Colorado Final Notice of Past Due Account

Description

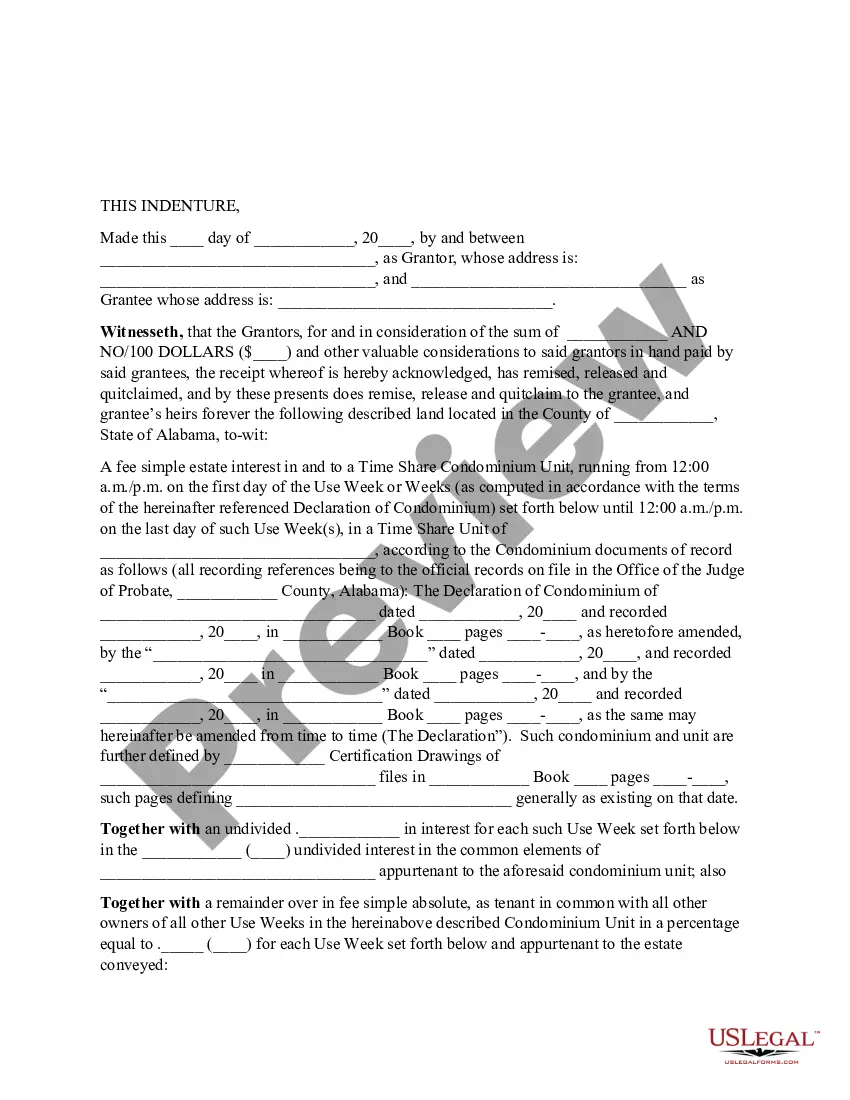

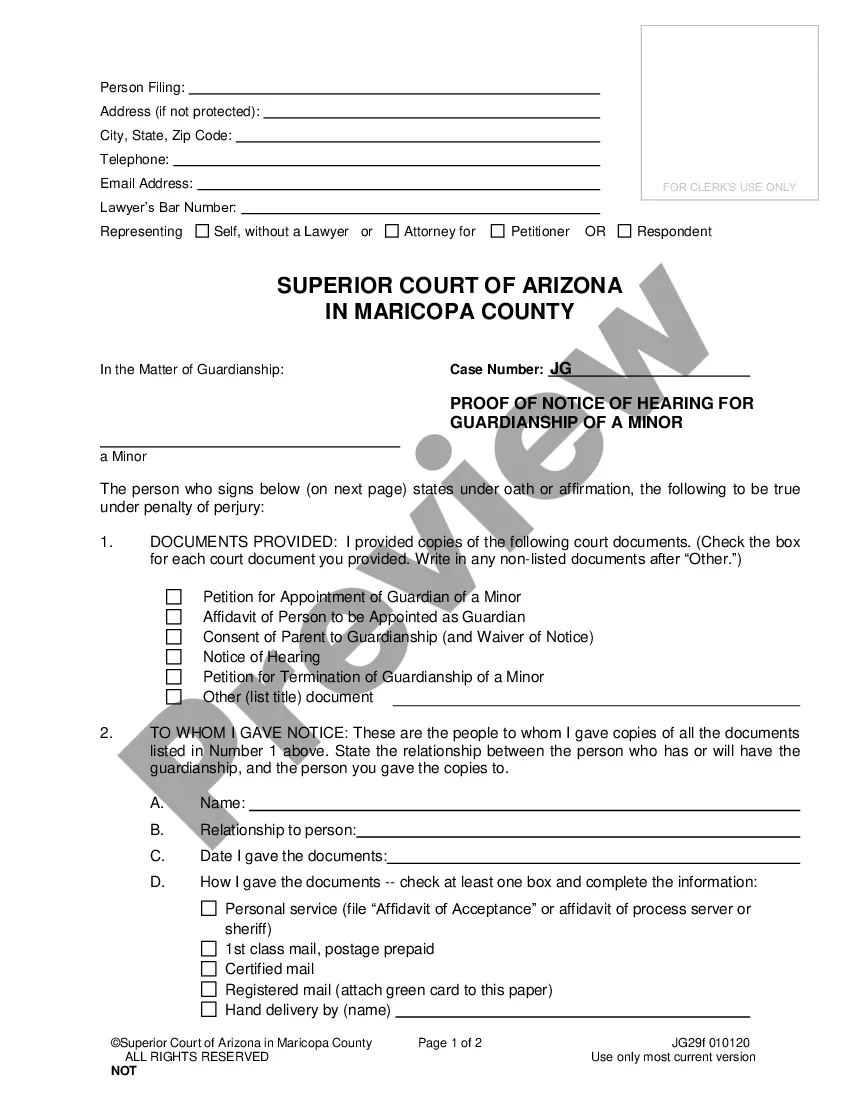

How to fill out Final Notice Of Past Due Account?

If you wish to summarize, obtain, or print approved document templates, utilize US Legal Forms, the leading collection of legal forms, which can be accessed online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have identified the form you require, select the Acquire now button. Choose your preferred payment plan and provide your details to register for an account.

- Utilize US Legal Forms to locate the Colorado Final Notice of Past Due Account with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the Colorado Final Notice of Past Due Account.

- You can also access forms you previously downloaded from the My documents tab within your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Verify that you have chosen the form for your specific city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the details.

Form popularity

FAQ

Generally, under IRC § 6502, the IRS will have 10 years to collect a liability from the date of assessment. After this 10-year period or statute of limitations has expired, the IRS can no longer try and collect on an IRS balance due.

Colorado charges the same income tax rate for its residents regardless of how much you make. The standard deduction in Colorado is $12,550 for single taxpayers and $25,100 for married filers. The state does not have personal exemptions.

Generally, the statute of limitations for the IRS to assess taxes on a taxpayer expires three (3) years from the due date of the return or the date on which it was filed, whichever is later. A return is considered to be filed on the due date of the return if it was filed on or before its due date.

While the Department is required by law to send the Notice of Deficiency or Rejection of Refund Claim letter, the main purpose of this letter is to provide you with the following information: Any adjustment made to the return you filed and the detail of that adjustment. The outstanding balance for a specified tax year.

The statute of limitations for Colorado income tax refunds and assessments is generally four years from the due date of the return. A return filed prior to the due date is considered filed on the due date. The Colorado statute of limitations is the federal statute of limitations plus one year.

How Long Is the Redemption Period After a Colorado Tax Lien Sale? In Colorado, you get a three-year redemption period following the sale during which you can redeem the property.

Colorado extends the statute of limitations to three years from the date of last payment (the federal two- year time frame plus one year). Any refund or credit claim under this extended statute of limitations is limited to the amount of tax paid within the three-year Page 5 period, not previous payments or tax issues.

Quick Tip: Colorado Department of Revenue uses 2 third party collection agencies to assist in collecting back-tax debts. If your case is transferred to either collection agency, you will have to deal directly with them.

Actions taken by the Colorado Department of Revenue may include the following: Filing a judgment/lien with the county to prevent the sale of your assets. Referral to a third-party collection agency. Seizure of assets such as wages, bank accounts and property such as cars, boats or real estate.