Connecticut Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

Are you presently in the location that you need documents for either organization or specific tasks almost every time.

There are numerous legal document templates accessible online, but locating ones you can trust is not easy.

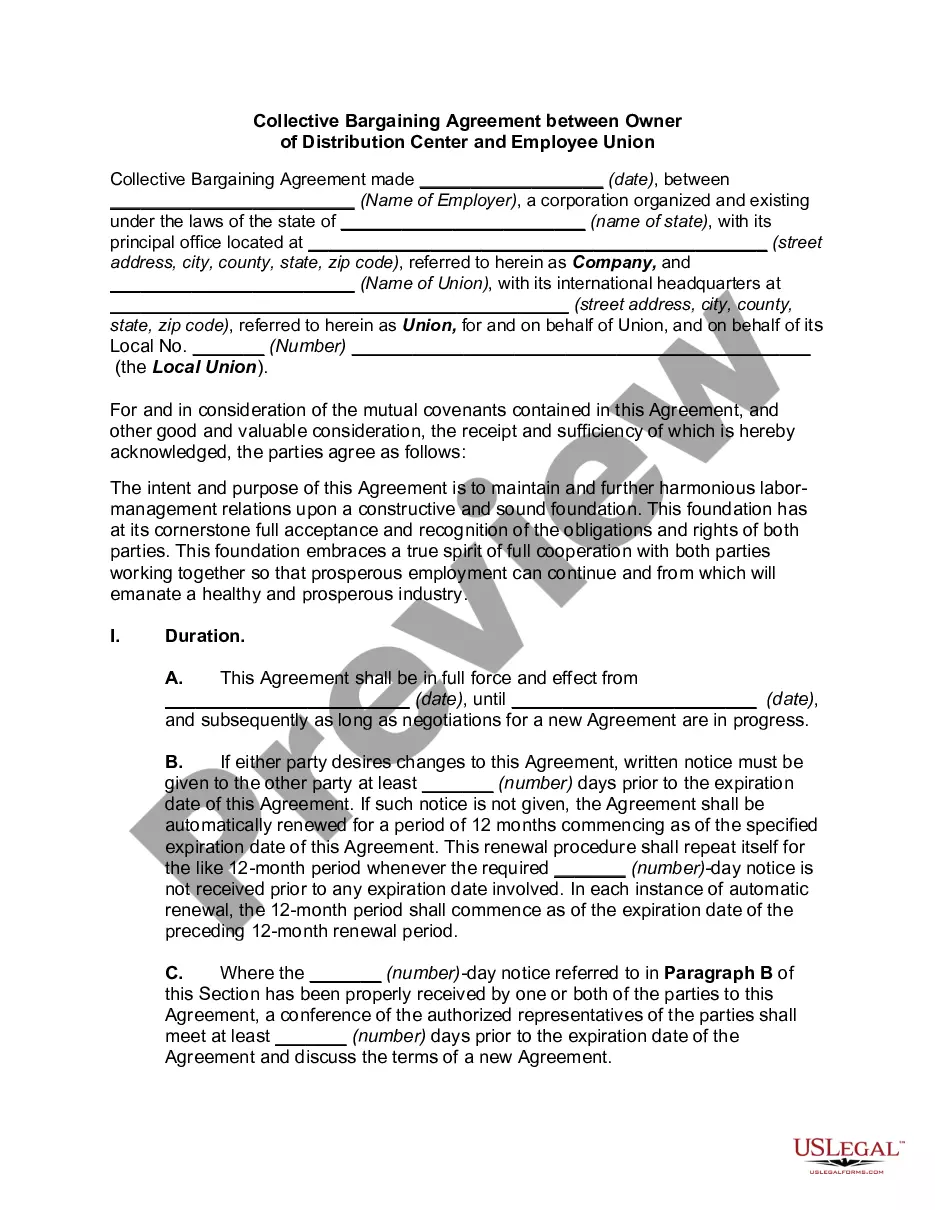

US Legal Forms offers a vast array of form templates, such as the Connecticut Direct Deposit Form for IRS, which can be tailored to meet state and federal requirements.

Select the pricing plan you prefer, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the Connecticut Direct Deposit Form for IRS template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct state/region.

