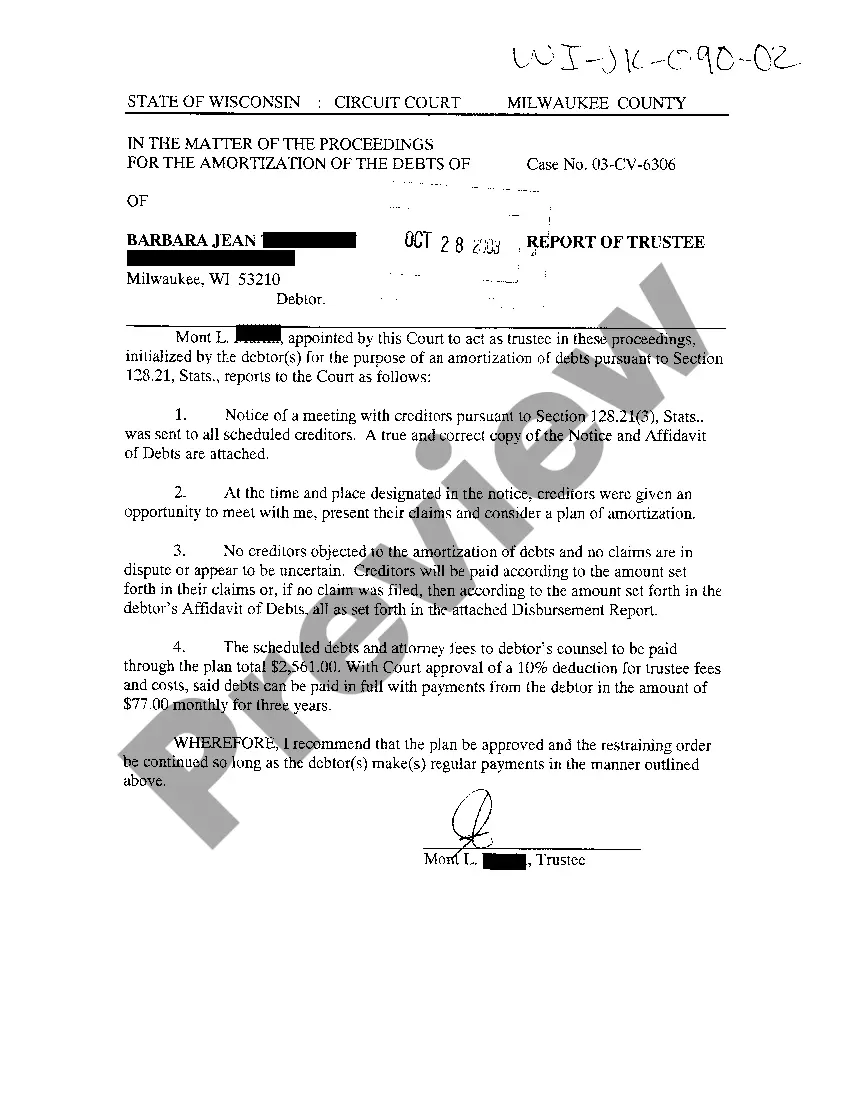

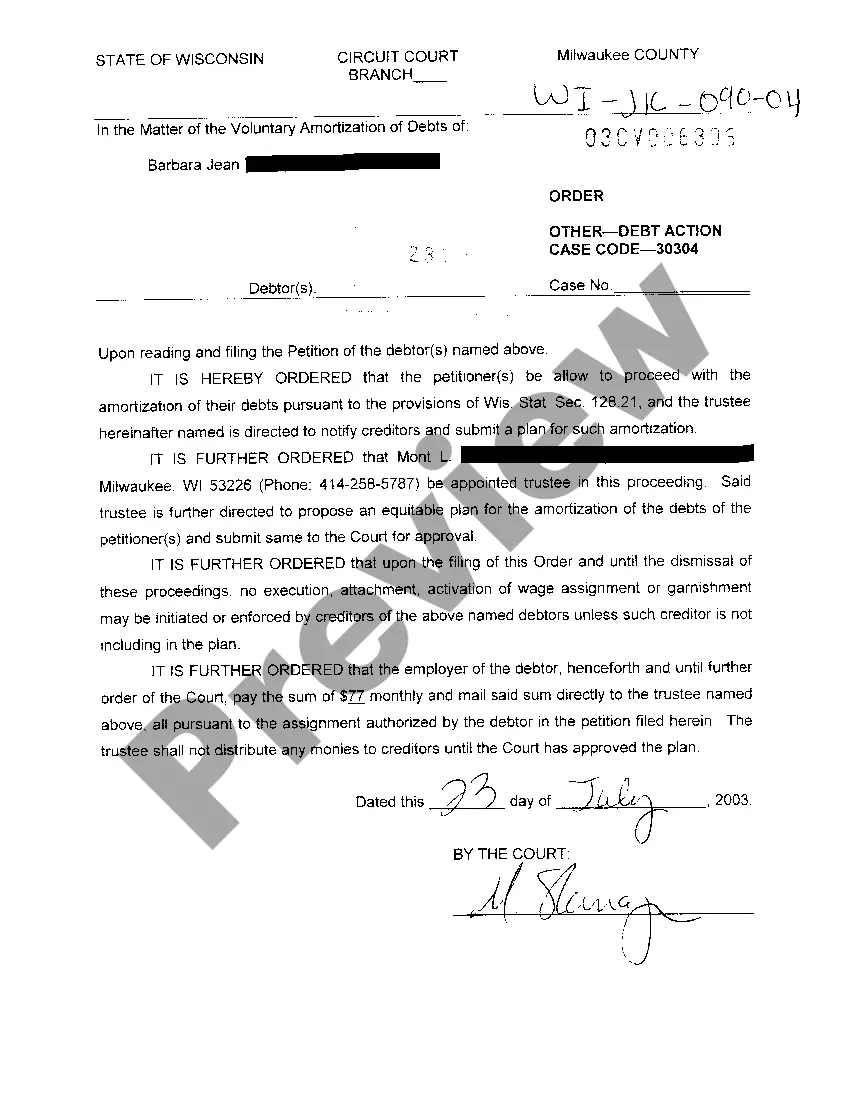

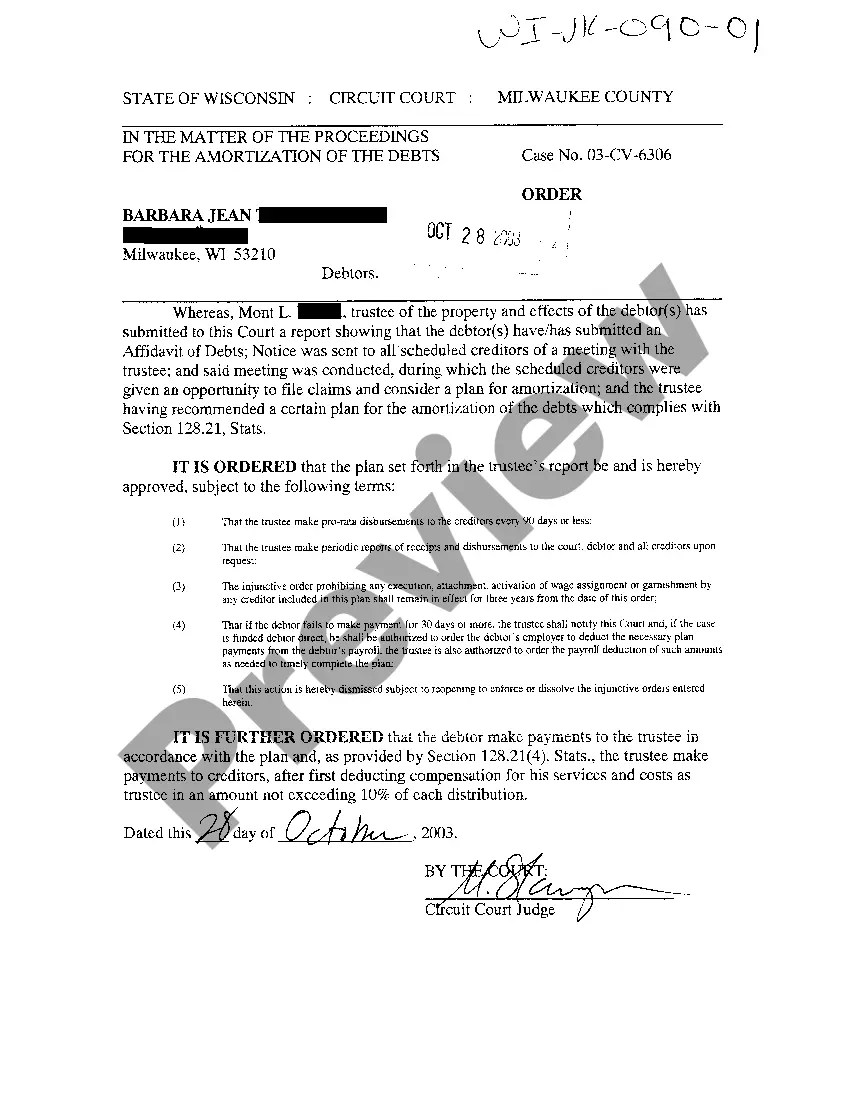

Wisconsin Order for Payments to Trustee

Description

How to fill out Wisconsin Order For Payments To Trustee?

Out of the great number of platforms that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before buying them. Its extensive library of 85,000 templates is grouped by state and use for simplicity. All of the documents on the platform have already been drafted to meet individual state requirements by accredited legal professionals.

If you have a US Legal Forms subscription, just log in, look for the template, hit Download and gain access to your Form name in the My Forms; the My Forms tab keeps your saved documents.

Keep to the guidelines below to obtain the document:

- Once you discover a Form name, ensure it’s the one for the state you need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Search for a new sample via the Search field if the one you have already found isn’t appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

When you have downloaded your Form name, it is possible to edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it continues to be the most updated version in your state. Our service offers quick and simple access to samples that fit both attorneys as well as their clients.

Form popularity

FAQ

Through a process known as debt management, InCharge can work with creditors to consolidate credit card debt, lower interest rate paid and arrive at an affordable monthly payment that reduces debt. The program is open to all credit profiles, which means a bad credit score won't keep an applicant from qualifying.

Payment. Current beneficiaries have the right to distributions as set forth in the trust document. Right to information. Right to an accounting. Remove the trustee. Termination of the trust.

Beneficiaries' right to information enables them to act upon another right: to petition the court to remove the trustee if they are not properly carrying out their duties, or to terminate the trust altogether under some circumstances.

Chapter 128is neither bankruptcy, nor credit counseling.Although the trustee does not clean up your credit report; however once the plan is completed, you get documents from the court that will help you clean up remaining problems with the credit bureaus.

