Connecticut Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title

Description

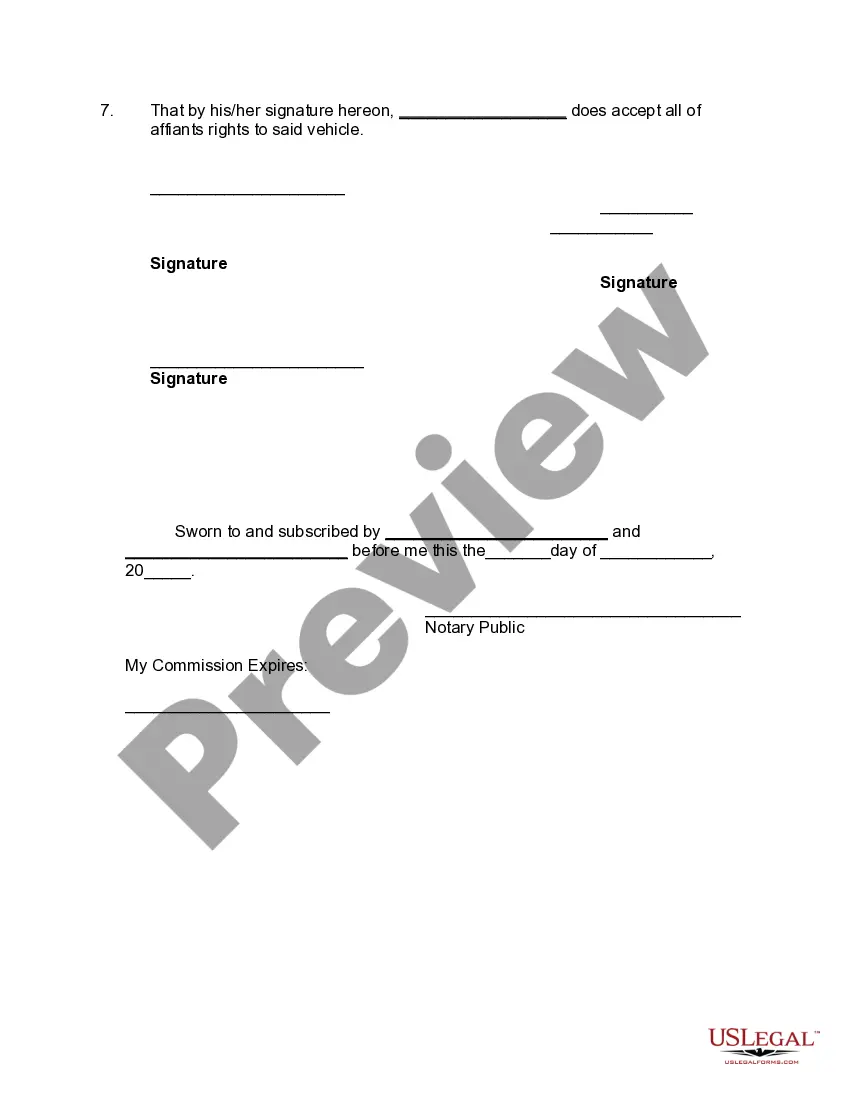

How to fill out Affidavit By Heirs Regarding Agreement As To Who Shall Inherit Motor Vehicle - To Obtain Transfer Of Title?

If you wish to total, download, or print lawful record web templates, use US Legal Forms, the most important selection of lawful varieties, that can be found on-line. Use the site`s easy and hassle-free lookup to discover the papers you want. Numerous web templates for business and personal reasons are sorted by categories and says, or keywords and phrases. Use US Legal Forms to discover the Connecticut Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title in just a handful of click throughs.

Should you be currently a US Legal Forms customer, log in to your accounts and click the Download key to obtain the Connecticut Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title. You may also access varieties you formerly acquired from the My Forms tab of your accounts.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for that correct town/land.

- Step 2. Make use of the Review choice to examine the form`s articles. Don`t overlook to learn the explanation.

- Step 3. Should you be not satisfied with all the kind, utilize the Lookup field towards the top of the screen to get other types of your lawful kind format.

- Step 4. When you have found the form you want, click on the Get now key. Opt for the rates program you like and put your credentials to sign up for an accounts.

- Step 5. Process the purchase. You should use your charge card or PayPal accounts to finish the purchase.

- Step 6. Pick the format of your lawful kind and download it on the gadget.

- Step 7. Full, change and print or sign the Connecticut Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title.

Each and every lawful record format you buy is the one you have for a long time. You might have acces to every single kind you acquired in your acccount. Click on the My Forms section and choose a kind to print or download again.

Remain competitive and download, and print the Connecticut Affidavit by Heirs regarding Agreement as to who shall Inherit Motor Vehicle - To Obtain Transfer of Title with US Legal Forms. There are thousands of expert and status-specific varieties you can utilize for the business or personal requirements.

Form popularity

FAQ

In Connecticut, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

All assets that were owned by the decedent in his sole name must be reported to the probate court. To do so, the executor must file an inventory form listing the solely-owned assets and their date-of-death values with the probate court within two months of appointment.

If assets are properly placed in trust before death, the living trust ?bypasses? probate as no proceedings are now necessary to pass title on death. However, the Connecticut Estate Tax Return must be filed through the Probate Court.

How to Transfer a Car After a Death The Certificate of Title, assigned to the new owner by the Executor or Administrator of the estate, A certified copy of the Probate Court document authorizing the transfer of the vehicle (a list of acceptable probate documents can be found on the DMV's website at .ct.gov/dmv),

For registration of a non-titled vehicle, the registration from the last owner and a Supplemental Assignment of Ownership (form Q-1) and/or Bill of Sale (form H-31) is needed. See more information when a title is not needed.

If you own the car with someone else and the word ?or? appears between the two names then it will automatically be solely owned by the other owner when you pass away, thereby avoiding probate. Or you could fill out the beneficiary designation section on the back of your registration.

How to Transfer a Car After a Death The Certificate of Title, assigned to the new owner by the Executor or Administrator of the estate, A certified copy of the Probate Court document authorizing the transfer of the vehicle (a list of acceptable probate documents can be found on the DMV's website at .ct.gov/dmv),

Gifting a Vehicle The CT DMV defines a family member as a parent, spouse, child, or sibling. The procedure is similar to selling a vehicle, but you'll also need to complete a Motor Vehicle or Vessel Gift Declaration (Form AU-463). You and the family member must complete and sign the AU-463.