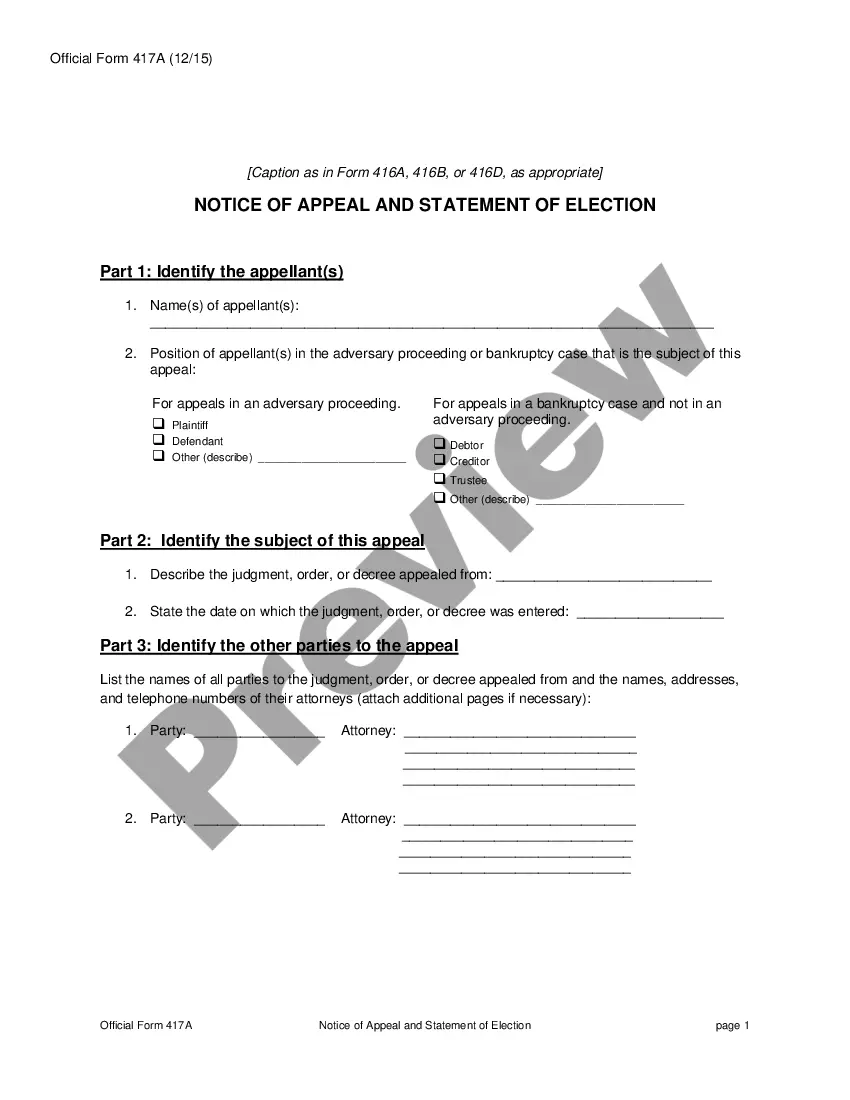

- Utilize the Review button to assess the form.

- Examine the summary to ensure you have selected the right form.

- If the form is not what you're searching for, use the Lookup area to find the form that meets your needs and requirements.

- Once you have the correct form, click Acquire now.

Form popularity

FAQ

You should mail form CT 3911 to the Connecticut Department of Revenue Services. Make sure to send it to the address specified on the form for accurate processing. If you are expecting a refund, utilizing the Connecticut Direct Deposit Form for IRS can help expedite the process.

No, the Direct File option is exclusive to federal tax returns. However, you can file your state taxes separately through Connecticut's tax filing system. For your convenience, remember to use the Connecticut Direct Deposit Form for IRS to ensure your state refund is processed smoothly.

The IRS direct filing program allows taxpayers to submit their tax returns electronically without intermediaries. This program aims to simplify the filing process and is designed to make tax preparation accessible. If you're looking for a seamless way to manage your refunds, the Connecticut Direct Deposit Form for IRS can be a great addition.

Yes, the IRS Direct File is still available for eligible taxpayers. This option allows you to file your federal taxes electronically without additional costs. To enhance your filing experience, consider using the Connecticut Direct Deposit Form for IRS for faster refunds.

Currently, the IRS has not made definitive plans regarding the availability of Direct File in 2026. However, the program is designed to evolve with taxpayer needs. You can stay updated on the IRS Direct File program and utilize resources like the Connecticut Direct Deposit Form for IRS for the most efficient filing.

In Connecticut, you can begin filing your taxes once the IRS opens the tax season, typically in late January. It's advisable to gather all necessary documents beforehand to streamline the process. Using the Connecticut Direct Deposit Form for IRS can help expedite your refund once your return is filed.

To change your direct deposit information with the IRS, you need to complete the IRS Form 8888. This form allows you to specify your new bank account details. Additionally, when filing your taxes, you can also provide updated information using the Connecticut Direct Deposit Form for IRS to ensure your refunds go to the correct account.

Yes, direct file is available in Connecticut. This process allows you to submit your tax return electronically, simplifying the filing experience. If you wish to utilize the Connecticut Direct Deposit Form for IRS, it's a straightforward way to ensure your refund is deposited directly into your bank account.

IRS Form 982 is used to claim a reduction of tax attributes due to a discharge of indebtedness. This form is crucial for taxpayers who have had their debts forgiven and are looking to adjust their tax liabilities accordingly. While it may not directly relate to the Connecticut Direct Deposit Form for IRS, understanding the purpose of Form 982 can help you navigate your tax situation more effectively. For detailed guidance, consider resources available on US Legal Forms.

IRS Form 8888 is used when you want to split your tax refund into multiple accounts for direct deposit. If you plan to allocate your refund to different bank accounts, this form is essential for making that process seamless. By using the Connecticut Direct Deposit Form for IRS alongside Form 8888, you can ensure that your funds are distributed according to your preferences. This helps you manage your finances more effectively.