Colorado Retirement Benefits Plan

Description

How to fill out Retirement Benefits Plan?

If you have to complete, download, or print lawful record web templates, use US Legal Forms, the most important collection of lawful varieties, which can be found on the Internet. Make use of the site`s easy and handy research to obtain the papers you want. Various web templates for business and person uses are sorted by classes and claims, or search phrases. Use US Legal Forms to obtain the Colorado Retirement Benefits Plan in just a few click throughs.

When you are currently a US Legal Forms customer, log in in your bank account and click on the Obtain button to obtain the Colorado Retirement Benefits Plan. Also you can gain access to varieties you earlier acquired in the My Forms tab of your own bank account.

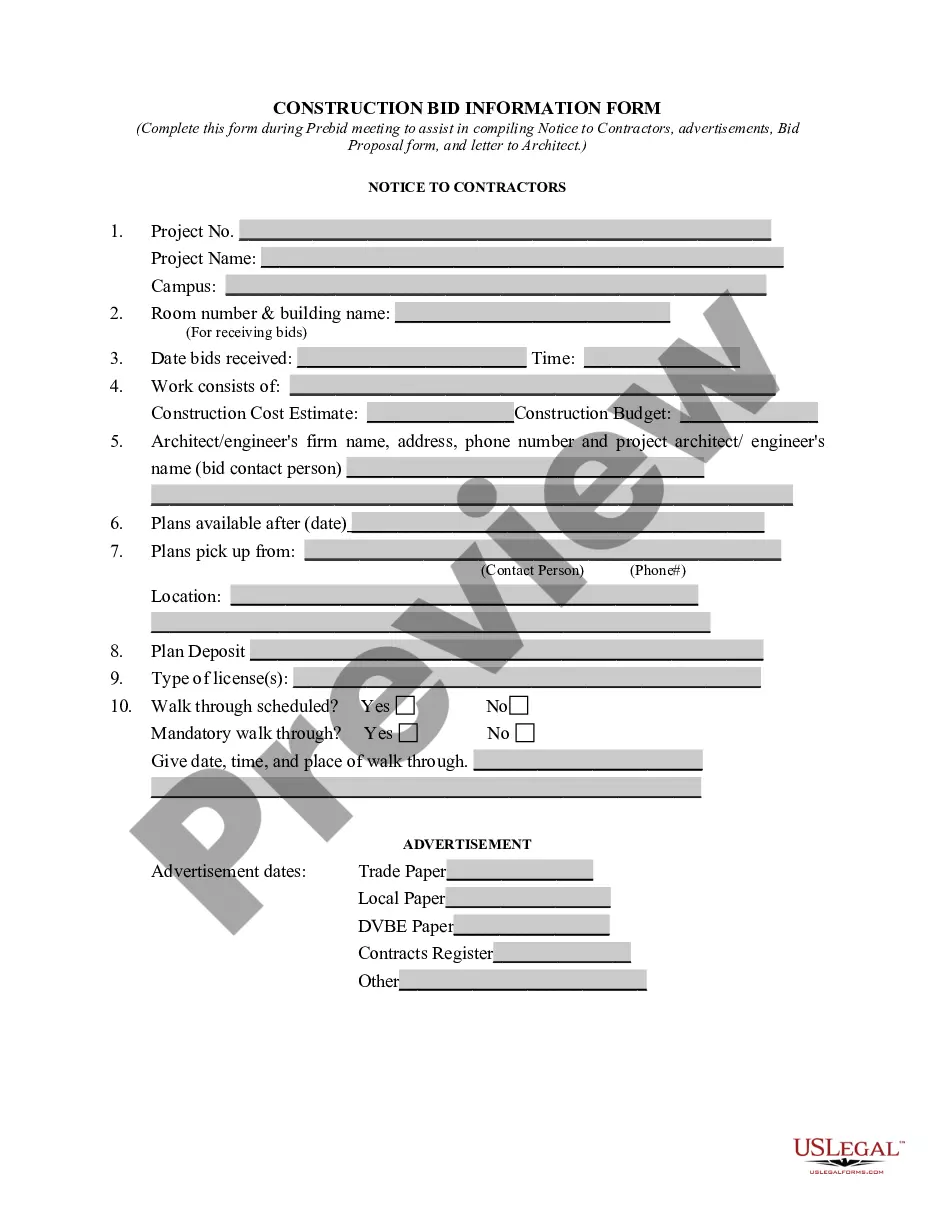

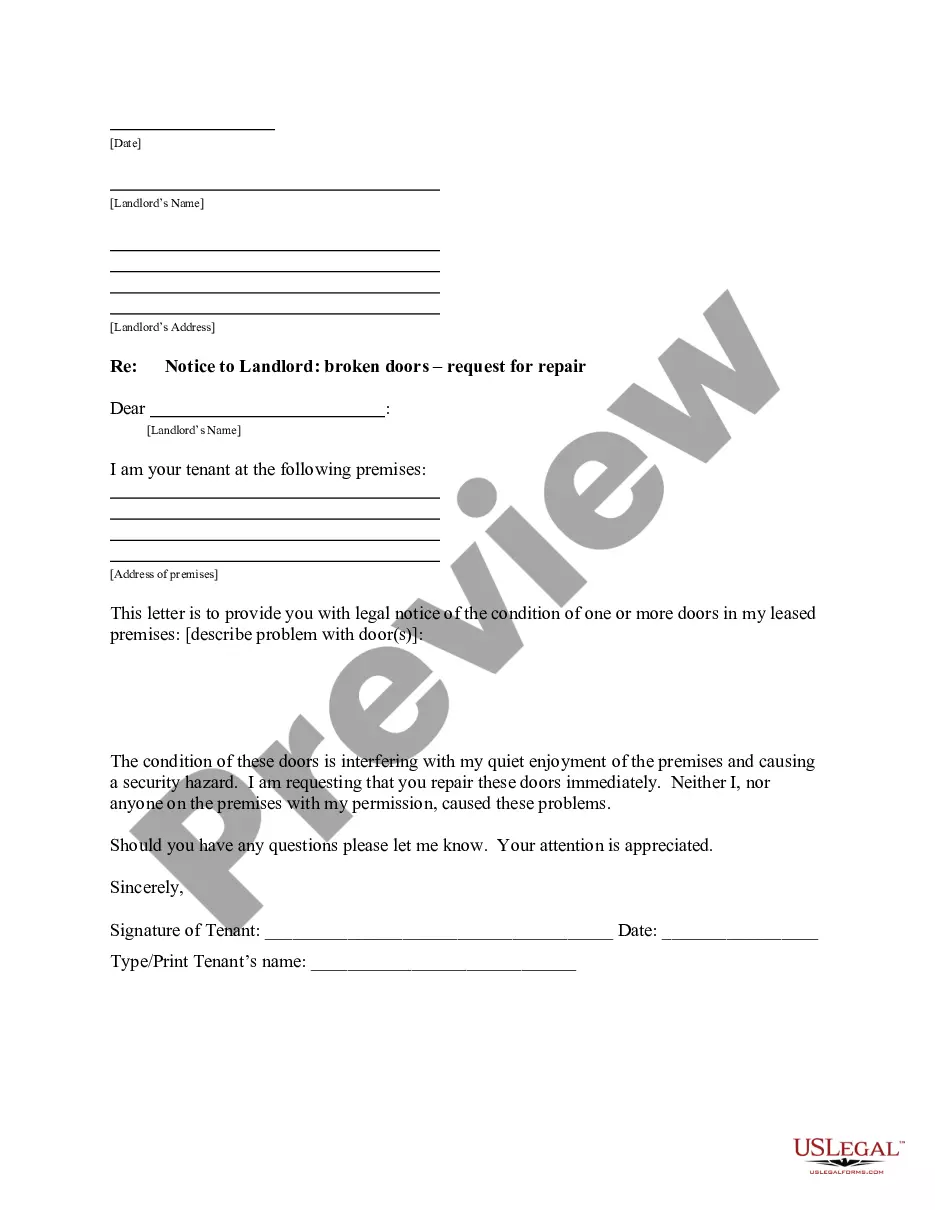

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have selected the form for that right area/region.

- Step 2. Utilize the Review choice to examine the form`s content. Never overlook to read through the information.

- Step 3. When you are not happy with all the develop, utilize the Search field near the top of the monitor to discover other versions from the lawful develop web template.

- Step 4. Upon having found the form you want, go through the Purchase now button. Opt for the pricing plan you prefer and put your credentials to register for the bank account.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to accomplish the deal.

- Step 6. Pick the formatting from the lawful develop and download it on your system.

- Step 7. Comprehensive, revise and print or sign the Colorado Retirement Benefits Plan.

Each and every lawful record web template you buy is yours for a long time. You have acces to every develop you acquired in your acccount. Click the My Forms section and pick a develop to print or download yet again.

