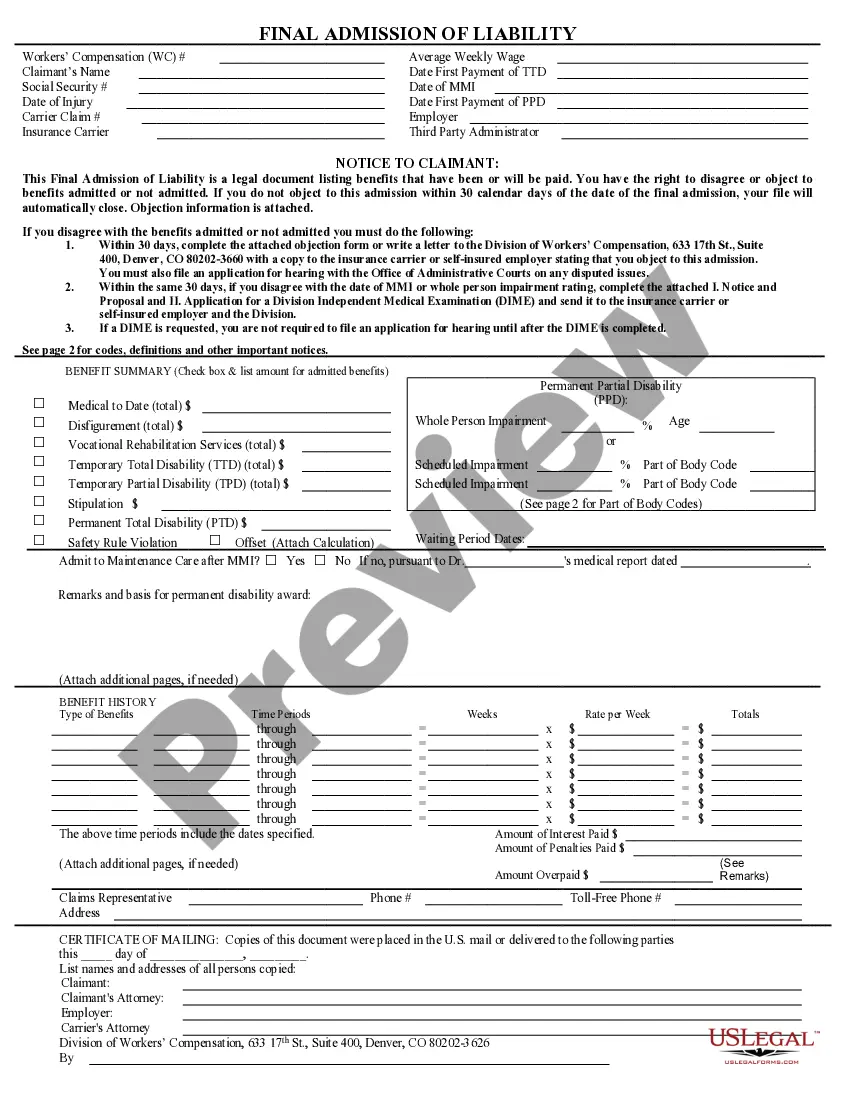

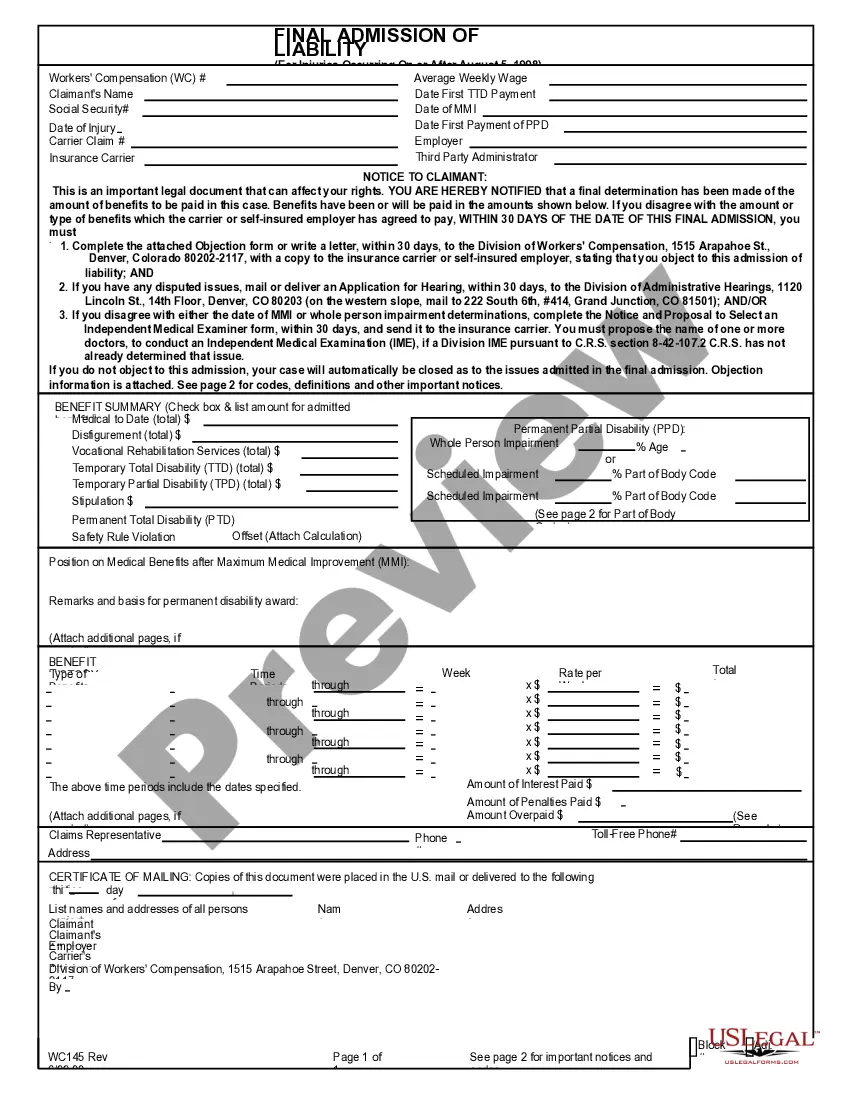

Colorado General Admission of Liability for Workers' Compensation

Description

How to fill out Colorado General Admission Of Liability For Workers' Compensation?

The greater the documentation you need to produce - the more anxious you become.

You can find numerous Colorado General Admission of Liability for Workers' Compensation forms online, yet you remain uncertain about which ones to trust.

Eliminate the complication to make obtaining samples easier with US Legal Forms.

Select Buy Now to initiate the registration process and choose a pricing plan that meets your needs. After that, provide the required information to create your account and pay for your order using PayPal or a credit card. Choose your preferred document type and download your copy. Access each document you receive in the My documents section. Simply navigate there to prepare a new version of the Colorado General Admission of Liability for Workers' Compensation. Even with expertly crafted forms, it’s still advisable to consult your local attorney to verify that your completed document is accurate. Achieve more with less expense using US Legal Forms!

- Obtain precisely crafted documents designed to meet state requirements.

- If you currently hold a US Legal Forms subscription, Log In to your account, and you'll find the Download option on the Colorado General Admission of Liability for Workers' Compensation page.

- If you have not utilized our platform before, follow the signup steps below.

- Verify if the Colorado General Admission of Liability for Workers' Compensation is applicable in your state.

- Re-evaluate your selection by reviewing the description or using the Preview feature if available for the selected file.

Form popularity

FAQ

There's nothing in the workers compensation law that protects your employment status. If you come back to work, you are not guaranteed a specific job or rate of pay. You will be entitled to differential wage loss benefits if your work injury prevents you from earning full, pre-injury wages.

