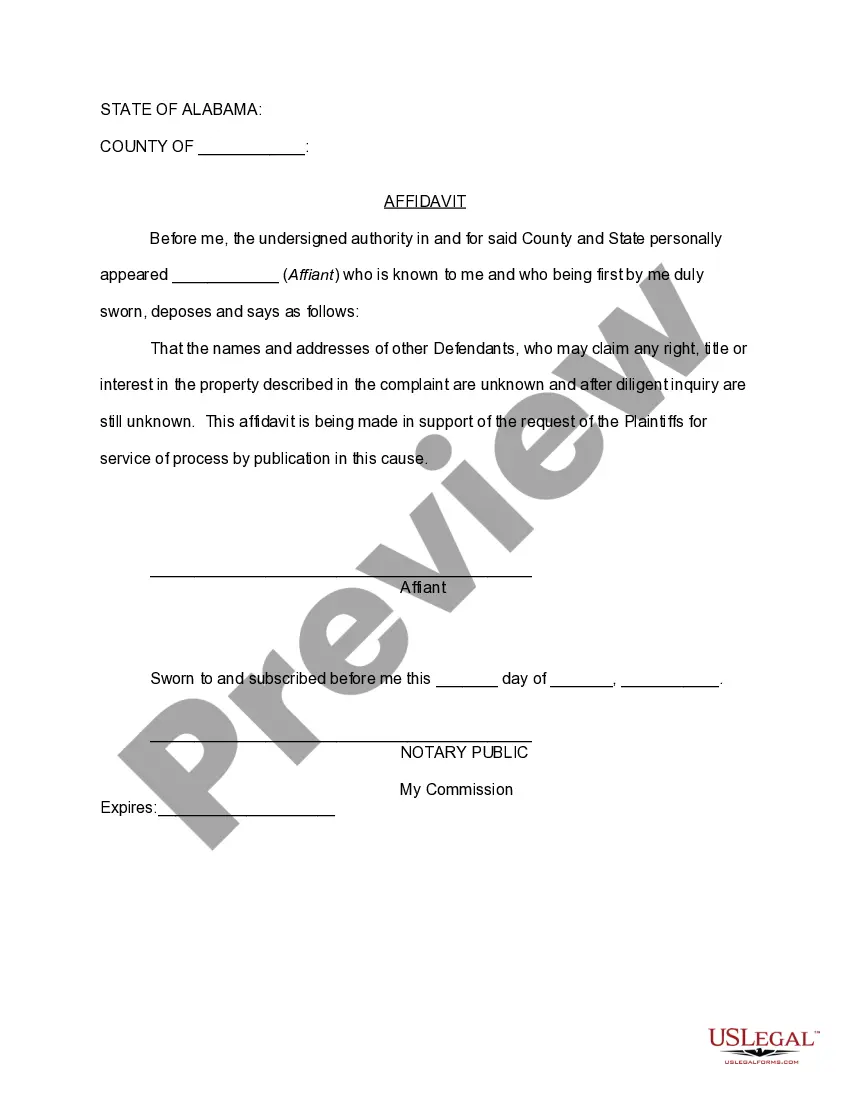

This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Connecticut Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

If you want to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online. Take advantage of the site's straightforward and user-friendly search to locate the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Connecticut Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to access the Connecticut Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. You can also access forms you have previously downloaded from the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Review function to scrutinize the form's content. Don’t forget to check the description. Step 3. If you are not satisfied with the document, utilize the Search area at the top of the screen to find alternative versions of the legal document template. Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Connecticut Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage.

- Every legal document template you purchase is yours permanently.

- You have access to every document you downloaded through your account.

- Visit the My documents section and select a document to print or download again.

- Be proactive and download, and print the Connecticut Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage with US Legal Forms.

- There are millions of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

A declaratory judgment in insurance is a legal determination about the rights and duties of the parties under an insurance policy. In cases like a Connecticut Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, it can help resolve issues about coverage, exclusions, or claims. By seeking a declaratory judgment, policyholders can gain clarity on their coverage without having to wait for a claim denial or other disputes.

The primary purpose of a declaratory judgment is to clarify legal rights and obligations in a dispute. For instance, in the context of a Connecticut Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, it helps parties understand their standing and what to expect regarding their insurance policies. This can prevent future conflicts and provide peace of mind to all involved.

One disadvantage of a declaratory judgment is that it may not provide the full relief you seek, especially in complex cases like a Connecticut Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Additionally, the process can lead to prolonged litigation if either party contests the judgment. This can result in increased legal fees and time spent in court, which may not be ideal for everyone.

issued declaratory judgment outlines the rights and responsibilities of each involved party. This judgment does not require action or award damages. It helps to resolve disputes and prevent lawsuits.

A declaratory judgment is typically requested when a party is threatened with a lawsuit but the lawsuit has not yet been filed; or when a party or parties believe that their rights under law and/or contract might conflict; or as part of a counterclaim to prevent further lawsuits from the same plaintiff (for example, ...

A common way of eliminating this uncertainty is with a declaratory judgment action, also called a declaration. This is a court-issued judgment that has the court clarify and affirm any rights, obligations and responsibilities of one or more parties involved in insurance litigation or other civil disputes.

A declaratory judgment is legally binding and has the same result and power than a final judgment. These judgments are also known as a declaration or declaratory relief.

Declaratory judgment actions are an exception to this rule and permit a party to seek a court judgment that defines the parties' rights before an injury occurs. A declaratory judgment differs from other judgments because it does not provide for any enforcement or order a party to take any action or pay damages.

issued declaratory judgment outlines the rights and responsibilities of each involved party. This judgment does not require action or award damages. It helps to resolve disputes and prevent lawsuits.

Examples: a party to a contract may seek the legal interpretation of a contract to determine the parties' rights, or a corporation may ask a court to decide whether a new tax is truly applicable to that business before it pays it.