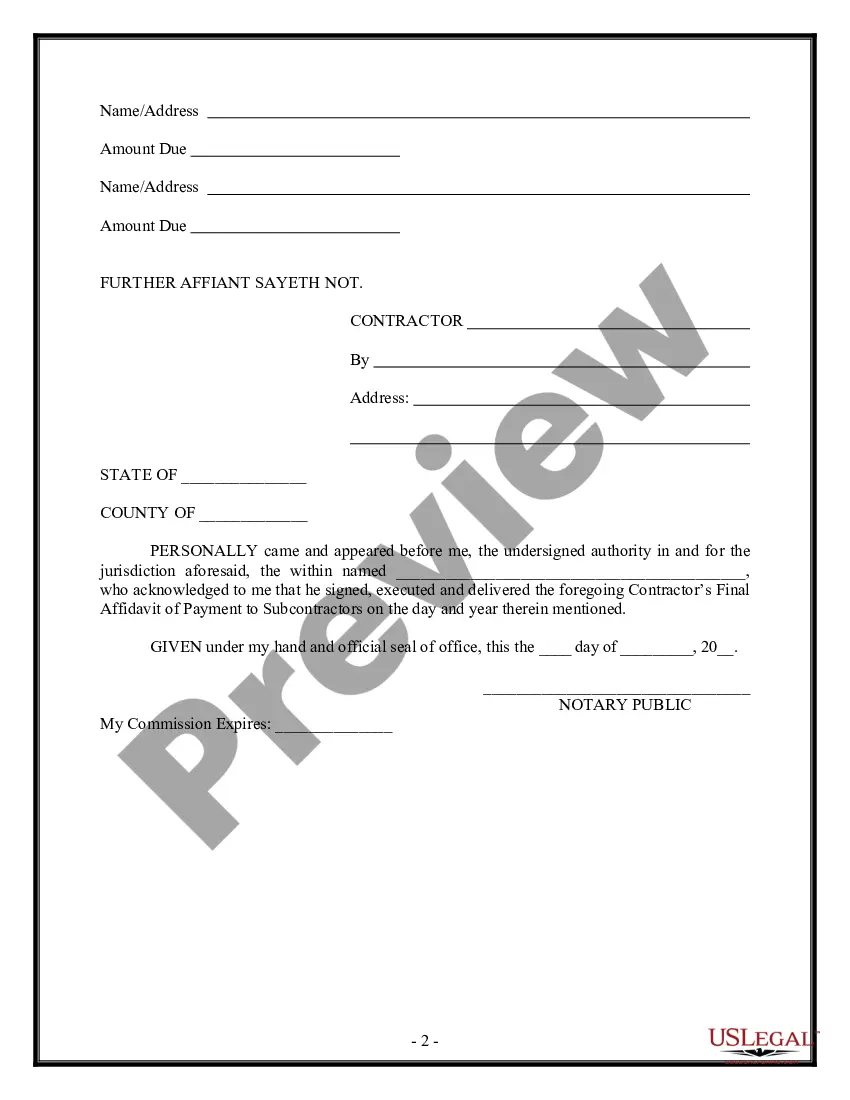

The Connecticut Contractor's Final Affidavit of Payment to Subcontractors is a legal document used by contractors in the state of Connecticut to ensure that all subcontractors have been paid in full for their work on a construction project. This affidavit serves as proof of payment and protects the contractor from any potential legal claims or liens imposed by subcontractors who have not received payment. The affidavit is typically filed towards the end of a construction project, once all subcontractors have completed their work and their payment is due. It is an essential component of the project's financial documentation, ensuring that all parties are transparent with their payment obligations. The Connecticut Contractor's Final Affidavit of Payment to Subcontractors includes various key elements to accurately convey the necessary information. These elements include: 1. Contractor Information: The affidavit begins with basic details about the contractor, including their name, address, contact information, and contractor license number. 2. Project Information: This section outlines the details of the construction project, such as the location, property owner's name, and project identification number, if applicable. This information ensures that the affidavit is specific to a particular project. 3. Subcontractor Information: The affidavit must include a comprehensive list of all subcontractors who were involved in the project, along with their contact information and the specific work they performed. This information assists in verifying that all subcontractors have been accounted for and paid accordingly. 4. Payment Details: The affidavit must specify the total amount due to each subcontractor and the date on which the payment was made. This information helps establish a clear record of payments and ensures all subcontractors have been compensated appropriately. 5. Verification: The affidavit requires the signature and notarization of the contractor, confirming the accuracy of the information provided. This step ensures that the contractor takes full legal responsibility for the affidavit's content and affirms the truthfulness of the payment claims. It's important to note that there may not be multiple types of Connecticut Contractor's Final Affidavit of Payment to Subcontractors. However, different construction projects may have unique variations within the document based on specific requirements or circumstances. Contractors should ensure that they use the correct form that aligns with the regulations and guidelines set forth by the state of Connecticut. Consulting with legal professionals or local authorities can provide further clarity on any potential variations or additional requirements for specific projects.

Connecticut Contractor's Final Affidavit of Payment to Subcontractors

Description

How to fill out Connecticut Contractor's Final Affidavit Of Payment To Subcontractors?

You might spend time online searching for the appropriate legal document template that meets the federal and state requirements you need.

US Legal Forms offers a multitude of legal forms that have been reviewed by experts.

You can download or print the Connecticut Contractor's Final Affidavit of Payment to Subcontractors from my service.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the Connecticut Contractor's Final Affidavit of Payment to Subcontractors.

