Arizona Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

Are you in a situation where you frequently require documents for various organizations or specific activities almost every day.

There are numerous official document templates available online, but locating trustworthy ones isn't easy.

US Legal Forms provides a wide array of document templates, including the Arizona Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, which can be tailored to fulfill state and federal guidelines.

Select a convenient file format and download your copy.

Access all the document templates you have acquired in the My documents section. You can obtain a new copy of the Arizona Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife at any time, if desired. Just follow the necessary form to retrieve or print the document template.

Use US Legal Forms, the most extensive assortment of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Following that, you can obtain the Arizona Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

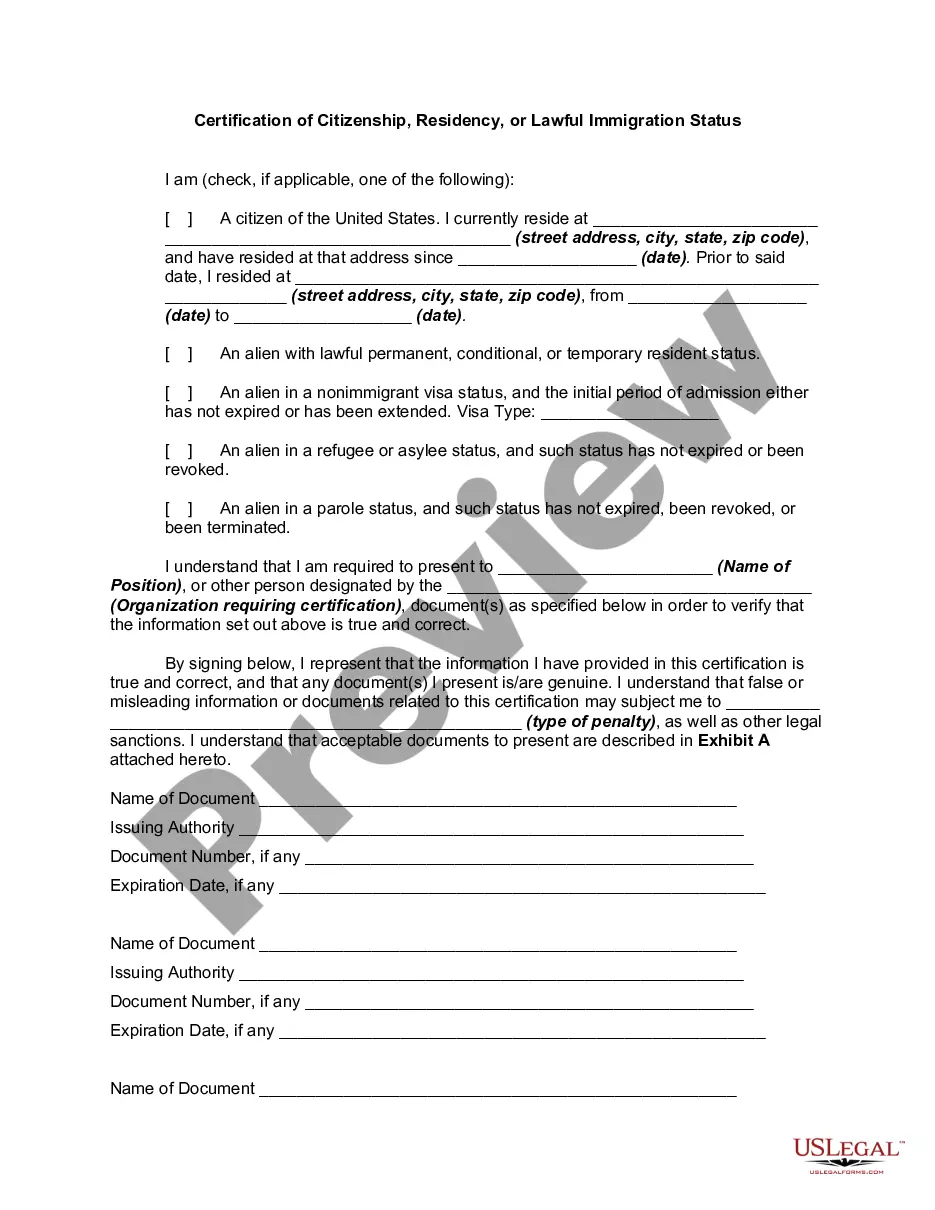

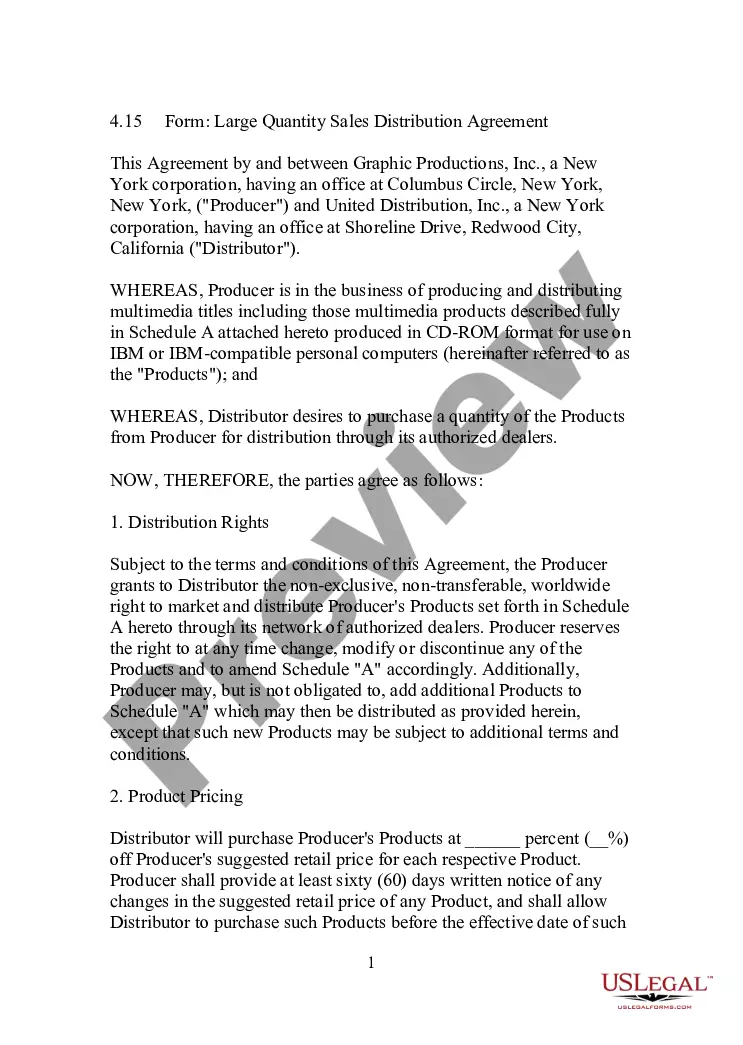

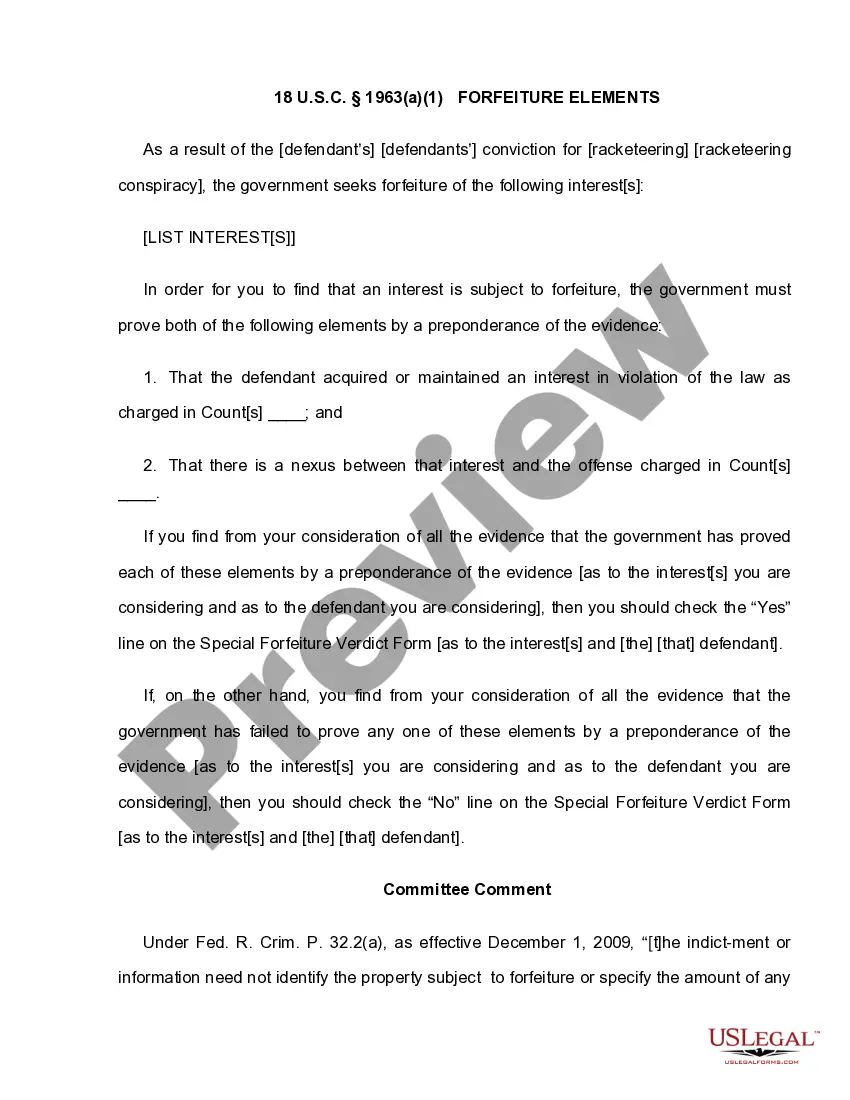

