Guam Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Resolution Selecting Depository Bank For Corporation And Account Signatories?

Selecting the appropriate legal document format can be quite challenging. Of course, there are many templates available online, but how do you find the legal form you require? Use the US Legal Forms website. This service offers thousands of templates, such as the Guam Resolution Selecting Depository Bank for Corporation and Account Signatories, which can be utilized for both business and personal needs.

All the forms are reviewed by experts and meet state and federal regulations.

If you are already a member, Log In to your account and click the Download button to obtain the Guam Resolution Selecting Depository Bank for Corporation and Account Signatories. Use your account to search the legal forms you have previously purchased. Visit the My documents section of your account to download another copy of the documents you need.

Complete, modify, print, and sign the received Guam Resolution Selecting Depository Bank for Corporation and Account Signatories. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to download professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

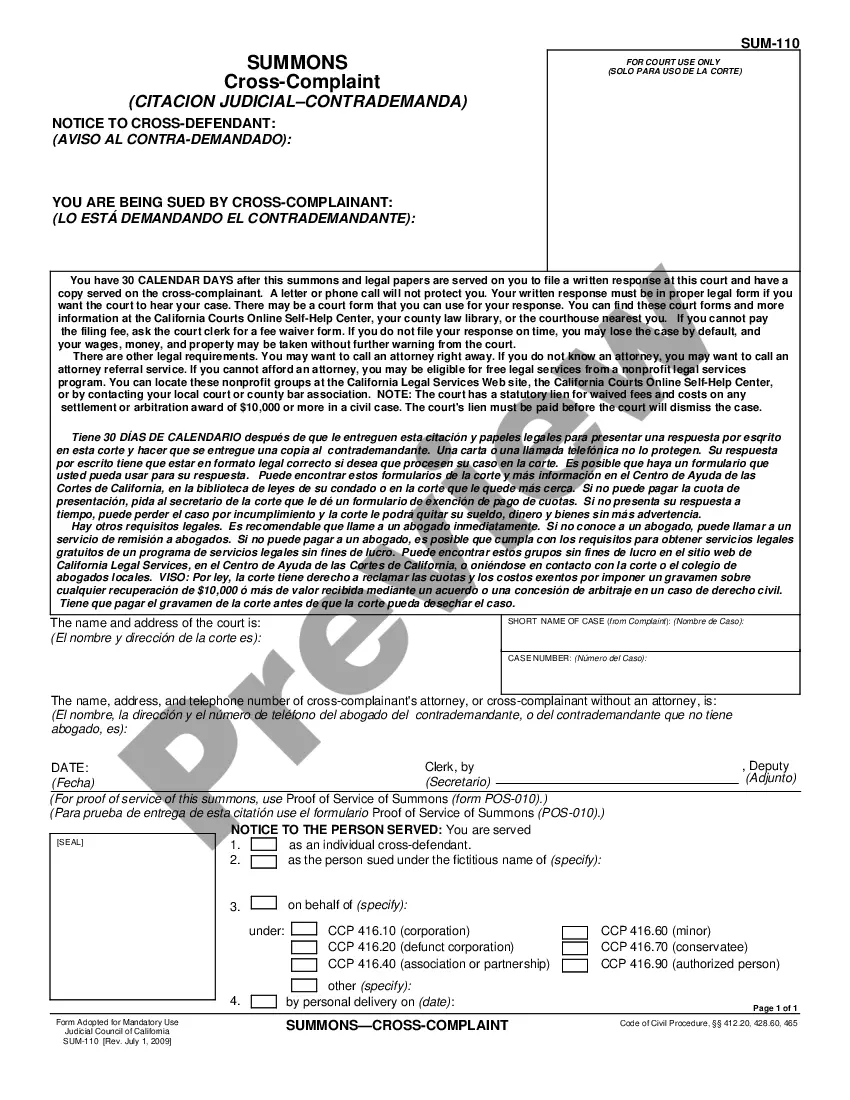

- First, ensure you have chosen the correct form for your city/region. You can preview the form using the Preview button and read the form description to confirm it is the right fit for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are sure that the form is suitable, click on the Download now button to obtain the document.

- Choose the pricing plan you desire and enter the required information. Set up your account and pay for the transaction using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

Form popularity

FAQ

Many reputable banks are FDIC approved, offering a wide range of services and insurance for their deposits. Some well-known names include JPMorgan Chase, Bank of America, and Wells Fargo. When considering Guam Resolution Selecting Depository Bank for Corporation and Account Signatories, reviewing FDIC approved banks ensures your funds remain secure, safeguarding your corporation's financial interests effectively.

Like any financial institution, CIT Bank has its challenges. Some users note limited branch access since it primarily operates online, which may not suit everyone’s banking preferences. Moreover, the bank's services may not cover every need, so it's wise to evaluate how CIT Bank aligns with your requirements in the context of Guam Resolution Selecting Depository Bank for Corporation and Account Signatories.

CIT Bank has shown stability and growth from its financial practices and strategic investments. While no bank can be entirely immune to market changes, CIT Bank's practices focus on risk management, thus ensuring a strong position in the financial landscape. Choosing the right bank is essential when navigating Guam Resolution Selecting Depository Bank for Corporation and Account Signatories, and CIT Bank's established track record can mitigate your concerns.

Yes, CIT Bank is FDIC insured, which provides crucial protection for your deposits. This insurance covers deposits up to $250,000 per depositor, helping secure your assets when considering Guam Resolution Selecting Depository Bank for Corporation and Account Signatories. Knowing that your funds are backed by the federal insurance makes CIT Bank a reliable choice for businesses.

A recovery plan focuses on strategies a bank employs to restore its financial health after facing trouble, while a resolution plan details the steps for winding down the bank if recovery fails. Both plans play significant roles in maintaining financial security. For firms involved in Guam Resolution Selecting Depository Bank for Corporation and Account Signatories, understanding both types of plans is vital.

A resolution plan for a bank is a detailed document that outlines how a financial institution would manage its winding down process during a crisis. These plans address various operational, financial, and regulatory aspects required to ensure stability. Companies engaging in Guam Resolution Selecting Depository Bank for Corporation and Account Signatories benefit from understanding these plans and their implications.

A Section 165 D resolution plan outlines the strategies banks must have in place for resolving financial distress and ensuring a smooth unwinding process. This plan is crucial for protecting depositors and maintaining financial stability. By focusing on the Guam Resolution Selecting Depository Bank for Corporation and Account Signatories, these plans guide banks through potential crises.

Section 165 D of the Dodd-Frank Act mandates that certain banking organizations create resolution plans, also known as living wills. These plans help regulators assess a bank's strategy for unwinding operations in the event of failure. Understanding this section is essential for entities involved in Guam Resolution Selecting Depository Bank for Corporation and Account Signatories.

The 165 D resolution plan refers to a strategic framework developed by financial institutions to address potential financial crises. This plan outlines the steps a bank would take to operate effectively in the case of severe financial distress. By creating a robust resolution plan, banks ensure compliance with the regulations related to Guam Resolution Selecting Depository Bank for Corporation and Account Signatories.

To write a resolution letter for changing bank signatories, start by stating the corporation's name and the reason for the change. Then, specify both the outgoing and incoming signatories, along with their respective roles. Following the guidelines in the Guam Resolution Selecting Depository Bank for Corporation and Account Signatories will ensure your letter meets all necessary requirements.