Generally, workers' compensation laws are administered under what is referred to as strict liability, which means that it is not an admission of fault when an employer provides benefits for an injured worker.

Once you've reached MMI, a doctor will evaluate you to determine if your work injury or illness has left you with any permanent lost function or impairment to part of your bodyand if so, to what extent. In most cases with any lasting impairment, you'll receive permanent partial disability benefits.

General Liability and Workers' Compensation Insurance. Most businesses should have both general liability and workers' compensation insurance.General liability insurance helps protect your actual business, while workers' compensation helps protect your employees if they get a work-related injury or illness.

General Liability and Workers' Compensation Insurance. Most businesses should have both general liability and workers' compensation insurance.General liability insurance helps protect your actual business, while workers' compensation helps protect your employees if they get a work-related injury or illness.

Workers' comp laws change constantly. Therefore, it can be difficult for the company to track what needs to be done. As laws change, the company must make adjustments to many facets of a claim, from the application process to the confirmation that you are eligible for compensation.

If you haven't reported your injury, your employer may deny you medical treatment and benefits for missed time from work.Also, if the accident isn't filed immediately, your employer may deny the accident happened or claim that it took place outside of work.

All injuries, no matter how minor, must be reported within 24 hours of the injury.It must be reported to our workers' compensation department in case the injury becomes worse and needs medical attention in the future. That way, the reporting of the injury will not be considered late by the state.

A worker is disqualified where the injury: (1) is caused by the worker's own intoxication (alcohol or other controlled substance as defined by the Health and Safety Code; (2) is intentionally self-inflicted; (3) occurs out of an altercation (mutual combat) where the claimant was the initial physical aggressor; (4)