Colorado Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

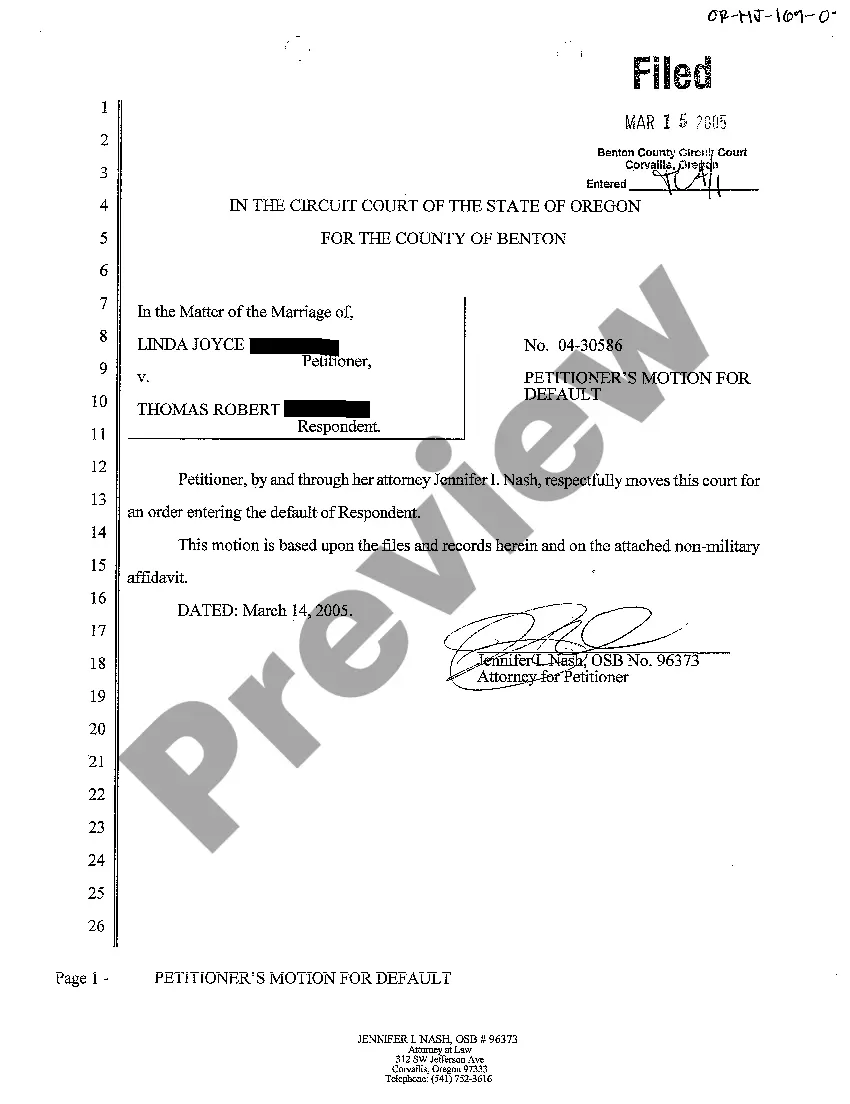

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

If you have to total, obtain, or printing authorized document layouts, use US Legal Forms, the biggest collection of authorized varieties, that can be found on the web. Utilize the site`s basic and hassle-free look for to discover the paperwork you want. Numerous layouts for company and person reasons are sorted by groups and says, or search phrases. Use US Legal Forms to discover the Colorado Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss in a handful of mouse clicks.

When you are presently a US Legal Forms customer, log in in your profile and click on the Obtain key to find the Colorado Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss. You can even gain access to varieties you in the past delivered electronically inside the My Forms tab of your respective profile.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have chosen the form for that appropriate area/region.

- Step 2. Use the Preview solution to examine the form`s articles. Do not neglect to see the explanation.

- Step 3. When you are not satisfied with the type, utilize the Look for area on top of the display to discover other variations from the authorized type web template.

- Step 4. Upon having discovered the form you want, click the Purchase now key. Opt for the pricing plan you prefer and put your qualifications to sign up to have an profile.

- Step 5. Method the deal. You should use your charge card or PayPal profile to complete the deal.

- Step 6. Select the format from the authorized type and obtain it on your own system.

- Step 7. Full, change and printing or signal the Colorado Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

Every authorized document web template you buy is yours permanently. You have acces to every type you delivered electronically in your acccount. Click the My Forms segment and decide on a type to printing or obtain once again.

Contend and obtain, and printing the Colorado Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss with US Legal Forms. There are many skilled and status-specific varieties you can utilize for your personal company or person requires.

Form popularity

FAQ

The preponderance of evidence standard applies primarily to civil law cases. For example, if Linda sues Tom due to injuries she sustained in a car crash, Linda must convince the courts that it is more probable than not that Tom caused the crash resulting in her injuries.

Preponderance of the evidence is one type of evidentiary standard used in a burden of proof analysis. Under the preponderance standard, the burden of proof is met when the party with the burden convinces the fact finder that there is a greater than 50% chance that the claim is true.

?Preponderance of the evidence? means evidence that has more convincing force than that opposed to it. If the evidence is so evenly balanced that you are unable to say that the evidence on either side of an issue preponderates, your finding on that issue must be against the party who had the burden of proving it.

The defendant has the burden of proving (each of) (his) (her) (its) affirmative defense(s) by a preponderance of the evidence. 3. To prove something by a ?preponderance of the evidence? means to prove that it is more probably true than not. claim(s) or defense(s) by a preponderance of the evidence.

All relevant evidence is admissible, except as otherwise provided by the Constitution of the United States, by the Constitution of the State of Colorado, by these rules, or by other rules prescribed by the Supreme Court or by the statutes of the State of Colorado. Evidence which is not relevant is not admissible.

Clear and convincing evidence is a higher standard of proof than the preponderance of the evidence standard, which only requires that enough facts are presented to make it more likely true than not. In contrast, clear and convincing evidence must be so strong as to remove any serious doubts about its truthfulness.