Contend and download, and print the Colorado Retirement Benefits Plan with US Legal Forms. There are millions of specialist and status-specific varieties you can use for your business or person requires.

Form popularity

FAQ

Tax advantages Colorado wins over retirees with plenty of tax incentives. There are no state income taxes on Social Security. Other retirement income up to $24,000 can be excluded for taxpayers aged 65 and up. That includes government and military pension plans.

Key takeaways. The best state to retire is Iowa because of its lower cost of living, affordable but high-quality healthcare and low crime.

Colorado Income Tax Colorado law excludes from Colorado state income tax total pension income up to $20,000 per year per person for those retirees age 55 through 64, or $24,000 for those retirees age 65 and over. The retiree's age on December 31 is used to determine the exclusion amount for that year.

Yes. Under Colorado law, Colorado employers will be required to offer their employees some sort of retirement savings. This can be a traditional pension, a 401(k) plan, a 403(b) plan, a SEP Plan, a SIMPLE IRA plan, a governmental deferred compensation plan ? or an account from Colorado SecureSavings.

Overall, Colorado is a great place to retire for a number of reasons. With its stunning natural environment, excellent healthcare options, and affordable cost of living, it offers a high quality of life for retirees.

Colorado PERA provides retirement benefits for public employees in Colorado, including school employees. The system provides a defined benefit (DB) pension, a retirement plan that typically offers a modest but stable monthly retirement income that lasts the remainder of a retiree's life.

Where to Retire in Colorado: 4 Best Colorado Cities to Move to After Retirement Breckenridge. The alpine town of Breckenridge sits between Denver to the east and White River National Forest to the west. ... Fort Collins. ... Evergreen. ... Frisco. ... Retirement Near the Rockies.

Age 60 or greater with at least 5 years of ?service?