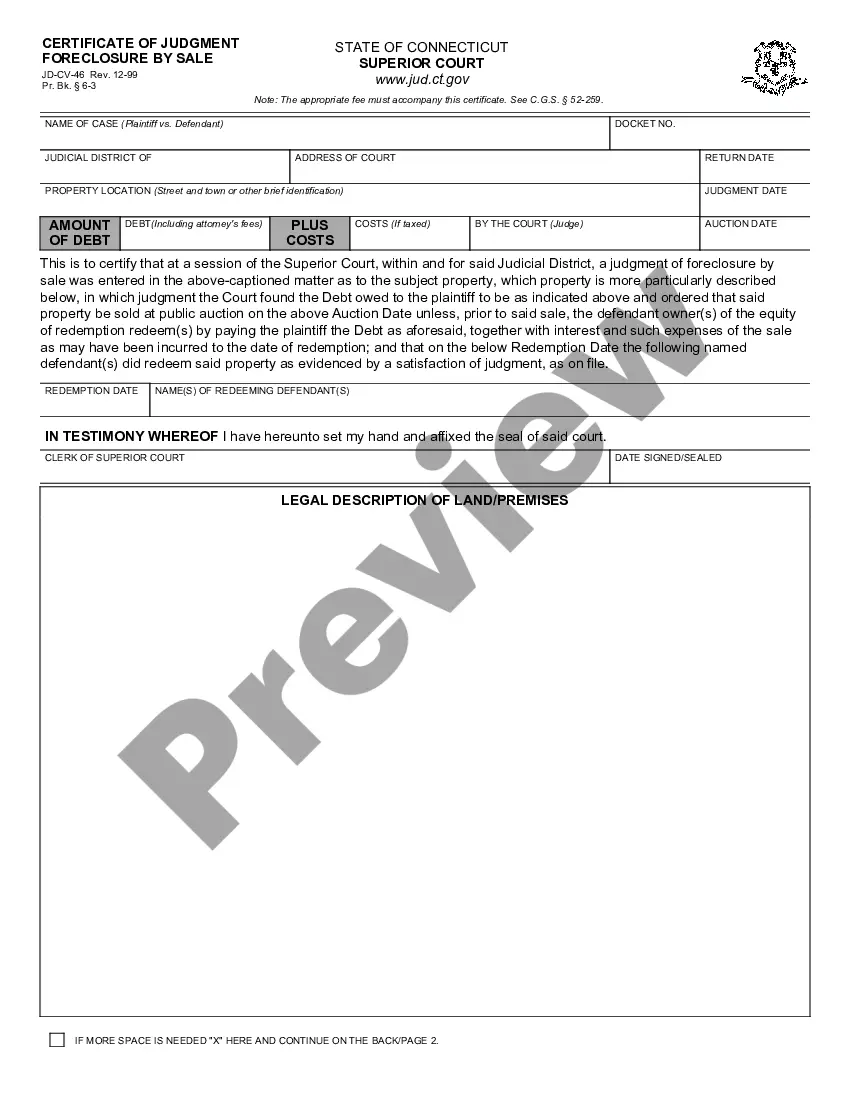

This form is used to certify the judgment for strict foreclosure of property which gives the property title without the sale of the property first taking place. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Certificate of Judgment - Strict Foreclosure

Description

How to fill out Connecticut Certificate Of Judgment - Strict Foreclosure?

The greater the documentation you need to assemble - the more anxious you become.

You can find numerous Connecticut Certificate of Judgment Strict Foreclosure templates online, but you can't be sure which ones to rely on.

Eliminate the frustration and simplify acquiring samples using US Legal Forms. Obtain properly drafted documents that comply with state regulations.

Fill in the required details to create your account and complete your order using your PayPal or credit card. Choose a suitable document format and obtain your sample. Access all documents you acquire in the My documents section. Navigate there to complete a new copy of your Connecticut Certificate of Judgment Strict Foreclosure. Even when working with professionally drafted forms, it’s still crucial to consider consulting your local legal expert to verify that your document is correctly filled out. Achieve more with less effort using US Legal Forms!

