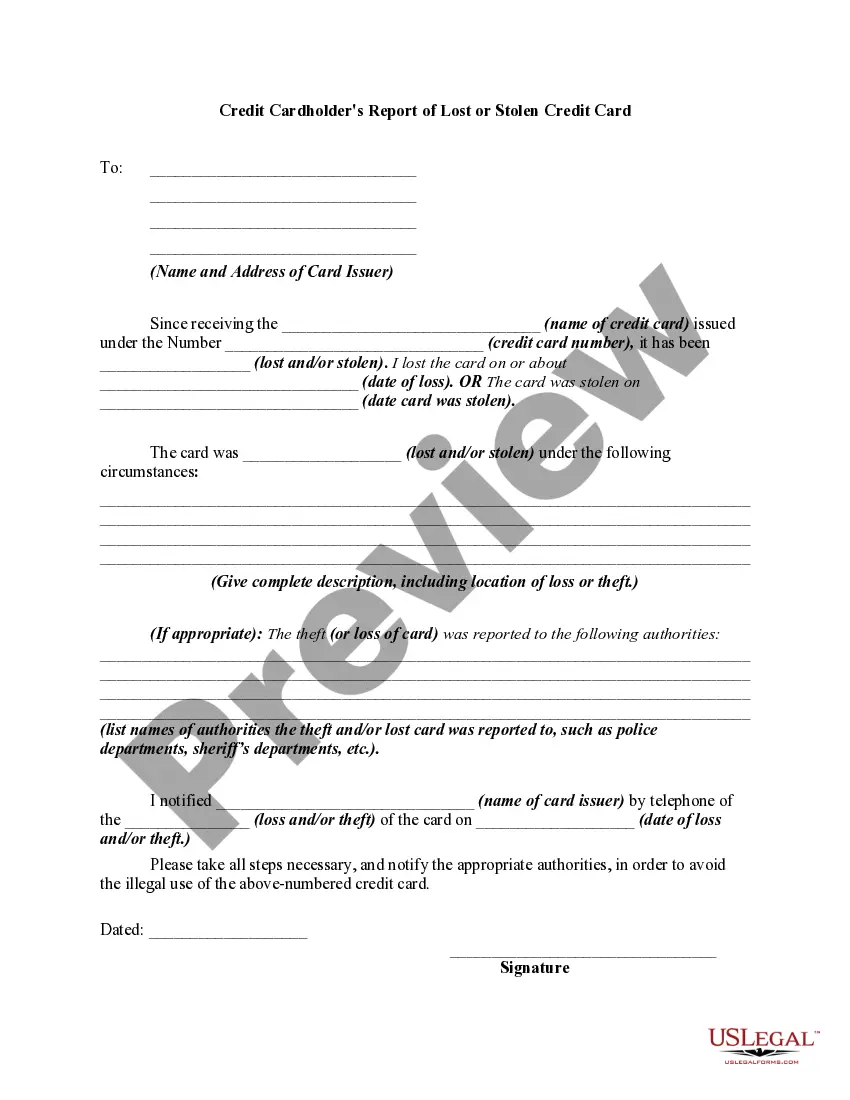

Connecticut Credit Cardholder's Report of Lost or Stolen Credit Card

Description

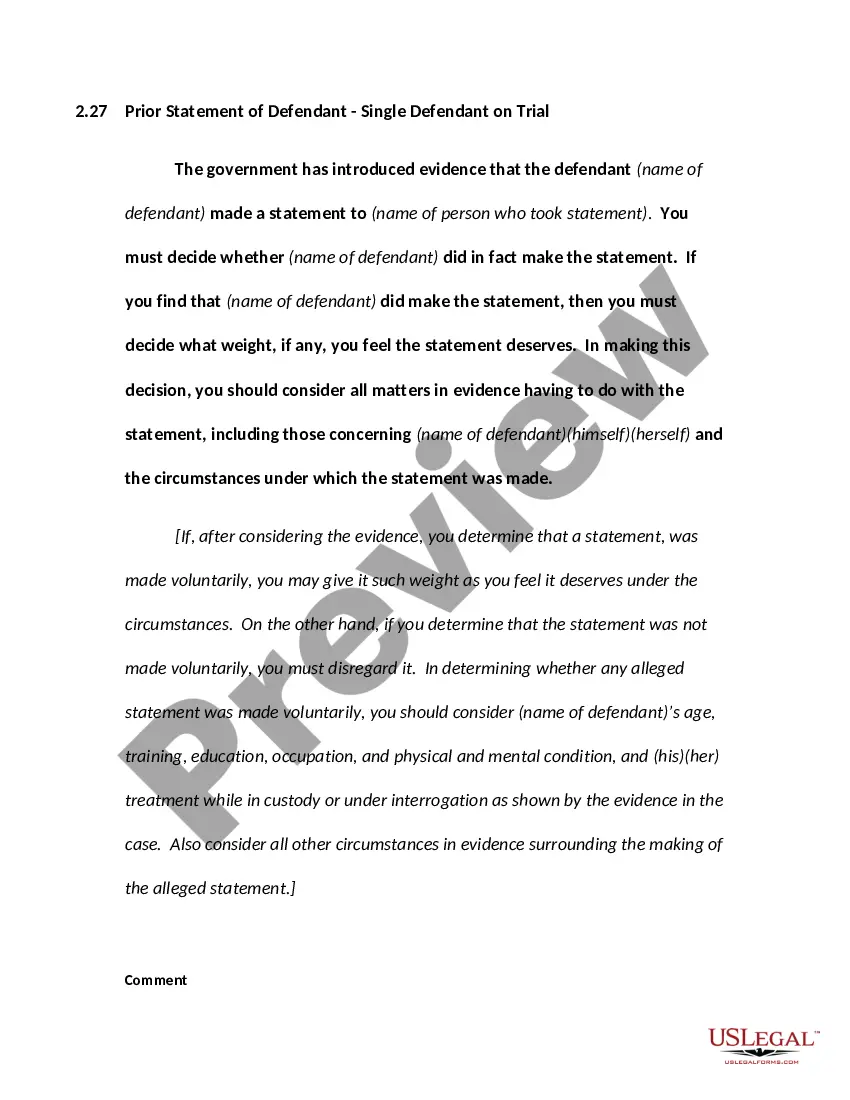

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card?

If you have to total, download, or print lawful document web templates, use US Legal Forms, the biggest collection of lawful varieties, which can be found on the web. Take advantage of the site`s basic and hassle-free research to obtain the papers you require. Different web templates for organization and specific purposes are categorized by groups and says, or keywords. Use US Legal Forms to obtain the Connecticut Credit Cardholder's Report of Lost or Stolen Credit Card with a handful of click throughs.

In case you are previously a US Legal Forms client, log in in your profile and then click the Acquire switch to find the Connecticut Credit Cardholder's Report of Lost or Stolen Credit Card. You can also access varieties you in the past downloaded in the My Forms tab of your own profile.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for the appropriate metropolis/land.

- Step 2. Utilize the Review choice to look over the form`s content material. Don`t forget to read through the information.

- Step 3. In case you are not satisfied with the develop, make use of the Lookup area near the top of the monitor to find other versions from the lawful develop web template.

- Step 4. Upon having discovered the form you require, click on the Purchase now switch. Pick the rates program you prefer and add your references to sign up for an profile.

- Step 5. Process the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to perform the financial transaction.

- Step 6. Pick the format from the lawful develop and download it in your system.

- Step 7. Total, modify and print or signal the Connecticut Credit Cardholder's Report of Lost or Stolen Credit Card.

Each and every lawful document web template you purchase is the one you have permanently. You might have acces to every single develop you downloaded in your acccount. Go through the My Forms section and decide on a develop to print or download again.

