This office lease is subject and subordinate to all ground or underlying leases and to all mortgages which may affect the lease or the real property of which demised premises are a part and to all renewals, modifications, consolidations, replacements and extensions of any such underlying leases and mortgages. This clause shall be self-operative.

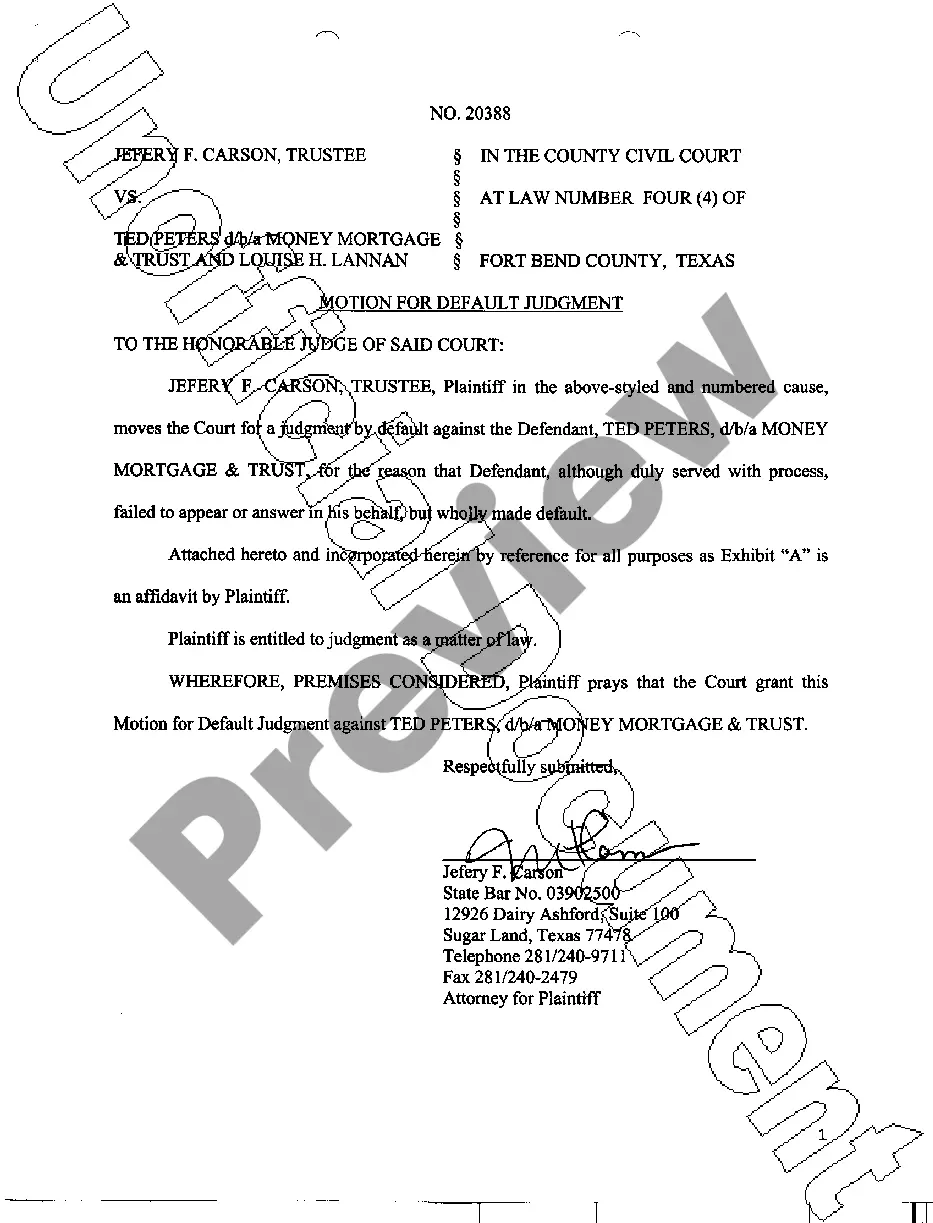

Colorado Subordination Provision

Description

How to fill out Subordination Provision?

US Legal Forms - among the most significant libraries of authorized varieties in the States - provides an array of authorized papers templates you can download or printing. Making use of the website, you can find 1000s of varieties for business and individual uses, categorized by types, claims, or key phrases.You will discover the newest versions of varieties like the Colorado Subordination Provision in seconds.

If you already possess a subscription, log in and download Colorado Subordination Provision in the US Legal Forms local library. The Down load button will appear on every type you see. You have accessibility to all in the past delivered electronically varieties in the My Forms tab of your accounts.

In order to use US Legal Forms the first time, allow me to share straightforward recommendations to get you started:

- Make sure you have chosen the proper type for the city/region. Click on the Review button to examine the form`s information. Read the type outline to ensure that you have chosen the proper type.

- In the event the type doesn`t fit your specifications, take advantage of the Look for discipline at the top of the display screen to get the the one that does.

- When you are happy with the form, confirm your choice by visiting the Get now button. Then, choose the pricing strategy you prefer and offer your qualifications to sign up to have an accounts.

- Process the deal. Use your bank card or PayPal accounts to finish the deal.

- Pick the formatting and download the form on your system.

- Make adjustments. Fill up, modify and printing and sign the delivered electronically Colorado Subordination Provision.

Each format you put into your account lacks an expiration day and is your own forever. So, in order to download or printing yet another copy, just go to the My Forms section and click on about the type you want.

Obtain access to the Colorado Subordination Provision with US Legal Forms, one of the most extensive local library of authorized papers templates. Use 1000s of skilled and status-distinct templates that meet up with your company or individual needs and specifications.

Form popularity

FAQ

A subordination agreement must be signed and acknowledged by a notary and recorded in the official records of the county to be enforceable.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future. Subordination is the act of yielding priority.

The Subordination Clause A subordination is a contractual agreement by the tenant that its leasehold interest in the collateral property, or portion thereof (the subject property of the lease), is subordinate either to the mortgage or to the lien of the mortgage.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

What is Subordination? Subordination is putting something in a lower position or rank. Therefore, a subordination agreement puts the lease below the mortgage loan in priority. Mortgage lenders want the leases to be subordinate to the mortgage. That way, the mortgage loan is paid first if there is a foreclosure.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

What is Subordination? Subordination is putting something in a lower position or rank. Therefore, a subordination agreement puts the lease below the mortgage loan in priority. Mortgage lenders want the leases to be subordinate to the mortgage. That way, the mortgage loan is paid first if there is a foreclosure.