Colorado Shipping Reimbursement refers to a policy or program that provides compensation or reimbursement for the cost of shipping goods or products within the state of Colorado. This initiative aims to support businesses, particularly small-scale enterprises, by alleviating the financial burden associated with shipping expenses. One type of Colorado Shipping Reimbursement is the Small Business Shipping Reimbursement Program. This program assists small businesses in covering a portion of their shipping costs, allowing them to reinvest their resources into other critical areas of their operations. Eligible businesses can apply for reimbursement based on a predetermined percentage or amount, depending on the program guidelines. Another type is the Rural Shipping Reimbursement Program, which specifically caters to businesses located in rural regions of Colorado. These areas often face additional challenges when it comes to shipping costs due to their remote locations. The program aims to promote economic growth and viability in these rural communities by subsidizing shipping expenses for eligible businesses. The Colorado Shipping Reimbursement program typically covers a wide range of shipping methods, including ground transportation, air freight, and even international shipments. Eligibility criteria may vary depending on the program, but typically, businesses must be registered in Colorado and meet specific criteria such as annual revenue thresholds or employment requirements. The reimbursement amount or percentage can also differ based on the program. In some cases, it may be a fixed amount or a percentage of the total shipping costs incurred by the business. The reimbursement process usually involves submitting necessary documentation, such as shipping receipts or invoices, to prove the expenses. By offering Colorado Shipping Reimbursement programs, the state aims to stimulate the growth and competitiveness of local businesses while also supporting economic development across different regions. This initiative not only helps alleviate the financial burden on businesses but also encourages them to explore new markets, expand their operations, or invest in product development and innovation.

