Colorado Breakdown of Savings for Budget and Emergency Fund

Description

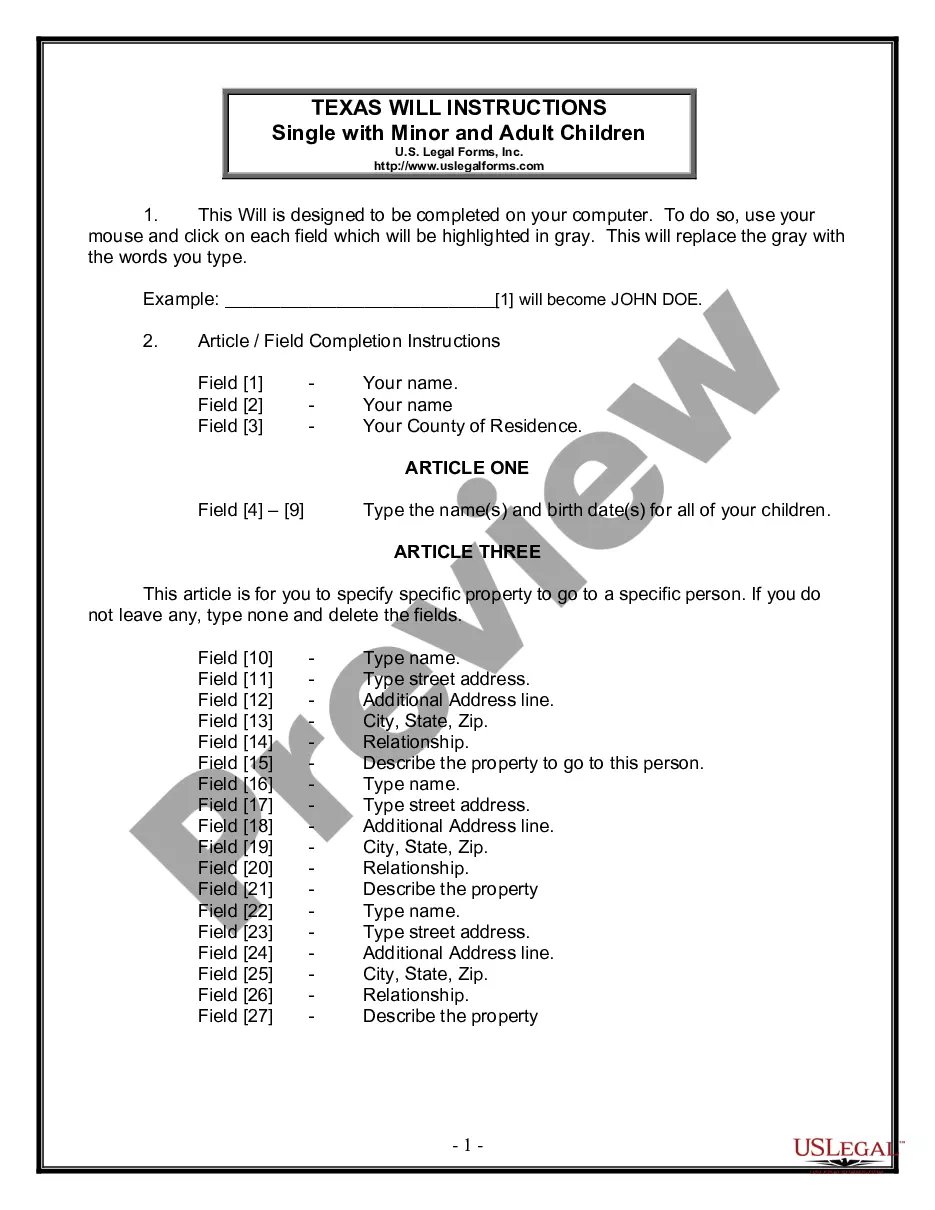

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

Finding the correct authentic document format may be a challenge. Certainly, there are numerous templates accessible online, but how can you obtain the genuine form you need? Explore the US Legal Forms website.

The platform provides a vast array of templates, such as the Colorado Summary of Savings for Budget and Emergency Fund, suitable for business and personal purposes. All of the forms are vetted by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click the Download button to obtain the Colorado Summary of Savings for Budget and Emergency Fund. Utilize your account to browse through the legal forms you have previously purchased. Visit the My documents tab of your account to retrieve another copy of the document you need.

Choose the document format and download the legal document format to your device. Complete, edit, and print, and sign the received Colorado Summary of Savings for Budget and Emergency Fund. US Legal Forms is the largest repository of legal forms where you can explore various document templates. Utilize the service to acquire professionally crafted paperwork that adheres to state requirements.

- First, ensure you have selected the correct form for your area/region.

- You can examine the form using the Preview button and review the form details to confirm it is the appropriate one for you.

- If the form does not satisfy your needs, use the Search feature to find the correct form.

- Once you are confident that the form is accurate, click the Buy now button to obtain the form.

- Choose the pricing plan you desire and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

The general recommendation is to allocate a higher percentage towards your emergency fund before fully funding other savings goals. Follow the Colorado Breakdown of Savings for Budget and Emergency Fund principles to guide your decisions. Begin with three to six months of expenses in your emergency fund, then allocate surplus income toward savings for future purchases. This balanced strategy helps you achieve financial resilience.

A 30-year-old should target at least three to six months of expenses in their emergency fund, which amounts to around $10,000 to $20,000, depending on individual circumstances. This aligns with the Colorado Breakdown of Savings for Budget and Emergency Fund, which highlights the importance of adequate financial preparation. Having this buffer fosters confidence and stability in managing life's unpredictability.

If you have consumer debt, I recommend saving a starter emergency fund of $1,000 first. Then, once you're out of debt, it's time to beef up that amount and save three to six months of expenses in a fully funded emergency fund.

It does work. That $1,000 emergency fund will be enough to have your back while you hustle to pay off your debt as quick as you can. The Baby Steps work, so stick with themno matter how uncomfortable it might make you feel. Lean into that awkward feeling and let that spur you on to pay off your debt even faster.

The report, based on telephone interviews with more than 1,000 adults, reveals that just 23 percent of Americans have emergency savings to cover six months of expenses.

Most Americans are still struggling to build solid savings accounts nearly two years into the coronavirus pandemic. Some 56% of Americans are unable to cover an unexpected $1,000 bill with savings, according to a telephone survey of more than 1,000 adults conducted in early January by Bankrate.

The median emergency fund balance among workers today is $5,000, according to the 21st Annual Transamerica Retirement Survey. Not surprisingly, emergency savings increase by age, with median balances coming in at: $2,000 for Gen Z workers. $5,000 for millennial workers.

The report, based on telephone interviews with more than 1,000 adults, reveals that just 23 percent of Americans have emergency savings to cover six months of expenses.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

Dave Ramsey: $1,000; then three to six months of expenses If you follow Ramsey's Seven Baby Steps, which are designed to help people take control of their money through debt payoff and building wealth, the first step is to establish a starter emergency fund of $1,000.