Virgin Islands Housecleaning Services Contract - Self-Employed

Description

How to fill out Housecleaning Services Contract - Self-Employed?

If you want to be thorough, obtain, or create valid document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s simple and convenient search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to get the Virgin Islands Housecleaning Services Contract - Self-Employed in just a few clicks.

Complete the payment. You can use your Visa, MasterCard, or PayPal account to finalize the transaction.

Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Virgin Islands Housecleaning Services Contract - Self-Employed. Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again. Be proactive and obtain, and print the Virgin Islands Housecleaning Services Contract - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to get the Virgin Islands Housecleaning Services Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Ensure you have selected the form for the appropriate city/state.

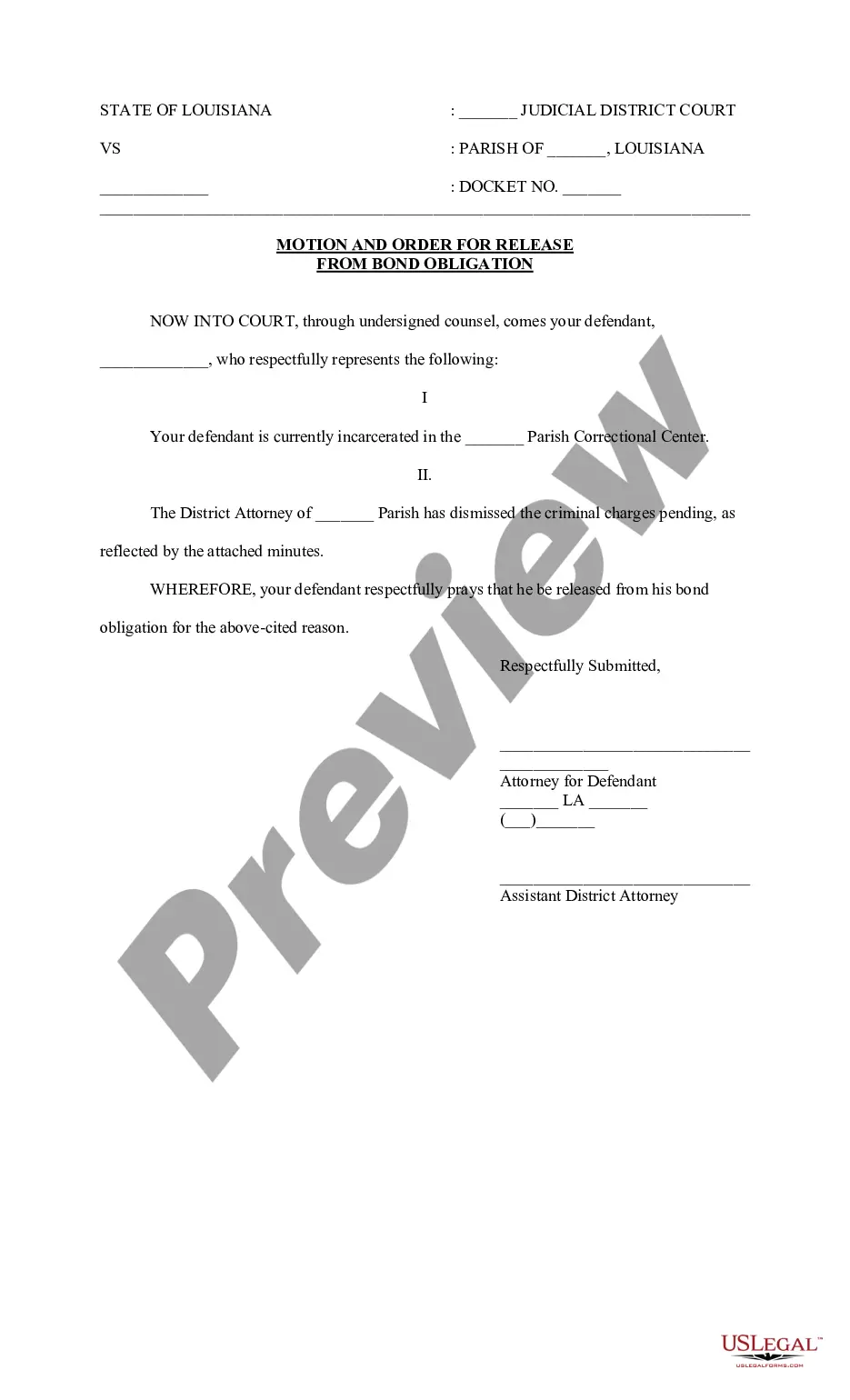

- Use the Preview option to review the form's content. Don't forget to read the summary.

- If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Once you find the form you need, click the Buy now button. Choose the payment plan you prefer and enter your information to register for an account.

Form popularity

FAQ

While it is possible to freelance without a contract, it is generally not a wise decision. Operating without a contract leaves you vulnerable to disputes and misunderstandings regarding service expectations. To establish trust and professionalism, using a Virgin Islands Housecleaning Services Contract - Self-Employed can solidify your freelance arrangements.

Yes, you can technically be classified as a 1099 worker without a formal contract, but this is not advisable. Without a written agreement, there may be ambiguity in your role and expectations. To avoid potential issues and clarify your status, a Virgin Islands Housecleaning Services Contract - Self-Employed offers peace of mind for both you and your clients.

Yes, housekeeping services can be tax-deductible under certain circumstances, particularly if they are necessary for your business. If you are self-employed, you can typically deduct the costs on your tax return, assuming they help you maintain your professional space. Utilizing a Virgin Islands Housecleaning Services Contract - Self-Employed can support you in documenting these expenses effectively.

