Colorado Telemarketing Agreement - Self-Employed Independent Contractor

Description

How to fill out Telemarketing Agreement - Self-Employed Independent Contractor?

If you wish to comprehensive, acquire, or print out authorized papers themes, use US Legal Forms, the largest selection of authorized types, that can be found online. Take advantage of the site`s simple and easy convenient search to get the paperwork you want. A variety of themes for company and individual reasons are categorized by categories and says, or keywords. Use US Legal Forms to get the Colorado Telemarketing Agreement - Self-Employed Independent Contractor with a handful of click throughs.

In case you are currently a US Legal Forms client, log in to your accounts and click on the Acquire switch to have the Colorado Telemarketing Agreement - Self-Employed Independent Contractor. You can also access types you formerly delivered electronically from the My Forms tab of your own accounts.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for that right metropolis/region.

- Step 2. Take advantage of the Review method to look through the form`s content material. Don`t forget about to see the explanation.

- Step 3. In case you are not happy together with the develop, utilize the Research discipline at the top of the screen to get other variations of your authorized develop template.

- Step 4. When you have discovered the shape you want, select the Get now switch. Pick the rates plan you prefer and add your credentials to sign up for an accounts.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to finish the financial transaction.

- Step 6. Select the format of your authorized develop and acquire it on your own product.

- Step 7. Total, modify and print out or signal the Colorado Telemarketing Agreement - Self-Employed Independent Contractor.

Each and every authorized papers template you purchase is your own forever. You possess acces to every develop you delivered electronically in your acccount. Select the My Forms section and decide on a develop to print out or acquire once more.

Compete and acquire, and print out the Colorado Telemarketing Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many professional and status-certain types you can utilize for your company or individual requirements.

Form popularity

FAQ

Independent contractors perform independently; whereas, under an employer/employee relationship the employer retains the right to direct and control the work being performed, as well as control over the details or techniques of the work to be performed. 3.

In September of 2019, Governor Newsom signed Assembly Bill (AB) 5 into law. The new law addresses the employment status of workers when the hiring entity claims the worker is an independent contractor and not an employee.

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or

More affordable Although you may pay more per hour for an independent contractor, your overall costs are likely to be less. You don't have to withhold taxes, pay for unemployment and workers comp insurance or provide healthcare benefits, nor do you have to cover the cost of office space or equipment.

The CUIAB has generally held that telemarketers are employees and not independent contractors in cases where they work under some or all of the following circumstances: The telemarketers are given a sheet to follow when arranging appointments.

Among those who can apply for the benefits are the self-employed, independent contractors and gig workers, like Uber and Lyft drivers, and also anyone who's out of work because of COVID-19.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

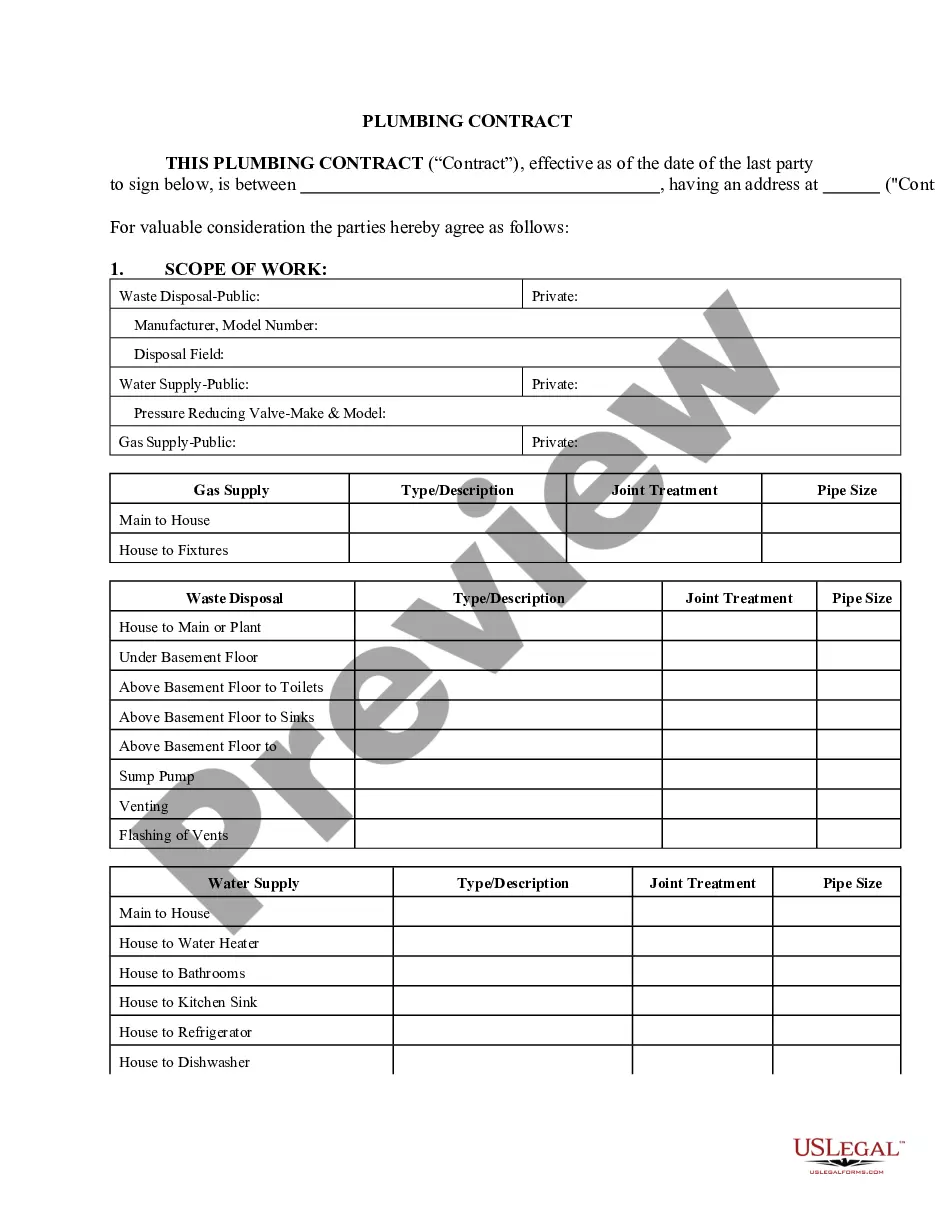

Who Needs A Contractor License In Colorado? You Need to Determine Which Contractor License You Need In Colorado, general contractors must obtain licenses at the municipal level, while electricians and plumbers must obtain licenses at the state level.

Wage & Hour LawIndependent contractors are not considered employees under the Fair Labor Standards Act and therefore are not covered by its wage and hour provisions. Generally, an independent contractor's wages are set pursuant to his or her contract with the employer.

Persons who follow a trade, business or professions such as lawyers, accountants or construction contractors who offer their services to the general public are usually considered independent contractors.