The following form is a general form for a declaration of a gift of property.

Connecticut Declaration of Gift

Description

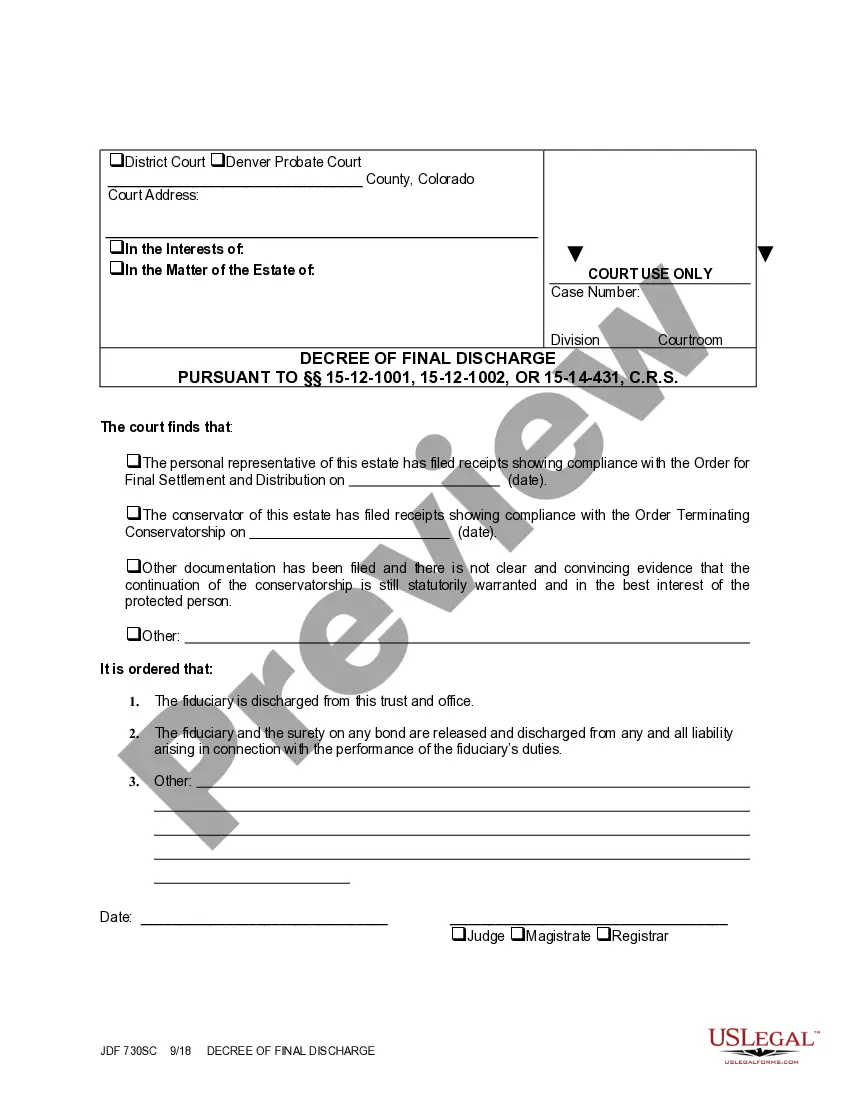

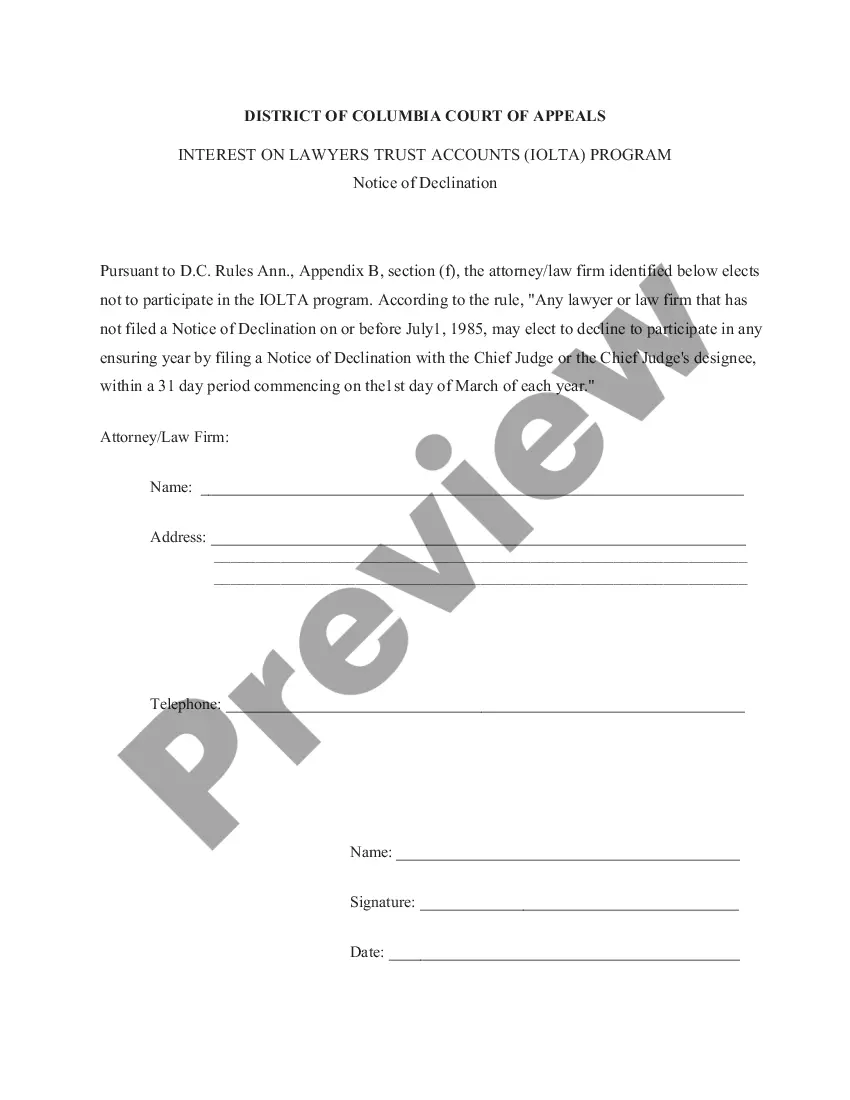

How to fill out Declaration Of Gift?

Are you in a circumstance where you require documents for potentially commercial or particular reasons nearly every day.

There are numerous authorized document templates available online, but finding those you can trust is challenging.

US Legal Forms offers a vast collection of form templates, including the Connecticut Declaration of Gift, designed to meet federal and state regulations.

If you find the correct form, click on Buy now.

Select the pricing plan you desire, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Connecticut Declaration of Gift template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct city/area.

- Use the Review button to inspect the document.

- Check the description to ensure you have selected the right form.

- If the template is not what you are looking for, utilize the Search section to find the form that suits your needs.

Form popularity

FAQ

In Connecticut, the amount you can inherit without paying taxes is determined by the state's estate tax rules. Currently, the estate tax applies to estates valued at over $12.92 million. Additionally, gifts made through a Connecticut Declaration of Gift may have implications on your estate's total value. To ensure you comply with these regulations and maximize your inheritance, consider consulting with a professional or utilizing platforms like US Legal Forms for assistance.

To avoid the Connecticut estate tax, individuals can use various strategies such as gifting assets while alive, utilizing trusts, and taking advantage of the state estate tax exemptions. The Connecticut Declaration of Gift can be an effective tool in this aspect, allowing you to transfer wealth during your lifetime. Consulting with a legal expert or using platforms like uslegalforms can provide tailored solutions to optimize your estate planning.

Deciding whether to gift a car or sell it for a dollar requires careful consideration of tax implications and personal circumstances. Gifting can be beneficial because it may not incur a tax liability, especially with the Connecticut Declaration of Gift in mind. However, selling it for a nominal amount can create a paper trail that proves the transaction, potentially preserving your gift tax exemption.

