This due diligence checklist lists liability issues for future directors and officers in a company regarding business transactions.

Colorado Checklist for Potential Director and Officer Liability Issues

Description

How to fill out Checklist For Potential Director And Officer Liability Issues?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can access the latest forms such as the Colorado Checklist for Potential Director and Officer Liability Issues within minutes.

If you already have a membership, Log In and download the Colorado Checklist for Potential Director and Officer Liability Issues from the US Legal Forms library. The Download button will be available on every document you view. You have access to all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Make edits. Complete, adjust, and print and sign the saved Colorado Checklist for Potential Director and Officer Liability Issues. Every document you added to your account has no expiration date and belongs to you indefinitely. So, if you want to download or print another copy, just navigate to the My documents section and click on the form you desire. Gain access to the Colorado Checklist for Potential Director and Officer Liability Issues with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and specifications.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to evaluate the contents of the form.

- Read the form details to confirm you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the pricing plan that suits you and provide your credentials to register for the account.

Form popularity

FAQ

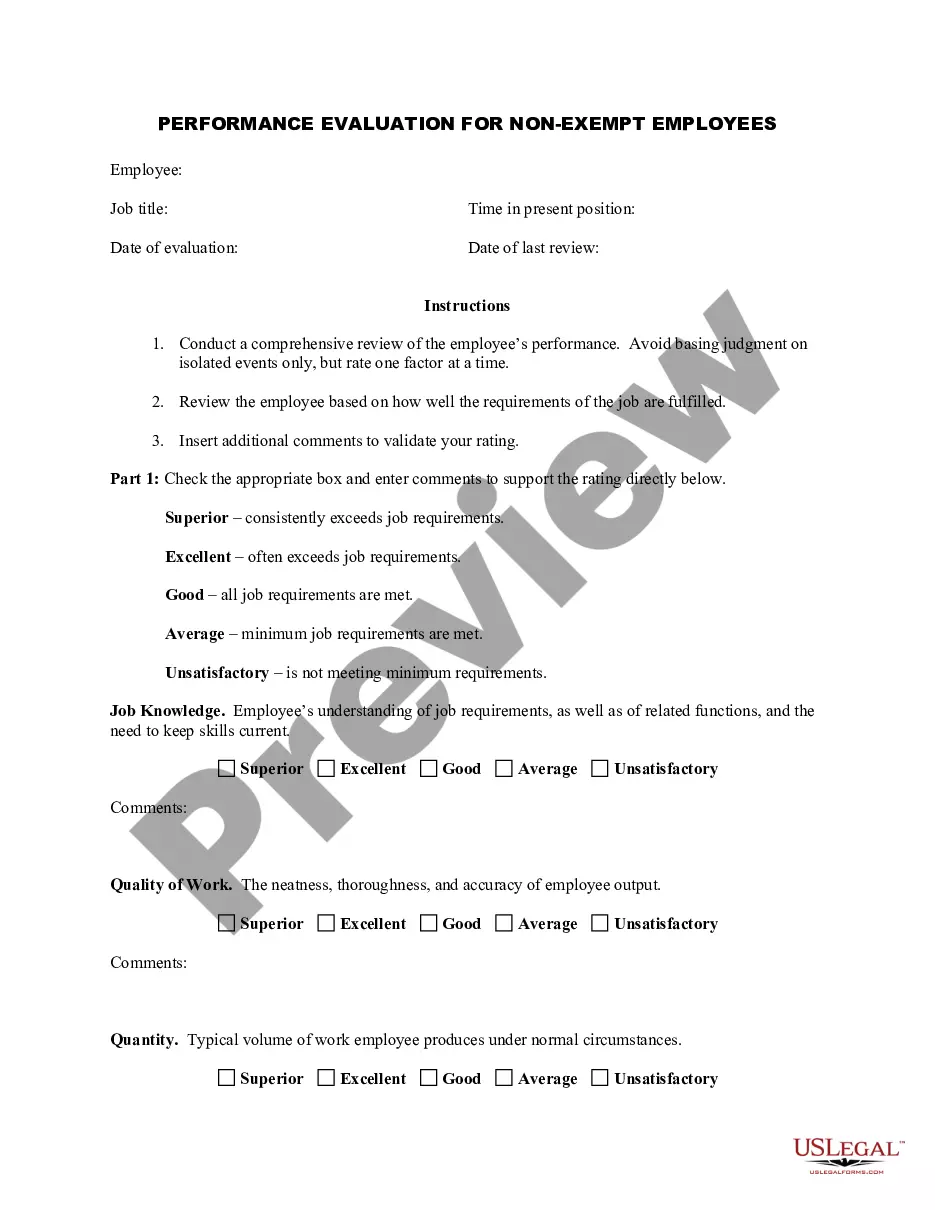

Typically, a corporate officer isn't held personally liable, as long as his or her actions fall within the scope of their position and the parameters of the law. An officer of a corporation may serve on the board of directors or fulfill a managerial role. A corporate officer may also be: A shareholder.

