Colorado Retirement Plan for Outside Directors

Description

How to fill out Retirement Plan For Outside Directors?

Are you presently in the place where you need to have papers for both business or personal functions nearly every time? There are tons of lawful document templates available online, but getting ones you can depend on is not easy. US Legal Forms offers a large number of form templates, much like the Colorado Retirement Plan for Outside Directors, which can be written to fulfill federal and state specifications.

If you are already familiar with US Legal Forms web site and have a free account, basically log in. After that, you may acquire the Colorado Retirement Plan for Outside Directors design.

If you do not come with an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Discover the form you want and make sure it is for your proper city/area.

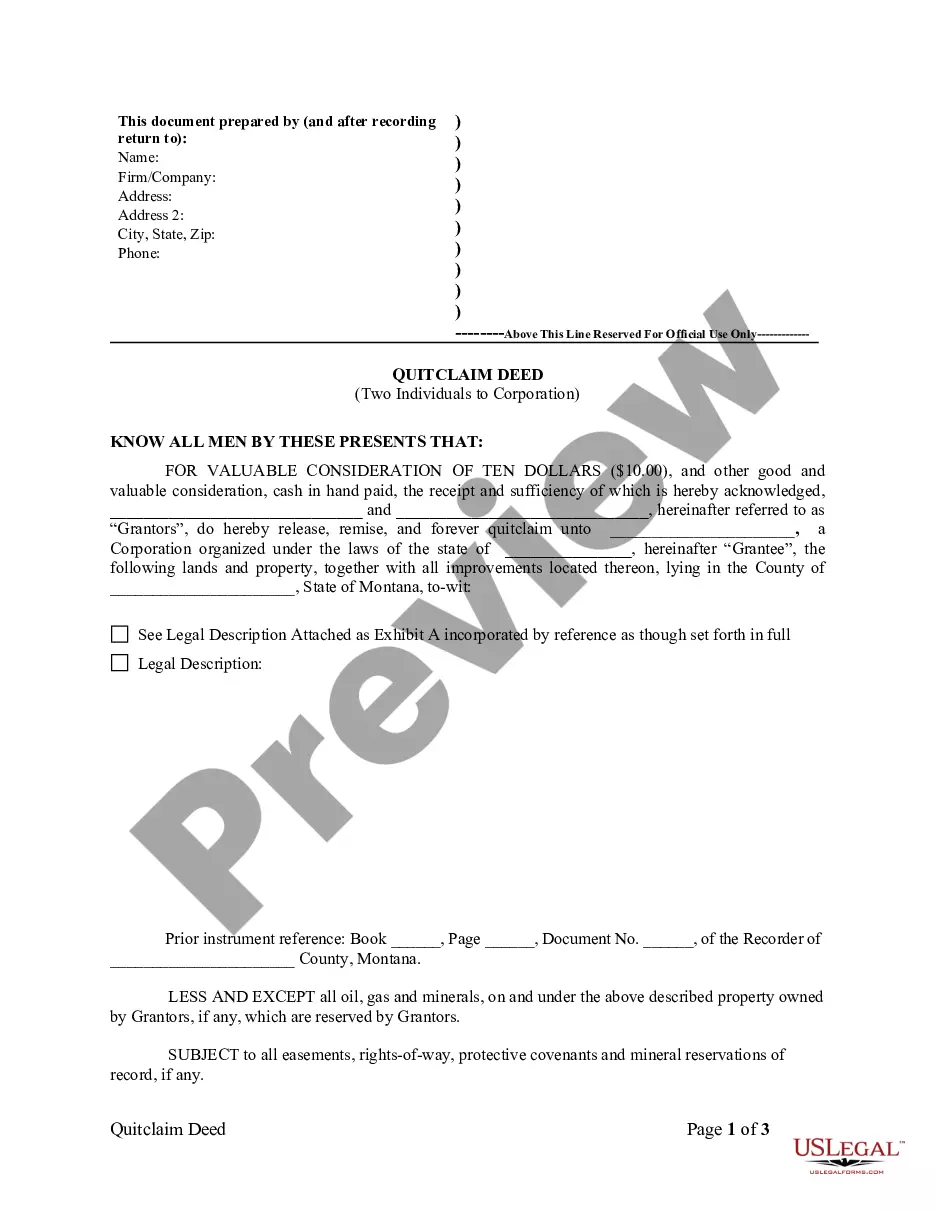

- Utilize the Review switch to check the shape.

- Look at the description to ensure that you have selected the correct form.

- In the event the form is not what you are seeking, take advantage of the Search industry to discover the form that suits you and specifications.

- When you obtain the proper form, click on Get now.

- Choose the prices plan you need, fill in the specified details to create your account, and pay money for an order using your PayPal or bank card.

- Decide on a handy paper structure and acquire your version.

Locate each of the document templates you have purchased in the My Forms menus. You can aquire a further version of Colorado Retirement Plan for Outside Directors anytime, if needed. Just click the needed form to acquire or print the document design.

Use US Legal Forms, probably the most substantial selection of lawful kinds, to save lots of time as well as steer clear of errors. The services offers skillfully manufactured lawful document templates that you can use for a variety of functions. Make a free account on US Legal Forms and start creating your way of life easier.

Form popularity

FAQ

Employers who sponsor a qualified retirement savings plan on their own are exempt from SecureSavings. They can certify their exemption online using the access code provided to them by the state.

Colorado SecureSavings is good for you and your employees Colorado SecureSavings gives businesses a convenient way to help employees save for their future. Employer-sponsored retirement plans can help improve worker satisfaction, increase productivity, and reduce employee stress.

In 2023, Colorado joins a growing list of states requiring most businesses to offer an employer-sponsored retirement savings program, like a 401(k) plan or Simplified Employee Pension Plan (SEP).

A new program for Colorado workers who don't have access to a 401(k) or other retirement plan at their job has officially launched after years in the making. The Colorado SecureSavings program was designed to help nearly 1 million workers with no retirement plan to start one at no cost to the employer.

You can opt out at any time online, by calling 1-844-711-5001, or by mailing in a completed Opt-Out Form( opens in a new window ) to the program.

If your business already offers a qualified retirement plan to your employees, you are not eligible to participate in Colorado SecureSavings.

Yes. Under Colorado law, Colorado employers will be required to offer their employees some sort of retirement savings. This can be a traditional pension, a 401(k) plan, a 403(b) plan, a SEP Plan, a SIMPLE IRA plan, a governmental deferred compensation plan ? or an account from Colorado SecureSavings.

Yes. Under Colorado law, Colorado employers will be required to offer their employees some sort of retirement savings. This can be a traditional pension, a 401(k) plan, a 403(b) plan, a SEP Plan, a SIMPLE IRA plan, a governmental deferred compensation plan ? or an account from Colorado SecureSavings.