Legal Forms profile, you are able to log in and click on the Down load key. After that, you are able to comprehensive, revise, print, or sign the Connecticut Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the. Every lawful record template you get is the one you have for a long time. To have an additional copy associated with a bought type, visit the My Forms tab and click on the related key.

If you are using the US Legal Forms website the very first time, follow the simple guidelines below:

- Very first, be sure that you have chosen the right record template for that area/town of your liking. Browse the type outline to ensure you have picked the correct type. If offered, utilize the Review key to check from the record template also.

- In order to discover an additional variation of the type, utilize the Research field to get the template that suits you and requirements.

- After you have identified the template you desire, just click Buy now to proceed.

- Select the rates strategy you desire, type your references, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You can utilize your Visa or Mastercard or PayPal profile to purchase the lawful type.

- Select the structure of the record and download it for your gadget.

- Make alterations for your record if required. It is possible to comprehensive, revise and sign and print Connecticut Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the.

Down load and print a large number of record layouts while using US Legal Forms web site, which offers the greatest assortment of lawful types. Use specialist and status-specific layouts to take on your business or individual requires.

Form popularity

FAQ

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Another exception to Discharge is for fraud while acting in a fiduciary capacity, embezzlement, or larceny. Domestic obligations are not dischargeable in Bankruptcy. Damages resulting from the willful and malicious injury by the debtor of another person or his property, are also not dischargeable in Bankruptcy.

A typical party in interest would include the bankruptcy trustee, other creditors in the same bankruptcy case, and, in some situations, the debtor. For instance, a Chapter 7 debtor will have standing to object?and thereby be an interested party?only if doing so might put money in the debtor's pocket.

Section 523 complaints focus on specific debts to a single creditor. A Section 727 complaint may be filed if the creditor or bankruptcy trustee believes that the debtor has not met the requirements for a discharge under Section 727. Section 727 complaints address the discharge of a debtor's entire debt obligations.

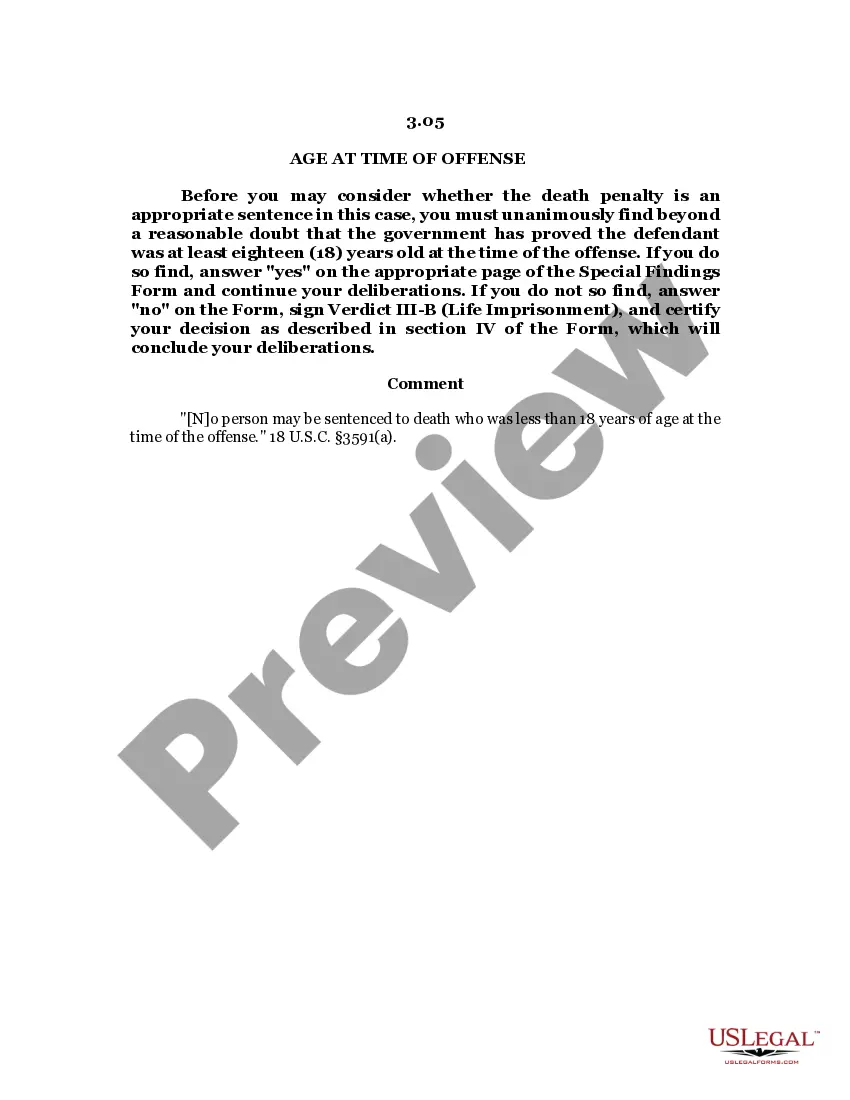

The debtor knowingly made a false oath or account, presented a false claim, etc. Failure to comply with a bankruptcy court order.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

If you had a Chapter 7 that resulted in discharge of your debts, you must wait at least eight years from the date you filed it before filing Chapter 7 bankruptcy again. While Chapter 7 is typically the quickest form of debt relief, the eight-year period to refile is the longest waiting time between cases.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.