Remain competitive and download, and print the Connecticut Credit Cardholder's Report of Lost or Stolen Credit Card with US Legal Forms. There are millions of expert and status-certain varieties you may use to your organization or specific needs.

Form popularity

FAQ

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

When you lose your credit card, you can avoid an impact to your finances by reporting the card lost or missing immediately. In general, a lost or stolen credit card will have no impact on your credit score. In most cases, you will not be held responsible for charges on a lost or stolen card.

Can You Track Someone Who Used Your Credit Card Online? No. However, if you report the fraud in a timely manner, the bank or card issuer will open an investigation. Banks have a system for investigating credit card fraud, including some standard procedures.

When you report the lost credit card, the issuer will most likely cancel your old card number in an effort to prevent any unauthorized charges and then send you a new card with a new number. But it could take a few days for the replacement card to arrive.

When you report a card as lost or stolen, your credit card company will deactivate or cancel your current credit card number. The card number previously assigned to you will no longer be active and you will be mailed a replacement credit card with a new number.

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss. It's important to act fast.

How to place: Contact any one of the three credit bureaus ? Equifax, Experian, and TransUnion. You don't have to contact all three. The credit bureau you contact must tell the other two to place a fraud alert on your credit report.

Notify your bank or credit union. As soon as you're reasonably certain you won't find your card, contact your bank or credit union and request a replacement. Typically, you can do this by phone or by visiting a branch location. Your lost card will be canceled, and it may take up to seven days to receive a new one.