- Each legal document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for the area/town of your choice.

- Read the form description to make sure you have chosen the right form.

Form popularity

FAQ

You can claim:Fuel costs.Repairs and servicing costs.Maintenance costs.Interest owed on the vehicle loan.Insurance premiums related to the vehicle.Payments on any lease agreements for the vehicle.Registration costs.Depreciation.

AIA Document G706A21221994 supports AIA Document G70621221994 in the event that the owner requires a sworn statement of the contractor stating that all releases or waivers of liens have been received.

Independent subcontractors regularly purchase materials and equipment related to their specific projects. Expenses for materials necessary for completion of a job may be directly deducted from taxable income on your tax return.

Contractors cannot ask for a deposit of more than 10 percent of the total cost of the job or $1,000, whichever is less. (This applies to any home improvement project, including swimming pools.) Stick to your schedule of payments and don't let payments get ahead of the completed work.

Subcontractor Costs means all costs incurred by subcontractors for the project, including labor and non-labor costs.

The exact deposit amount contractors ask for upfront varies and is especially dependent on the size of the project. For relatively small jobs, like a $15,000 bathroom remodel, contractors may ask for a 50% deposit. For large jobs, like a $100,000 full-home renovation, a 10%20% deposit is more typical.

The following steps can help contractors get the payments they are owed.Create Solid Contracts. A solid contract is the strongest weapon in your arsenal.Optimize Your Contracts.Send Invoices for Progress Payments.Use Preliminary Notices & Conditional Lien Waivers.5 Seek Payment After the Project is Completed.

Markups vary from one contractor to the next and possibly from one project to the next. But as a general guide, the typical markup on materials will be between 7.5 and 10%. However, some contractors will mark up materials as much as 20 percent, according to the Corporate Finance Institute.

An up-front payment is reasonable to allow the contractor to acquire needed materials. However, it generally should not represent more than one-third of the entire project.

A: It's not uncommon for contractors to ask for a down payment up front to secure your spot on their schedule or purchase some of the job materials in advance. Asking for more than half of the project cost up front, though, is a big red flag.

Interesting Questions

More info

They assist project managers and project staff with the overall process, while focusing at the start on the process that needs to be followed to achieve full deliverables by the final delivery deadline. Approach team can consist of an overall team (project team), a small group within the overall team (management team), or a small team within a larger management team (project team). A development plan may be created with an approach team. A management plan can be created with approach team. Both a management plan and a development plan should be developed by an approach team. Work Open Legal Home Services About Approach Team approach An approach team can be a team of managers, executives, and project managers who develop the best practices needed to deliver a project in a timely manner.