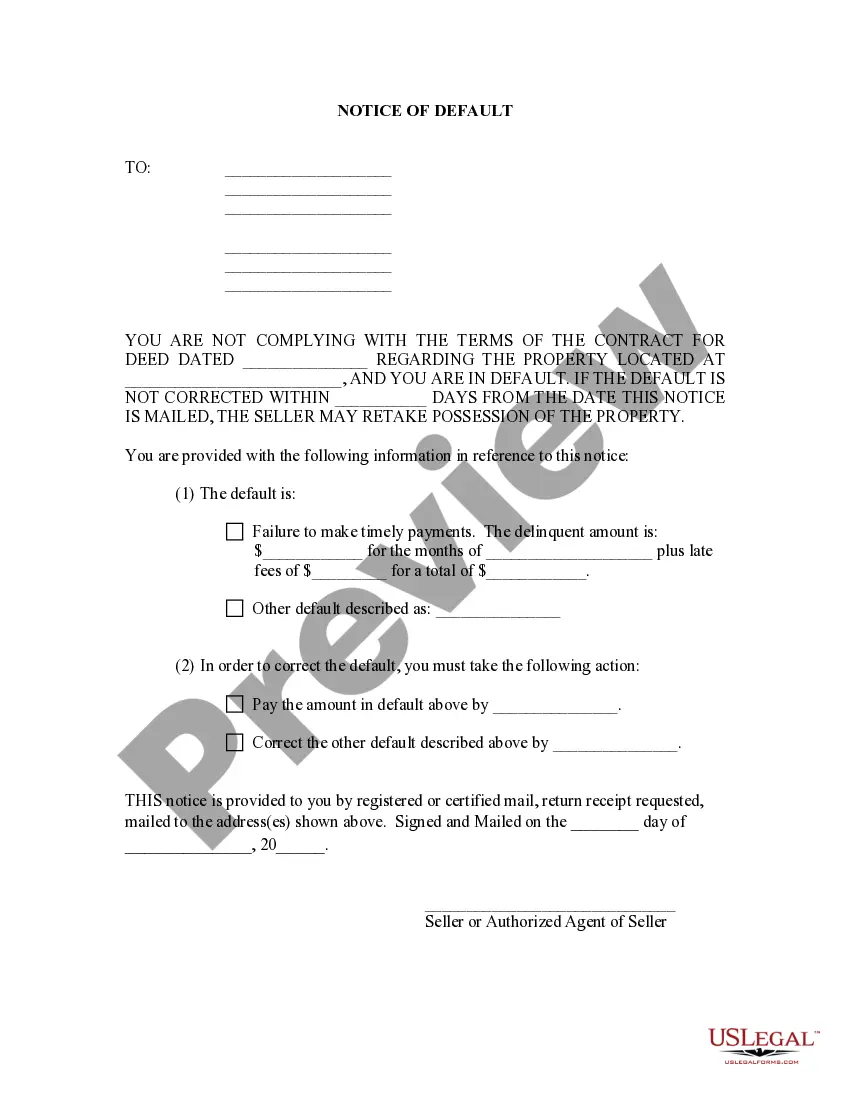

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

Connecticut General Notice of Default for Contract for Deed

Description

How to fill out Connecticut General Notice Of Default For Contract For Deed?

Utilize US Legal Forms to acquire a printable Connecticut General Notice of Default for Contract for Deed.

Our court-acceptable forms are crafted and routinely revised by qualified attorneys.

Ours is the most comprehensive Forms repository on the web, providing budget-friendly and precise samples for individuals, lawyers, and small to medium-sized businesses.

Press Buy Now if it’s the form you need. Create your account and make payment through PayPal or by card|credit card. Retrieve the form to your device and feel free to reuse it countless times. Use the Search field to find additional document templates. US Legal Forms offers thousands of legal and tax templates and packages for business and personal requirements, including the Connecticut General Notice of Default for Contract for Deed. Over three million users have successfully utilized our platform. Choose your subscription plan and obtain high-quality documents in just a few clicks.

- The documents are sorted into state-specific categories, and some can be previewed prior to downloading.

- To obtain samples, users must hold a subscription and Log In to their account.

- Click Download next to any form you require and locate it in My documents.

- For users without a subscription, adhere to the following instructions to promptly locate and download the Connecticut General Notice of Default for Contract for Deed.

- Ensure that you possess the correct template based on the required state.

- Examine the form by scanning the description and utilizing the Preview feature.

Form popularity

FAQ

Filling out a contract for deed requires careful attention to detail. Include the full names of the buyer and seller, a legal description of the property, and payment terms. Each section should be clearly articulated to avoid misunderstandings. The US Legal Forms platform provides easy-to-use templates that can assist you in this task, ensuring accuracy in line with the Connecticut General Notice of Default for Contract for Deed.

When you default on a contract for deed, the seller may take steps to reclaim the property. Typically, this involves issuing a Connecticut General Notice of Default for Contract for Deed, which serves as a formal declaration of the default. You may lose any equity you built up in the property. It is advisable to consult a legal professional to explore your options.

Recording a contract for deed involves submitting the completed contract to the county recorder's office. Make sure to include all necessary information such as property description, buyer and seller details, and signatures. Once recorded, the contract is available for public inspection. A Connecticut General Notice of Default for Contract for Deed should be included if there are any defaults associated with it.

You record a land contract at the recorder's office or the county clerk's office in the county where the property is located. This office maintains public records and ensures the transaction is officially recognized. Recording protects your rights as a buyer or seller under a contract for deed. A Connecticut General Notice of Default for Contract for Deed may also be recorded at this time if necessary.

To file a notice of default, you will need to prepare the document following state-specific requirements. Typically, you should provide details about the parties involved, a description of the property, and the reason for the default. After completing the notice, you must file it with the appropriate county recorder's office. This action creates a formal record and may involve the Connecticut General Notice of Default for Contract for Deed process.

When reporting a contract for deed on your taxes, you'll need to understand its implications under the Internal Revenue Code. Generally, any income you receive from a contract for deed is taxable, while certain expenses can be deducted. It's essential to consult tax guidelines or a tax professional. You may also want to prepare a Connecticut General Notice of Default for Contract for Deed if problems arise.

If a buyer backs out of a transaction without invoking her rights under a contingency, the seller could sue her to force the sale to move forward or for damages. To avoid this risk, most contracts contain a clause that allows the seller to keep the buyer's deposit if the buyer backs out.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.