Colorado Ground Lease with Lessee to Construct Improvements

Description

How to fill out Ground Lease With Lessee To Construct Improvements?

Choosing the right legitimate record template could be a battle. Naturally, there are plenty of web templates available on the net, but how do you find the legitimate develop you need? Take advantage of the US Legal Forms site. The assistance delivers a huge number of web templates, such as the Colorado Ground Lease with Lessee to Construct Improvements, that can be used for organization and personal needs. All of the types are checked out by pros and meet up with federal and state specifications.

In case you are presently listed, log in in your accounts and then click the Acquire button to get the Colorado Ground Lease with Lessee to Construct Improvements. Make use of accounts to check with the legitimate types you possess ordered formerly. Check out the My Forms tab of the accounts and get an additional duplicate from the record you need.

In case you are a fresh user of US Legal Forms, listed here are straightforward recommendations that you should comply with:

- Initially, ensure you have selected the proper develop for the town/state. It is possible to look through the form while using Review button and study the form description to ensure it will be the best for you.

- In case the develop does not meet up with your requirements, take advantage of the Seach field to discover the correct develop.

- Once you are sure that the form is proper, click the Buy now button to get the develop.

- Pick the costs strategy you need and enter in the essential information and facts. Design your accounts and buy an order utilizing your PayPal accounts or bank card.

- Choose the data file format and down load the legitimate record template in your gadget.

- Total, modify and produce and indication the received Colorado Ground Lease with Lessee to Construct Improvements.

US Legal Forms may be the largest collection of legitimate types in which you can discover numerous record web templates. Take advantage of the company to down load expertly-produced papers that comply with state specifications.

Form popularity

FAQ

Leasehold improvements are assets, and are a part of property, plant, and equipment in the non-current assets section of the balance sheet. Therefore, they are accounted for with other fixed assets in ance with ASC 360.

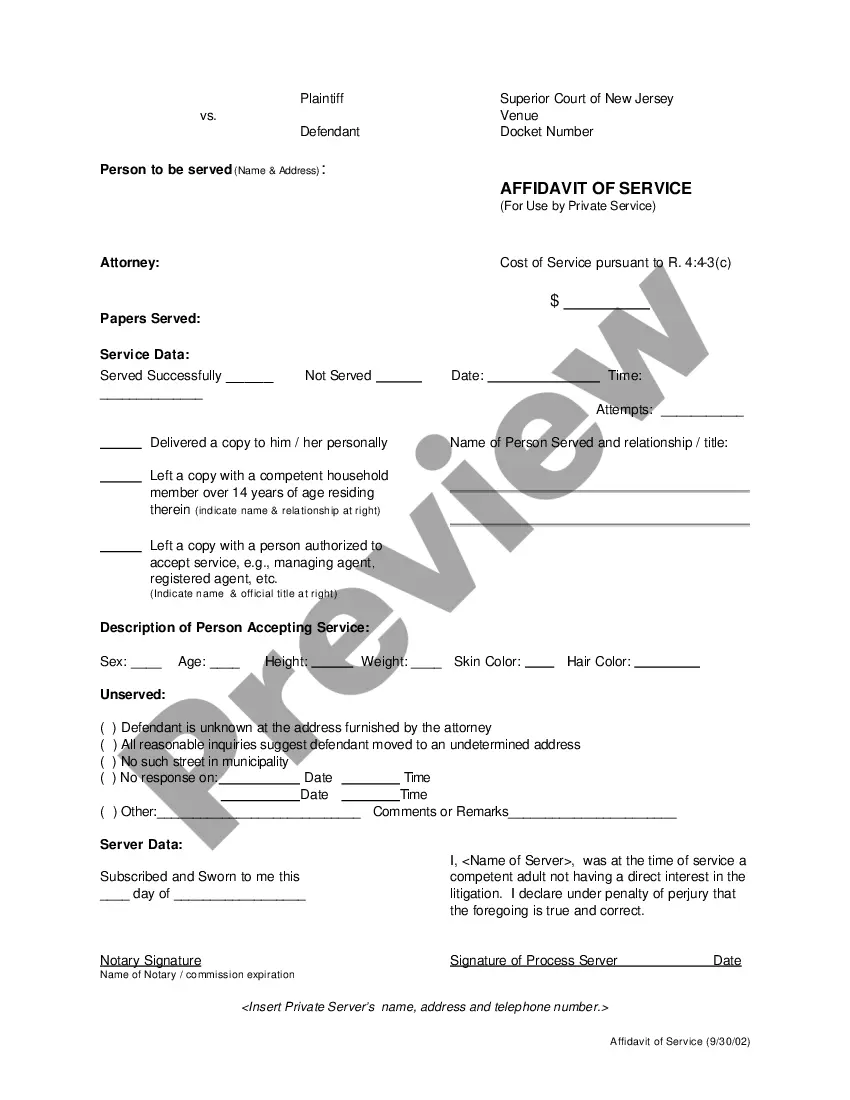

The collateral which secures these loans is the leasehold interest held by the lessee and the improvements upon (or to be constructed upon, in the case of construction financing) the leased property.

Yes, depreciation on leasehold improvements is allowed under the Income Tax Act in India. Leasehold improvements are the changes made to a rented space to meet the needs of the tenant.eg installing new flooring, painting, and making structural changes.

From an accounting standpoint, leasehold improvements must be capitalized on the balance sheet, meaning the cost of the improvements is spread out over time in line with the company's use of space.

Leasehold improvements are done within the walls of the rented space and are designed to benefit you as the tenant. A leasehold improvement can also be a building constructed on a leased piece of land. Building improvements are done outside of your space.

For purposes of accounting, the costs of leasehold improvements are capitalized as a fixed asset and then amortized rather than depreciated, as the prior section mentioned.

Under the Alternative Depreciation System (ADS), the recovery period is 20 years. This classifies leasehold improvements as Qualified Improvement Property (QIP). QIP is also eligible for 80% bonus depreciation in 2023, allowing a majority of the cost to be deducted in the first year up to a set limit.

Leasehold improvements are also called tenant improvements or buildouts. The property owner typically makes modifications to a commercial real estate space to accommodate the needs of the tenant. Leasehold improvements are applied to the interior space, such as the ceilings, walls, and floors.