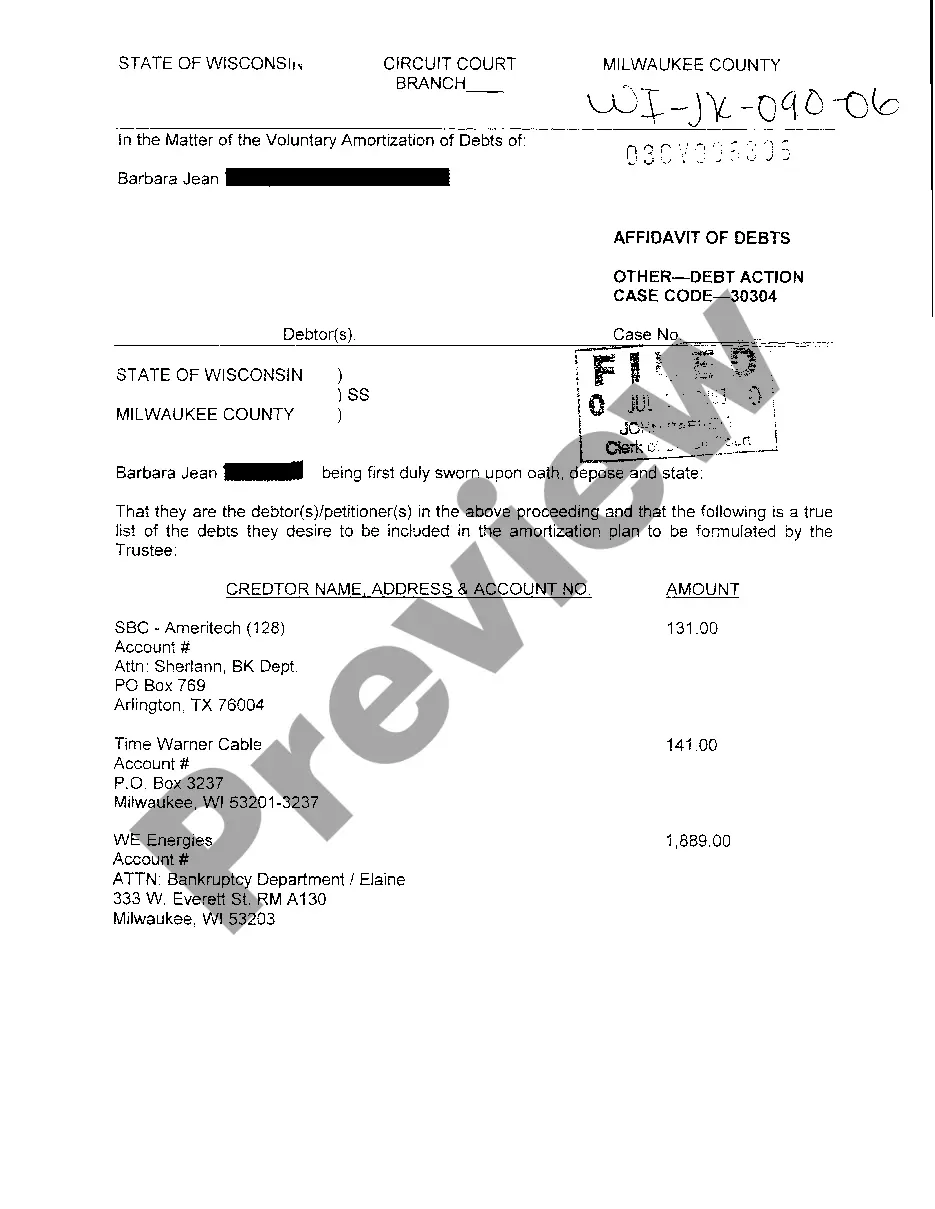

A debtor filing Chapter 128 fills out a simple petition to reorganize debts and an affidavit listing the debts he or she wishes to include. Chapter 128 covers unsecured debts such as credit cards, payday loans, speeding tickets, medical bills, late utility bills and rent payments.

With voluntary amortization of debts, you work with a court-appointed trustee to set up an approved payment plan and amortize all debts included in the plan so they're paid in full within three years.If you renege on the plan or do not pay the debt in full, creditors can resume debt-collection efforts.

Any payments made by you personally are to be made by money order or cashier's check made payable to the Office of the Chapter 13 Trustee, and mailed to the Atlanta address at Chapter 13 Trustee - COLS P.O. Box 116347 Atlanta, Georgia 30368-6347.

Chapter 128 plans are filed through an attorney, as these are legal proceedings. The attorney will review your situation to determine if you qualify for the plan. He or she will examine your debt situation, explain the plan, prepare and submit the required documents with the Court and communicate with the trustee.