Colorado Approval of Stock Option Plan

Description

How to fill out Approval Of Stock Option Plan?

You may commit time on the web looking for the authorized papers web template that fits the federal and state requirements you need. US Legal Forms gives a huge number of authorized types which are analyzed by experts. It is possible to obtain or printing the Colorado Approval of Stock Option Plan from the support.

If you already have a US Legal Forms profile, it is possible to log in and click the Down load key. Next, it is possible to complete, change, printing, or signal the Colorado Approval of Stock Option Plan. Each authorized papers web template you get is your own property forever. To acquire yet another backup of any purchased develop, visit the My Forms tab and click the related key.

If you use the US Legal Forms internet site initially, stick to the easy directions under:

- Initial, make sure that you have chosen the right papers web template for your region/metropolis that you pick. See the develop explanation to ensure you have picked the right develop. If readily available, utilize the Review key to check with the papers web template at the same time.

- In order to find yet another variation in the develop, utilize the Research field to find the web template that meets your requirements and requirements.

- Upon having located the web template you need, click Get now to carry on.

- Select the pricing plan you need, type your references, and register for a free account on US Legal Forms.

- Complete the deal. You can use your bank card or PayPal profile to cover the authorized develop.

- Select the formatting in the papers and obtain it to the device.

- Make alterations to the papers if needed. You may complete, change and signal and printing Colorado Approval of Stock Option Plan.

Down load and printing a huge number of papers templates making use of the US Legal Forms website, that offers the greatest collection of authorized types. Use expert and condition-certain templates to take on your business or person demands.

Form popularity

FAQ

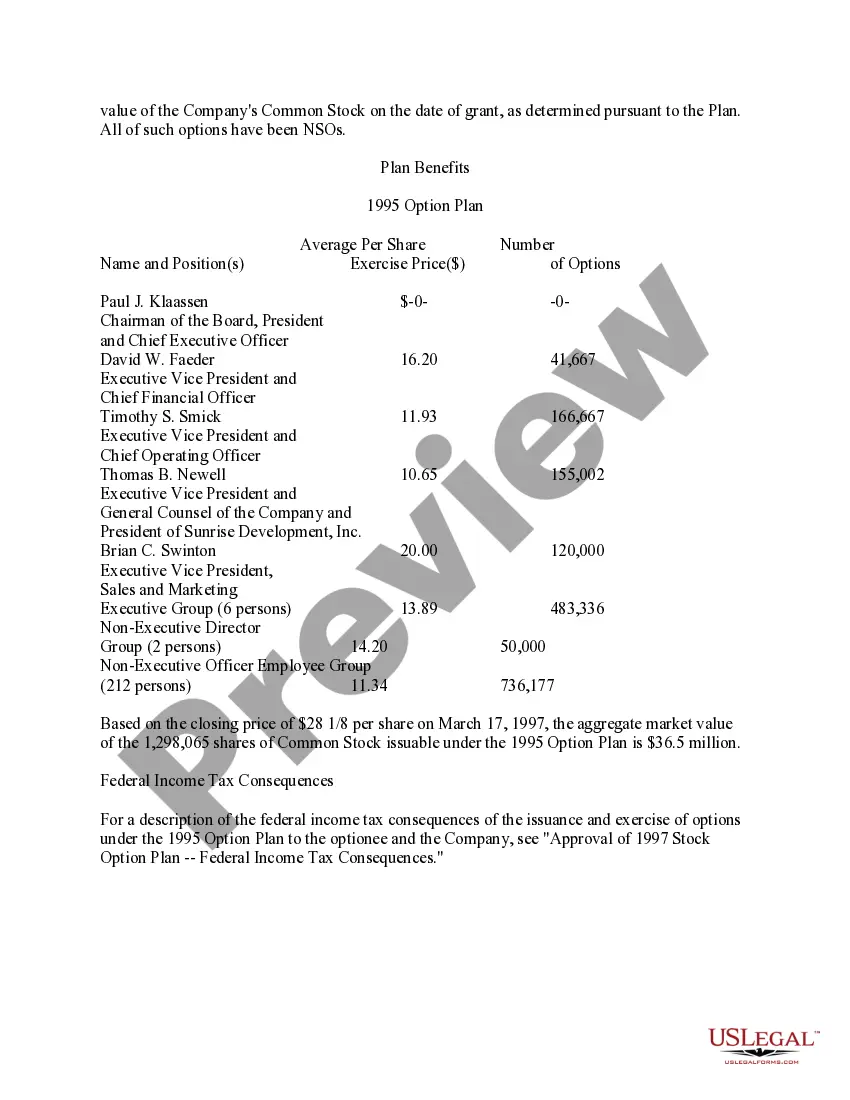

In US companies, an option grant is typically awarded to an employee, advisor or other individual who performs services for the company, and the option can be exercised during the term of service to the company and for a finite period of time following cessation of services.

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

The Company's board of directors must approve all stock option grants, including the name of the recipient, the number of shares, the vesting schedule and the exercise price. This can be done either in a board meeting or via unanimous written consent.

Once the grant has vested, they still don't own anything in the company. Rather, they now own the option to purchase these shares. The jargon for actually buying these shares is termed ?exercising options.? When it comes to exercising options, employees need to spend some money before they can actually make some money.

Before options can be written, a stock must be properly registered, have a sufficient number of shares, be held by enough shareholders, have sufficient volume, and be priced high enough.

Failure to get board approval Let's start with an obvious one that founders routinely miss in the early days: Stock option grants must be approved by the board. If the board doesn't approve (either at a board meeting or by unanimous written consent), the stock options haven't actually been granted.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.