The IRS requires self-employed house cleaners to report their income and can deduct allowable business expenses. You must keep detailed records of your income and expenses throughout the year. In addition, paying estimated taxes quarterly is essential to avoid penalties. Employing a Virgin Islands Housecleaning Services Contract - Self-Employed can help you stay organized and meet IRS requirements.

Having a contract as a self-employed cleaner is not mandatory, but it is highly recommended. A contract outlines the terms of your services, ensuring both you and your clients have clear expectations. This clarity can prevent misunderstandings and protect your rights. A Virgin Islands Housecleaning Services Contract - Self-Employed provides a professional framework for your agreements.

Self-employed individuals operate their own business, while contracted workers typically work under an agreement for a specific task or duration. Self-employed cleaners have more autonomy over their schedules and clients, whereas contractors may have less flexibility. Understanding this distinction can guide you in deciding what best suits your business model when leveraging a Virgin Islands Housecleaning Services Contract - Self-Employed.

As a self-employed cleaner, you can claim several expenses that are necessary for your business. This includes cleaning supplies, equipment, and any travel costs related to your cleaning jobs. Additionally, professional services, advertising, and home office expenses may also be deductible. Utilizing a Virgin Islands Housecleaning Services Contract - Self-Employed helps clarify what you can claim effectively.

To write a simple contract agreement, include the parties involved, the services provided, and the payment terms. Ensure that the contract is clear and easy to understand. Following these steps leads to a solid Virgin Islands Housecleaning Services Contract - Self-Employed, which can protect your interests and outline your responsibilities as a self-employed cleaner. Consider using templates from platforms like uslegalforms for guidance.

When writing a cleaning contract agreement, start by outlining the services you will provide, such as frequency of cleaning and specific tasks. Clearly state the payment terms and methods, as well as any cancellation policies. A comprehensive Virgin Islands Housecleaning Services Contract - Self-Employed ensures both you and your clients understand the terms of your arrangement, preventing misunderstandings.

To start self-employed cleaning, you must define your services, set your rates, and find clients. Begin by targeting residential or commercial properties in the Virgin Islands. Utilize online platforms and social media to promote your business and showcase your expertise. Having a solid Virgin Islands Housecleaning Services Contract - Self-Employed helps you establish clear expectations with clients.