Colorado Purchase and License Agreement of Custom Software Program

Description

How to fill out Purchase And License Agreement Of Custom Software Program?

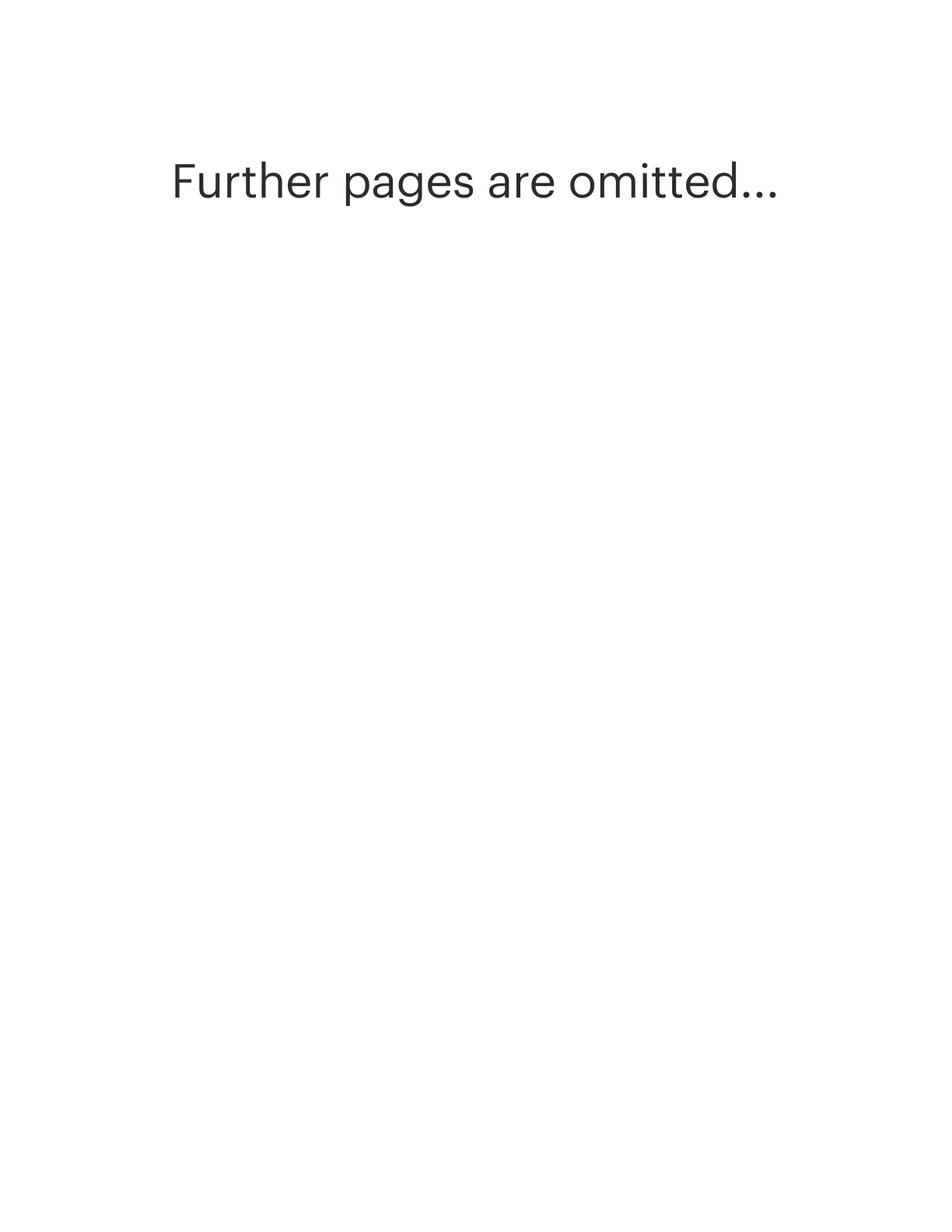

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print. By using the website, you can access thousands of templates for business and personal purposes, categorized by type, state, or keywords. You can find the latest editions of documents such as the Colorado Purchase and License Agreement for Custom Software in just minutes.

If you already hold a monthly subscription, Log In and download the Colorado Purchase and License Agreement for Custom Software from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously saved documents within the My documents tab of your account.

If you wish to use US Legal Forms for the first time, here are simple steps to get started: Ensure you have chosen the correct document for your city/area. Click the Preview button to view the document’s content. Review the document description to confirm that you have selected the right form. If the document does not meet your needs, use the Search field at the top of the screen to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose your preferred pricing plan and provide your details to register for an account.

- Process the payment. Use a credit card or PayPal account to finalize the transaction.

- Select the format and download the document to your device.

- Edit. Complete, modify, print, and sign the downloaded Colorado Purchase and License Agreement for Custom Software.

- Every template you add to your account does not have an expiration date and is yours indefinitely.

- So, if you wish to download or print another copy, simply go to the My documents section and click on the document you need.

- Access the Colorado Purchase and License Agreement for Custom Software with US Legal Forms, the most extensive library of legal document templates available. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

Form popularity

FAQ

When obtaining a proprietary software license, you usually need to accept a Colorado Purchase and License Agreement of Custom Software Program. This agreement outlines the terms and conditions under which you can use the software, including licensing fees, usage rights, and restrictions. It is crucial to carefully review this contract to understand your obligations and rights. Using a platform like USLegalForms can simplify the process by providing templates and guidance tailored to your needs.

A software license typically grants the purchaser specific rights to use the software under defined conditions. With a Colorado Purchase and License Agreement of Custom Software Program, the license may specify how the software can be used, whether it can be modified, and the duration of use. Understanding these rights is vital for both parties to maintain a healthy business relationship. USLegalForms offers guidance and templates to help you create a comprehensive and clear software license agreement.

When dealing with proprietary software, it is essential to choose a license that protects your intellectual property while allowing customers to use the software. The Colorado Purchase and License Agreement of Custom Software Program typically outlines the terms for proprietary software licenses, ensuring your rights are maintained. You may want to explore different licensing options, such as exclusive or non-exclusive licenses, based on your business needs. Platforms like USLegalForms provide templates that can help you draft a suitable agreement.

Yes, software sales are generally subject to sales tax in Colorado. However, the taxability can depend on how the software is delivered, such as whether it is downloaded or accessed online. For businesses using a Colorado Purchase and License Agreement of Custom Software Program, it's crucial to understand your tax obligations to ensure compliance. Consulting with a tax professional or using resources like USLegalForms can help clarify your specific situation.

The personal computers, software, and maintenance agreements are all taxable. 2.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Luckily, California - the US's biggest state for digital goods - has defined digital goods, software, and SaaS as exempt from sales tax.

Pre-written software is taxable. Pre-written software is commonly referred to as canned, or off the shelf and is typically developed for sale or license to multiple users. Pre-written software may also include software modules or components that are designed to be integrated into a larger software package.