Colorado Request for Copy of Tax Form or Individual Income Tax Account Information

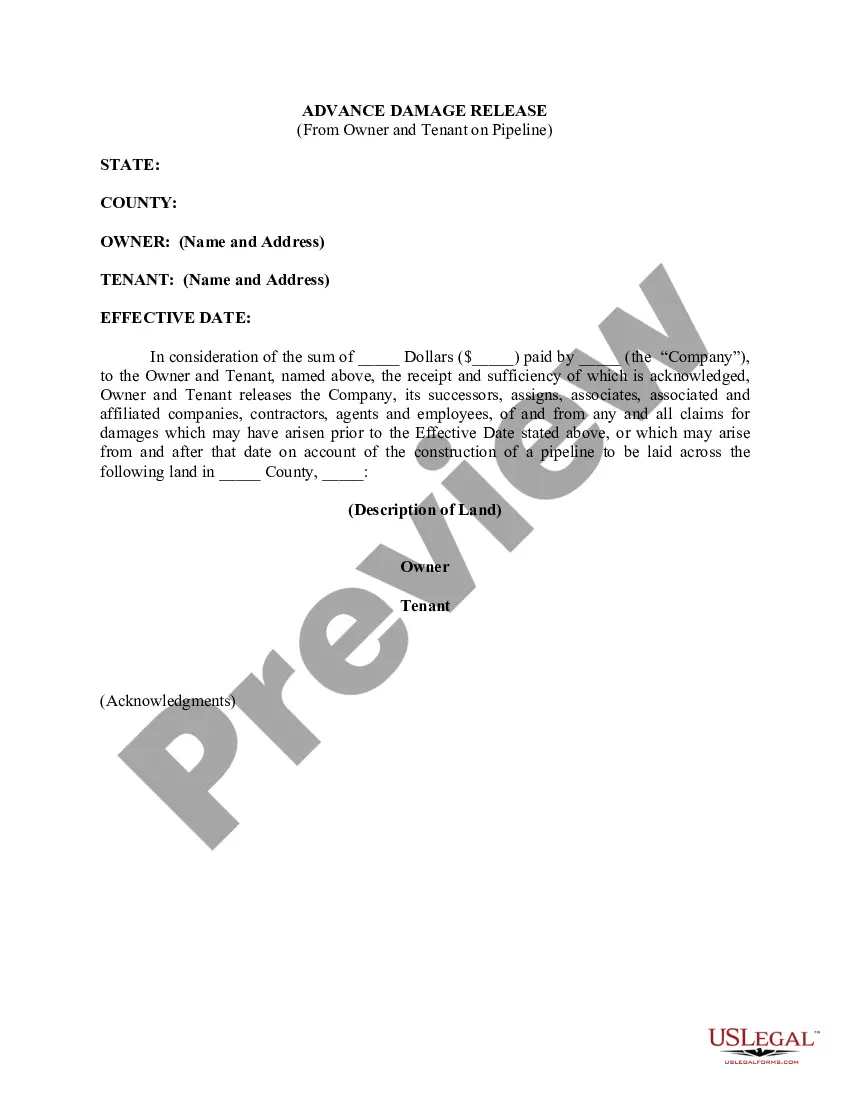

Description

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

If you need to complete, down load, or produce legal papers themes, use US Legal Forms, the biggest variety of legal varieties, that can be found online. Utilize the site`s easy and hassle-free search to get the documents you will need. A variety of themes for company and individual functions are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Colorado Request for Copy of Tax Form or Individual Income Tax Account Information in just a number of mouse clicks.

Should you be previously a US Legal Forms buyer, log in in your accounts and then click the Download button to get the Colorado Request for Copy of Tax Form or Individual Income Tax Account Information. You can even access varieties you earlier delivered electronically from the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that correct metropolis/land.

- Step 2. Take advantage of the Review solution to examine the form`s information. Don`t overlook to read through the description.

- Step 3. Should you be not happy together with the form, use the Look for industry on top of the screen to find other versions of your legal form format.

- Step 4. Once you have found the shape you will need, click on the Get now button. Choose the rates program you favor and add your qualifications to register for the accounts.

- Step 5. Method the transaction. You can use your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Select the file format of your legal form and down load it on your own gadget.

- Step 7. Complete, modify and produce or indicator the Colorado Request for Copy of Tax Form or Individual Income Tax Account Information.

Every legal papers format you get is the one you have for a long time. You have acces to each form you delivered electronically with your acccount. Go through the My Forms portion and select a form to produce or down load once more.

Compete and down load, and produce the Colorado Request for Copy of Tax Form or Individual Income Tax Account Information with US Legal Forms. There are many professional and status-specific varieties you can utilize for your company or individual demands.