For 2025, the Connecticut estate tax exemption is projected to be adjusted, continuing to provide relief for smaller estates. The exact figure will depend on legislative changes that may occur. Utilizing the Connecticut Declaration of Gift allows individuals to manage their estate efficiently, potentially lowering the taxable portion of their estate when the time comes.

Connecticut does not currently impose a gift tax; however, any gifts exceeding the annual exclusion limit must be reported for federal tax purposes. The federal gift tax exemption allows individuals to transfer a certain amount without facing a tax. Knowing how the Connecticut Declaration of Gift works can help you strategically plan your gifting to maximize benefits without triggering tax issues.

The Connecticut estate tax exemption refers to the amount of assets an individual can transfer upon death without incurring estate tax. As of now, this exemption is set at a specific value, allowing individuals to protect a certain threshold of their estate. It's crucial to understand the implications of the Connecticut Declaration of Gift, as making gifts during your lifetime can also affect your estate's taxable value.

The format of a gift declaration in Connecticut typically includes sections for the giver's name, recipient's name, description of the gift, and its fair market value. Additionally, the document may require signatures from both parties to confirm the transfer. You can simplify this process by using platforms like US Legal Forms, which provide templates for creating your Connecticut Declaration of Gift easily and accurately.

A gift declaration is an official document that outlines the details of a gift you received. In Connecticut, this declaration includes essential information such as the donor's identity, the gift's value, and the date of receipt. It helps establish ownership and clarify gift tax obligations. By using the Connecticut Declaration of Gift, you ensure compliance with state regulations.

Failing to declare a gift can lead to legal complications and potential tax penalties. The Connecticut Declaration of Gift serves to protect both the giver and receiver. If you neglect this responsibility, the state may perceive the gift as income, resulting in unexpected tax liabilities. It's crucial to follow the proper procedures to avoid any negative consequences.

Yes, you must declare any significant gift you receive. In Connecticut, the Declaration of Gift ensures clarity regarding the origin and value of the gift. This process is essential for tax purposes and helps prevent future misunderstandings. By documenting the gift, you protect yourself and your financial interests.