- Utilize the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form isn't what you are looking for, use the Lookup field to find the form that suits your needs and preferences.

- Once you find the right form, click Get now.

- Select the pricing plan you prefer, fill out the required information to create your account, and complete your order using PayPal or Visa or Mastercard.

Form popularity

FAQ

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

Trusts are a crucial element to Estate Planning as they help provide more control over asset distribution after death. Among the various types available, a Testamentary Trust can be one of the best options for those thinking of their young children or grandchildren.

Distributions of principal are not subject to income tax. Distributions of income are subject to income tax. The trust has to pay income tax on any income that is not distributed. Some trustmakers have so much control over the trusts they have created that the IRS ignores the trusts completely.

In nearly all scenarios, Arizona will allow the spouse of the deceased to inherit his or her full intestate estate. More specifically, this applies either to a marriage where neither partner had children or where all the children in the picture they had together.

A Bypass Trust is sometimes called a Residual Trust, a Family Trust, or a Tax Avoidance Trust. Typically, the entire estate is divided in half (provided the entire estate is community property) and the decedent's half goes into a Bypass Trust.

Taxation of Testamentary Trusts Once a testamentary trust has been created, it becomes a taxable entity in its own right and is thus subject to income taxes. If it has $600 or more in annual income, it must file a U.S. Income Tax Return for Estates and Trusts (Form 1041) for that year.

Taxation of Testamentary Trusts Once a testamentary trust has been created, it becomes a taxable entity in its own right and is thus subject to income taxes. If it has $600 or more in annual income, it must file a U.S. Income Tax Return for Estates and Trusts (Form 1041) for that year.

Living trusts and testamentary trustsA living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.

Well, because a testamentary trust allows the grantor some control over the assets during his or her lifetime. After the grantor passes away, the testamentary trust, which is considered an irrevocable trust, is created. Irrevocable trusts can sometimes protect assets against judgments and creditors.