Colorado Term Sheet - Convertible Debt Financing

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status."

How to fill out Term Sheet - Convertible Debt Financing?

If you want to comprehensive, obtain, or print out lawful document themes, use US Legal Forms, the greatest variety of lawful forms, which can be found on-line. Use the site`s simple and handy look for to obtain the paperwork you require. Numerous themes for business and person reasons are sorted by categories and suggests, or keywords. Use US Legal Forms to obtain the Colorado Term Sheet - Convertible Debt Financing within a handful of clicks.

In case you are already a US Legal Forms customer, log in to your account and click the Acquire switch to get the Colorado Term Sheet - Convertible Debt Financing. You can even gain access to forms you earlier saved inside the My Forms tab of the account.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have selected the form for the right town/nation.

- Step 2. Use the Preview method to check out the form`s information. Don`t forget to read through the outline.

- Step 3. In case you are unhappy together with the develop, utilize the Look for area towards the top of the screen to get other models of the lawful develop web template.

- Step 4. When you have found the form you require, click the Acquire now switch. Choose the rates strategy you favor and put your references to sign up for an account.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal account to complete the financial transaction.

- Step 6. Choose the file format of the lawful develop and obtain it in your product.

- Step 7. Full, revise and print out or indicator the Colorado Term Sheet - Convertible Debt Financing.

Every lawful document web template you acquire is your own for a long time. You may have acces to every single develop you saved with your acccount. Click the My Forms segment and choose a develop to print out or obtain yet again.

Be competitive and obtain, and print out the Colorado Term Sheet - Convertible Debt Financing with US Legal Forms. There are thousands of skilled and express-distinct forms you may use to your business or person requires.

Form popularity

FAQ

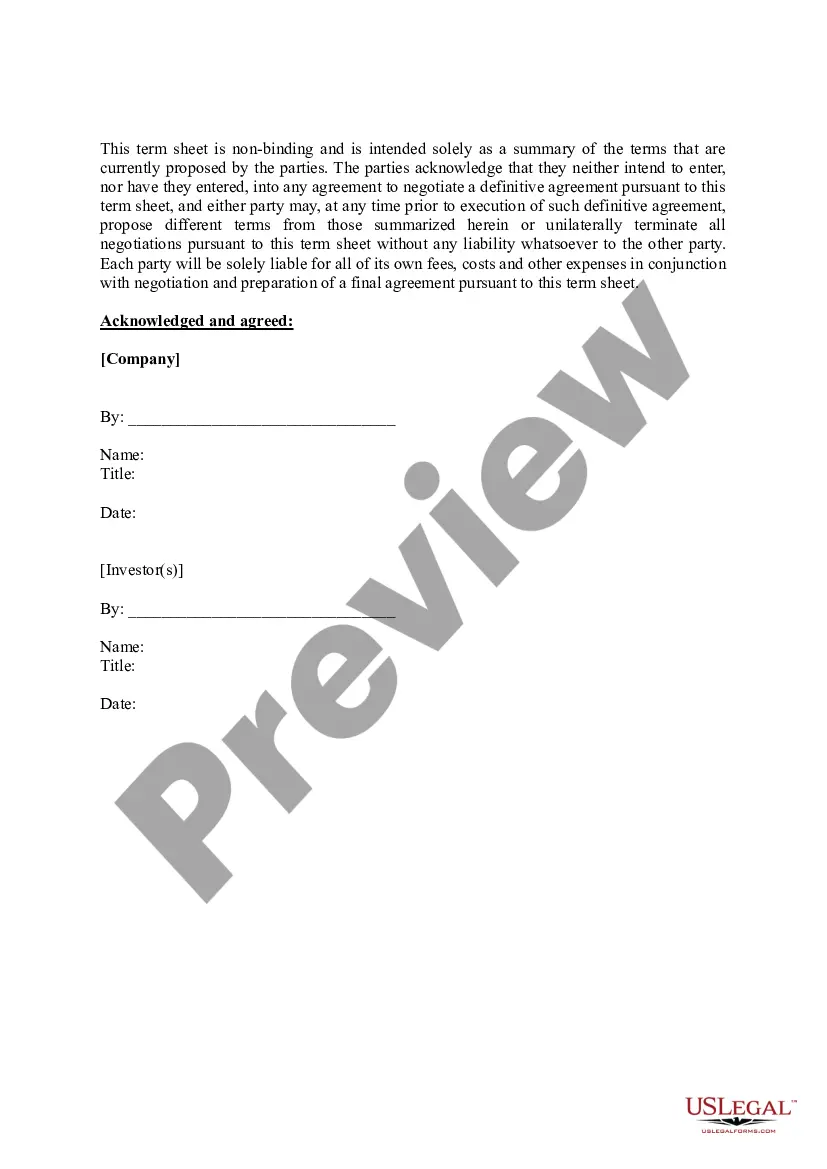

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

At its most basic, convertible debt is a loan ? an investor gives your startup money to build the business. But unlike bank loans and credit cards, you don't pay back the loan with more money.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

A primary disadvantage of convertible bonds is their liquidity risk. In theory, when a stock declines, the associated convertible bond will decline less, because it is protected by its value as a fixed-income instrument. However, CBs can decline in value more than stocks due to their liquidity risk.

Convertible bonds offer lower interest rates than comparable conventional bonds, so they're a cost-effective way for the company to raise money. Their conversion to shares also saves the company cash, although it risks diluting the share price.

A venture capital (VC) term sheet is a statement of the proposed terms and conditions for a proposed investment. Most of the terms are non-binding, except for certain confidentiality and exclusivity rights. Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process.

Advantages of convertible notes Allow for fundraising before company valuation. Founders don't have to give up equity at early stages. Compared to equity, they're safer for investors because they're debt instruments.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

What is a Term Sheet? A term sheet is a nonbinding bullet-point document that outlines the material terms and conditions of a potential business agreement. The purpose of a term sheet is to outline the terms upon which the venture debt provider is willing to make the investment.

Share. Convertible debt definition. With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future.