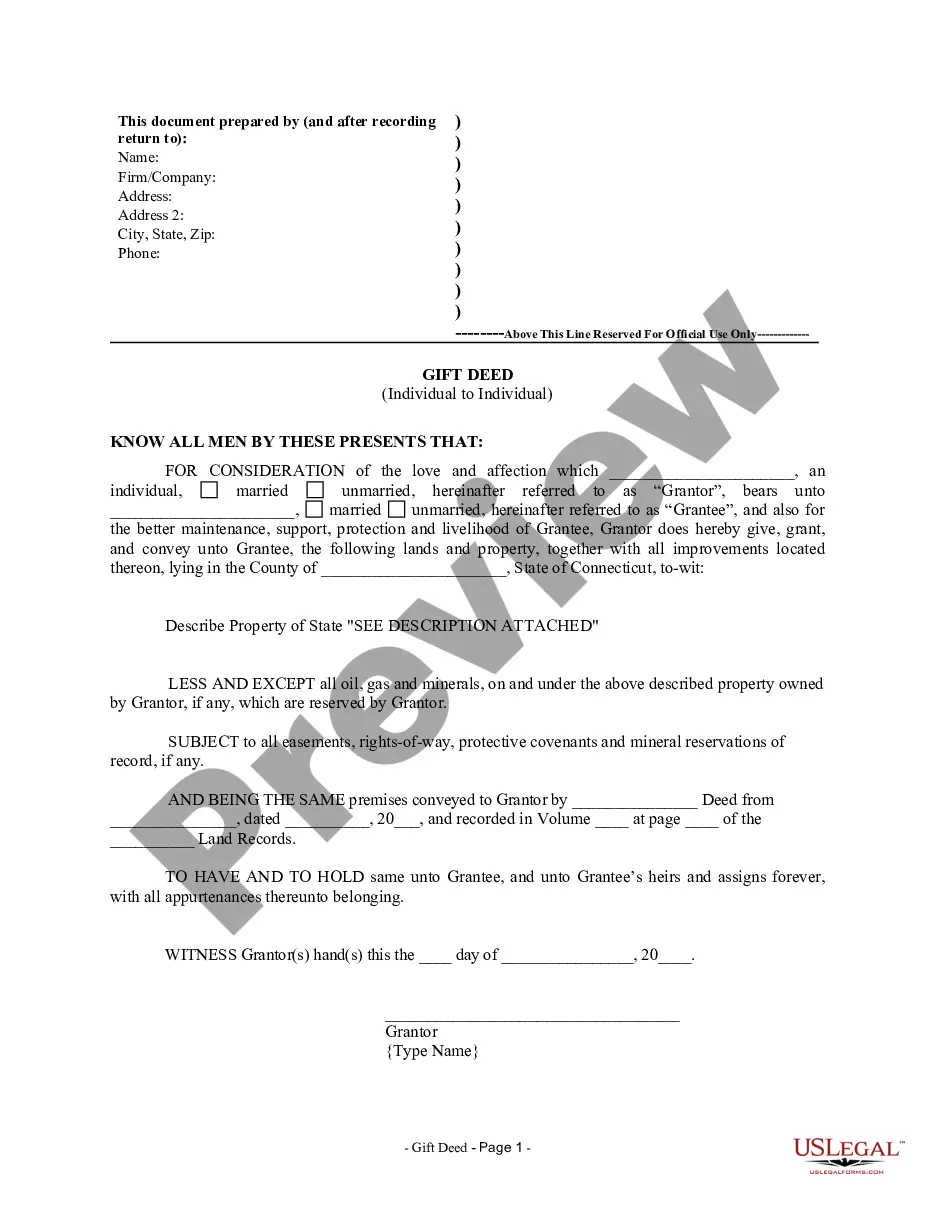

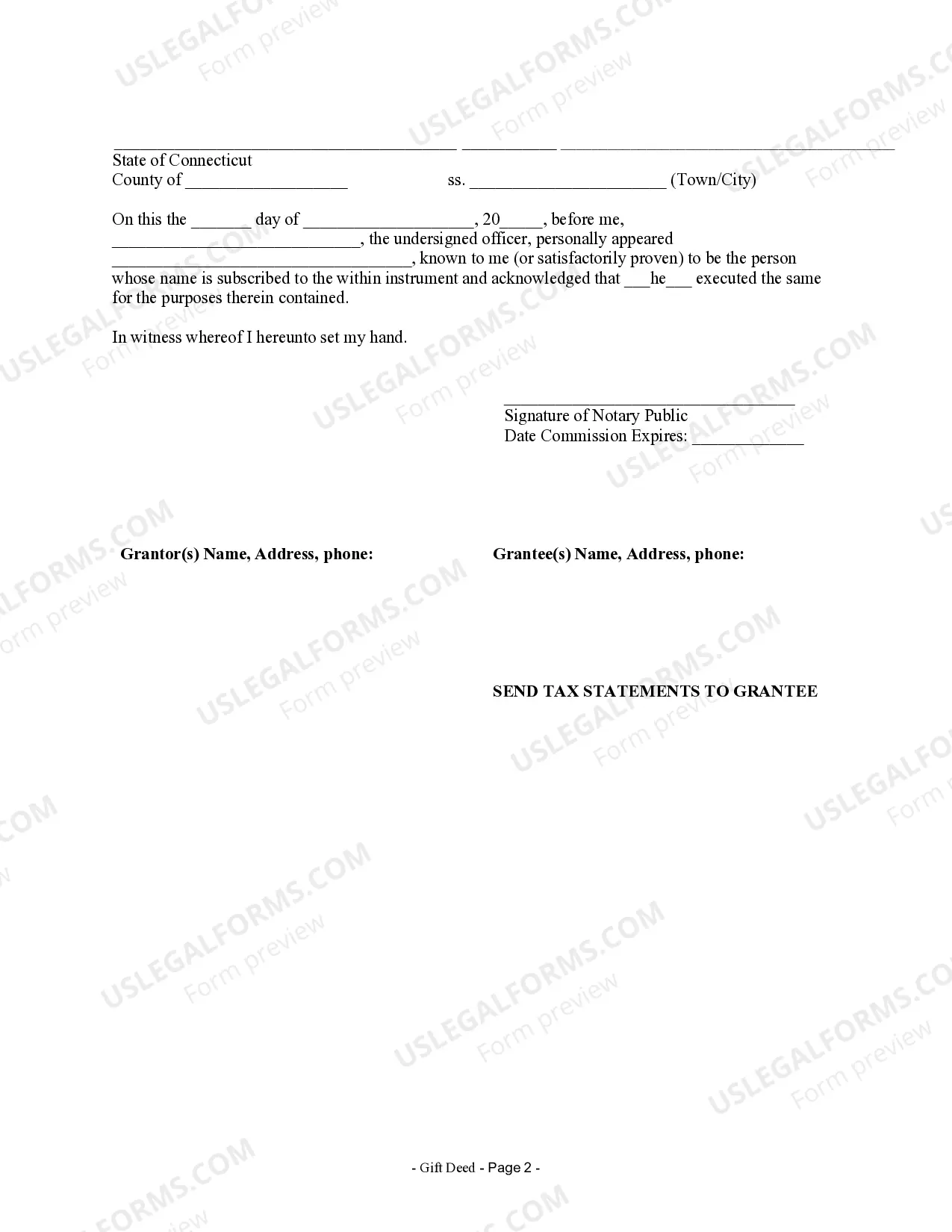

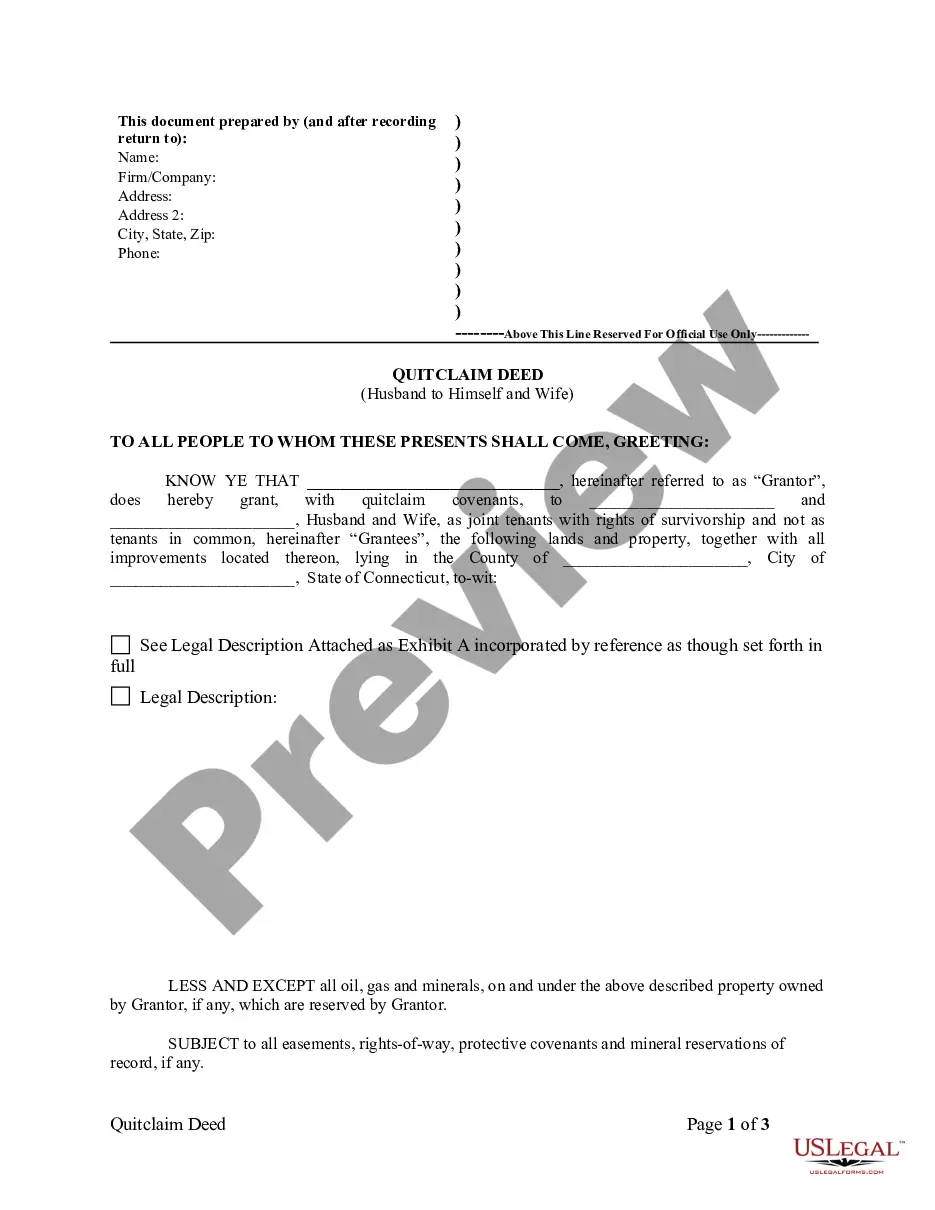

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Connecticut - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CT-020-77

Connecticut Gift Deed for Individual to Individual

Description

How to fill out Connecticut Gift Deed For Individual To Individual?

The greater number of documents you need to produce - the more anxious you become.

You can find numerous Connecticut Gift Deed for Individual to Individual formats available online, but you may not be certain which ones to trust.

