Colorado Domestic Partnership Dependent Certification Form

Description

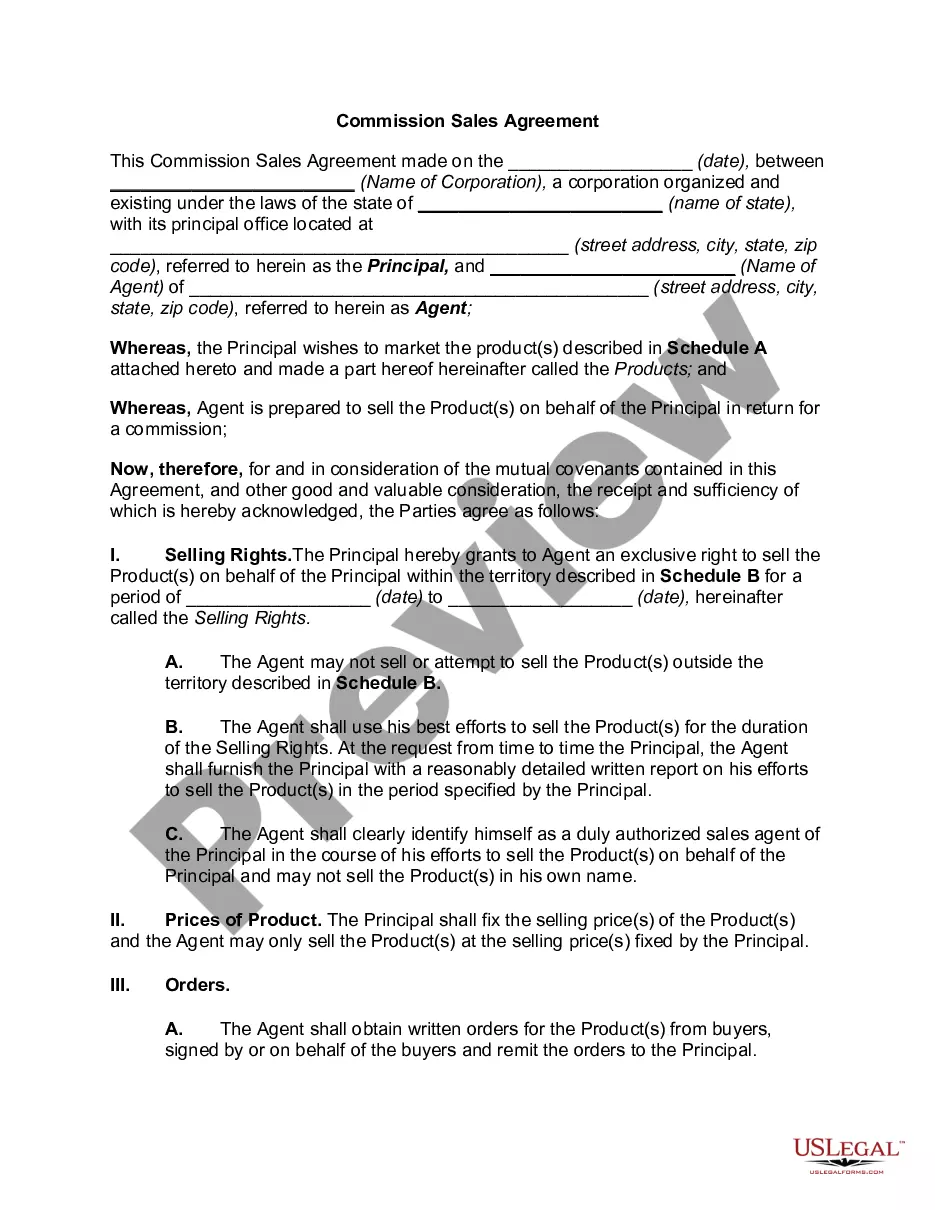

How to fill out Domestic Partnership Dependent Certification Form?

Have you ever been in a location where you consistently require documentation for either corporate or particular purposes.

There are numerous authentic document templates offered online, yet locating reliable versions can be challenging.

