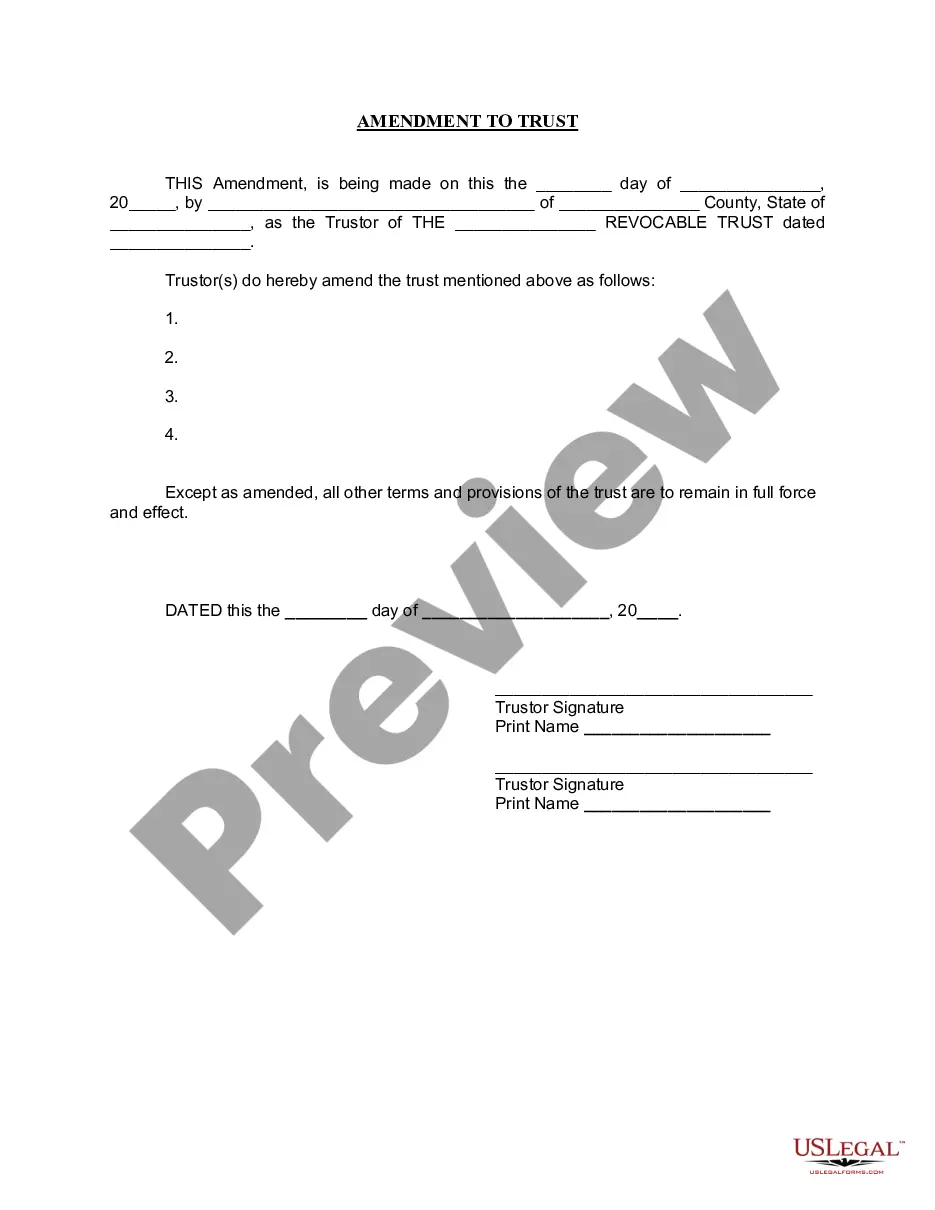

Colorado Interest Verification

Description

How to fill out Interest Verification?

Discovering the right lawful document template can be quite a struggle. Naturally, there are tons of templates accessible on the Internet, but how can you find the lawful develop you want? Take advantage of the US Legal Forms website. The support offers a large number of templates, for example the Colorado Interest Verification, which can be used for company and private needs. All of the kinds are examined by specialists and meet up with federal and state requirements.

If you are presently authorized, log in in your bank account and click on the Download switch to have the Colorado Interest Verification. Make use of bank account to appear through the lawful kinds you have ordered in the past. Visit the My Forms tab of the bank account and acquire an additional version of the document you want.

If you are a brand new customer of US Legal Forms, here are straightforward guidelines that you can comply with:

- Initially, make certain you have selected the right develop for your town/county. You can look through the shape using the Preview switch and study the shape description to make sure this is the best for you.

- When the develop fails to meet up with your expectations, take advantage of the Seach area to obtain the right develop.

- Once you are positive that the shape would work, go through the Get now switch to have the develop.

- Select the prices program you need and type in the essential information. Build your bank account and pay for your order utilizing your PayPal bank account or charge card.

- Select the document structure and acquire the lawful document template in your device.

- Comprehensive, edit and produce and indication the obtained Colorado Interest Verification.

US Legal Forms is the biggest local library of lawful kinds for which you will find a variety of document templates. Take advantage of the company to acquire appropriately-created papers that comply with status requirements.

Form popularity

FAQ

Check or Money Order Make the check or money order payable to the Colorado Department of Revenue. A check should never be sent to the Department of Revenue without a voucher form. Do not send a copy of the return. Write your Social Security number, the tax year and the words 'Form 104' on the check.

Make sure your check or money order includes the following information: Your name and address. Daytime phone number. Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.

If you do not receive the 1099-G in the mail, sign up for access and log in to your account through our Revenue Online service to view the amount of last year's Colorado refund that was reported to you on Form 1099-G.

Locate the ?Payment Options? box on the Revenue Online(opens in new window) homepage. Click ?Make a Payment.? Read the information about the various service fees and processing timelines before selecting a payment option. Select either ?Debit or Credit Card? or ?E-Check.?

Senate Bill 22-233 authorized a one-time refund of $750 to each qualified individual ($1,500 for individuals who filed jointly) between August 2022 and January 2023. More details about this program are available on the Colorado Cash Back webpage.

Use the DR 1079 to remit Colorado tax withheld on transfers of real property interests. The determination of the amount to be withheld, if any, will be made on the DR 1083. The amount of the withholding tax remitted will be credited to the Colorado income tax account of the transferor, similar to wage withholding.

Use certified mail, return receipt requested, if you send your return by U.S. mail. It will provide proof that it was received. The IRS accepts deliveries from FedEx, UPS, and DHL Express. But you must use an approved class of service.

Individuals Include a copy of your notice, bill, or payment voucher. Make your check, money order, or cashier's check payable to Franchise Tax Board. Write either your FTB ID, SSN, or ITIN, and tax year on your payment. Mail to: Franchise Tax Board PO Box 942867. Sacramento CA 94267-0001.