Eliminate the stress and simplify the process of finding templates with US Legal Forms.

Click Buy Now to initiate the subscription process and select a pricing plan that suits your needs.

- Obtain expertly crafted paperwork developed to comply with state regulations.

- If you are already subscribed to US Legal Forms, Log In to your account to see the Download button on the page for the Connecticut Gift Deed for Individual to Individual.

- For new users, complete the registration process by following these steps.

- Verify that the Connecticut Gift Deed for Individual to Individual is applicable in your state.

- Review your selection by checking the description or using the Preview mode if available for the chosen document.

Form popularity

FAQ

In Connecticut, you can inherit up to the estate tax exemption limit, approximately $9.1 million in 2025, without incurring taxes. However, for amounts exceeding this, tax obligations will apply. Properly utilizing tools like the Connecticut Gift Deed for Individual to Individual can help manage wealth transfer efficiently within tax guidelines. This strategy ensures that individuals pass on their assets with less tax burden.

While the estate tax exemption amount can change based on legislation, it’s currently projected to remain stable at around $9.1 million for 2025. However, legislative reviews may affect future values. Staying updated on these changes is crucial if you're considering transactions like a Connecticut Gift Deed for Individual to Individual. Timely adjustments in your estate plans can provide significant benefits.

A Connecticut QTIP election allows a surviving spouse to receive income from a deceased spouse’s trust while postponing estate taxes. This election is particularly beneficial in estate planning strategies, including using a Connecticut Gift Deed for Individual to Individual. Understanding how this election works can improve overall estate management and financial outcomes.

Yes, Connecticut requires a gift tax return if the total gifts exceed the annual exclusion amount of $15,000. This requirement applies regardless of whether the gifts are taxable. If you are using a Connecticut Gift Deed for Individual to Individual, it’s essential to maintain transparency in your gifting process. Filing the proper forms can prevent future tax issues.

Tax exemptions in Connecticut for 2025 include the estate tax exemption and the annual gift tax exclusion, as mentioned earlier. It's important to note that additional exemptions may apply based on specific family situations or types of property transfers. Engaging in discussions about Connecticut Gift Deed for Individual to Individual allows individuals to better navigate these exemptions. This strategy can provide significant savings.

In 2025, the gift tax exclusion in Connecticut remains at $15,000 per individual donor per recipient. This means you can gift up to this amount without triggering gift tax obligations. When utilizing a Connecticut Gift Deed for Individual to Individual, staying informed on gift tax rules ensures clear planning and execution. It's always beneficial to consult tax professionals for personalized advice.

The estate tax exemption in Connecticut for 2025 is expected to be approximately $9.1 million. This means your estate can be valued at this amount before any estate taxes apply. If you're considering property transfers using a Connecticut Gift Deed for Individual to Individual, understanding the estate tax exemption is crucial. Proper planning can help minimize tax liabilities.

Yes, you can gift a house in Connecticut using a gift deed. This allows the property owner to transfer ownership to another person without expecting payment in return. It’s essential to follow Connecticut’s legal requirements for such a deed to ensure a smooth transfer. Utilizing platforms like uslegalforms can simplify this process, providing you the necessary forms and guidance for a Connecticut Gift Deed for Individual to Individual.

The main difference between a quitclaim deed and a gift deed lies in their purposes. A quitclaim deed transfers whatever interest the grantor has, without any guarantees. On the other hand, a gift deed is specifically meant to transfer property as a gift, indicating the intent behind the transfer. For a clear and intentional transfer of ownership, using a Connecticut Gift Deed for Individual to Individual is advisable.

One disadvantage of a gift deed is that once the property is given, the donor cannot reclaim it without the recipient's consent. Moreover, if the recipient faces financial difficulties, the property can be vulnerable to creditors. Also, it may have tax implications for both parties. When using a Connecticut Gift Deed for Individual to Individual, it’s wise to consult a professional to understand these factors fully.