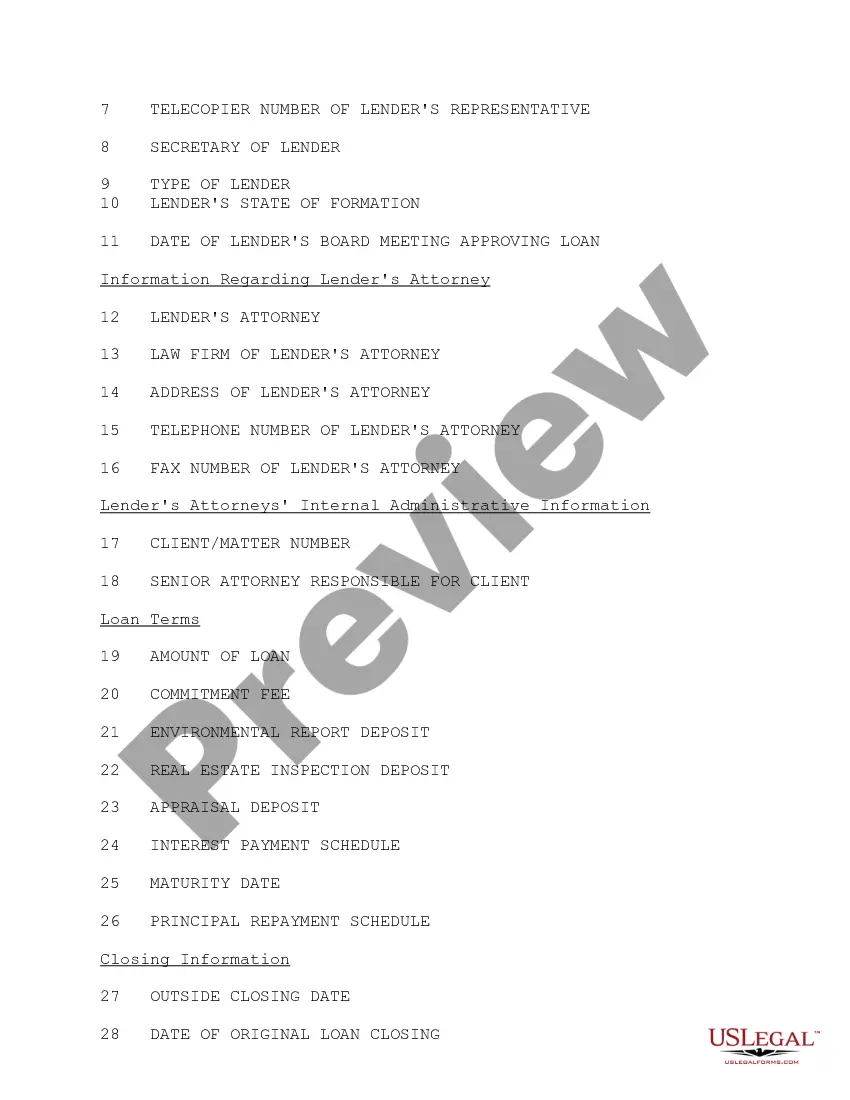

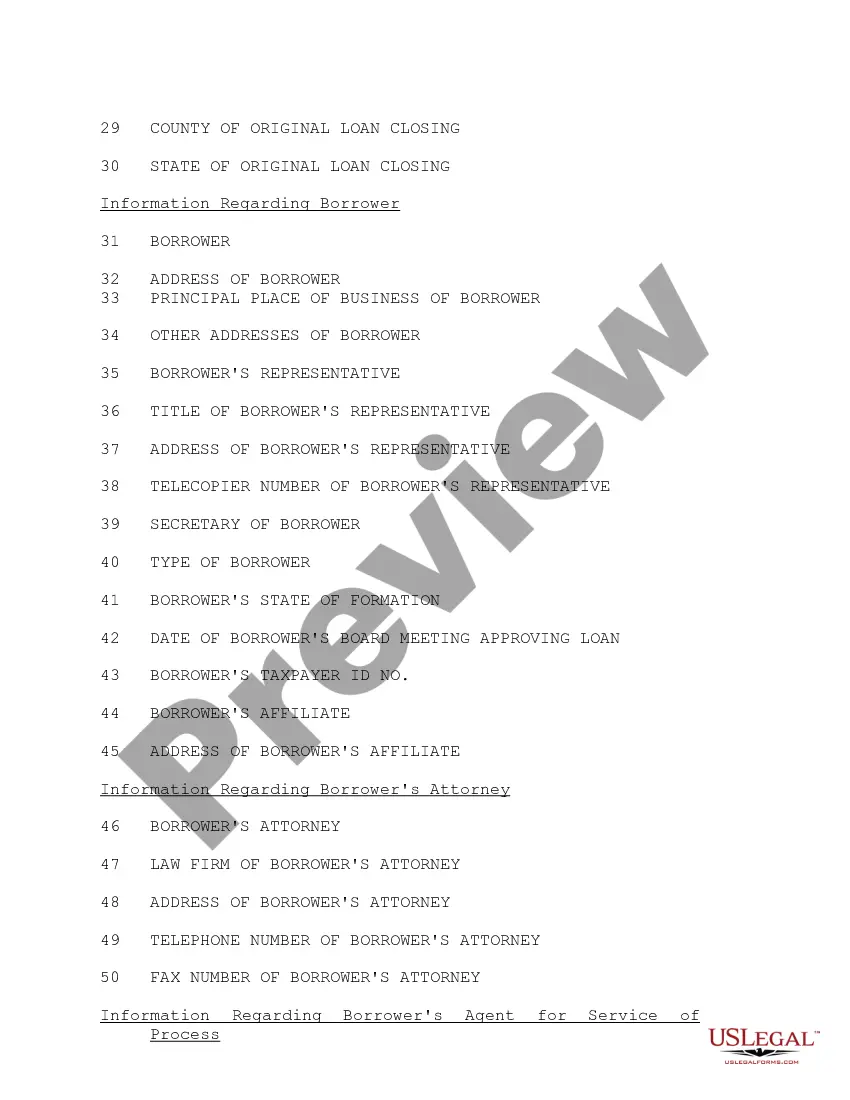

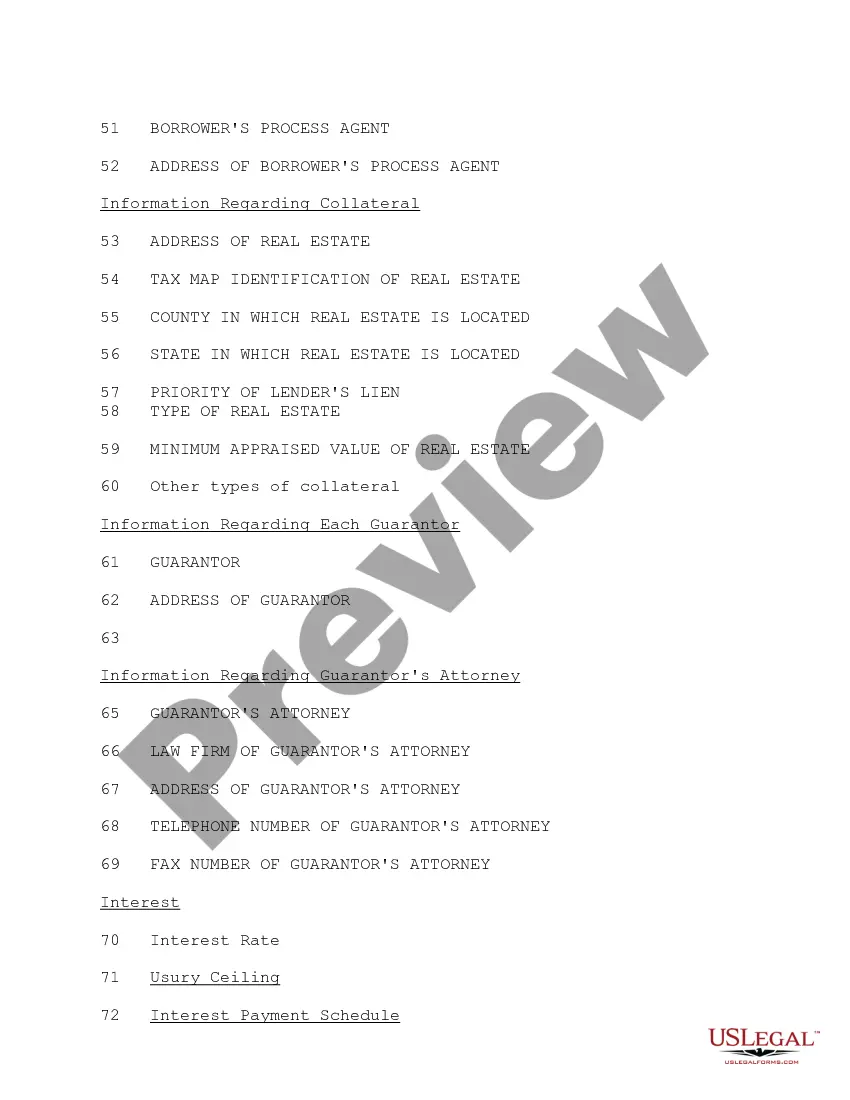

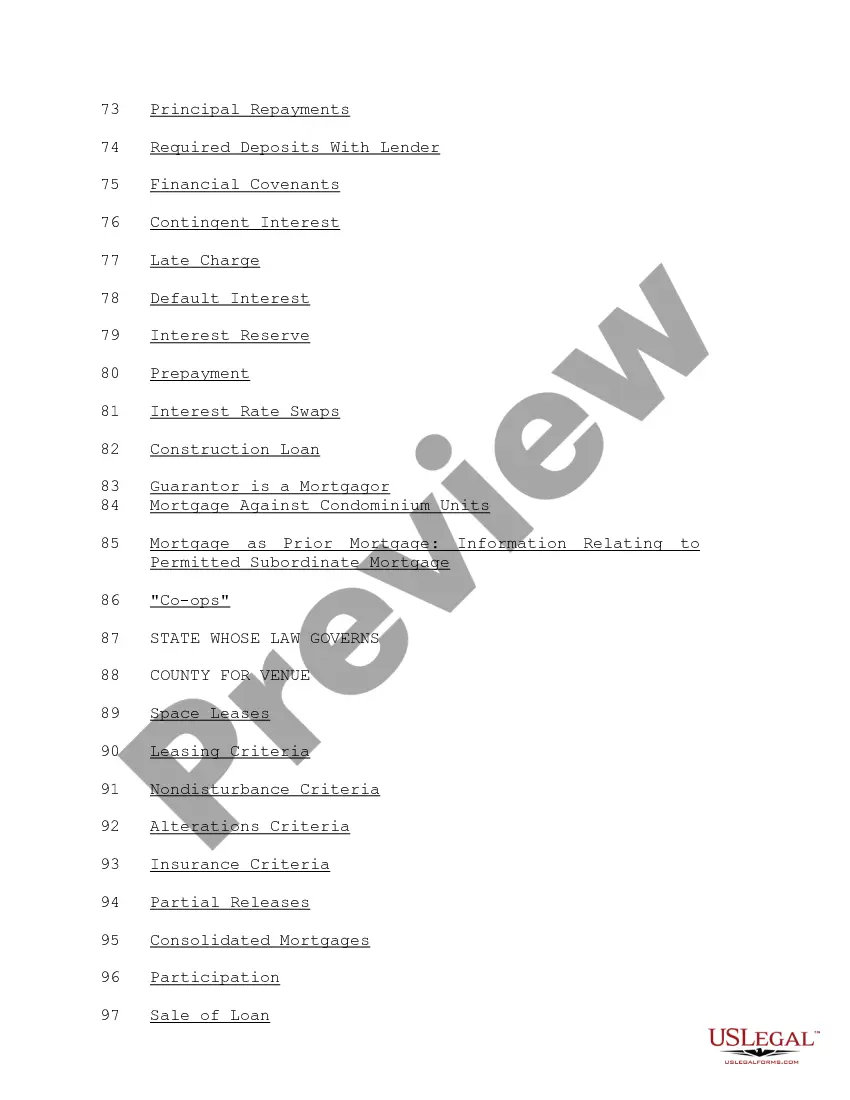

"Data Input Sheet" is a American Lawyer Media form. This is a form is an instructional form on how to fill out the different real estate forms.

Colorado Data Input Sheet

Description

How to fill out Data Input Sheet?

If you need to full, acquire, or produce authorized record web templates, use US Legal Forms, the most important assortment of authorized varieties, which can be found on the web. Take advantage of the site`s basic and practical search to discover the documents you need. A variety of web templates for enterprise and specific functions are categorized by categories and claims, or keywords. Use US Legal Forms to discover the Colorado Data Input Sheet within a few mouse clicks.

If you are previously a US Legal Forms consumer, log in to your bank account and then click the Download option to find the Colorado Data Input Sheet. You can also access varieties you formerly acquired within the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape for your proper metropolis/land.

