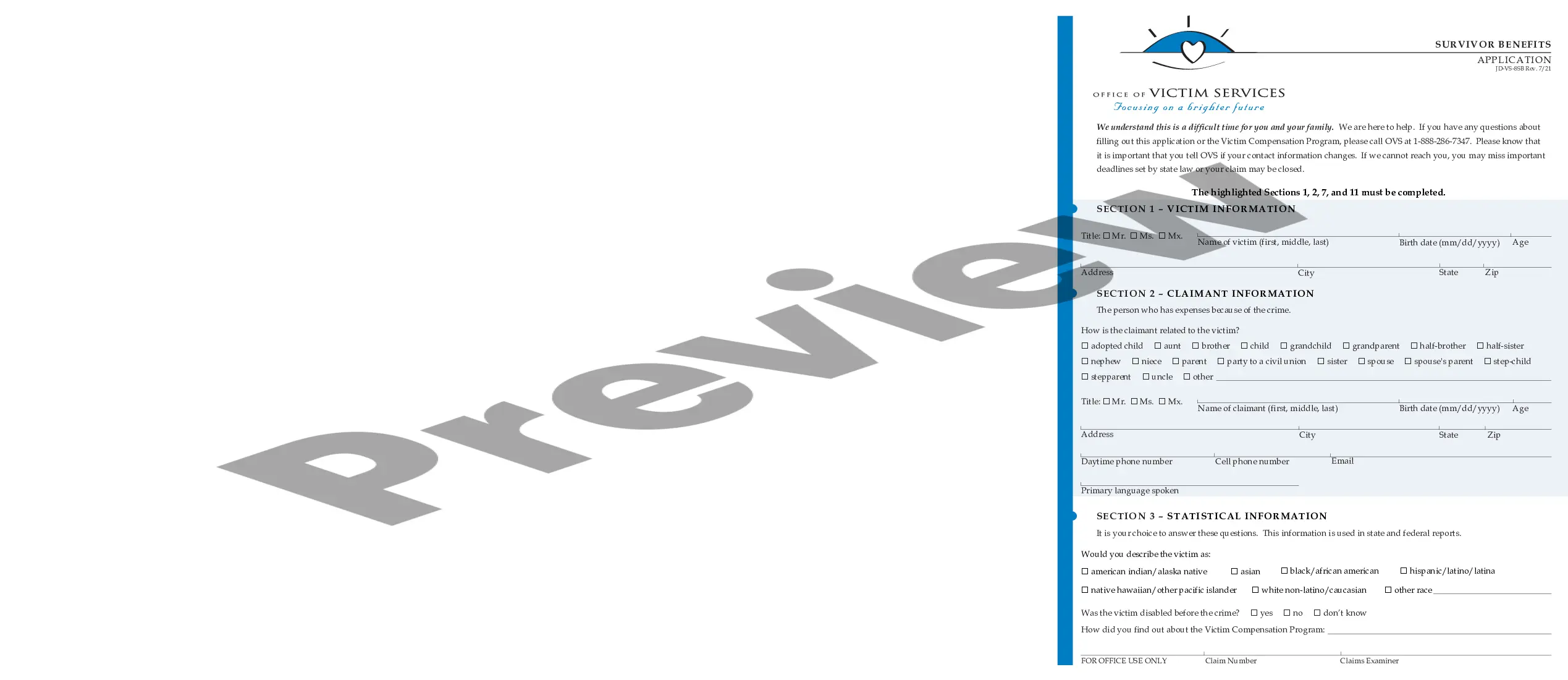

The Connecticut Application for Waiver of Two Year Filing Requirement is an application process that allows certain individuals to apply for a waiver to the two-year filing requirement in the state of Connecticut. The two-year filing requirement states that a person must file a Connecticut income tax return to the two years prior to the current year in order to be eligible for certain tax benefits, such as the homestead credit or property tax credit. There are two types of Connecticut Application for Waiver of Two Year Filing Requirement: one for individuals and one for married couples filing jointly. For individuals, the application must include the person's name, address, Social Security Number, date of birth, and any other relevant information required. For married couples filing jointly, both individuals must provide the same information on the application. The Connecticut Application for Waiver of Two Year Filing Requirement must be submitted to the Connecticut Department of Revenue Services (DRS) along with supporting documentation (i.e. copies of prior year's tax returns, proof of disability, etc.). Once the application is submitted, the DRS will review the information and make a determination if the waiver is approved or not.

Connecticut Application for Waiver of Three Year Filing Requirement

Description

How to fill out Connecticut Application For Waiver Of Three Year Filing Requirement?