Form popularity

FAQ

Do I need to attach a copy of my federal return? No, the Colorado Department of Revenue does not require taxpayers to attach a copy of the federal return to the Colorado return.

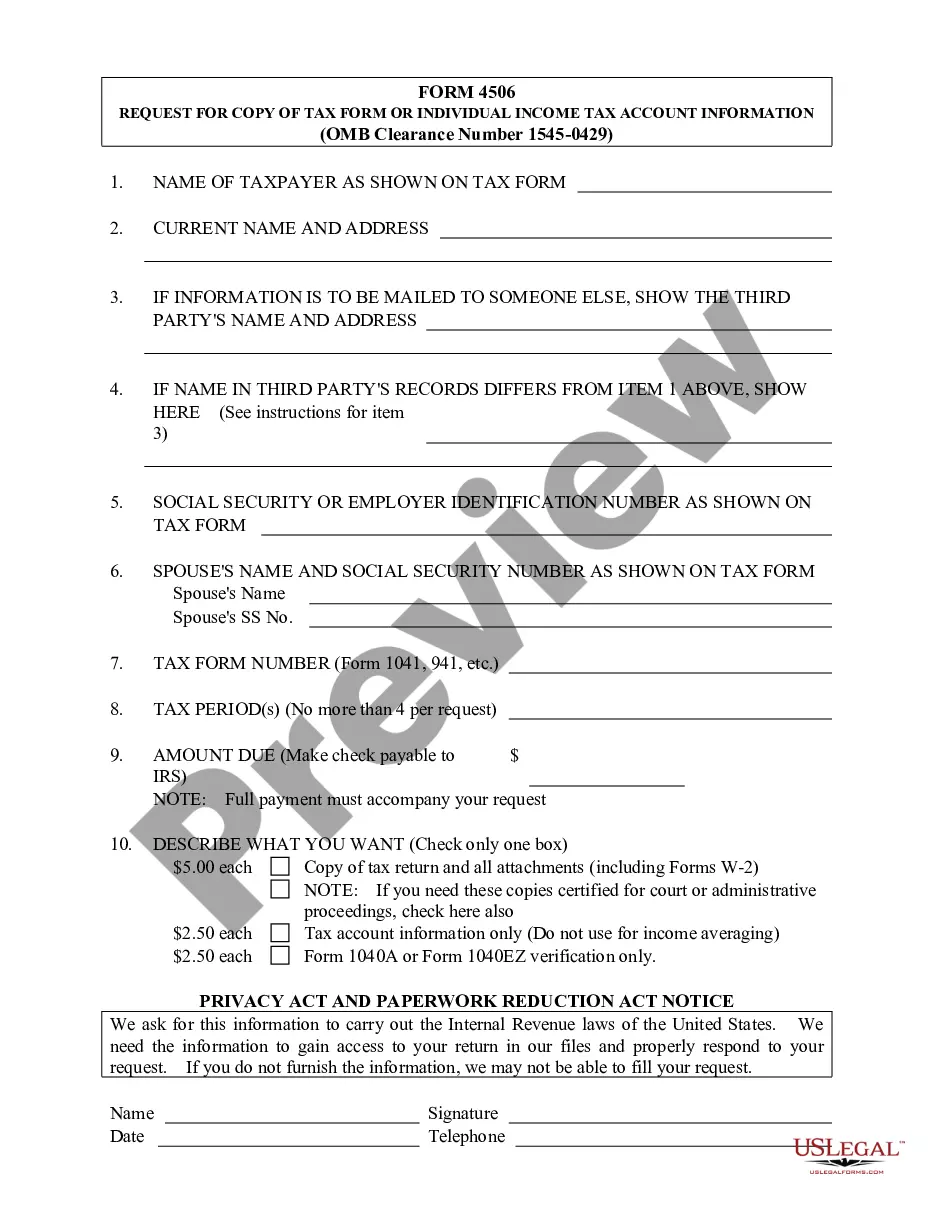

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return. Refer to the form for instructions and for the processing fee.

Form DR 0004 is the new Colorado Employee Withholding Certificate that is available for 2022. It is not meant to completely replace IRS form W-4 for Colorado withholding, but to help employees in a few specific situations fine-tune their Colorado withholding.

Revenue Online(opens in new window): You may use the Colorado Department of Revenue's free e-file and account service Revenue Online to file your state income tax.

Use Form 4506-T to request tax return information. You can also designate (on line 5) a third party to receive the information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript. Note.

Colorado's income tax rate is 4.4%. It is one of 11 states with a flat income tax. Colorado state income tax returns were due April 18, 2023.

We have received federal 1040 and 1040-SR tax forms, 1040 instructions, and Colorado state 104 tax booklets. These are the only forms and instructions issued to us for the current tax year. The Internal Revenue Service is moving to a web-first service approach and reducing the availability of paper tax products.

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.