Colorado Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions

Description

How to fill out Confirmation Of Orally Accepted Employment Offer From Applicant To Company - Exempt Or Nonexempt Positions?

You might dedicate time online searching for the legal document template that meets the federal and state requirements you require.

US Legal Forms offers thousands of legal templates that have been vetted by professionals.

It is easy to obtain or generate the Colorado Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions through the service.

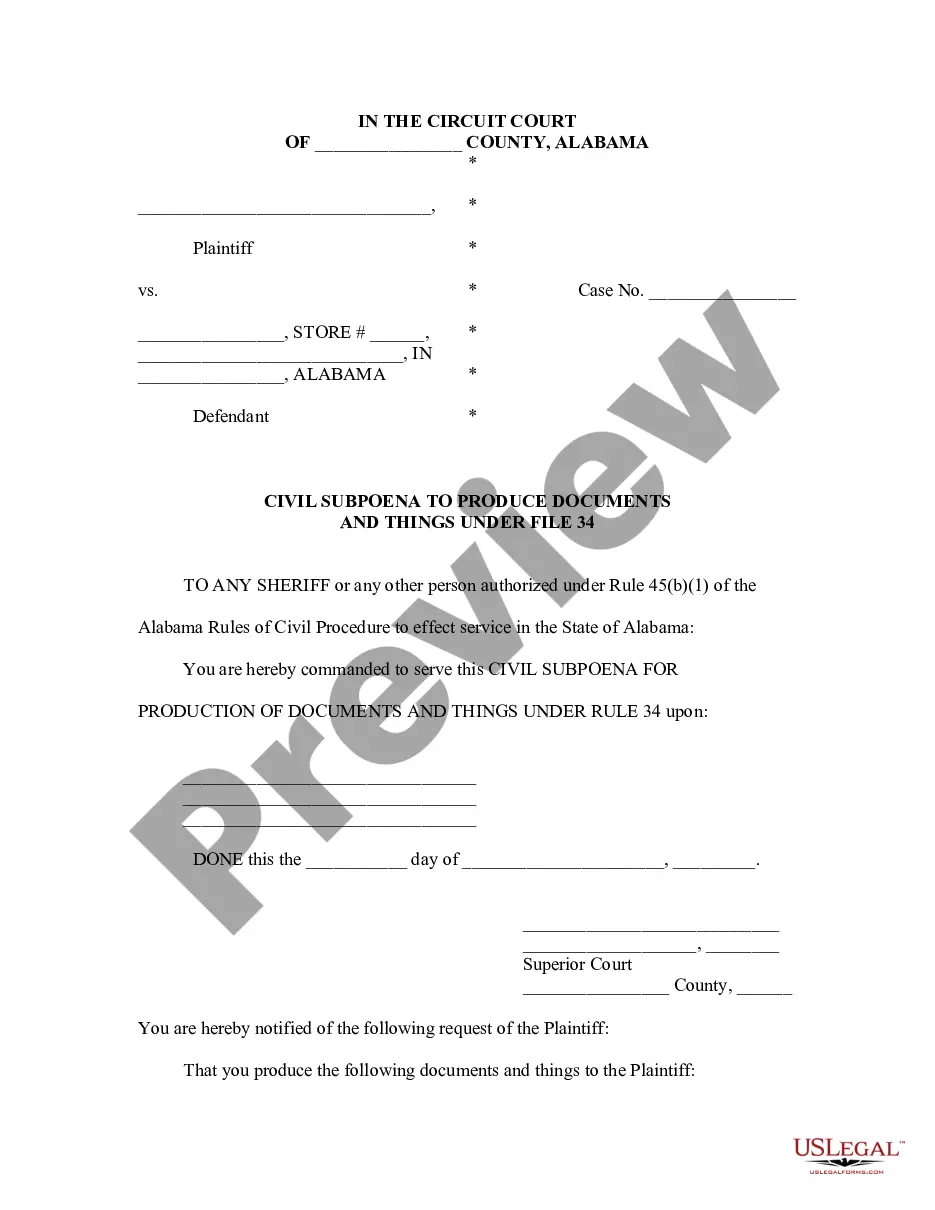

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Then, you can complete, edit, generate, or sign the Colorado Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions.

- Every legal document template you obtain is yours permanently.

- To get another copy of any obtained form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area that you choose.

- Review the form summary to make sure you’ve selected the right template.

Form popularity

FAQ

Contrary to what most people think, a signed offer letter, except in very rare instances, is not a legally binding implied contract. Candidates often think that because they have signed and accepted an offer letter, they have some sort of legal right to the job.

A job offer can be made in writing or verbally and once made it is legally binding. A job offer can be conditional or unconditional.

Overtime pay, also called "time and a half pay", is one and a half times an employee's normal hourly wage. Therefore, Colorado's overtime minimum wage is $18.84 per hour, one and a half times the regular Colorado minimum wage of $12.56 per hour.

In order to be exempt, an employee must meet the salary and duties requirements. Effective January 1, 2021, the salary threshold for overtime exemption is $40,500, then will increase to $45,000 in 2022, to $50,000 in 2023, and to $55,000 in 2024.

The offer letter should provide details on the salary and pay periods. Employee compensation should be stated in an hourly, a weekly or a per-pay-period salary amount to avoid the expectation of receiving the full annual salary if the employee is terminated midyear.

Some important details about an offer letter are: It is NOT a legally binding contract. It does NOT include promises of future employment or wages. It includes an employment at-will statement.

The state of Colorado requires employers to pay employees overtime, unless an exemption applies, at a rate of 1½ times their regular rate when they work: more than 40 hours in a workweek, more than 12 hours in a workday, or. 12 consecutive hours without regard to the workday.

Generally, for each hour worked over 40/week or 12/day by both salaried and hourly employees, federal and Colorado overtime laws require overtime pay to be paid at a rate of one and a half times the employee's regular hourly rate.

The salary threshold for certain exempt employees including those under the administrative, executive, and professional exemptions will increase from $684.00 per week ($35,568 per year) to $778.85 per week ($40,500.20 per year).

In general, offer letters are less formal than employment contracts, which typically set terms and conditions of employment that are legally binding. It's also vital for employers to understand that they aren't required by federal law to send an offer letter to new hires.