Colorado Approval of Incentive Stock Option Plan

Description

How to fill out Approval Of Incentive Stock Option Plan?

US Legal Forms - among the most significant libraries of lawful kinds in the United States - delivers a variety of lawful record templates you can download or produce. Utilizing the website, you can find a huge number of kinds for company and person functions, sorted by categories, says, or keywords and phrases.You can find the most recent variations of kinds much like the Colorado Approval of Incentive Stock Option Plan within minutes.

If you already have a membership, log in and download Colorado Approval of Incentive Stock Option Plan through the US Legal Forms catalogue. The Obtain switch can look on every single kind you view. You get access to all previously acquired kinds inside the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, listed below are basic directions to help you started out:

- Be sure to have picked out the proper kind for your personal town/county. Click on the Review switch to review the form`s information. Browse the kind information to actually have selected the appropriate kind.

- When the kind does not match your requirements, take advantage of the Research area towards the top of the monitor to get the one which does.

- Should you be content with the form, affirm your choice by visiting the Buy now switch. Then, select the costs plan you like and give your qualifications to sign up on an account.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal account to perform the deal.

- Pick the file format and download the form in your product.

- Make adjustments. Complete, revise and produce and signal the acquired Colorado Approval of Incentive Stock Option Plan.

Every format you included in your money does not have an expiry time which is your own forever. So, if you wish to download or produce an additional duplicate, just proceed to the My Forms segment and click on the kind you want.

Get access to the Colorado Approval of Incentive Stock Option Plan with US Legal Forms, by far the most comprehensive catalogue of lawful record templates. Use a huge number of skilled and status-particular templates that meet your company or person requirements and requirements.

Form popularity

FAQ

Corporate actions include stock splits, dividends, mergers and acquisitions, rights issues and spin-offs. All of these are major decisions that typically need to be approved by the company's board of directors and authorized by its shareholders.

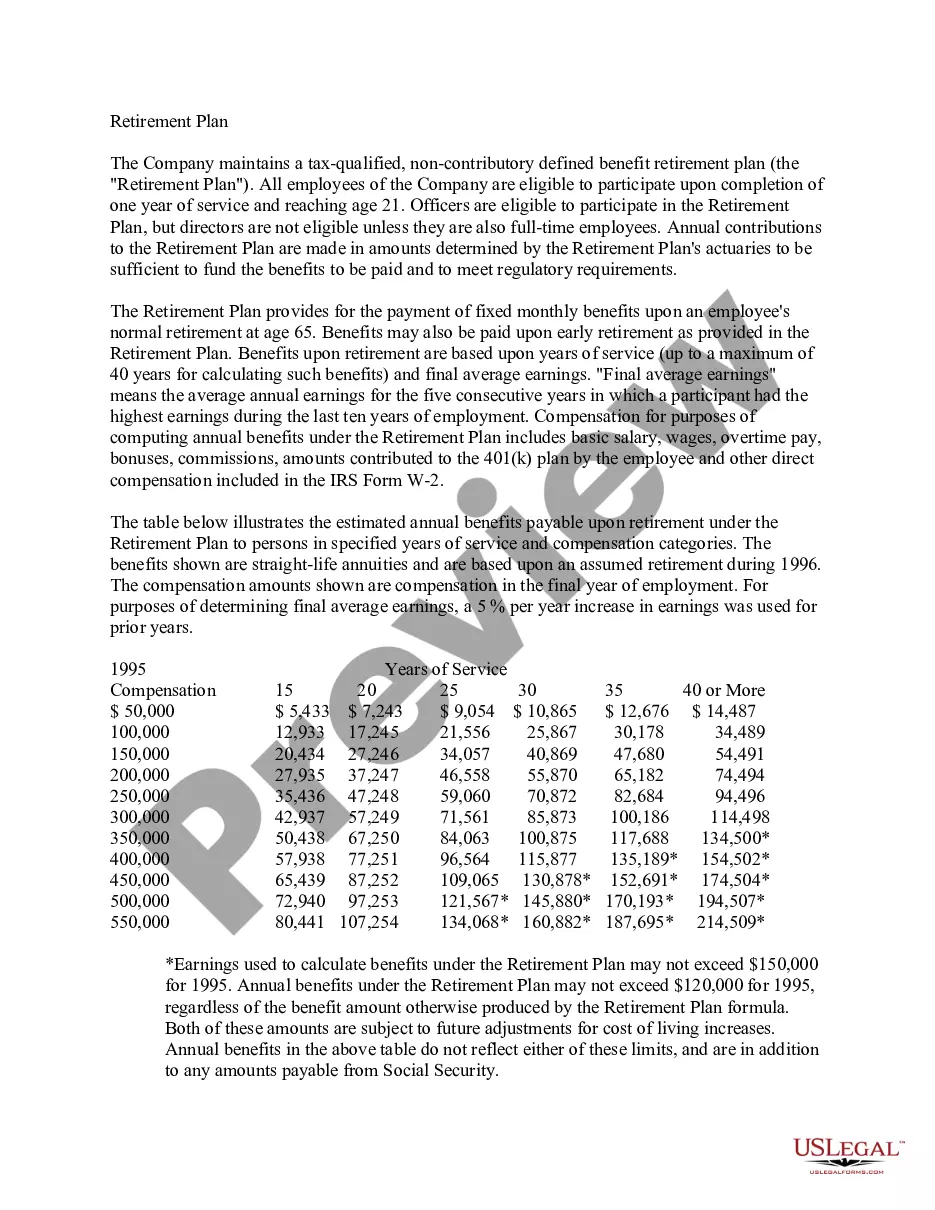

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Stock Based Compensation (also called Share-Based Compensation or Equity Compensation) is a way of paying employees, executives, and directors of a company with equity in the business.

Board Approval The Company's board of directors must approve all stock option grants, including the name of the recipient, the number of shares, the vesting schedule and the exercise price. This can be done either in a board meeting or via unanimous written consent.

Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees.

Failure to get board approval Let's start with an obvious one that founders routinely miss in the early days: Stock option grants must be approved by the board. If the board doesn't approve (either at a board meeting or by unanimous written consent), the stock options haven't actually been granted.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

A stock option plan must be adopted by the company's directors and, in some cases, approved by the company's shareholders.