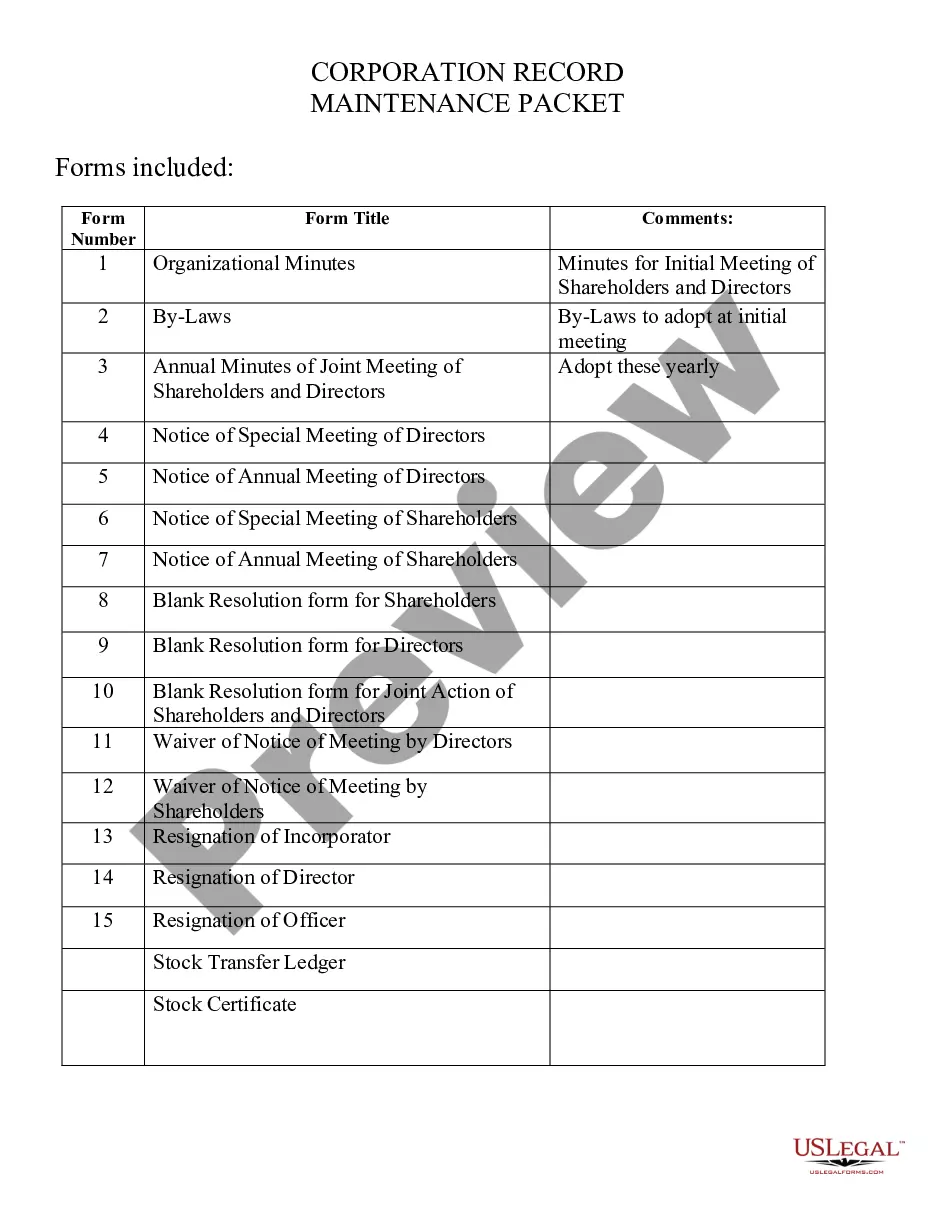

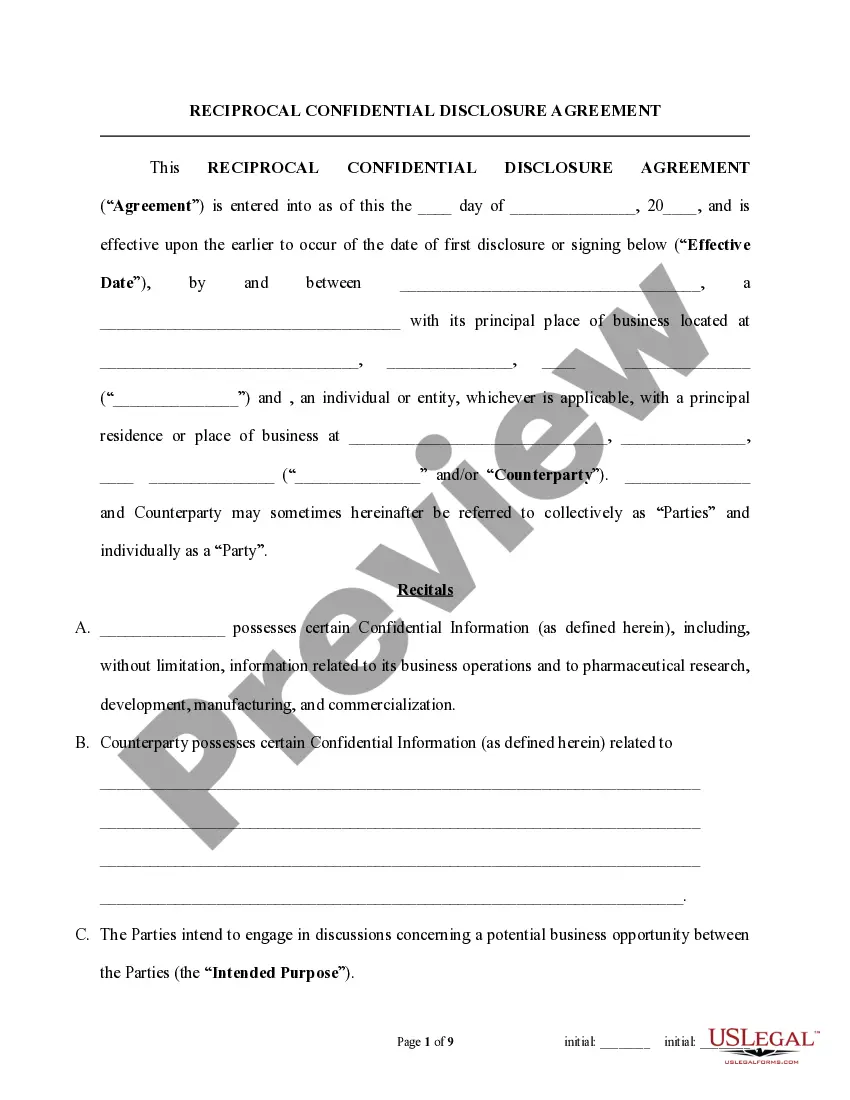

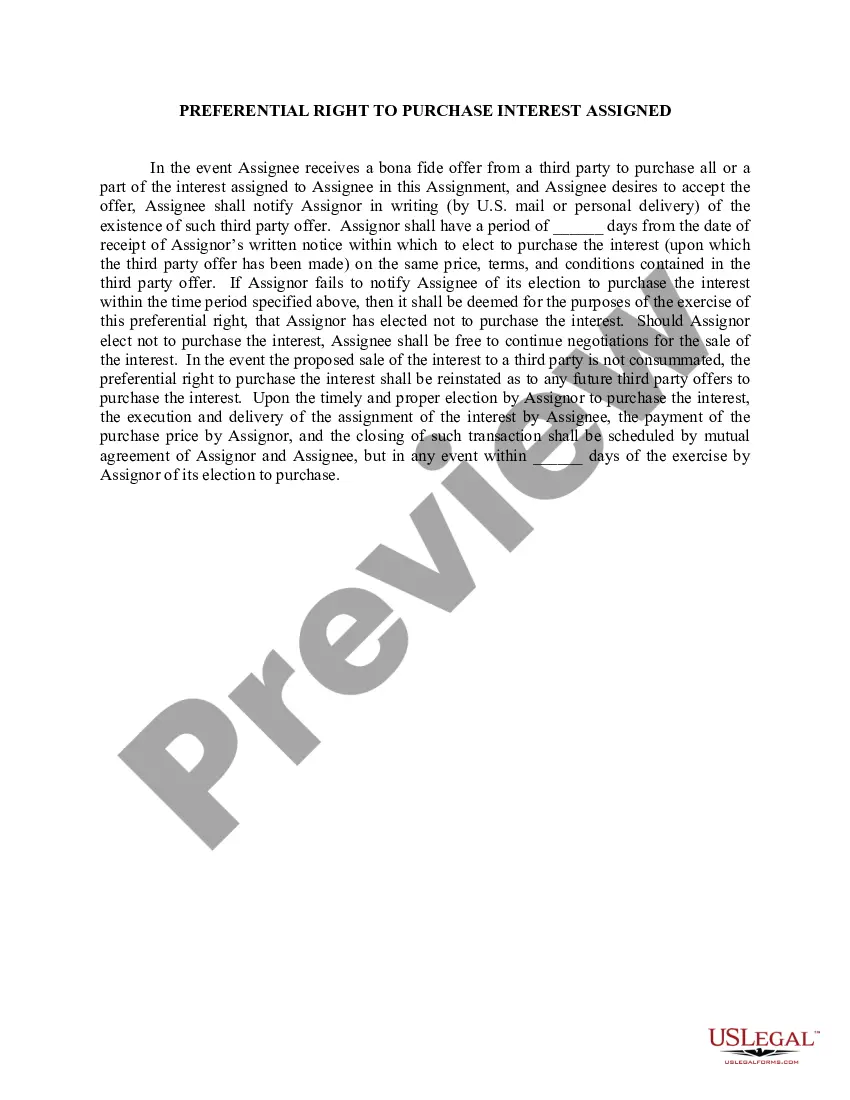

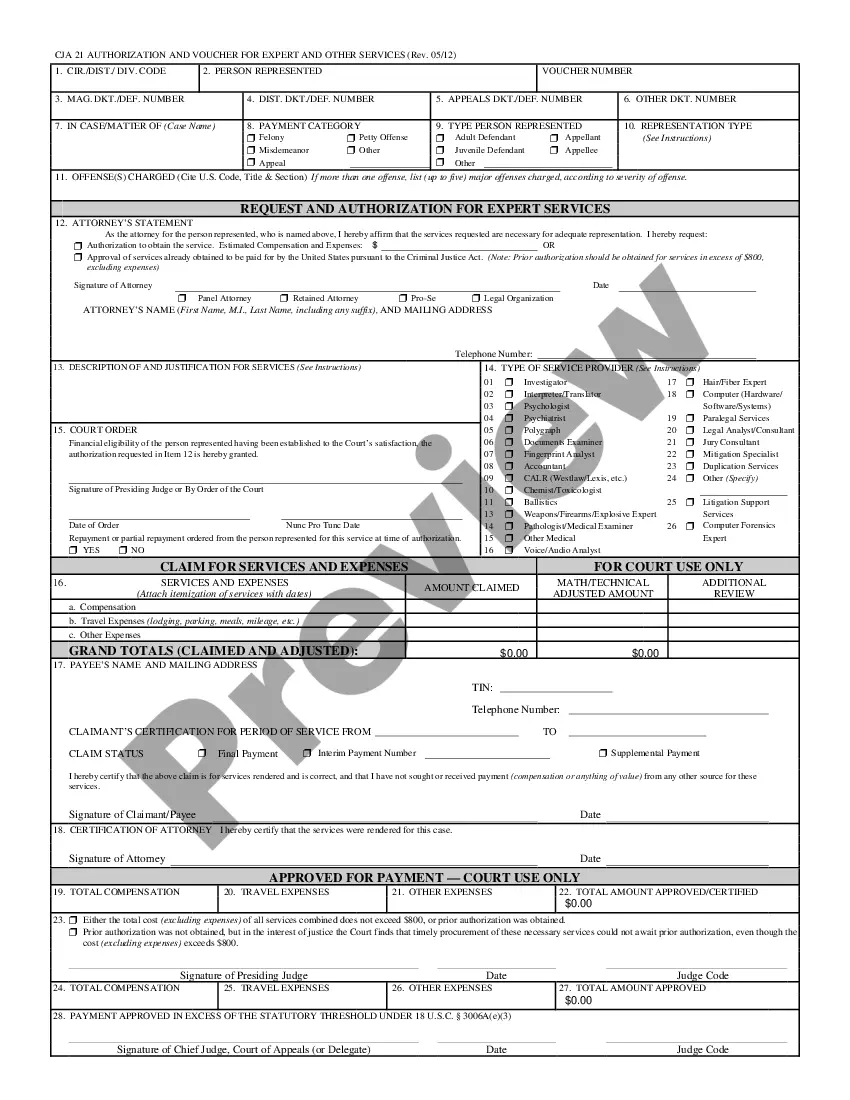

US Legal Forms provides thousands of form templates, such as the Colorado Domestic Partnership Dependent Certification Form, designed to fulfill federal and state requirements.

Choose the pricing plan you prefer, complete the required information to create your account, and proceed with the payment using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the Colorado Domestic Partnership Dependent Certification Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it corresponds to the correct city/region.

- Utilize the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the right form, click Get now.

Form popularity

FAQ

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

The State of Colorado does recognize domestic partnerships, and there are specific steps that you can take to establish this relationship in the eyes of the law.

Two individuals seeking to become domestic partners must complete and file a declaration of domestic partnership in person with the City Clerk Department. Each applicant must provide a valid photo ID issued by a United States government agency that provides name, date of birth, height, weight, and hair and eye color.

Legal Rights and ResponsibilitiesDomestic partnership registration is voluntary, and does not create any new or different legal rights or responsibilities.

How to Register as a Domestic Partner in ColoradoSchedule an appointment with the clerk.Bring an ID document with a picture.Provide proof of shared address for each person (e.g. utility bill or bank statement)Pay the $25 registration fee.

Colorado does not require that insurance plans provide benefits for same-sex domestic partners, and many plans continue to deny employees in domestic partnerships benefits equivalent to those afforded their married colleagues.

The State of Colorado does recognize domestic partnerships, and there are specific steps that you can take to establish this relationship in the eyes of the law.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.