- If you are already a subscriber of US Legal Forms, Log In to your account, and you'll find the Download option on the Connecticut Certificate of Judgment Strict Foreclosure’s page.

- If this is your first time using our site, complete the registration process by following these steps.

- Verify if the Connecticut Certificate of Judgment Strict Foreclosure is legitimate in your state.

- Double-check your choice by reviewing the description or utilizing the Preview option if available for the selected record.

- Simply click Buy Now to initiate the sign-up procedure and select a pricing plan that suits your needs.

Form popularity

FAQ

The downside of a foreclosure includes the potential loss of equity and homeownership for the borrower. In both strict and judicial foreclosures, homeowners may face significant financial challenges after losing their homes due to unpaid debts. Additionally, a foreclosure adversely affects credit scores, making it harder for individuals to secure future loans or housing.

To initiate a strict foreclosure, the lender must meet specific legal requirements, including obtaining a Connecticut Certificate of Judgment - Strict Foreclosure. The lender must demonstrate the borrower's default on mortgage payments and follow proper court procedures. Proper documentation and adherence to state regulations are crucial to ensure a smooth process.

The Judgment of strict foreclosure in Connecticut is a court order that allows a lender to take ownership of a property when the homeowner cannot repay their debt. Upon issuing a Connecticut Certificate of Judgment - Strict Foreclosure, the court essentially confirms that the lender can bypass the auction process. This judgment leads to a more expedited resolution for both the lender and the borrower.

An example of strict foreclosure occurs when a homeowner fails to make mortgage payments for an extended period, prompting the lender to file for a Connecticut Certificate of Judgment - Strict Foreclosure. The court may then issue a judgment that allows the lender to obtain the property directly. This process efficiently transfers ownership without the traditional auction method.

The primary difference between judicial foreclosure and strict foreclosure lies in the procedure and outcomes. In judicial foreclosure, the property is sold at auction to recover outstanding debts, while strict foreclosure allows the lender to take ownership without a sale. Therefore, once a Connecticut Certificate of Judgment - Strict Foreclosure is issued, the lender retains complete control over the property.

In a strict foreclosure, the lender does not sell the property at a public auction but rather takes direct possession of it after a court judgment is made. This process begins when the lender obtains a Connecticut Certificate of Judgment - Strict Foreclosure, which effectively ends the homeowner's ability to redeem the property. As a result, the borrower loses any remaining equity in the home, and the lender gains full ownership.

The duration of a foreclosure in Connecticut can vary significantly depending on factors like court schedules and the complexity of the case. Generally, a standard foreclosure may take several months to over a year to resolve. However, strict foreclosure, finalized through the Connecticut Certificate of Judgment - Strict Foreclosure, can expedite the process, leading to quicker resolution for lenders and borrowers alike.

A foreclosure sale in Connecticut usually involves a public auction where the property is sold to the highest bidder. The sale is conducted by an appointed committee or sheriff, following court procedures. If the property is sold through strict foreclosure, rather than auction, the Connecticut Certificate of Judgment - Strict Foreclosure is issued, simplifying the transfer of ownership directly back to the lender.

In Connecticut, while the standard foreclosure process provides a 120-day grace period post-default, there are exceptions based on specific circumstances. For instance, if a mortgage includes a waiver of the right to redeem, the lender may proceed without waiting the full 120 days. Understanding the implications of the Connecticut Certificate of Judgment - Strict Foreclosure can help navigate these exceptions.

Yes, there is a statute of limitations on foreclosure actions in Connecticut. Generally, lenders have six years from the date of default to initiate a foreclosure case. The Connecticut Certificate of Judgment - Strict Foreclosure must be pursued within this timeframe to ensure that the lender's rights are protected, making timeline awareness crucial for homeowners.