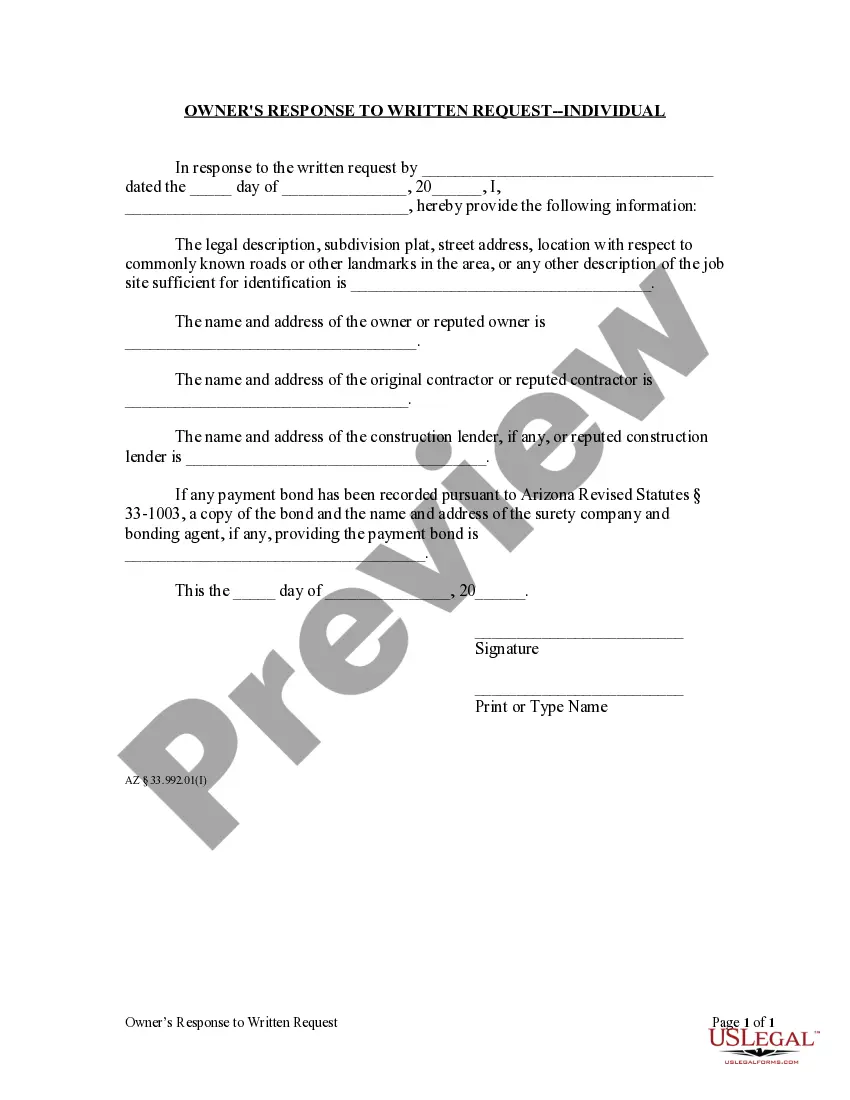

This form is an application and/or declaration of insolvent estate due to an inability to pay debts. This document is used in probate matters. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Application/Declaration of Insolvent Estate

Description

How to fill out Connecticut Application/Declaration Of Insolvent Estate?

The larger quantity of documents you are required to produce - the more anxious you become.

You can discover a multitude of Connecticut Application - Declaration of Insolvent Estate templates online, yet, you're unsure which ones to rely on.

Eliminate the stress of locating samples more efficiently by using US Legal Forms.

Click Buy Now to initiate the registration process and select a pricing plan that meets your needs. Enter the required information to create your account and process the payment via PayPal or credit card. Choose a convenient document format and receive your copy. Access each document you download in the My documents section. Simply navigate there to complete a new copy of the Connecticut Application - Declaration of Insolvent Estate. Even when utilizing properly drafted templates, it's still essential to consider consulting your local attorney to verify the completed form to ensure your record is accurately filled out. Achieve more for less with US Legal Forms!

- Obtain professionally crafted documents that comply with state regulations.

- If you already possess a US Legal Forms subscription, Log In to your account to find the Download button on the Connecticut Application - Declaration of Insolvent Estate page.

- If you have yet to use our service, complete the registration process following these steps.

- Ensure the Connecticut Application - Declaration of Insolvent Estate is applicable in your residing state.

- Verify your choice by reviewing the description or utilizing the Preview option if available for the selected document.

Form popularity

FAQ

Similar to the previous considerations, an estate must generally exceed $40,000 to warrant probate in Connecticut. When assets are valued below this limit, families can often bypass the probate court altogether. Familiarizing yourself with the Connecticut Application/Declaration of Insolvent Estate will provide you clarity on your specific situation in this regard.

To initiate probate in Connecticut, an estate typically needs to exceed $40,000 in value. Estates below this threshold might not necessitate a formal probate process, making administration simpler. It's beneficial to understand these distinctions when planning your estate to ensure compliance. Utilizing the Connecticut Application/Declaration of Insolvent Estate can help you navigate these specifics effectively.

There are several methods to avoid probate in Connecticut, such as establishing joint ownership of assets or placing them in a trust. These options allow for a smoother transfer of assets to heirs without court intervention. Additionally, the Connecticut Application/Declaration of Insolvent Estate can provide guidance for managing estates that face financial difficulty, helping to simplify the process further.