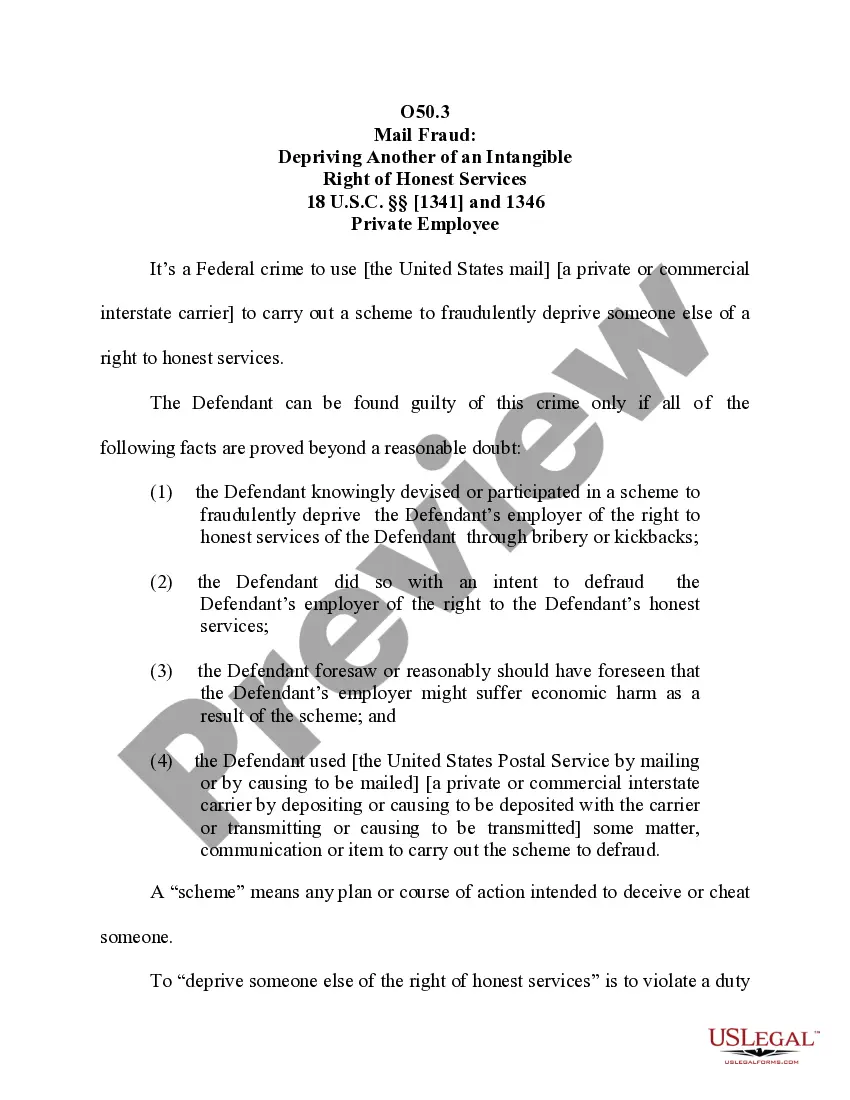

The following are several examples of Management Liability (D&O) claims.Misrepresentation. Directors and officers at a company failed to disclose material facts and provided inaccurate and misleading information to their investors.Credit Fraud.Stolen Corporate Secrets.Recruiting Sales Executives.Investment Agreement.

Directors and Officers (D&O) liability insurance protects your organization's directors and officers from personal financial loss that may result from allegations and lawsuits of wrongful acts or mismanagement carried out in their appointed capacity.

Limited liability protects shareholders, directors, officers and employees against personal liability for actions taken in the name of the corporation and corporate debts. Ordinarily, an officer of the corporation, whether also a shareholder, director or employee, cannot be held personally liable.

An "exclusion of liability" clause does just what it sounds like: it excludes all of your liability for certain events or consequences. It anticipates that there will be a breach of contract, and then excludes all liability for that breach.

5 Important Things to Look for in Your D&O Insurance PolicyCriminal Act Exclusions.Notification Requirements.Insured vs. Insured.Exceptions To Exclusions.Unique Details.

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

Board members can be sued for their individual actions, such as if they personally and directly injure someone, guarantee a loan on which the nonprofit defaults, do something intentionally illegal or mix the nonprofit's funds with their personal funds.

D&O insurance will not provide coverage for what many would consider the worst acts of the directors or officers; dishonesty, fraud, criminal or malicious acts committed deliberately. Insurance is created to transfer risk and not to cover the intentional acts of the insured.

Directors and Officers Liability or D&O insurance covers damages for which the nonprofit is liable, which result from bad decisions, errors or omissions made by the nonprofits' directors, appointed officers, employees or volunteers.