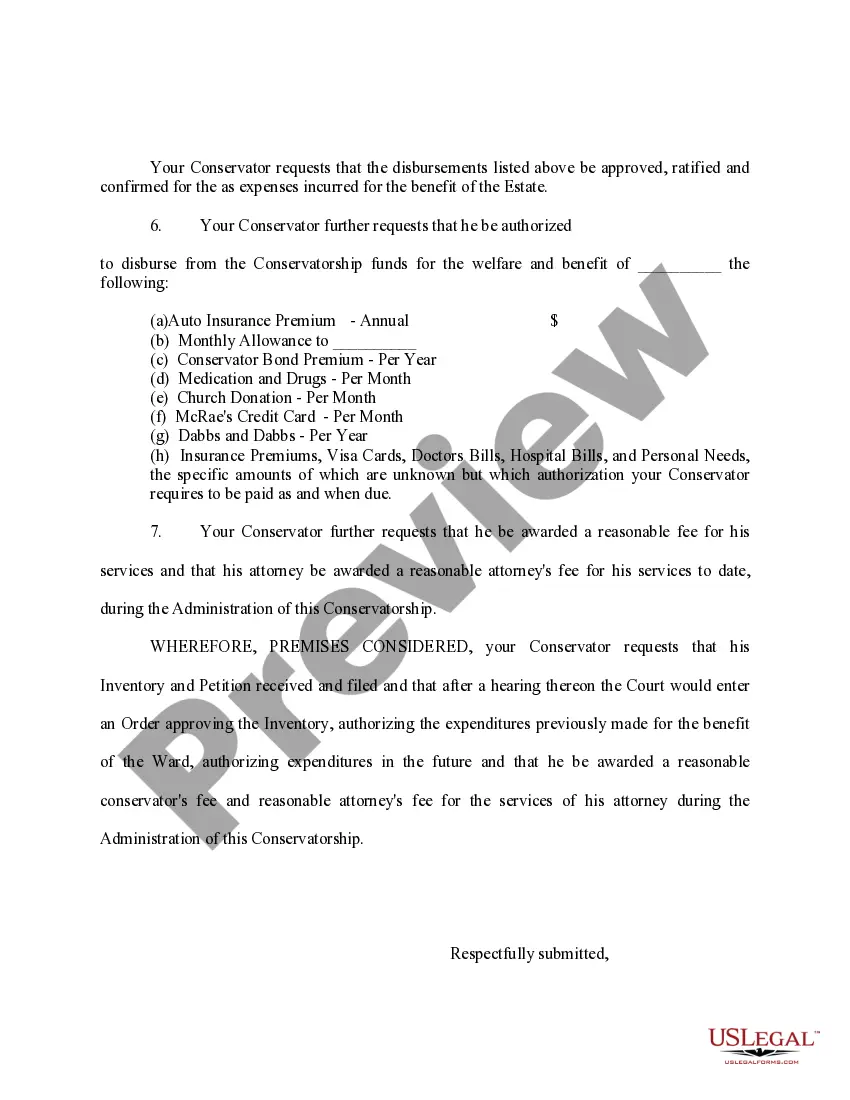

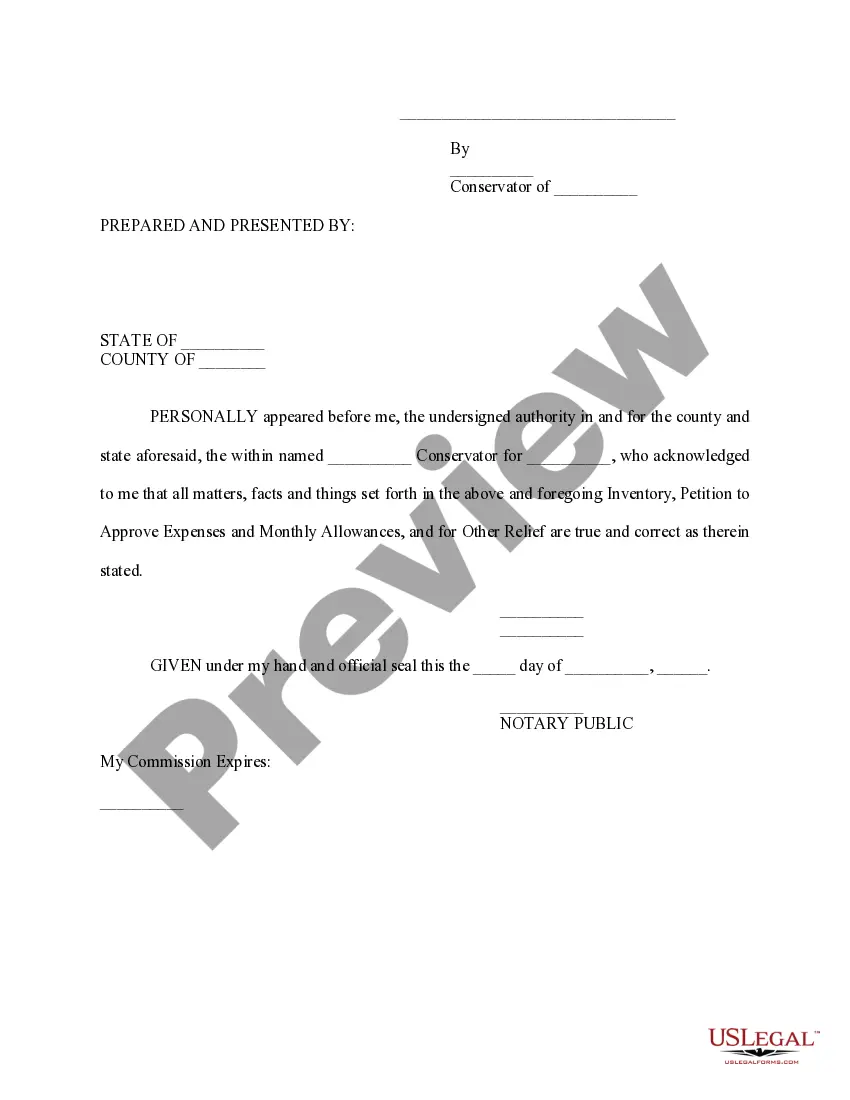

Connecticut Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief

Description

How to fill out Inventory, Petition To Approve Expenses And Monthly Allowances, And For Other Relief?

Finding the right lawful record web template can be a have a problem. Obviously, there are plenty of layouts available on the net, but how would you obtain the lawful type you require? Use the US Legal Forms website. The support gives a huge number of layouts, including the Connecticut Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief, that can be used for organization and private needs. All the types are inspected by pros and satisfy federal and state needs.

When you are previously authorized, log in for your account and click the Down load switch to have the Connecticut Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief. Make use of your account to check throughout the lawful types you may have bought in the past. Visit the My Forms tab of the account and obtain yet another backup of your record you require.