If you are seeking a method to suitably prepare the Connecticut Application for Waiver of Two Year Filing Requirement without employing a legal expert, then you are in the perfect place.

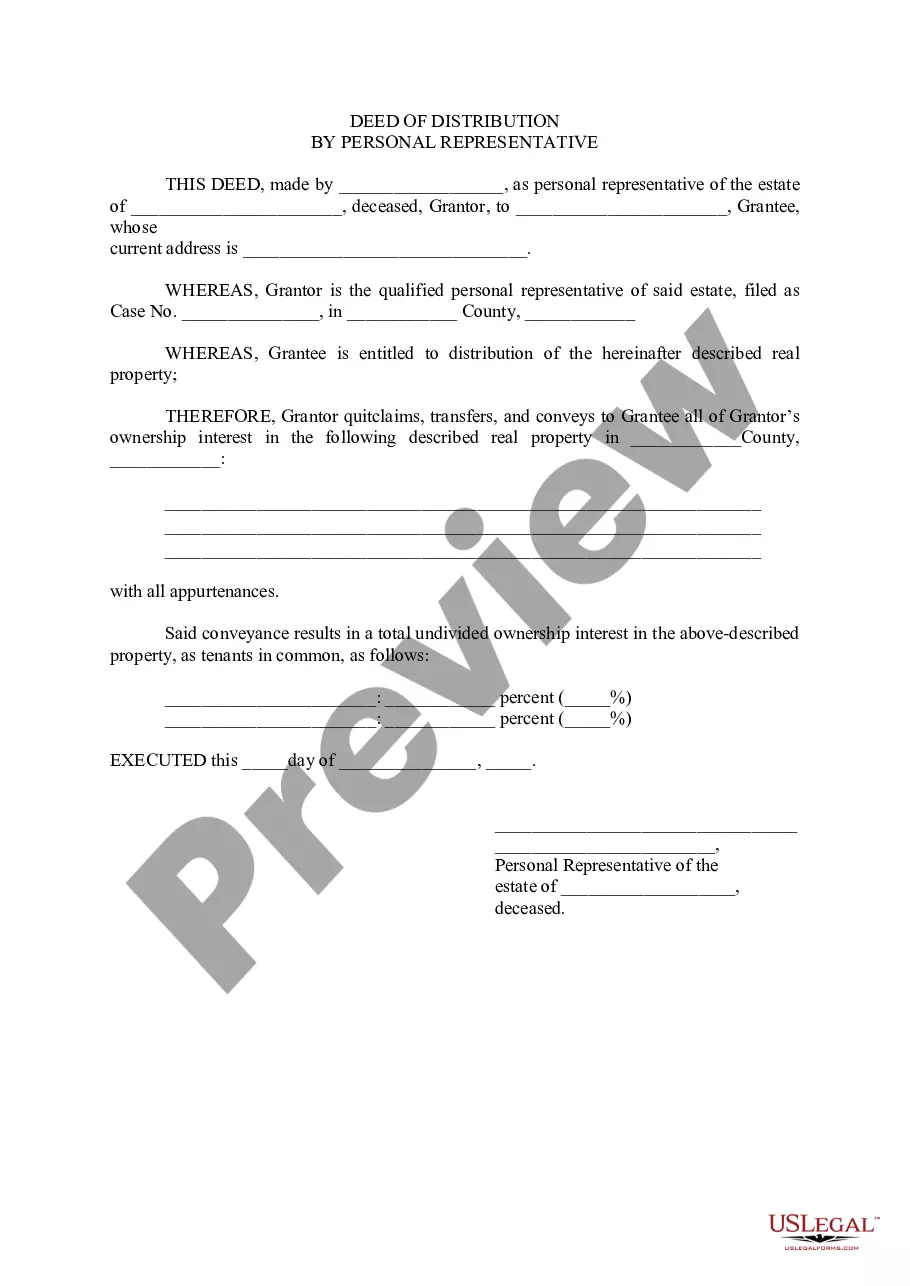

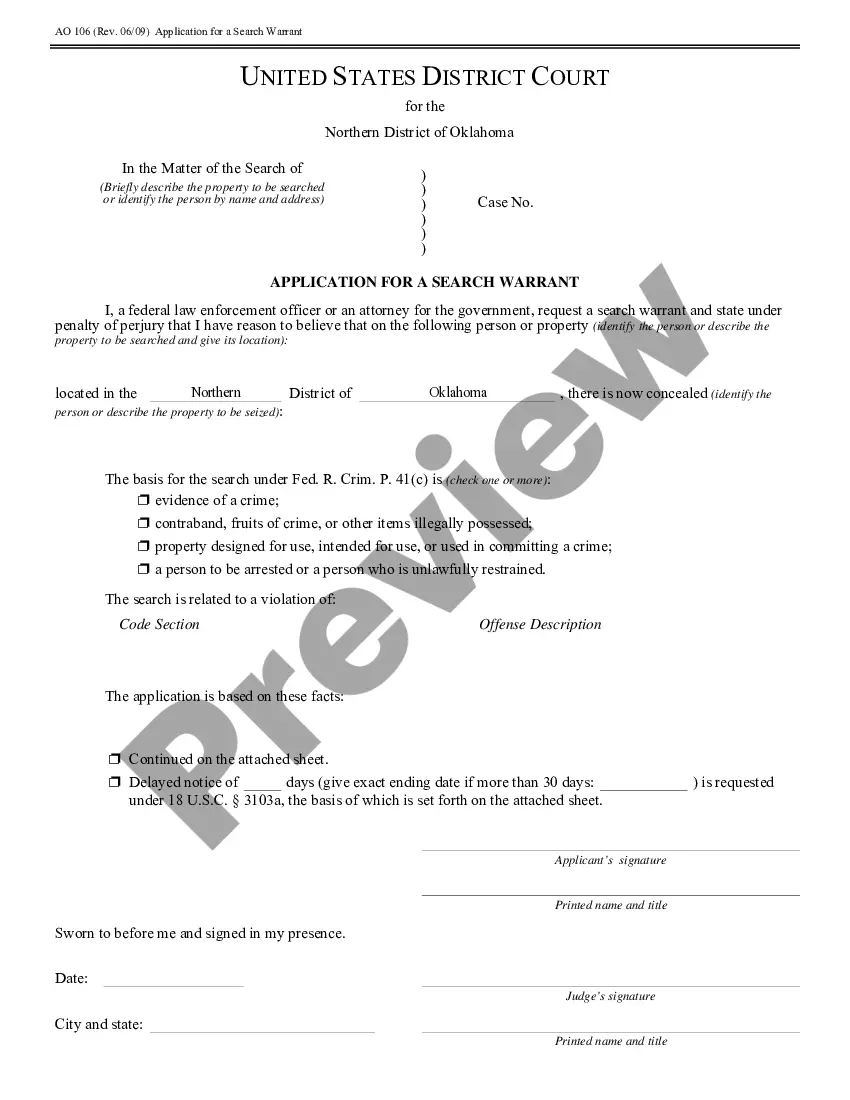

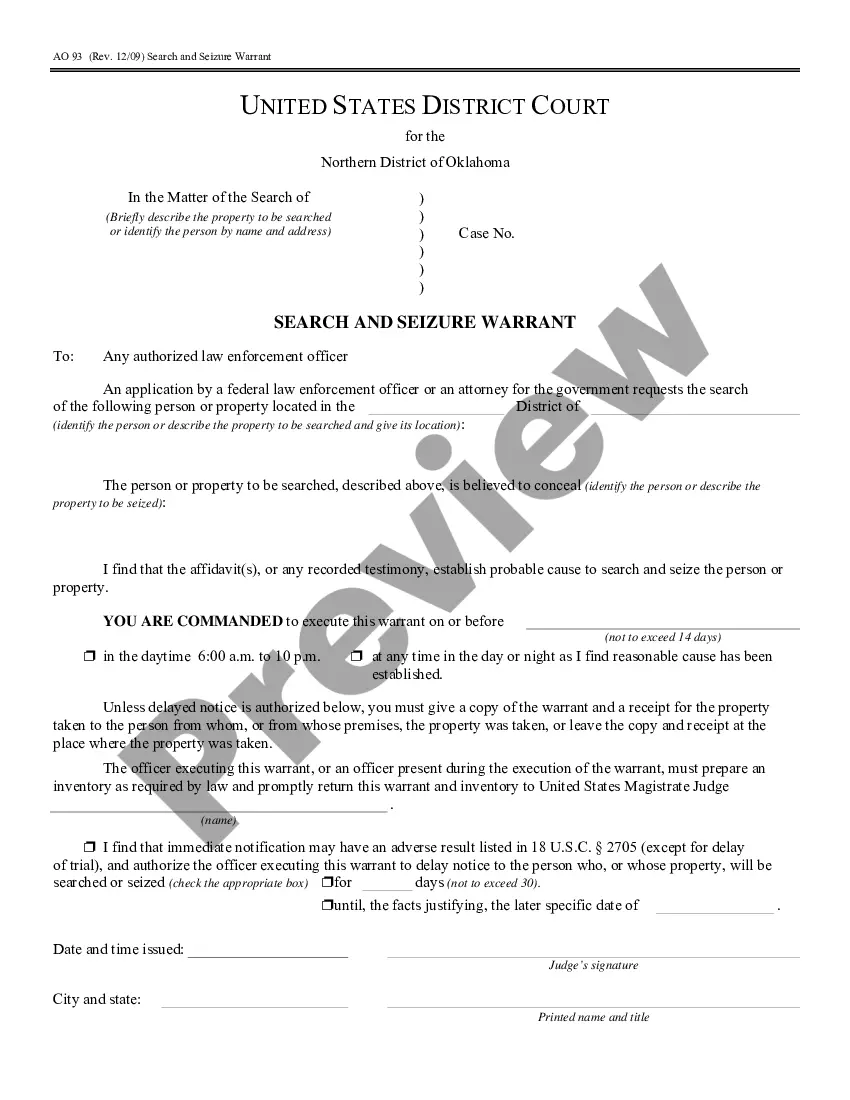

US Legal Forms has established itself as the most comprehensive and esteemed collection of official templates for every personal and commercial scenario. Each document you discover on our online service is crafted in accordance with federal and state regulations, ensuring that your forms are properly arranged.

Another fantastic feature of US Legal Forms is that you will never misplace the documents you have obtained - you can access any of your downloaded forms in the My documents section of your account whenever you need them.

- Verify that the document displayed on the page is suitable for your legal circumstances and complies with state laws by reviewing its description or exploring the Preview mode.

- Enter the document title in the Search tab located at the top of the page and select your state from the available options to find another template in case of discrepancies.

- Repeat the verification process and click Buy now once you are sure that the paperwork meets all the stipulations.

- Access your account and click Download. Create an account with the service and select a subscription plan if you do not already possess one.

- Utilize your credit card or the PayPal method to acquire your US Legal Forms subscription. The document will be accessible for download immediately after.

- Select in which format you prefer to receive your Connecticut Application for Waiver of Two Year Filing Requirement and download it by clicking the appropriate button.

