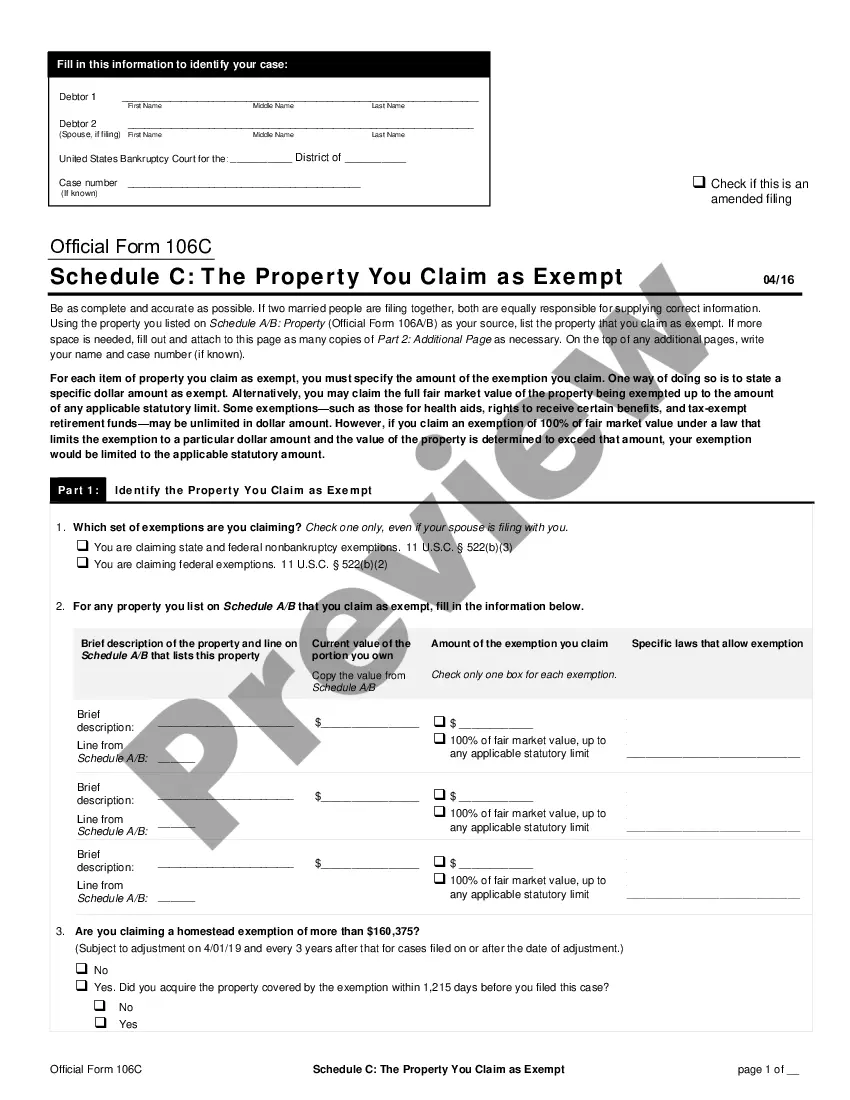

Colorado Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

You are able to devote time on-line searching for the legal document web template that suits the state and federal specifications you will need. US Legal Forms gives a huge number of legal kinds which can be evaluated by pros. You can actually acquire or produce the Colorado Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 from my assistance.

If you already have a US Legal Forms account, you may log in and click on the Download switch. Following that, you may full, edit, produce, or indicator the Colorado Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. Every single legal document web template you acquire is your own property forever. To obtain another copy of any acquired form, visit the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms internet site the very first time, follow the simple directions beneath:

- First, be sure that you have selected the right document web template to the county/metropolis that you pick. See the form description to make sure you have picked the right form. If available, use the Review switch to appear throughout the document web template at the same time.

- If you would like get another variation in the form, use the Search discipline to get the web template that suits you and specifications.

- Upon having located the web template you desire, simply click Purchase now to carry on.

- Find the rates prepare you desire, type in your references, and register for an account on US Legal Forms.

- Total the deal. You can utilize your credit card or PayPal account to cover the legal form.

- Find the format in the document and acquire it in your product.

- Make adjustments in your document if needed. You are able to full, edit and indicator and produce Colorado Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Download and produce a huge number of document web templates using the US Legal Forms site, that provides the biggest variety of legal kinds. Use skilled and condition-distinct web templates to deal with your organization or individual requirements.

Form popularity

FAQ

Hear this out loud PauseColorado's statutory homestead exemption exempts a portion of a homestead from seizure to satisfy a debt, contract, or civil obligation. Section 2 increases the amount of the homestead exemption: From $75,000 to $250,000 if the homestead is occupied as a home by an owner of the home or an owner's family; and.

HOMESTEAD EXEMPTION FOR SENIORS Must be 65 years of age on January 1 of the year they apply for the exemption. A surviving spouse of a qualifying owner. Must be the primary residence of the owner on record for 10 consecutive years. The property is classified as residential.

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.

Hear this out loud PauseAll personal property is taxable unless it is specifically exempt by law. Exemptions include, but are not limited to: inventories for resale, materials and supplies consumed, agricultural equipment used on the farm or ranch to produce agricultural products, ag and livestock products, and livestock.

This form/report is issued to the property owner by the division of property taxation and must be completed and filed with the division each year along with the correct fee. The report is used to determine the property's ongoing eligibility for exemption from general property taxation.

Hear this out loud PauseSome religious, charitable and educational nonprofit tax-exempt organizations may qualify for property-tax exemption. An organization must own real property to take advantage of this exemption.