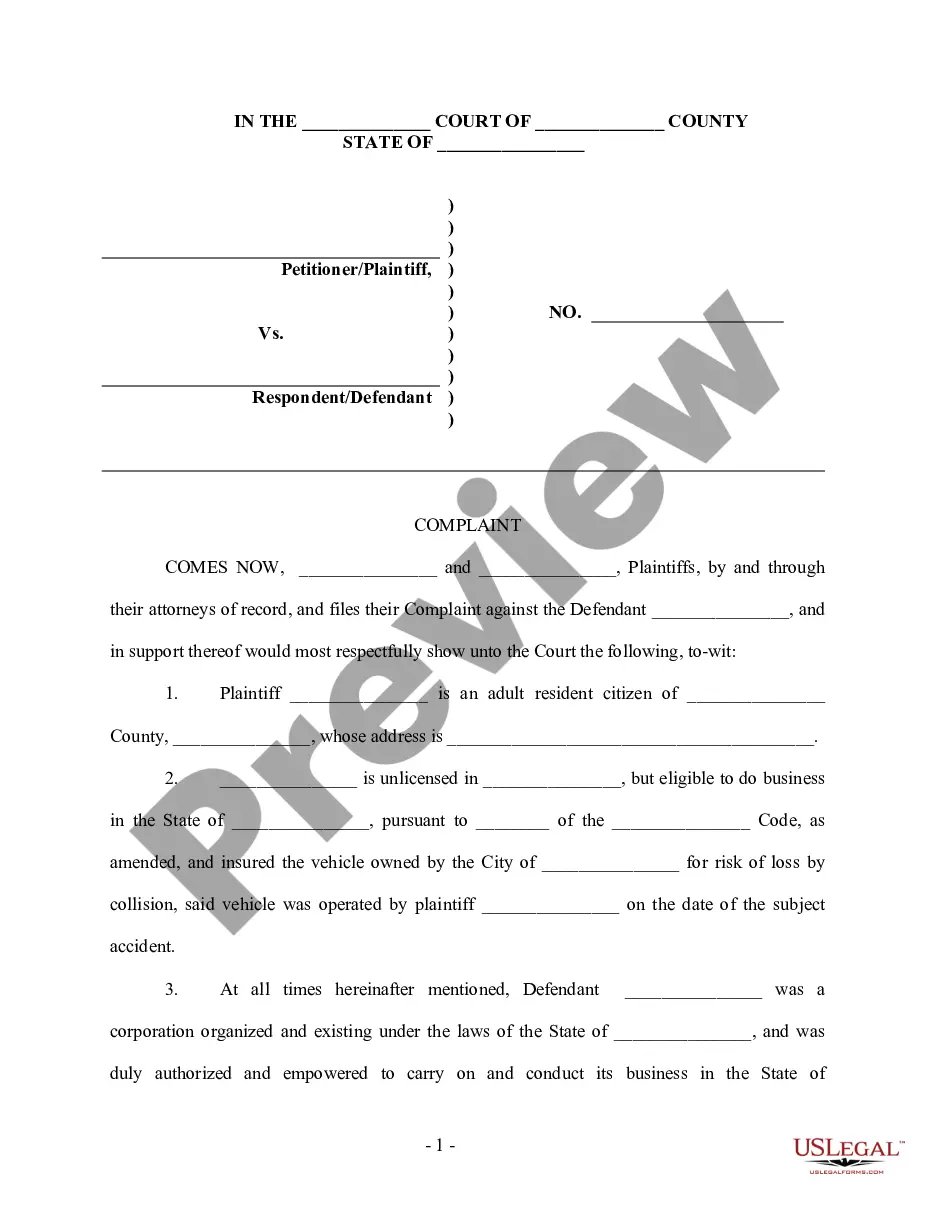

Connecticut Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

US Legal Forms - one of many biggest libraries of legal varieties in the USA - provides a variety of legal file layouts you can acquire or produce. Utilizing the website, you can find a huge number of varieties for organization and individual purposes, categorized by types, claims, or key phrases.You will discover the latest types of varieties such as the Connecticut Complaint regarding Insurer's Failure to Pay Claim within minutes.

If you have a membership, log in and acquire Connecticut Complaint regarding Insurer's Failure to Pay Claim through the US Legal Forms catalogue. The Down load key can look on each and every type you perspective. You have accessibility to all in the past saved varieties inside the My Forms tab of your own bank account.

If you wish to use US Legal Forms for the first time, listed here are easy recommendations to obtain started:

- Be sure to have picked the correct type for your area/county. Click on the Review key to analyze the form`s articles. Browse the type outline to actually have chosen the proper type.

- In case the type doesn`t fit your needs, utilize the Research discipline near the top of the monitor to obtain the one who does.

- In case you are happy with the form, validate your decision by visiting the Buy now key. Then, choose the costs plan you favor and give your accreditations to register to have an bank account.

- Approach the financial transaction. Use your charge card or PayPal bank account to accomplish the financial transaction.

- Choose the formatting and acquire the form on the device.

- Make adjustments. Fill out, revise and produce and indicator the saved Connecticut Complaint regarding Insurer's Failure to Pay Claim.

Each and every design you added to your bank account lacks an expiry particular date and it is your own for a long time. So, in order to acquire or produce one more backup, just check out the My Forms area and click on in the type you will need.

Get access to the Connecticut Complaint regarding Insurer's Failure to Pay Claim with US Legal Forms, probably the most considerable catalogue of legal file layouts. Use a huge number of specialist and state-distinct layouts that meet up with your small business or individual needs and needs.

Form popularity

FAQ

The minimum amount of Connecticut auto insurance coverage is $25,000/$50,000/$25,000. In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident. It also covers up to $25,000 for damage to another person's property.

Connecticut is no longer a no-fault state for automobile insurance, but was before 1994. The term ?no-fault automobile insurance? often refers to automobile insurance that permits a person to recover financial losses from his or her own insurance company regardless of who caused the loss.

STATE OF CONNECTICUT. INSURANCE DEPARTMENT. Consumer Affairs Division. ... PHONE 860.297.3900 | FAX 860.297.3872. ... CONSUMER COMPLAINT FORM. Complainant Name: __________________________________________________________________________ ... ? Auto ? Home/Renters ? Life ? Annuity ? Commercial ? Travel ? Pet.

Insurance companies in Connecticut do not have a specific amount of time in which they must settle an insurance claim. Instead, state law requires them to settle claims with ?reasonable promptness?.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

Connecticut requires a driver to carry minimum liability coverage of $25,000 per person and $50,000 per accident for bodily injury and $25,000 per accident for property damage (CGS § 14-112).

You're not required to purchase health insurance in Connecticut, but the Affordable Care Act does have a mandate for insurance coverage at the federal level.

The standard coverage is equal to your bodily injury liability coverage. You can buy extra coverage up to twice the amount of your bodily injury liability coverage. You must have at least $25,000 per person and $50,000 per accident by law.