- Upload your template to an online editor to swiftly complete and sign it or print it out to prepare a hard copy manually.

Form popularity

FAQ

Yes, Connecticut does require certain separation notices in specific circumstances, especially related to unemployment or termination. It’s important to understand your responsibilities under state law. For matters like the Connecticut Application for Waiver of Three Year Filing Requirement, make sure you address any notices as part of your filing process.

You can pick up tax forms at various locations, including state offices, libraries, and some municipal buildings. These locations provide the most common tax forms needed for filing. If you need forms specifically for the Connecticut Application for Waiver of Three Year Filing Requirement, check the availability at these locations.

Yes, filing a state extension in Connecticut requires a separate application from the federal extension. This ensures that all state-specific deadlines are adhered to under Connecticut law. Whenever you are filing for the Connecticut Application for Waiver of Three Year Filing Requirement, ensure you also manage your extension correctly.

Connecticut requires you to apply for an extension if you anticipate needing more time to file. This application is separate from federal extensions and must be submitted on time. If you're handling the Connecticut Application for Waiver of Three Year Filing Requirement, it’s vital to comply with state requirements for extensions.

Yes, Connecticut does allow electronic filing of amended returns, making the process simpler and quicker. Make sure to follow the online instructions closely to avoid any errors. When dealing with the Connecticut Application for Waiver of Three Year Filing Requirement, filing electronically can save you time.

Physical copies of tax forms can be obtained at state offices, public libraries, and some local government buildings. Additionally, you can download and print forms from the Connecticut Department of Revenue Services website. Always ensure you have the correct forms like those for the Connecticut Application for Waiver of Three Year Filing Requirement.

Form CT 1040 Ext should be sent to the address provided on the form itself, which may vary based on whether you are issuing a payment. It's always best to verify with the Connecticut Department of Revenue Services to ensure timely processing. If you’re using the Connecticut Application for Waiver of Three Year Filing Requirement, keep the filing instructions handy.

In Connecticut, individuals must file a tax return if they meet certain income thresholds. This requirement varies depending on whether you are single or married. When applying for a waiver like the Connecticut Application for Waiver of Three Year Filing Requirement, be sure to understand the filing requirements that apply to you.

CT state tax forms are conveniently available on the Connecticut Department of Revenue Services' website. You can also visit state libraries or municipal offices for physical copies. Remember, using the Connecticut Application for Waiver of Three Year Filing Requirement may require specific forms, so check carefully.

Typically, post offices do not carry Connecticut state tax forms anymore. However, you can obtain them easily through online resources or local offices. The Connecticut Application for Waiver of Three Year Filing Requirement has specific forms you must have; checking the official website is your best bet.