Colorado Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

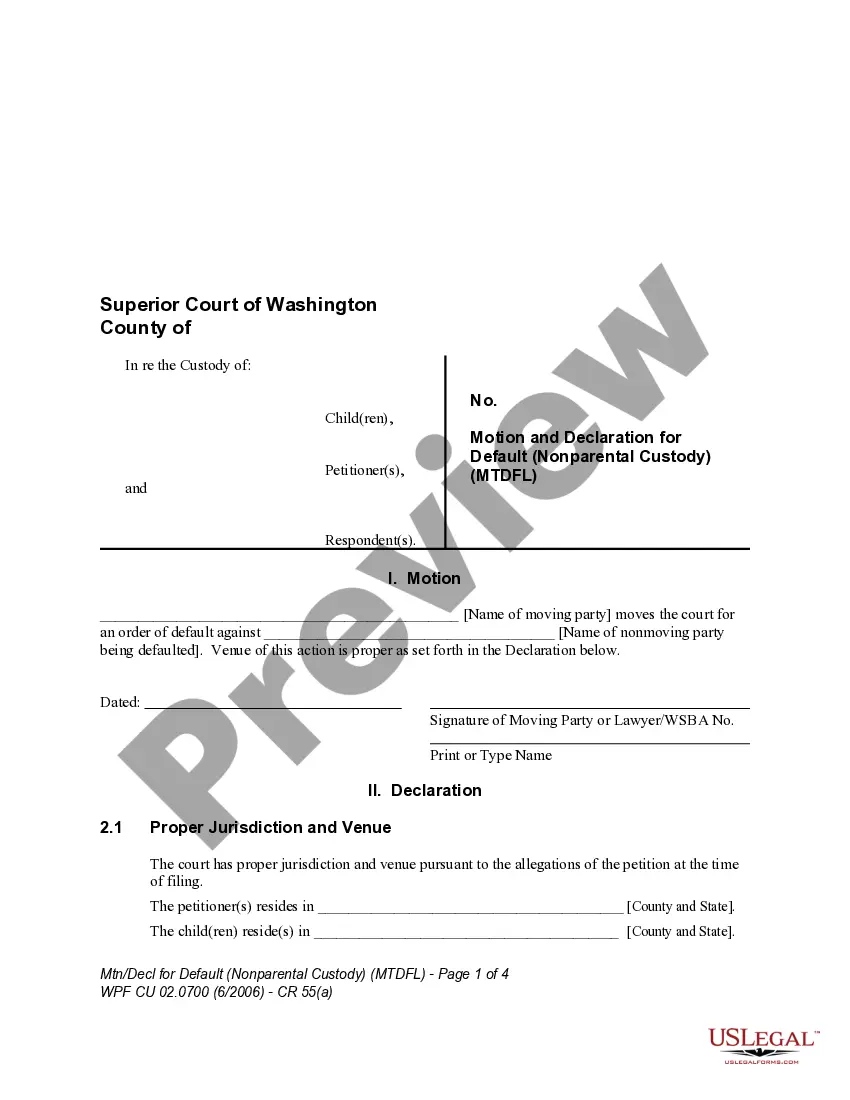

Are you presently in a scenario where you frequently require documents for potential business or specific tasks? There are numerous legal document templates available on the web, but finding reliable ones is not straightforward. US Legal Forms provides a vast array of form templates, including the Colorado Statement to Add to Credit Report, which are designed to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Colorado Statement to Add to Credit Report template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct city/state. Utilize the Review button to verify the form. Check the description to confirm that you have selected the correct form. If the form does not meet your requirements, use the Search section to find the form that suits your needs. Once you identify the correct form, click Purchase now. Select the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or Visa/Mastercard. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Colorado Statement to Add to Credit Report at any time, if needed. Just click on the desired form to download or print the document template.

Make use of US Legal Forms, the leading source of legal templates, to enhance efficiency and reduce errors in your documentation process.

Establish an account on US Legal Forms to begin making your tasks easier.

- Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes.

- The service offers properly drafted legal document templates suitable for various purposes.

- Create an account on US Legal Forms and start simplifying your life.

- Take advantage of the resources available to streamline your document needs.

- Ensure compliance with both federal and state regulations.

- Access a wide range of templates tailored for specific situations.

- Benefit from the convenience of downloading and printing documents as needed.

Form popularity

FAQ

To remove your LLC from delinquency in Colorado, you must first resolve any outstanding fees or penalties. Next, file the necessary documents with the Secretary of State to reinstate your LLC. Staying proactive about compliance is essential to prevent future issues. USLegalForms can provide the forms and guidance needed to efficiently navigate this process.

To upload tax documents, first, log into the e-filing platform you are using. Navigate to the document upload section, where you can select and attach your files. Ensure your documents are in the appropriate format and confirm they are complete before submission. If you require a step-by-step guide, USLegalForms can assist you with the document upload process.

Yes, Colorado follows the 183-day rule, which pertains to residency for tax purposes. This rule states that if you spend 183 days or more in Colorado during the tax year, you are considered a resident for tax purposes. Understanding this rule is crucial for accurate tax filing and compliance. USLegalForms can provide detailed insights into residency rules and their implications for your tax situation.

Yes, Colorado provides several e-file forms for taxpayers to use when filing their returns electronically. These forms facilitate a smooth filing process and are available through various e-filing software options. Utilizing these forms can help streamline your tax submission, ensuring compliance with state regulations. If you need assistance in finding the right forms, USLegalForms is a valuable resource.

If you are unable to electronically file your Colorado tax return, it may be due to missing information or not meeting the criteria for e-filing. Additionally, certain forms or situations might require paper filing instead. Ensure your documents are complete and check for any notifications from the e-filing system. For additional support, consider using USLegalForms to navigate these challenges effectively.

The Colorado filing requirement necessitates that all taxpayers file a return if they have a specific level of income or owe taxes. Typically, individuals must file if their income exceeds the state’s threshold. It's important to stay informed about these requirements to avoid penalties. For more detailed information, the USLegalForms platform can provide you with comprehensive guidelines and resources.

Submitting an efiler attachment in Colorado involves accessing your e-filing platform. After logging in, find the section for document attachments and upload your files accordingly. Always double-check that your documents adhere to the accepted formats to ensure successful submission. If you need further help, USLegalForms offers resources that can simplify your e-filing experience.

To submit an e filer attachment in Colorado, you will need to log into your e-filing account. Once there, you can choose the attachment option and upload your documents. Make sure your files meet the required format and size specifications to avoid any issues. For assistance with this process, consider using USLegalForms, which can guide you through the e-filing requirements.

Yes, you can include a 100 word statement on your credit report. This statement serves to clarify or explain circumstances that may have affected your credit history. A Colorado Statement to Add to Credit Report can be an effective way to communicate your story to potential lenders. To ensure your statement meets requirements, consider using US Legal Forms for guidance and resources.

A 100 word consumer statement is a brief explanation that you can add to your credit report. This statement allows you to share your perspective on any negative information, providing context for potential lenders. Including a Colorado Statement to Add to Credit Report can enhance your narrative and improve your chances of approval for credit. Services like US Legal Forms can help you craft a concise and effective statement.