Colorado Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor

Description

How to fill out Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor?

If you wish to total, down load, or printing legal record web templates, use US Legal Forms, the largest assortment of legal varieties, that can be found online. Use the site`s simple and easy handy look for to find the papers you will need. Various web templates for business and specific reasons are sorted by classes and says, or key phrases. Use US Legal Forms to find the Colorado Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor in a number of mouse clicks.

In case you are already a US Legal Forms client, log in to your bank account and then click the Down load button to obtain the Colorado Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor. Also you can access varieties you in the past acquired within the My Forms tab of your own bank account.

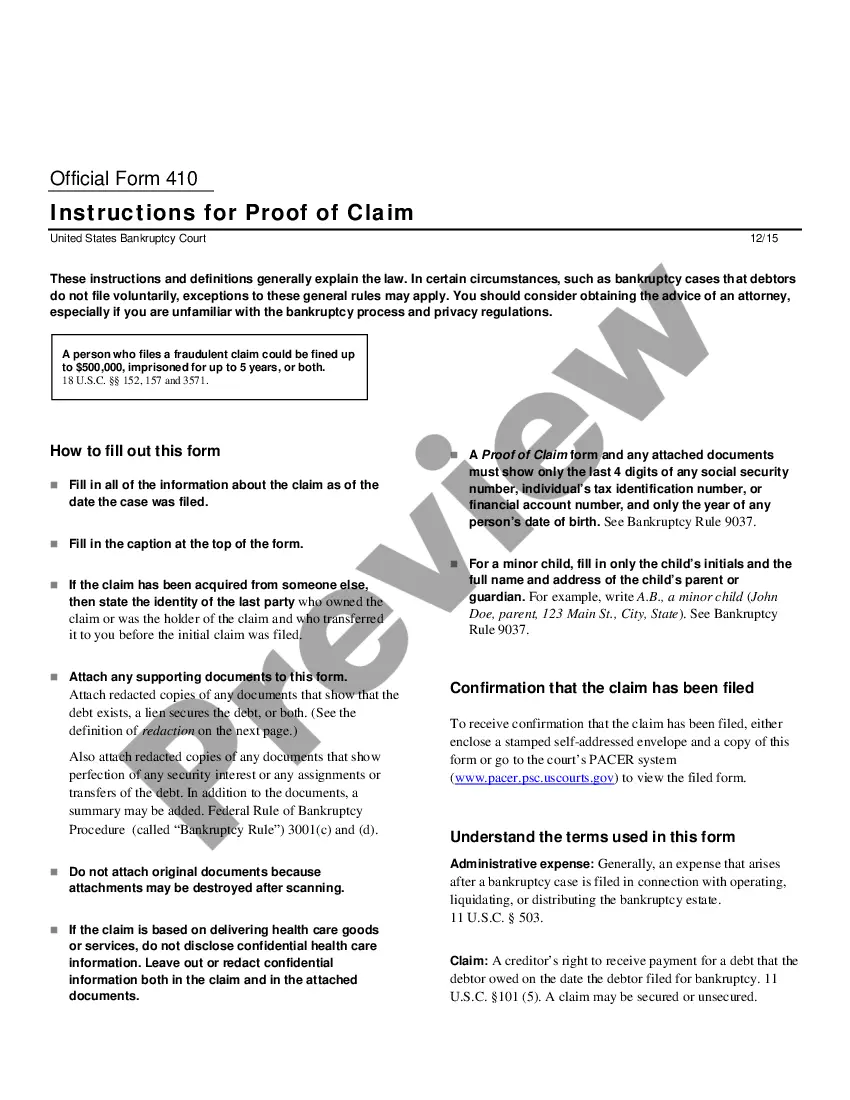

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have selected the form to the right town/nation.

- Step 2. Use the Preview solution to examine the form`s information. Do not forget to see the outline.

- Step 3. In case you are not satisfied together with the kind, make use of the Look for field on top of the screen to find other models in the legal kind web template.

- Step 4. Once you have discovered the form you will need, select the Purchase now button. Select the pricing prepare you favor and add your qualifications to sign up on an bank account.

- Step 5. Method the deal. You can use your charge card or PayPal bank account to finish the deal.

- Step 6. Select the format in the legal kind and down load it on the system.

- Step 7. Full, modify and printing or sign the Colorado Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor.

Each and every legal record web template you get is your own property forever. You might have acces to each and every kind you acquired with your acccount. Click on the My Forms area and pick a kind to printing or down load once more.

Contend and down load, and printing the Colorado Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor with US Legal Forms. There are thousands of expert and condition-distinct varieties you can utilize to your business or specific needs.

Form popularity

FAQ

An independent contractor is not considered an employee for Form I-9 purposes and does not need to complete Form I-9.

As an independent contractor, you're the boss of your own taxes. This means there's no employer to withhold taxes for you. The T2125 form. You'll want to become good friends with the T2125 tax form: It's the form you'll use to report your business income and expenses.

Form I-9 rules govern whether an individual is considered self-employed with respect to using E-Verify. Generally, self-employed individuals are not required to complete Forms I-9 on themselves; therefore, they are not required to use E-Verify.

As mandated by IRCA, an individual or entity (client) is NOT required to obtain Form I-9, or otherwise inquire about immigration status from independent contractors or sporadic domestic workers.

There are pros and cons to each structure, but most independent contractors choose the sole proprietorship model, as it is fairly simple to set up and operate. If you choose this structure, you'll need to register your business with your local provincial/territorial government, as opposed to the federal government.

Generally speaking, the difference between independent contractors and employees in California is whether or not the entity paying for services has the right to control or direct the manner and means of work (tending to signify an employment relationship.)

In some circumstances, a foreign entity can hire a Canadian as an independent contractor. However, this means that the foreign entity will not be ?hiring? an employee, but rather a service provider who will be charging taxes on the services. Misclassification is the main risk when engaging an independent contractor.

Contracting of service providers The foreign employee requires a work permit and must either get a Labour Market Impact Assessment (LMIA) or meet the requirements of a LMIA-exempt work permit category.