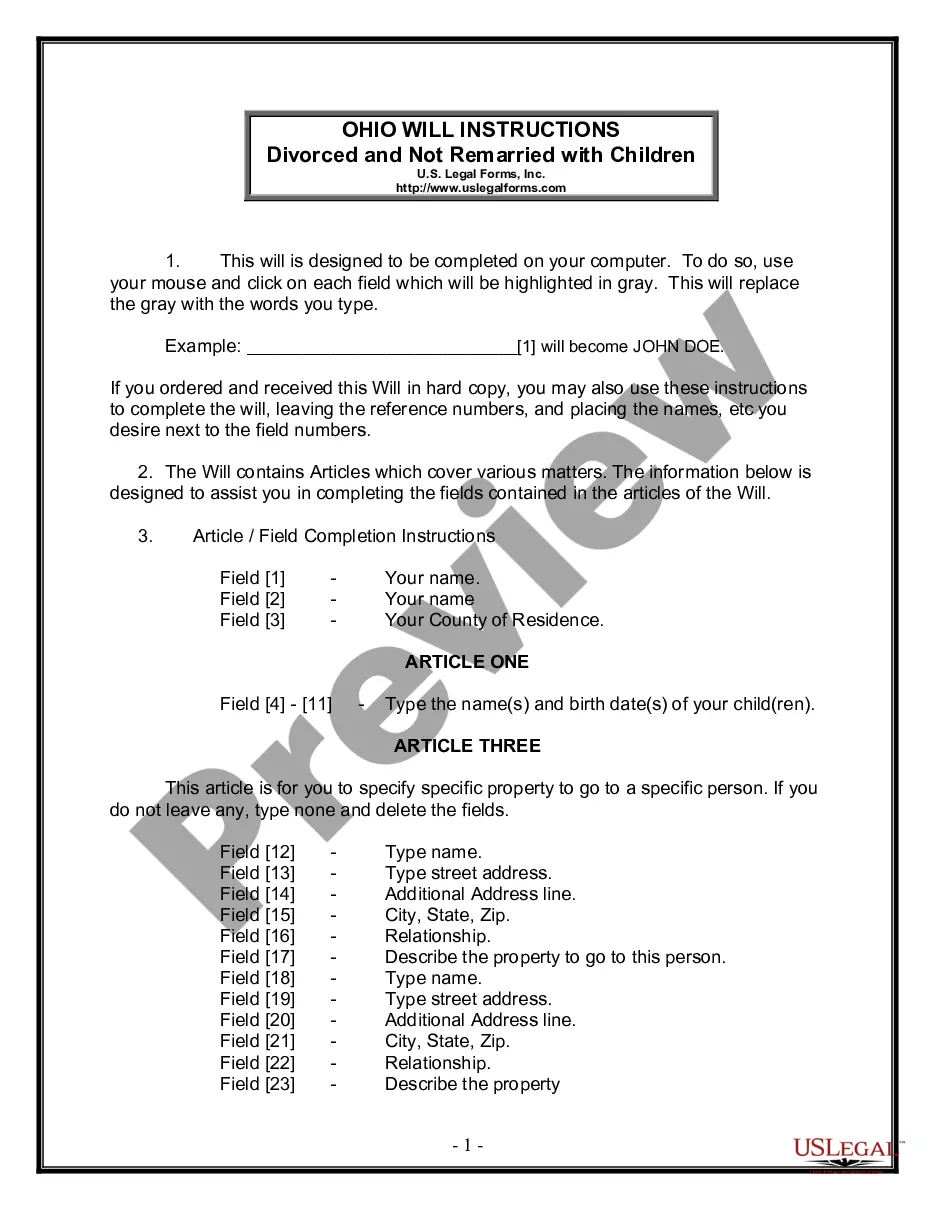

When you are a fresh user of US Legal Forms, listed here are simple recommendations so that you can comply with:

- Very first, be sure you have selected the proper type for the area/county. It is possible to check out the form utilizing the Preview switch and look at the form outline to make certain it is the right one for you.

- In the event the type is not going to satisfy your preferences, use the Seach area to discover the right type.

- When you are certain the form is acceptable, click on the Get now switch to have the type.

- Select the pricing prepare you need and enter the necessary details. Design your account and buy your order making use of your PayPal account or charge card.

- Pick the document formatting and download the lawful record web template for your system.

- Full, revise and print and sign the obtained Connecticut Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief.

US Legal Forms is the most significant local library of lawful types in which you can discover different record layouts. Use the company to download professionally-created documents that comply with status needs.

Form popularity

FAQ

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

(a)(1) Any person eighteen years of age or older, and of sound mind, may execute in advance of such person's death a written document, subscribed by such person and attested by two witnesses, either: (A) Directing the disposition of such person's body upon the death of such person, which document may also designate an ...

Examples of assets that will go through Probate in CT are: Solely owned business. Solely owned bank accounts. Solely owned real estate. Solely owned Household goods and furniture. Solely owned Jewelry. Solely owned cars. Solely owned investment accounts. Any Jointly owned asset on the 2nd death (one co-

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

The Estate Settlement Timeline: Although Connecticut law does not specify a particular deadline for this, it is generally advisable to do so within a month to avoid unnecessary delays in the probate process.

Section 36.5 Fiduciary to send copy of financial report or account and affidavit of closing to each party and attorney (a) A fiduciary submitting a financial report, account or affidavit of closing shall send a copy, at the time of filing, to each party and attorney of record and shall certify to the court that the ...

Creditors have 150 days to file a claim in a Connecticut estate going through probate unless the Executor sends the creditor the letter described above. A creditor can't just ignore the Executor and march into any court other than the probate court and get a judgment for payment.

The Connecticut statute of limitations for a claim against a decedent's estate is the earlier of the (i) date the applicable statute of limitations for such claim expires, or (ii) two years from the date of the decedent's death if such claim is or could have been asserted during the decedent's lifetime, or two years ...