Colorado OEM Software Program License Agreement

Description

How to fill out OEM Software Program License Agreement?

Locating the appropriate legal document format can be a considerable challenge.

It goes without saying that there are numerous designs available online, but how can you find the legal document you require.

Utilize the US Legal Forms website. The service provides an extensive selection of templates, including the Colorado OEM Software Program License Agreement, suitable for both business and personal use. All documents are reviewed by professionals and comply with federal and state regulations.

If the document does not satisfy your requirements, use the Search field to find the right document. Once you are confident that the document is appropriate, click the Purchase now button to obtain the document. Choose the pricing plan that you want and enter the necessary information. Create your account and complete the order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document format to your system. Complete, edit, and print, then sign the downloaded Colorado OEM Software Program License Agreement. US Legal Forms is the largest repository of legal documents from which you can find various document formats. Use the service to acquire professionally crafted paperwork that meets state requirements.

- If you are already registered, Log In to your account and click the Download button to get the Colorado OEM Software Program License Agreement.

- Use your account to search through the legal documents you have previously purchased.

- Navigate to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct template for your region/state.

- You can review the document using the Preview button and read the document description to confirm it is suitable for you.

Form popularity

FAQ

Yes, Colorado does have a tax applicable to Software as a Service (SaaS). Tax liability can arise based on how the service is provided and accessed. Businesses utilizing SaaS solutions under the Colorado OEM Software Program License Agreement should be aware of their tax obligations to remain compliant.

Software licenses can typically be tax deductible as business expenses in Colorado. However, the specifics can depend on the type of software and how it fits within your business operations. Engaging with the Colorado OEM Software Program License Agreement may offer your organization unique opportunities for financial benefits, including deductions.

In Colorado, the taxability of software depends on various factors, including whether it is custom or off-the-shelf software. Generally, tangible personal property sold in Colorado, including many software products, is subject to sales tax. If your organization utilizes the Colorado OEM Software Program License Agreement, consider consulting specific regulations for accurate tax obligations.

Yes, a single member LLC in Colorado generally needs to file a state tax return. The earnings of the LLC pass through to the member’s personal tax return, following the federal tax framework. Therefore, if you are involved in the Colorado OEM Software Program License Agreement as a single member LLC, ensure you comply with both state and federal filing requirements.

In Colorado, certain items are exempt from sales tax, including food, prescription drugs, and some agricultural products. Additionally, certain software licenses may also qualify for exemption under specific conditions. If your business engages with the Colorado OEM Software Program License Agreement, it’s essential to verify which items may be exempt to ensure proper tax treatment.

Nexus rules in Colorado determine the connection between a business and the state for tax purposes. Generally, if your business has a physical presence, such as an office or employees in Colorado, you may be required to collect sales tax. This includes businesses engaging in the Colorado OEM Software Program License Agreement. Understanding these rules helps you maintain compliance and avoid unexpected liabilities.

In Colorado, operating agreements are not legally required for limited liability companies (LLCs). However, having a well-drafted operating agreement is highly advisable as it helps define the management structure and protects the interests of all members. Additionally, when navigating the Colorado OEM Software Program License Agreement, a clear operating agreement can streamline operations and ensure compliance. Therefore, consider utilizing platforms like US Legal Forms to create a comprehensive operating agreement that suits your LLC's needs.

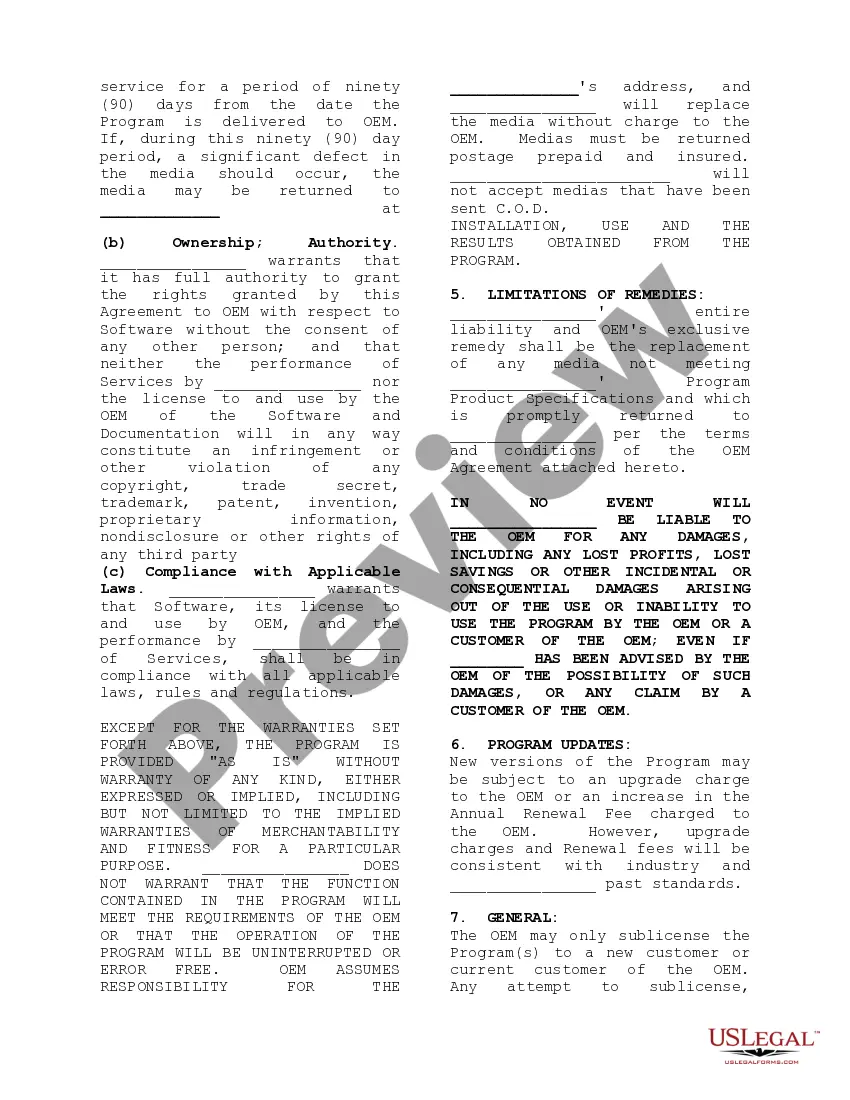

An OEM distribution license allows a company to distribute software along with its products. This license outlines the permissions for incorporating the software, as well as any restrictions that may apply. Through the Colorado OEM Software Program License Agreement, businesses can confidently navigate the complexities of software distribution while ensuring compliance with all necessary regulations.

An OEM license is a type of software licensing that enables original equipment manufacturers to integrate software into their hardware products. This license typically allows the manufacturer to offer the software to end customers as part of a hardware sale. The Colorado OEM Software Program License Agreement provides clarity and legal protection for both parties involved in this transaction.

An OEM agreement is a contract between the original equipment manufacturer and the software provider, detailing the terms of the software usage. This agreement establishes the rights for distribution, usage, and support related to the OEM software. Utilizing the Colorado OEM Software Program License Agreement helps companies streamline their operations and foster better partnerships.