Colorado Shipping Reimbursement

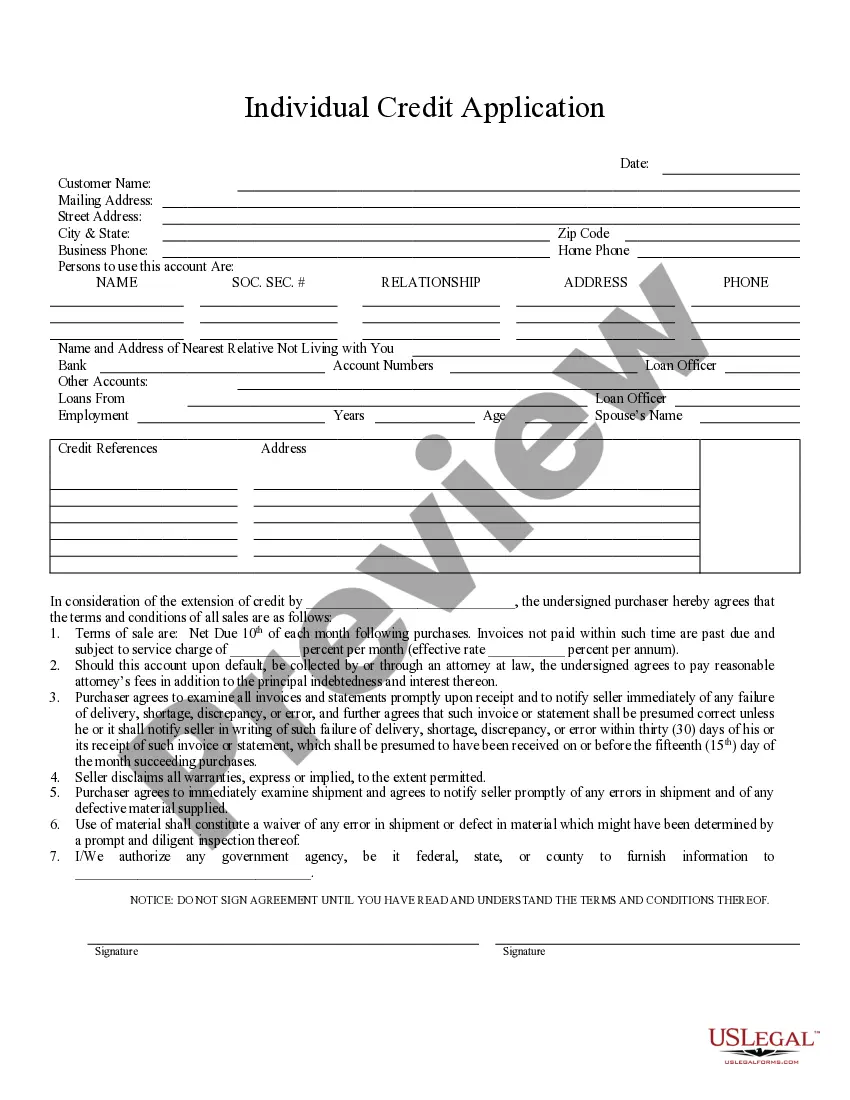

Description

How to fill out Colorado Shipping Reimbursement?

Are you in the placement the place you require papers for possibly organization or specific uses just about every working day? There are a lot of legal file templates available on the net, but finding ones you can trust is not effortless. US Legal Forms delivers 1000s of type templates, just like the Colorado Shipping Reimbursement, which are composed in order to meet federal and state demands.

Should you be presently informed about US Legal Forms website and have a free account, simply log in. Next, you are able to download the Colorado Shipping Reimbursement design.

Should you not offer an account and would like to start using US Legal Forms, follow these steps:

- Discover the type you want and ensure it is to the appropriate area/state.

- Take advantage of the Review button to examine the shape.

- See the description to ensure that you have chosen the correct type.

- When the type is not what you`re trying to find, make use of the Look for area to discover the type that meets your requirements and demands.

- When you obtain the appropriate type, click on Get now.

- Pick the prices plan you need, complete the desired details to make your account, and pay money for an order utilizing your PayPal or credit card.

- Select a handy data file file format and download your duplicate.

Find all the file templates you possess bought in the My Forms food selection. You can obtain a more duplicate of Colorado Shipping Reimbursement anytime, if possible. Just go through the required type to download or print the file design.

Use US Legal Forms, one of the most considerable assortment of legal varieties, in order to save efforts and stay away from blunders. The support delivers appropriately produced legal file templates that can be used for an array of uses. Make a free account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

Colorado merchants can accept a Colorado sales tax license (which is also a resale certificate). Colorado doesn't issue a specific resale certificate, so you can just use your license number.

You can apply for a resale certificate through your state's tax department. Be sure to apply to the state tax department in the state you physically have an addressnot the state in which you are incorporated, if it's different.

Steps for filling out the DR 0563 Colorado Sales Tax Exemption CertificateStep 1 Begin by downloading the Colorado Sales Tax Exemption Certificate Form DR 0563.Step 2 Identify the business name and business address of the seller.Step 3 Identify the name and business address of the buyer.More items...?

Colorado Form 104 is the state's standard individual income tax form. This form is used for anyone who earned income in Colorado, whether a full-year resident of the state, a part-year resident or a nonresident; part-year residents and nonresidents will need to complete the additional Colorado Form 104PN.

Taxable and exempt shipping chargesDelivery and freight charges are generally exempt from Colorado sales tax so long as they're both separable from the purchase and separately stated on the customer invoice.

Carrying, delivery, freight, handling, pickup, shipping, and other similar charges or fees. order for shipping and handling to the $35 list price. The $3 charge for shipping and handling is part of the purchase price and is subject to Denver's tax.

Separately stated postage, shipping, and transportation charges are generally exempt, but crating, handling, packaging, or similar charges are taxable whether separately stated or included in the sale price.

Steps for filling out the 5000a Arizona Resale CertificateStep 1 Begin by downloading the Arizona Resale Certificate Form 5000A.Step 2 Identify the name, business address, and TPT License number of the buyer.Step 3 Indicate whether the certificate covers a single transaction or a blanket date range.More items...?18-Apr-2022

To apply for this certificate with Colorado, use the Application for Sales Tax Exemption for Colorado Organization (DR 0715). No fee is required for this exemption certificate and it does not expire. All valid non-profit state exemption certificates start with the numbers 98 or 098.

Colorado state use tax is the same as the state sales tax, 2.9%. State retailer's use taxes are reported in the state column of the form DR 0173: Retailer's Use Tax Return.