Not all estates must go through probate in Connecticut. If an estate’s value is below the set threshold, or if certain assets are held in joint ownership, probate may not be necessary. This can significantly expedite the transfer of assets. Understanding your options through tools like the Connecticut Application/Declaration of Insolvent Estate can clarify your path forward.

In Connecticut, the minimum estate value that requires probate is $40,000. When an estate is valued below this amount, it may qualify for a simplified probate process. This process can save time and provide an easier way to manage the estate distribution. For a precise understanding, consider the Connecticut Application/Declaration of Insolvent Estate as a crucial step in simplifying your obligations.

Certain assets do not go through probate, including life insurance proceeds, retirement accounts, and jointly owned properties. Assets held in a living trust also bypass the probate process. These exceptions can simplify estate management significantly. By understanding the implications of a Connecticut Application/Declaration of Insolvent Estate, you can navigate the nuances of your estate's assets more effectively.

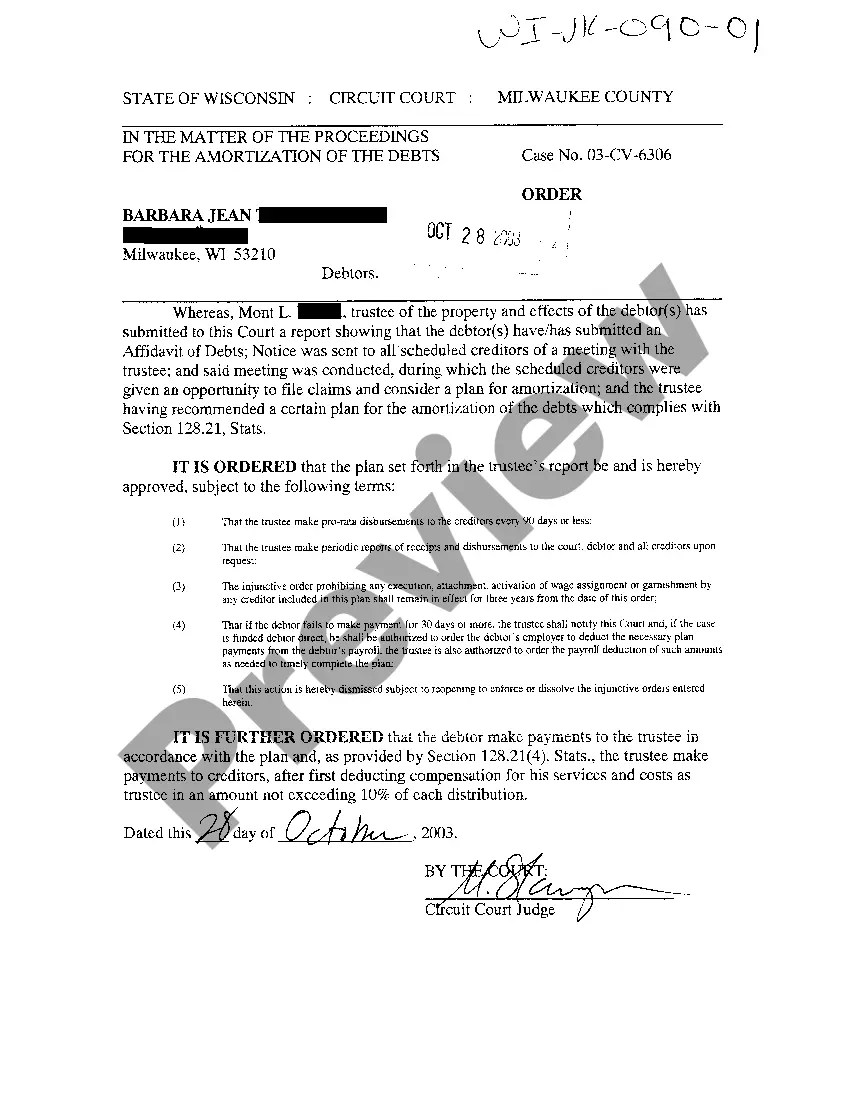

To establish that an estate is insolvent, you must list all assets and debts of the estate. When the debts exceed the assets, you can declare the estate insolvent by filing a Connecticut Application/Declaration of Insolvent Estate. This declaration helps in managing creditors and ensuring that the estate is settled according to the law. It is crucial to understand this process, as it can directly influence your responsibilities as an executor or administrator.

In Connecticut, not all wills require probate. If the assets are minimal or if they can be transferred directly, probate may not be needed. However, if the estate is significant, then the probate process typically applies. Consulting a professional familiar with the Connecticut Application/Declaration of Insolvent Estate can help you understand whether probate is essential for your situation.

To obtain a probate certificate in Connecticut, you must file the appropriate documents with the probate court in your district. Be sure to provide the death certificate as well as proof of the estate's value. After the court processes your application, you will receive the certificate, allowing you to manage the estate effectively. For those handling a Connecticut Application/Declaration of Insolvent Estate, a probate certificate can clarify your responsibilities.

Not all estates in Connecticut must go through probate. If an estate falls below a certain value, it may qualify for a simplified process. However, if the estate includes property solely owned by the deceased, then probate might be necessary. When dealing with a Connecticut Application/Declaration of Insolvent Estate, understanding the probate process can ensure you make informed decisions.