- Step 2. Utilize the Review method to check out the form`s content material. Do not neglect to see the explanation.

- Step 3. If you are unhappy together with the type, make use of the Search area on top of the screen to discover other versions from the authorized type format.

- Step 4. Upon having discovered the shape you need, go through the Buy now option. Select the prices prepare you like and include your accreditations to sign up for an bank account.

- Step 5. Approach the financial transaction. You may use your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Choose the format from the authorized type and acquire it on the device.

- Step 7. Total, modify and produce or indicator the Colorado Data Input Sheet.

Each and every authorized record format you buy is the one you have eternally. You may have acces to each and every type you acquired with your acccount. Go through the My Forms portion and pick a type to produce or acquire again.

Remain competitive and acquire, and produce the Colorado Data Input Sheet with US Legal Forms. There are many expert and status-certain varieties you can use to your enterprise or specific requirements.

Form popularity

FAQ

If your business is inside the State of Colorado, use MyBizColorado(opens in new window) or the Wage Withholding Account Application (CR 0100(opens in new window)). Out-of-state businesses should complete the Wage Withholding Account Application (CR 0100(opens in new window)).

Step-by-Step Instructions Go to Revenue Online(opens in new window) at least 5 days before you plan to file a W-2, 1099, or W-2G entry. In the "Withholding" menu panel, click "Submit Year End Withholding" Click on the link "Request Withholding Submitter Access" Complete the requested fields.

Food and beverage expense deduction However, for tax years 2021 and 2022, section 274(n)(2)(D) of the Internal Revenue Code generally permits deduction of 100% of the expense for food and beverages provided by a restaurant.

For many years, meal expenses incurred while traveling for business were only 50% deductible. However, during 2021 and 2022, business meals in restaurants are 100% deductible.

A partnership or S corporation may file a composite income tax return for its nonresident partners or shareholders, as a simplified way of paying the income tax owed by those partners or shareholders.

Coloradoa??s Qualified Business Income Deduction Under existing law, this provision applied to tax years beginning in 2021 or 2022. An addition equal to the amount of the deduction is required for single filers with adjusted gross income over $500,000 and joint filers with adjusted gross income over $1 million.

By a greater than 10% margin, Colorado voters passed Proposition FF which limits the standard and itemized deductions for individuals making more than $300,000. Effective January 1, 2023, single filers are limited to $12,000 and joint filers are limited to $16,000 of deductions.

Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. Type of ExpenseDeductionBusiness meals with clients50% deductibleOffice snacks and meals50% deductibleCompany-wide party100% deductibleMeals & entertainment (included in compensation)100% deductible1 more row ?